Fed's Policy Pause Masks AI-Driven Wealth Inequality Risks

The Federal Reserve's Tightrope Walk: Navigating Inflation, Growth, and the Unseen Consequences of Policy

This conversation reveals the intricate dance between economic policy and its often-unforeseen ripple effects. While the Federal Reserve, under Jay Powell, maintained its current interest rate, the underlying currents of economic data and future policy shifts suggest a more complex landscape than a simple pause implies. The hidden consequences lie not just in the immediate decision but in how this stance shapes future inflation, employment, and even the very structure of the economy through forces like AI and wealth effects. For business leaders, investors, and policymakers, understanding these downstream implications is crucial for anticipating market reactions and navigating an economy where traditional indicators may no longer tell the whole story. This analysis offers a strategic advantage by dissecting the subtle signals and long-term dynamics that conventional wisdom often overlooks.

The "Sunset" of Powell: More Than Just a Policy Pause

The Federal Reserve's decision to hold interest rates steady, while seemingly straightforward, marks a pivotal moment. Jay Powell, nearing the end of his tenure, appears to be steering the ship towards calmer, albeit uncertain, waters. The broad consensus within the FOMC for holding rates reflects a committee comfortable with the current economic data, which they perceive as improving. However, this comfort masks a deeper tension: the diminishing, but still present, conflict between employment and inflation. The "upside risks to inflation and downside risks to employment have probably both diminished a bit," as Powell stated, suggesting a delicate balance is being maintained. This isn't merely a pause; it's a strategic positioning for what comes next, with the implication that any further rate cuts might be the domain of a new Fed chair.

"There are different views on the committee, and you know, we'll find our way forward as the data evolve."

-- Jay Powell

The market's reaction, or lack thereof, to this announcement underscores a key takeaway: the Fed is prioritizing stability and data evolution over aggressive action. This approach, while seemingly prudent, creates a delayed payoff. By not cutting rates now, despite some dissent, the Fed is potentially laying the groundwork for a more sustainable disinflationary path later. However, this also means that the immediate pressure on inflation remains, and the potential for sticky inflation in the near term is acknowledged. This creates a scenario where the next Fed chair might inherit an economy with inflation still above target, making the job of cutting rates more challenging. The conventional wisdom here is that a pause means the problem is solved; the deeper analysis reveals it's a calculated maneuver to manage future, more complex challenges.

The AI Undercurrent: Reshaping Labor and Consumption

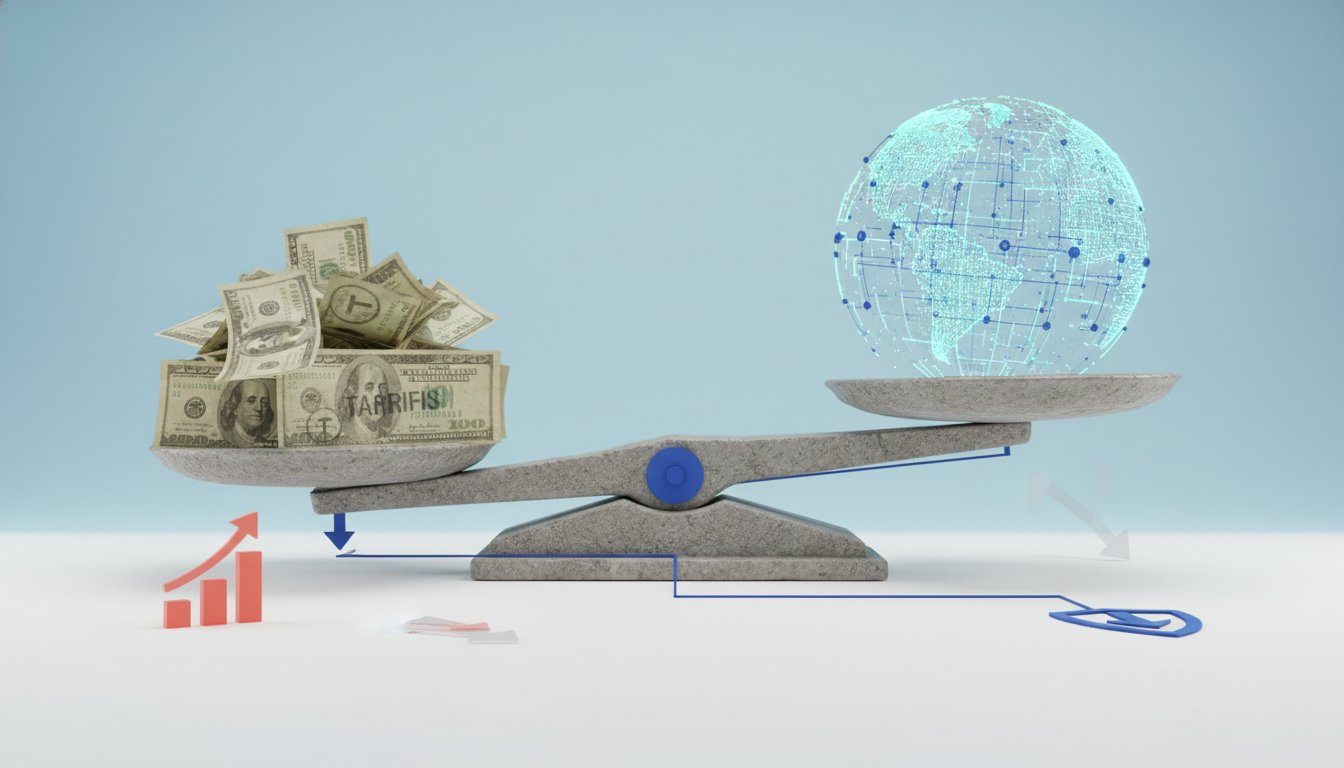

Beyond the immediate policy decisions, a significant undercurrent shaping the economic future is the pervasive influence of Artificial Intelligence. The conversation highlights how AI is not just a technological advancement but a force reconfiguring the labor market and consumption patterns. Stephanie Roth points out the risk that AI could do to services what globalization did to manufacturing, potentially leading to structural shifts in unemployment. This is a long-term consequence that current monetary policy, focused on immediate inflation and employment figures, may not fully address.

"The risk now that we have to confront in the West at least is whether AI is going to do that to services what globalization did to manufacturing."

-- Stephanie Roth

The implications are profound. If AI automates significant portions of the service sector, we could see a rise in structural unemployment, even if the headline unemployment rate remains low in the short term. This creates a K-shaped economy where a segment of the population benefits immensely from AI-driven productivity and wealth creation, while another segment faces job displacement. The wealth effect, driven by soaring tech valuations, is currently propping up consumption, but this is a fragile foundation if it's not broadly shared. The Fed's current policy, by influencing financial conditions, can exacerbate this inequality. As Jeff Rosenberg notes, the Fed's toolkit, particularly its use of quantitative easing and its impact on financial conditions, has, over the past two decades, contributed to the very inequality it now struggles to address. This suggests a systemic issue where monetary policy, by design or by consequence, amplifies existing economic divides.

The Wealth Effect: A Double-Edged Sword

The conversation consistently circles back to the "wealth effect" as a primary driver of current economic buoyancy. This phenomenon, where rising asset prices boost consumer confidence and spending, is largely fueled by the AI boom and strong corporate earnings, particularly in the tech sector. Jeff Rosenberg emphasizes that this effect has broadened beyond the ultra-wealthy, with younger generations participating more in equity markets. However, he also cautions that this is a "double-edged sword." A significant repricing of these assets, driven by any number of factors, could quickly turn these current headwinds into tailwinds, creating a sharp economic downturn.

This dynamic reveals a critical failure of conventional economic thinking. While policymakers often focus on aggregate demand and supply, they can overlook how concentrated wealth creation, amplified by technology, can create an illusion of broad-based prosperity. The fact that consumer confidence measures, like the Conference Board's, remain subdued despite strong spending, highlights this disconnect. Consumers may feel the pinch of price levels and policy uncertainty, even as they benefit from rising asset values. This suggests that durable economic health requires more than just stimulating demand; it necessitates addressing the underlying mechanisms of wealth creation and distribution.

The delayed payoff here is the potential for a more resilient economy if the benefits of AI and technological advancement are more widely distributed. Conversely, the immediate gratification of a booming stock market, fueled by the wealth effect, risks creating a future shock if those gains are not sustained or shared. The Fed's role in managing financial conditions, therefore, becomes critical, not just for inflation control, but for mitigating the systemic risks associated with extreme wealth concentration and its potential to destabilize the economy.

Key Action Items

-

Immediate Actions (Next 1-3 Months):

- Scenario Planning for Interest Rate Volatility: Develop contingency plans for both continued high rates and potential, unexpected rate cuts later in the year, recognizing the Fed's data-dependent stance.

- Analyze AI's Impact on Your Sector: Conduct a detailed assessment of how AI is currently impacting or is projected to impact your industry's labor needs and operational efficiency.

- Review Consumer Spending Drivers: Understand whether your customer base is primarily driven by wage growth or wealth effect, and adjust marketing and sales strategies accordingly.

-

Medium-Term Investments (Next 6-18 Months):

- Invest in Reskilling and Upskilling Programs: Proactively train your workforce for roles that complement AI technologies, rather than compete with them. This addresses the potential for AI-driven job displacement.

- Diversify Revenue Streams Beyond Wealth-Effect Dependent Markets: Explore opportunities that are less sensitive to asset market fluctuations and more tied to essential services or consistent wage growth.

- Build Resilience Against Supply Chain Shocks: Given the acknowledgment of "firm goods prices" and potential consumer stimulus impacts, strengthen supply chain management to mitigate inflationary pressures.

-

Long-Term Investments (18+ Months):

- Develop AI Integration Strategies: Move beyond initial assessments to implement AI solutions that enhance productivity and create new value, rather than simply cutting costs. This is where delayed payoffs for competitive advantage are most significant.

- Advocate for Broader Economic Policy Solutions: Engage with policymakers to highlight the limitations of monetary policy in addressing structural issues like AI-driven inequality and advocate for fiscal and educational policies that promote broader prosperity.

- Monitor and Adapt to Shifting Labor Market Dynamics: Continuously track the evolving nature of work, particularly the impact of AI on service sector jobs, and adjust long-term workforce planning to anticipate structural unemployment risks.