Geopolitical Divergence Reshapes Global Alliances and Business Strategies

This conversation reveals the often-unseen downstream consequences of geopolitical pronouncements and technological ambitions. Far from being mere political noise or isolated business challenges, the discussions around "middle countries," semiconductor manufacturing, and international trade agreements highlight how immediate actions, driven by political expediency or perceived necessity, can create complex, compounding effects across global alliances and industries. Those who understand these intricate feedback loops--how a nation's "rupture" narrative impacts trade, how a chipmaker's execution struggles ripple through the AI supply chain, or how protectionist rhetoric reshapes global manufacturing--gain a significant advantage in anticipating market shifts and strategic realignments. This analysis is crucial for business leaders, investors, and policymakers who need to navigate an increasingly fragmented and unpredictable world.

The Cascading Effects of "Rupture" Narratives

The notion of a geopolitical "rupture," as articulated by figures like Mark Carney, is often presented as a dramatic shift. However, Terry Haines of Pangaea Policy argues that much of this rhetoric, particularly surrounding international summits like Davos, can be dismissed as "political noise" serving individual political purposes. The real impact, Haines suggests, lies not in the pronouncements themselves, but in how they validate or challenge existing geopolitical frameworks. Zelensky's critique of Europe's focus on the future rather than the present, for instance, serves to underscore the United States' frustration with its allies' commitment levels.

"Carney's responses serve Carney's political purposes as well. As Tyler points out, this was integral to exactly why Carney is Canada's Prime Minister right now. But the most important speech out of Davos for me this week was Zelensky's, in no small part because what Zelensky did was validate the United States' view of the world that Trump, and I think by extension Canada to some extent, isn't living up to its commitments and had better start."

This dynamic reveals a deeper consequence: the way leaders frame global events can either reinforce established alliances or sow seeds of doubt, impacting everything from defense spending to trade negotiations. Haines cautions against overestimating the immediate impact of such "elbowing" on the Western alliance, particularly when dealing with a geopolitical competitor like China, whose playbook is fundamentally different. The pursuit of "middle country" status, as Carney champions for Canada, risks isolating nations if they attempt to play major powers against each other, potentially leading to a "Fidel Castro" scenario of picking sides rather than fostering genuine multilateralism. Europe's struggles, exemplified by the protracted negotiation of the Mercosur trade agreement and subsequent judicial review, are seen as a symptom of a broader inability to act decisively, a point validated by Zelensky's own criticisms.

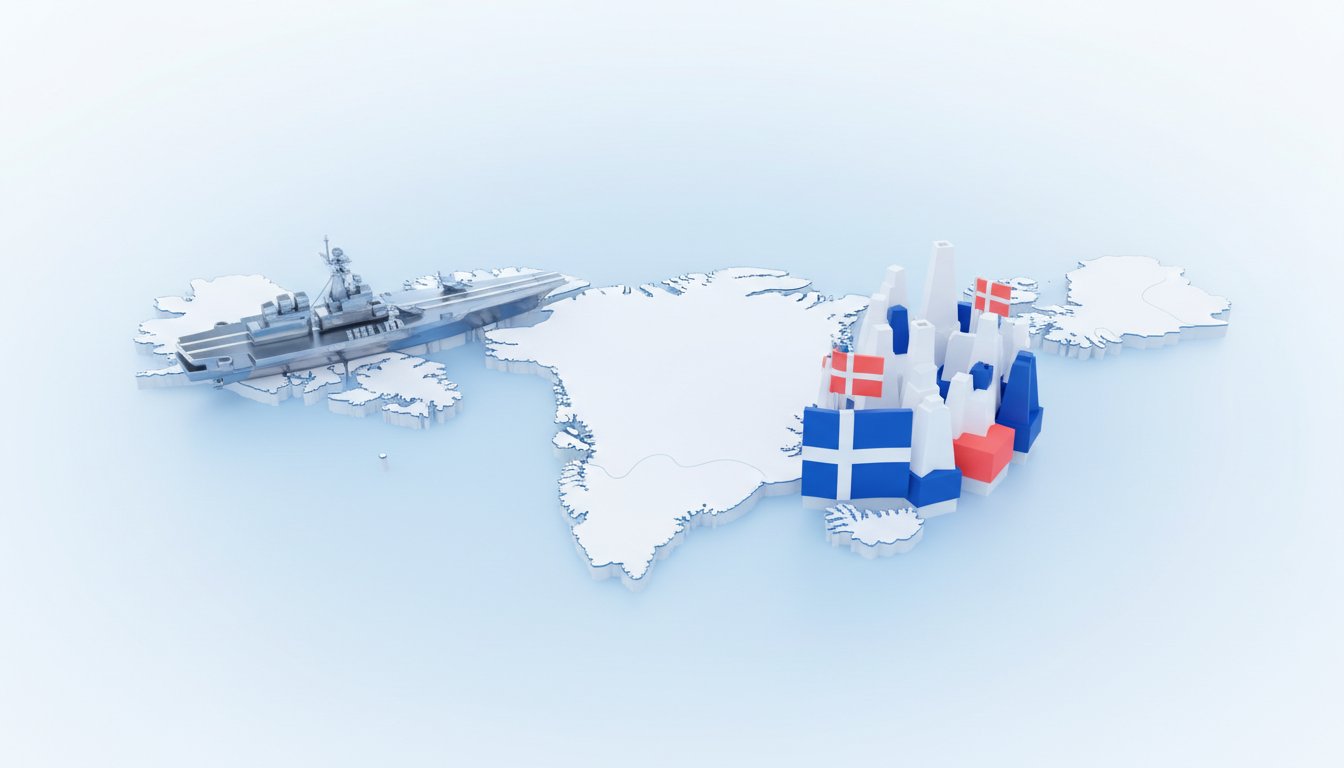

Greenland: A Geopolitical Flashpoint or Strategic Imperative?

The United States' intense focus on Greenland, particularly under the Trump administration, is framed by Haines not as mere folly, but as a strategic imperative driven by escalating geopolitical risk. While markets might dismiss the "how" of Trump's methods, Haines argues that the "what" and "why" point to a broader economic and defense realignment driven by competition with China. This includes securing access to rare earths and minerals, and bolstering the defense industrial base.

"The United States' interest has been consistent throughout. It's not different than the interest in Venezuela, frankly. There were two priorities in Greenland: first, to improve the United States and Western national security in what's now being called the Far North; secondly, was to gain greater access to minerals and rare earths. That's the through line, and that's been the Trump administration's interest, and that's how they're going forward."

This persistent focus on Greenland underscores a long-term strategy that predates current political discourse. The consequence of this sustained focus is a potential reshaping of Arctic security and resource access, driven by a pragmatic assessment of global competition rather than transient political whims. The frustration with European allies over defense commitments, as highlighted by Zelensky's comments, further solidifies the US's independent strategic calculus, suggesting that immediate geopolitical pressures are driving a more assertive and self-reliant approach to national security and resource acquisition.

Intel's Foundry Gamble: Execution Risk in a Geopolitical Landscape

Intel's struggles with its foundry business, characterized by disappointing revenue forecasts and ongoing execution issues, present a complex case of immediate operational challenges intertwined with long-term geopolitical pressures. Frank Lee of HSBC points out that while overall CPU and data center demand remains strong, Intel's guidance suggests persistent internal production problems. The market's enthusiasm for Intel's foundry ambitions, Lee notes, may have outpaced the reality of customer engagement and actual orders.

The pressure on Intel to establish a domestic foundry capability, driven by US government interest, adds another layer of complexity. This geopolitical imperative, while potentially beneficial in the long run, creates a significant burden on a company already grappling with execution.

"Yeah, I think the other thing that also perhaps the market got a bit overexcited with was the foundry piece. This is an area where we've generally been more cautious. I know there's been a lot of speculation in the last couple of months about more companies wanting to sign with Intel, wanting to do deals with them, and we've acknowledged that there's engagement, but engagement and actual orders and actual revenues are two different things."

The consequence of this dual pressure--operational execution and geopolitical mandate--is a prolonged and uncertain path to profitability for the foundry business. While advancements in packaging technology offer a glimmer of hope for earlier revenue generation, the core front-end foundry business remains a significant long-term investment with substantial execution risk. This situation highlights how even with strong demand for its core products, a company's strategic bets, influenced by external pressures, can create significant headwinds.

NVIDIA's China Conundrum: Demand vs. Self-Sufficiency

The possibility of China allowing major tech firms like Alibaba, Tencent, and ByteDance to prep orders for NVIDIA's H200 chips presents a nuanced scenario. Frank Lee suggests that while such a move would impact near-term sentiment, NVIDIA's overall growth trajectory is robust enough to achieve significant data center revenue targets even without substantial Chinese market contribution. The core thesis remains global AI data spending, not solely reliant on China.

However, the underlying dynamic is China's long-term ambition for self-sufficiency in chip manufacturing.

"But I think there's also realistic that it is not entirely in their hands in terms of being able to tap that market. I also think that there's also a recognition that the Chinese is going to look to develop their own in-house chip-making abilities over time, like they have with other areas. So there is always going to be on the backdrop that while we're able to again to China, at the same time, the Chinese are going to look at increasing their self-sufficiency over time."

This creates a persistent overhang: even if sales to China are permitted, the long-term trend is towards reduced reliance on foreign suppliers. China's focus on efficiency in AI models, as demonstrated by breakthroughs like DeepSeek, suggests a strategic effort to achieve performance without necessarily needing the absolute highest-end chips. The consequence for NVIDIA is that while short-term opportunities may arise, the strategic landscape is one where China actively seeks to displace foreign technology, creating a continuous need for NVIDIA to innovate and maintain its competitive edge globally.

US-UK Trade Relations: Navigating Protectionism and Impasse

Duncan Edwards, CEO of British American Business, describes the mood among member companies following a week of threatened tariffs as one of relief, albeit tinged with concern. The underlying business models of many companies have already been recalibrated to account for a "permanently or at least semi-permanently higher" cost of exporting to the US, reflecting a broader trend towards protectionist policies.

The attempts to formalize US-UK trade agreements, such as the Economic Prosperity Deal and the Technology Prosperity Deal, have hit an impasse. This stems from differing expectations: the US side envisioned significant policy shifts from the UK regarding standards, data, and EU relations, while the UK anticipated more modest adjustments.

"So from the US side, I think there was an expectation that there would be a wholesale change of attitude towards some areas of UK policy around standards, food, food and agricultural product imports, data issues, the relationship with the EU, a whole range of things. Whereas I think from the UK side thought, 'No, no, this is just a sort of, we'll tweak things, but there's no kind of ment.'"

The consequence of this disconnect is a frustration on both sides, leading to a lack of progress on formalizing trade and investment. Despite these high-level impasses, businesses continue to operate and invest, demonstrating a pragmatic approach to navigating the complexities of international trade in an era of shifting geopolitical alignments and protectionist sentiments. The emphasis for many businesses, and trade associations like Edwards', is on focusing on core business issues rather than engaging in broader social or cultural debates, a stark contrast to previous years.

Key Action Items

- Re-evaluate "Rupture" Narratives: Critically assess geopolitical pronouncements for their underlying strategic drivers versus mere political posturing. (Immediate)

- Stress-Test Supply Chains: Map vulnerabilities and explore diversification strategies to mitigate risks associated with rising protectionism and geopolitical instability. (Ongoing, review quarterly)

- Monitor Foundry Execution: Closely track Intel's progress on its foundry business, focusing on concrete orders and revenue rather than engagement metrics. (Next 6-12 months)

- Diversify AI Revenue Streams: For companies like NVIDIA, continue to focus on global AI spending while acknowledging China's long-term drive for self-sufficiency. (Ongoing, pays off in 18-24 months)

- Formalize Trade Agreements: Urge policymakers to bridge the gap between differing expectations in US-UK trade negotiations to create clear, actionable frameworks. (This year)

- Focus on Core Business: Encourage a return to business fundamentals, separating commercial operations from broader social and cultural debates. (Immediate and ongoing)

- Invest in Arctic Security and Resources: Acknowledge and plan for the long-term strategic importance of regions like Greenland for resource access and national security. (Long-term investment, pays off in 3-5 years)