Federal Reserve Dilemma, Media Consolidation, and Muted Market Outlook

TL;DR

- The Federal Reserve faces a dilemma cutting rates despite inflation remaining above target for 55 months and an exceptionally tight labor market, questioning the rationale for easing policy.

- The labor market's unusual stability, particularly for prime-age workers, suggests a departure from historical "hockey stick" patterns of rapid weakening, complicating the Fed's decision-making.

- Trade shocks are proving to be sectoral and regional, impacting specific industries like autos and steel while being offset by growth in sectors like healthcare, negating a single national economic story.

- Media industry consolidation is seen as inevitable, with subscale streaming players like Warner Bros. Discovery needing combinations with entities like Netflix or Skydance to achieve global scale.

- Media M&A historically proves more difficult than spreadsheets suggest, with cultural clashes and industry headwinds often hindering the realization of projected synergies and upside.

- While the market anticipates rate cuts, the Fed's commentary on market liquidity, bank reserves, and potential quantitative easing programs will be more impactful than the 25-basis-point cut itself.

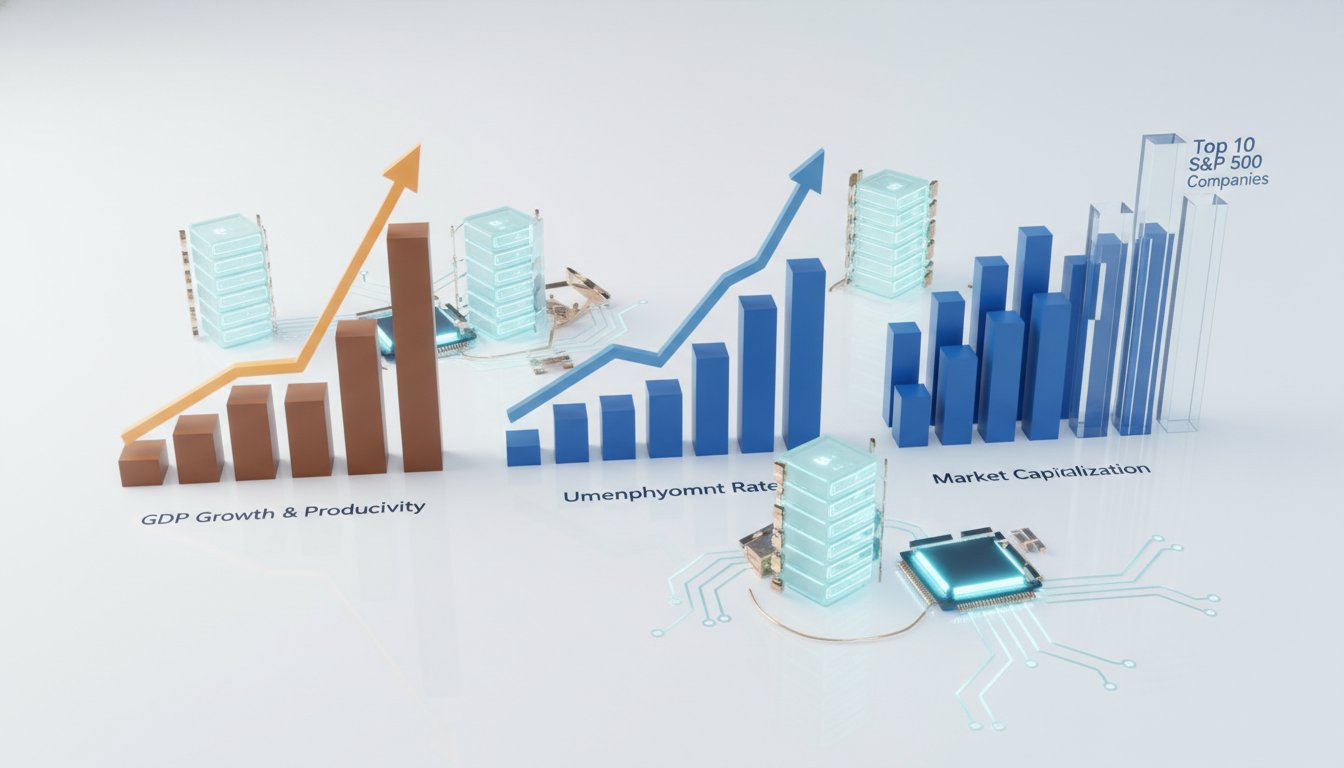

- Despite a strong 2025 for markets, 2026 is expected to be more muted due to policy uncertainty and a midterm election year, though underlying fundamentals should support positive territory by year-end.

Deep Dive

The Federal Reserve faces a complex decision regarding interest rate cuts, balancing strong economic data like a 3.5% GDP growth rate and a historically tight labor market against persistent inflation above its target. While market participants anticipate rate cuts, the crucial factor for 2026 will be the Fed's forward guidance on policy and its assessment of market liquidity, rather than the immediate 25-basis-point decision.

The media industry is undergoing significant consolidation, with Warner Bros. Discovery (WBD) at the center of potential mergers. A combination with Netflix is seen as a "nice to have" for Netflix, offering global scale and monetization opportunities for WBD's content, which Netflix already licenses. For Paramount-Skydance, however, such a merger is a "must have" to accelerate their streaming ambitions and achieve desired global scale. Media M&A historically faces challenges beyond spreadsheets, primarily due to cultural integration and the ongoing headwinds in the linear ecosystem, suggesting that realized synergies may be less than initially projected. Regulatory hurdles are also significant, with Netflix arguing for a broader definition of the media market to counter antitrust concerns, positioning itself as a smaller player compared to traditional media conglomerates when all forms of content consumption are considered.

Looking ahead, the stock market anticipates a muted but positive 2026, with potential for mid-to-high single-digit returns in both equities and bonds. While the economy is expected to moderate slightly from its current strong performance, a recession is not foreseen. Policy uncertainty, particularly around midterm elections, will likely create a choppy environment, but strong underlying fundamentals are expected to drive positive territory by year-end. In the bond market, investors may find opportunities to take on additional credit risk, though tight spreads indicate already high valuations and limited room for significant gains. The ongoing trend of cord-cutting is showing signs of improvement, with net ad growth and stabilizing subscriber numbers, suggesting a potential turning point for traditional distributors.

Action Items

- Audit economic data interpretation: Identify 3-5 instances where data subcomponents (e.g., unemployment by age group) offer more nuance than aggregate figures.

- Analyze media M&A synergy claims: For 2-3 proposed mergers, quantify potential cost synergies versus published figures and assess cultural integration risks.

- Track sector-specific trade shock impacts: For 3-5 key sectors, measure job shedding and offsetting growth to understand trade policy's granular economic effects.

- Evaluate Fed policy effectiveness: For 2-3 specific economic scenarios (e.g., small business impact), compare the effect of rate cuts versus other factors like tariffs.

- Measure content monetization strategy: For 2-3 streaming platforms, calculate the correlation between premium content acquisition and user engagement growth.

Key Quotes

"I'm going to make two observations the money market fund used to be 4 x even 5 the money market fund is now 3 6 3 7 and the other observation is that landed gdp now the gdp now is a stunning 3 5 why in god's name are we cutting interest rates tom if i woke up this morning and i'd been in a coma and all i had was the data i would think well this federal reserve must be neutral or hawkish heading into this period"

Frances Donald, Chief Economist at RBC, questions the rationale for cutting interest rates given current economic data. Donald highlights that money market fund yields have decreased significantly and that current GDP growth is strong, suggesting a neutral or hawkish stance from the Federal Reserve would be more appropriate.

"what happened to the concept of normalizing and growth is fine so what i want to hear from chair powell today is why are you cutting on the other side of the argument people are saying cut cut let's go let's go let's go has it myron frankly a lot of other people as well state their case all the unemployment rate is moving in the quote unquote wrong direction and historically uh labor markets move like uh forgive the canadian reference in a hockey shape direction uh which is that they when they peak and they tend to weaken aggressively and quickly"

Frances Donald expresses a desire to understand the Federal Reserve's reasoning for considering interest rate cuts. Donald points out that growth appears healthy and the unemployment rate is historically low, contrasting with the typical pattern of labor markets weakening sharply after peaking, and questions why the Fed would cut rates under these conditions.

"I am feeling a little introspective that I used to spend so much time parsing out fed talk because the fed was such a large input into the economic outlook uh but perhaps it's my now growing old age I didn't have a birthday this weekend but I do have a milestone one coming up and uh increasingly I do believe that the data will lead the story and while there are biases that exist within the fed they're probably within a reasonable margin of error"

Frances Donald reflects on a shift in her approach to economic forecasting, suggesting that economic data itself is becoming a more dominant driver than Federal Reserve commentary. Donald notes that while Fed biases exist, they are likely within a manageable range, and the data will ultimately dictate the economic narrative.

"I cannot believe that we are still not starting every conversation with respect to tariff policy we are still in the midst of a once in 100 year trade shock uh we have not yet seen the full effects of that and we don't even know the final trade policies that are coming through"

Frances Donald emphasizes the ongoing importance of tariff policy and trade shocks in economic discussions. Donald argues that the full impact of these trade disruptions has not yet been realized and that the final trade policies remain uncertain, suggesting these factors are being overlooked.

"rate cuts today are like taking a tylenol for a broken arm it'll help but it's not going to cure you i took tylenol yesterday for a birthday it didn't work"

Amanda Agati uses an analogy to describe the limited impact of potential interest rate cuts on small businesses. Agati suggests that while rate cuts might offer some minor relief, they do not address the more significant underlying issues, such as tariffs, that are truly impacting small businesses.

"I think the market is maybe particularly interested in what the fed says today about the liquidity profile of the market you know what are our bank reserves too low what do they think is thinking as it relates to qe or maybe a qe light kind of program some of those other topics I think are going to be more important today in terms of the market's path forward than just 25 basis points"

Amanda Agati indicates that the stock market's focus on the Federal Reserve's meeting extends beyond the anticipated interest rate cut. Agati believes market participants are more concerned with the Fed's commentary on market liquidity, bank reserves, and potential quantitative easing (QE) programs.

Resources

External Resources

Books

- "Media 101" - Mentioned in relation to the success rate of media mergers.

Articles & Papers

- "A five page note" (Moffett and Nathanson) - Discussed for its insights on media mergers and Wall Street knowledge.

People

- Frances Donald - Chief Economist at RBC, discussed for her economic analysis and insights on the Fed decision.

- Robert Fishman - Senior Analyst at MoffettNathanson, discussed for his analysis of WBD/Amazon/Paramount media mergers.

- Amanda Agati - Chief Investment Officer of Asset Management at PNC Bank, discussed for her market outlook and Fed day analysis.

- Lisa Mateo - Mentioned for her role in reviewing front-page headlines.

- Jerome Powell - Mentioned in relation to Fed policy and potential interest rate cuts.

- Michael Nathanson - Mentioned for his long-standing analysis of media mergers and his insights on the industry.

- Stewart Hoffman - Mentioned in relation to PNC Bank's economic forecast.

- Craig Moffett - Mentioned in relation to MoffettNathanson's research on cord-cutting.

- Ryan Reynolds - Mentioned in relation to Mint Mobile.

Organizations & Institutions

- RBC (Royal Bank of Canada) - Mentioned as the employer of Frances Donald, Chief Economist.

- MoffettNathanson - Mentioned as a source of research and analysis on media mergers and cord-cutting.

- PNC Bank - Mentioned as the employer of Amanda Agati and Stewart Hoffman, providing economic and market insights.

- JPMorgan Asset Management - Mentioned for its active fixed income ETFs.

- Verizon Business - Mentioned for its business mobile and internet plans.

- Adobe - Mentioned for its Acrobat Studio software with AI capabilities.

- Netflix - Mentioned in the context of media mergers and its streaming strategy.

- Warner Bros. Discovery (WBD) - Mentioned in the context of media mergers and potential bids.

- Amazon - Mentioned as a potential bidder for Warner Bros. Discovery assets.

- Paramount - Mentioned in the context of media mergers and potential bids.

- Skydance - Mentioned in the context of media mergers and potential bids.

- Comcast - Mentioned as a potential player in media industry consolidation.

- YouTube - Mentioned as a competitor in content engagement and viewership.

- Nielsen - Mentioned as a measurement service for media viewership.

- TikTok - Mentioned as a platform for content engagement.

- Instagram - Mentioned as a platform for content engagement.

- HBO - Mentioned as part of the Warner Bros. content library.

- Fed (Federal Reserve) - Mentioned in relation to monetary policy and interest rate decisions.

- Mastercard - Mentioned for its commercial acceptance solutions for B2B payments.

- CVS Caremark - Mentioned for its prescription savings plan.

- FedEx - Mentioned for its smart platform and digital intelligence for supply chain management.

- Mint Mobile - Mentioned for its wireless plans.

Tools & Software

- Adobe Acrobat Studio - Mentioned for its AI-powered PDF capabilities.

Websites & Online Resources

- jpmorgan.com/getactive - Mentioned for information on JPMorgan Asset Management's active fixed income ETFs.

- verizon.com/business - Mentioned for Verizon Business mobile plans.

- adobe.com/dothatwithacrobat - Mentioned for learning more about Adobe Acrobat Studio.

- omnystudio.com/listener - Mentioned for privacy information related to podcasts.

- cmk.co/stories - Mentioned for learning how CVS Caremark helps members save.

- mintmobile.com - Mentioned for Mint Mobile's wireless plans.

Podcasts & Audio

- Bloomberg Surveillance - Mentioned as the podcast hosting the discussion.

Other Resources

- Active ETFs - Mentioned as an investment strategy aiming to outperform benchmarks.

- Passive ETFs - Mentioned as an investment strategy aiming to match benchmarks.

- Money Market Fund - Mentioned in relation to its yield and historical size.

- GDP Now - Mentioned as a real-time estimate of GDP growth.

- Tariff Policy - Mentioned as a significant economic factor impacting trade and specific sectors.

- Spread Market - Mentioned as a dynamic area with significant factors.

- QE (Quantitative Easing) - Mentioned in relation to potential central bank programs.

- QE Light - Mentioned as a potential, less extensive version of quantitative easing.

- Cord Cutting - Mentioned in relation to trends in subscription services and traditional distributors.

- Net Ads - Mentioned in relation to advertising revenue growth in the media industry.

- B2B Payments - Mentioned in the context of evolving payment landscapes for large corporations.

- Virtual Card Payments - Mentioned as a payment method increasingly demanded by buyers.

- Private Equity - Mentioned in relation to investment in Penn State.

- Credit Risk - Mentioned as a factor to consider in bond investments.