The President's Promises and the Unseen Economic Currents

This conversation reveals a critical disconnect between public policy pronouncements and the subtle, yet powerful, forces shaping the economy. While the President focuses on campaign promises and immediate political wins, the underlying economic currents--driven by factors like tariff uncertainty, evolving consumer behavior, and the quiet influence of government-backed entities--suggest a more complex reality. This analysis is crucial for investors and business leaders who need to look beyond the headlines to understand the delayed payoffs and hidden costs that will determine long-term success. It highlights how conventional wisdom about economic indicators can falter when extended forward, offering a distinct advantage to those who grasp the system-level dynamics at play.

The Unseen Hand of GSEs and the Slow Burn of Tariffs

The current economic landscape, as discussed, is a complex interplay of visible policy decisions and less apparent systemic forces. On one hand, the administration is leaning into campaign promises, attempting to buoy sentiment through actions like directing Fannie Mae and Freddie Mac (GSEs) to purchase more agency mortgage-backed securities. This move, while aimed at marginally helping the economy and potentially influencing mortgage rates, carries a significant downstream consequence: it decreases the likelihood of the GSEs going public. The implication is clear: the administration prefers control over privatization, a strategic choice that shapes the future of a critical sector of the housing market. This decision is not about immediate economic stimulus but about long-term institutional control, a strategy that pays off in stability and influence rather than overt growth.

On the other hand, the persistent specter of tariff uncertainty is creating a palpable drag on industries. Jin Suroka, Executive Director of the Port of Los Angeles, articulates this vividly, noting that companies are dedicating significant resources to simulating future policy impacts and reconfiguring supply chains. This isn't just about the immediate cost of tariffs; it's about the paralysis they induce.

"Trade tariff uncertainty is creating volatility in the supply chain it's making long term planning pointless."

This uncertainty forces a strategic retreat from long-term planning, a direct consequence of unpredictable policy. Companies are shifting sourcing away from China, but the challenge of tracking complex, transshipped goods and identifying the true origin of manufacturing expertise makes this a difficult, ongoing battle. The result is a choppy, unpredictable environment where immediate operational adjustments are prioritized over strategic investments. This dynamic creates a competitive advantage for those who can navigate this ambiguity, as many are stuck in what was termed "macro paralysis" -- a state of inaction due to the inability to plan.

"The pattern repeats everywhere Chen looked: distributed architectures create more work than teams expect. And it's not linear--every new service makes every other service harder to understand. Debugging that worked fine in a monolith now requires tracing requests across seven services, each with its own logs, metrics, and failure modes."

The conversation also touches upon the labor market, where a divergence in interpretation of job growth data exists. While some see low job gains as a sign of a weakening market, others argue that changes in immigration policy and a potentially full employment pace of job gains are masking underlying resilience. The forecast suggests a pace of around 50,000 jobs per month might maintain the current unemployment level. This highlights how different metrics can tell conflicting stories, and the "correct" interpretation depends heavily on the underlying assumptions about the economy's capacity. The idea that growth can be disinflationary, particularly with the advent of AI-driven productivity gains, is a key point of contention. While AI might boost productivity (a disinflationary force), the associated growth and increased demand for resources like data centers could exert upward pressure on inflation. This tension between AI-driven efficiency and increased economic activity is a critical system dynamic to monitor.

The AI Productivity Paradox and the Fed's Balancing Act

The burgeoning impact of Artificial Intelligence (AI) presents a fascinating case study in delayed payoffs and system-level effects. While AI is expected to boost productivity--a traditionally disinflationary force--its broader economic implications are multifaceted. James Eggarhoff of BNP Paribas suggests that the AI boom will not only lead to disinflationary productivity gains but also a cyclical boom, driven by rising neutral rates and existing stimulus. This dual effect--simultaneously easing price pressures through efficiency and stimulating demand through growth--creates a complex environment for monetary policy.

The build-out of AI infrastructure, such as data centers, is noted to have a moderate impact on inflation, primarily through increased electricity demand and construction costs. However, the more significant inflationary or disinflationary impact, according to the discussion, stems from the booming business sentiment fueled by AI optimism. This sentiment translates into cyclical economic activity, supporting growth and the labor market. This is where the "AI productivity paradox" emerges: while AI promises efficiency, its widespread adoption and the resulting economic expansion could sustain inflationary pressures, making the Federal Reserve's task of balancing growth and price stability particularly challenging.

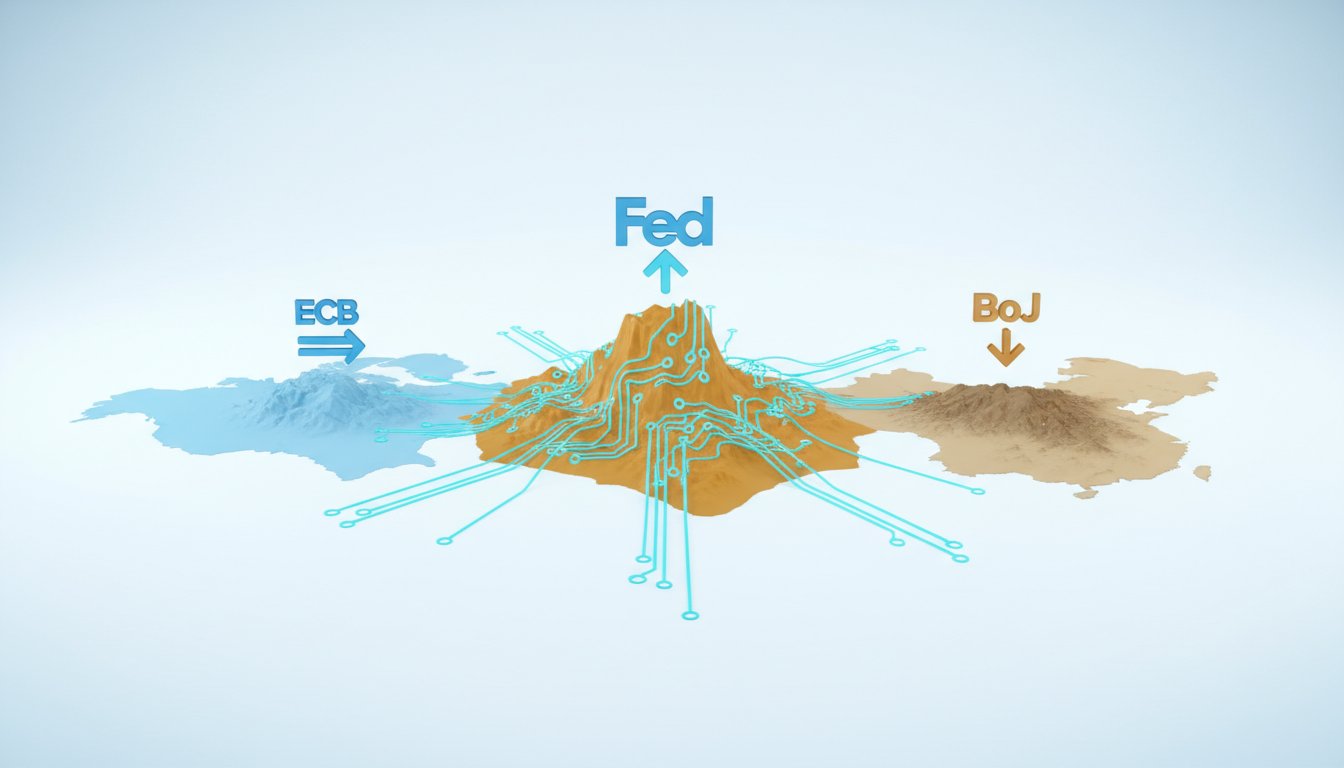

The potential Federal Reserve Chair, Kevin Walsh, is discussed in the context of this balancing act. His strong personal and professional ties to President Trump are seen as a potential asset, fostering a more cooperative relationship between the White House and the Fed, thereby enhancing monetary policy independence. However, the market's expectation of rate cuts--at least two this year--contrasts with the view that the Fed might hold steady. The argument against cuts is rooted in the belief that the economy is performing robustly, with strong growth and some residual inflation, particularly from ongoing tariff pass-through and a resilient services sector. This suggests a Fed that might prioritize containing inflation over stimulating growth, a stance that could diverge from market expectations and create volatility.

"We think the fed is going to react to the data that is going to follow the economic outlook and its standard policy framework regardless of who leads it or for the course of the year so we think that powell i think he's delivered the easing he wants to deliver we had earlier thought there might be room for one less one but the data has just held up just so well that we've recently taken that out beyond that we think the data will tell the story and that the story of a strong economy and with a stable labor market and with inflation that's a bit higher than what we think the fed is looking for"

The implication here is that the market's anticipation of rate cuts might be premature. If the economy continues to show strength and inflation proves stickier than expected, the Fed may indeed stand pat, leading to a period of adjustment for investors who have priced in easing. This divergence between policy reality and market expectation is a classic example of how system dynamics can create unexpected outcomes, rewarding those who are patient and adaptable.

Key Action Items

- Immediate Action (Next 1-3 Months):

- Diversify Supply Chains: Actively explore and implement sourcing strategies beyond China to mitigate tariff risks and supply chain volatility.

- Scenario Planning for GSEs: Analyze the implications of continued government control over GSEs for mortgage markets and real estate investment strategies.

- Monitor Services Sector Inflation: Pay close attention to ISM Services data and commentary for early signals of persistent inflation in the services economy.

- Medium-Term Investment (3-12 Months):

- Develop AI Integration Strategies: Begin piloting and integrating AI tools to capture productivity gains and understand their impact on operational costs and business sentiment.

- Stress-Test Financial Models: Re-evaluate financial models assuming a 'no-rate-cut' or 'delayed-cut' scenario for the Federal Reserve, considering the impact on borrowing costs and market valuations.

- Build Inventory Management Flexibility: Develop agile inventory strategies that can adapt to fluctuating consumer demand and potential future trade policy shifts, avoiding the pitfalls of overstocking or understocking.

- Long-Term Investment (12-18 Months+):

- Cultivate Policy Agility: Build organizational resilience to navigate unpredictable policy environments, focusing on adaptability rather than rigid long-term plans.

- Invest in Data Traceability: Enhance supply chain visibility and data tracking capabilities to better understand product origins and counter efforts to circumvent trade policies.

- Strategic Patience in Capital Allocation: Be prepared to invest in long-term growth projects (e.g., infrastructure, new terminals) that are essential for future capacity, even if immediate economic conditions appear uncertain.