US Investors Face Concentration Risk Amid Global Outperformance

TL;DR

- US investors exhibit historic concentration risk by remaining virtually unexposed to international markets, where 70% outperformed the US last year, indicating a need to rebalance portfolios to avoid significant downside.

- Treating cash as an asset class can yield an additional 150 basis points by moving it from low-yield accounts to treasuries or blended portfolios, addressing a significant undermanaged portion of many families' wealth.

- The current investment phase is characterized by massive building of productive capacity, particularly in electrification and data centers, which, despite short-term commodity price tightness, is a long-term driver of total factor productivity.

- European economic recovery, especially in Germany, is supported by increased fiscal and capex spending, coupled with rising incomes outpacing inflation, which can significantly boost consumer spending from its current high savings rate.

- The US corporate sector's ability to translate massive investment into profits and positive returns is the primary indicator of economic health, overshadowing traditional labor market metrics like payroll numbers.

- Republicans face a significant challenge in the midterms due to a lack of a clear affordability agenda, with potential legislation limited to extending ACA subsidies rather than expanding them, due to a narrow House majority.

- The public's primary concern is affordability, making foreign policy and immigration secondary to economic issues like gas and grocery prices, a sentiment that significantly impacts electoral outcomes.

Deep Dive

The current market, while showing momentum and broadening earnings, presents a significant concentration risk for US investors due to an overemphasis on domestic tech and large-cap stocks. This lack of diversification, particularly an under-exposure to international markets which outperformed the US in the previous year, creates a problematic imbalance in portfolios. Furthermore, the wealth management industry is failing many families by overcharging for advice and underperforming through passive strategies and poorly managed cash assets, highlighting a systemic issue driven by industry consolidation and misaligned incentives.

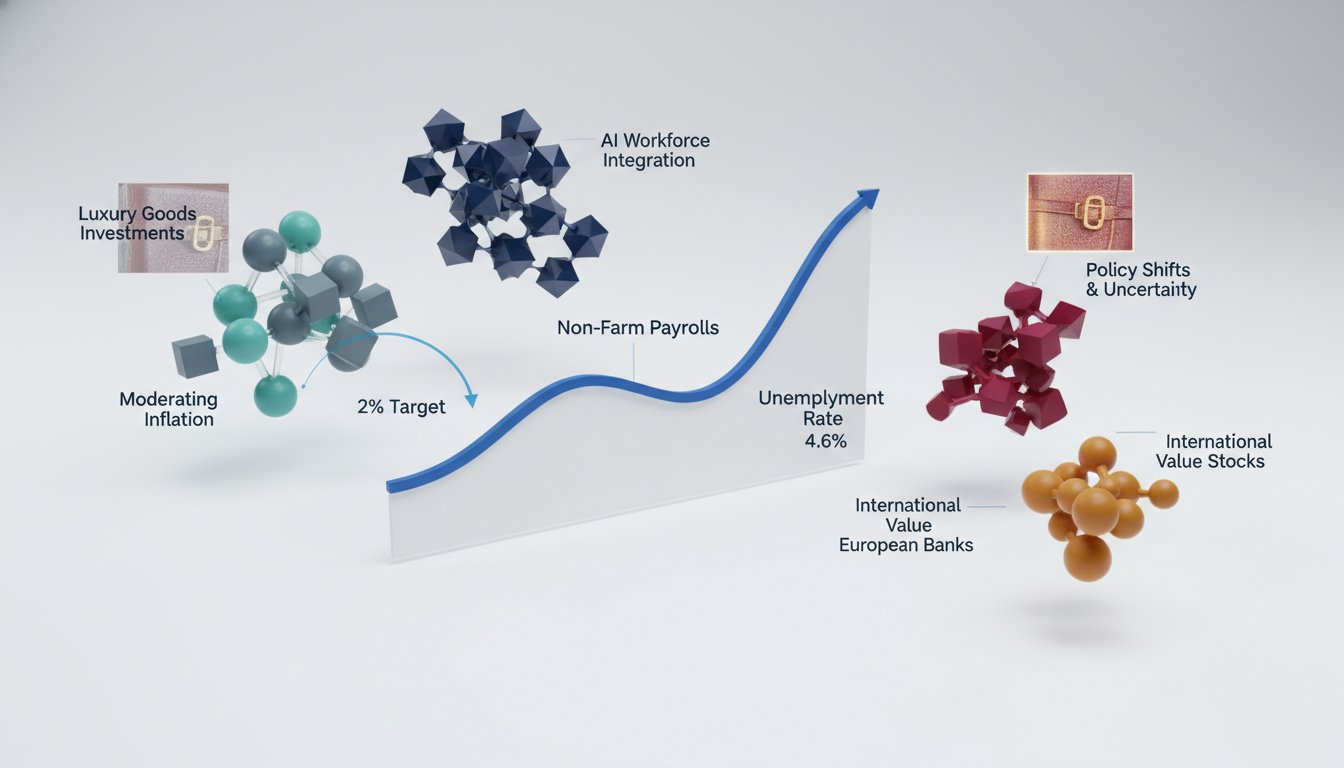

The economic outlook for 2026 suggests continued positive equity returns, assuming no recession, bolstered by potential fiscal stimulus and the lagged effects of Federal Reserve rate cuts. International markets, particularly in Asia and pockets of Europe like Japan, India, and Germany, offer attractive growth at lower valuations compared to the US. This presents an opportunity for diversification beyond the concentrated US tech sector, with potential avenues including European dividend shares, US and international pharmaceuticals, and specific tech areas in Asia influenced by AI. The emphasis on building productive capacity, particularly in electrification and data centers, is driving commodity demand, which is seen as a symptom of a larger investment phase rather than purely inflationary pressure. In Europe, Germany's fiscal stimulus and increased capital expenditure offer a potential catalyst for growth, supported by high household savings that could be activated as incomes rise faster than inflation. Investors should focus on fundamental corporate earnings and the translation of investment into profits, rather than solely on short-term labor market indicators like payroll numbers, as the US corporate sector's ability to generate returns from significant investment is the key driver of market health.

Politically, the affordability of healthcare and everyday goods remains the paramount concern for American voters, particularly heading into midterm elections. Republicans face a challenge in presenting a clear affordability agenda, while Democrats are still formulating their proactive platform, largely focusing on critiquing the opposition's unfulfilled promises on price reduction. The narrow Republican majority in the House limits legislative action, with extending rather than expanding ACA subsidies being the most achievable healthcare-related measure. Tariffs are highly unpopular with the American public, creating a significant political liability for any administration that champions them, especially when contrasted with the public's indifference to foreign policy issues. The pervasive polarization in the United States has blurred the lines between personal financial well-being, the state of the economy, and political affiliation, making it difficult for any administration to effectively address public concerns about affordability.

Action Items

- Audit portfolio concentration: For 3-5 clients, quantify US equity exposure versus international markets to identify diversification gaps.

- Track 5-10 international markets (e.g., Japan, India, Europe) for lower valuations and higher growth rates to inform diversification strategies.

- Measure cash yield disconnect: For 3-5 clients, calculate the difference between current cash yields and potential treasury/blended portfolio yields (4-5%).

- Analyze fee structure: For 3-5 client portfolios, calculate total fees (fund costs + advice) as a percentage of assets and projected 15-year returns.

- Evaluate European dividend shares: Identify 3-5 specific sectors in Europe for potential dividend income and diversification benefits.

Key Quotes

"Seventy percent of international markets last year outperformed the US. US investors are virtually unexposed to those markets, a lack of diversification in their portfolios. So I like the momentum of the market, I like where it's going, but I think there are lots of areas where people need to go, whether it's in pharmaceuticals, whether it's in energy, whether it's in MLPs, where there's simply no real action on the part of investors."

David Bahnsen argues that US investors are missing out on international market growth due to a lack of diversification. He highlights that many international markets outperformed the US, yet US portfolios remain largely unexposed to them. Bahnsen suggests that while the overall market momentum is positive, investors are overly concentrated in specific sectors, neglecting other areas with potential.

"That is the number one thing that we're talking with clients about today, is the fact that if a client has multiple advisors, and they're all investing in the same thing, and they don't rebalance portfolios, that is the number one observation that we've seen in our data this past year, is that everyone is letting these trades ride."

David Bahnsen points out a critical issue for clients with multiple advisors: a lack of portfolio rebalancing leading to concentrated risk. He observes that investors are allowing existing successful trades to continue without adjusting, creating a significant risk in their portfolios. Bahnsen emphasizes that this concentration is the primary concern he discusses with clients.

"The average family has more than 9% of their portfolio in cash and has had it there for basically five to ten years, saying they'll be opportunistic, and they never are. The average cash yield for that family is 2.7%. They could be earning 4% in treasuries, they could be earning 5% if they have a blended portfolio."

David Bahnsen highlights that many families hold a significant portion of their portfolio in cash for extended periods, intending to be opportunistic but failing to act. He contrasts the low average yield on this cash with the higher potential returns available from treasuries or blended portfolios. Bahnsen suggests this represents a missed opportunity for investors to increase their overall returns.

"I think if you believe that the economy is in a decent place, you believe we're going to get fiscal stimulus coming through this year. We see unemployment behaving itself per your earlier comments just now. If we see the impact, which is always delayed, of the Fed cuts coming through and actually supporting the economy, which we think they will, then if you look back through history, nine times out of ten in a year with no recession, and we're not calling for a recession, we think the odds are pretty low, then the S&P delivers positive total returns."

John Bilton suggests that a positive economic outlook, supported by fiscal stimulus, stable unemployment, and the delayed impact of Fed cuts, historically leads to positive S&P returns. Bilton indicates that in years without a recession, which he believes has low odds, the S&P has delivered positive total returns approximately nine out of ten times. He advises against betting against stocks given these favorable historical odds.

"The push up in commodity prices is a symptom of the investment that's being made, and the investments that are being made at the moment are in building productive capacity. It's in electrification, which will ultimately bring down costs. It's also in data centers, which is a huge part of the AI infrastructure build-out. We're going through a massive building phase at the moment, a phase where we're building productive capacity, and we know that the biggest driver of total factor productivity over the long run is the investment made in those productive assets."

John Bilton explains that rising commodity prices are a result of significant investment in building productive capacity, such as in electrification and data centers for AI infrastructure. Bilton posits that this massive building phase, focused on productive assets, is the primary driver of long-term total factor productivity. He views current commodity price increases as a symptom of this larger investment theme.

"The best that they could do is extend the ACA subsidies that expired at the end of last year. 24 million people, some people paying $1,000 more in ACA subsidies. That's going to be the bulk of it. And the real news from that event yesterday was around the Hyde Amendment, which is related to abortion. We're on the same old issues we've been focusing on for 16 years. So expecting radical change on the healthcare front is just unrealistic."

Henrietta Treyz states that due to a narrow Republican majority, the most achievable action on healthcare is extending expired ACA subsidies, which would benefit 24 million people facing higher costs. Treyz notes that the focus remains on long-standing issues like the Hyde Amendment, making radical healthcare reform unlikely. She concludes that expecting significant changes in healthcare policy is unrealistic given the current political landscape.

"The president's commentary shows that there is honestly kind of gaslighting going on within the White House. And I would start with the tariffs. The tariffs are widely understood by the American public. Everybody watched the news on Liberation Day, and every small business that's importing anything, whether it's a children's toy or a refrigerator, is focused on what happens next. What happens at the Supreme Court? Do I need to pay this harmonized tariff schedule number? What's my tariff rate? Every single person in the United States is concerned about tariffs, and they do not like them."

Henrietta Treyz suggests that the White House may be misrepresenting the public's view on tariffs, which she states are widely understood and disliked by Americans. Treyz highlights that businesses importing goods are directly concerned with tariff rates and potential Supreme Court decisions affecting them. She asserts that tariffs are a significant concern for nearly everyone in the US and are unpopular.

Resources

External Resources

Books

- "The Great Reset" by Klaus Schwab - Mentioned in relation to the concept of global economic restructuring.

Articles & Papers

- "The Great Reset" (World Economic Forum) - Discussed as a concept influencing global economic restructuring.

People

- Klaus Schwab - Author of "The Great Reset."

- David Bahnsen - CEO of CIO Group, guest on the podcast.

- Jonathan Ferro - Host of the Bloomberg Surveillance podcast.

- Lisa Abramowicz - Host of the Bloomberg Surveillance podcast.

- Amaryllis Hordern - Host of the Bloomberg Surveillance podcast.

- John Bulten - Of JP Morgan Asset Management, guest on the podcast.

- Donald Trump - Mentioned in relation to House Republicans and healthcare issues.

- Jonathan Tamari - Of Bloomberg Government, guest on the podcast.

- Henrietta Trace - Of Veda Part, guest on the podcast.

- Speaker Johnson - Mentioned in relation to the Republican majority in the House.

- Schumer - Mentioned in relation to narrative focus on affordability and housing.

- Hakeem Jeffries - Mentioned in relation to narrative focus on affordability and housing.

Organizations & Institutions

- Bloomberg - Provider of the podcast and television show.

- CIO Group - Company led by David Bahnsen.

- JP Morgan Asset Management - Organization John Bulten is affiliated with.

- House Republicans - Mentioned in relation to healthcare issues.

- Veda Part - Organization Henrietta Trace is affiliated with.

- World Economic Forum - Publisher of "The Great Reset."

- JP Morgan Chase Bank, N.A. - Mentioned in relation to Chase for Business and the Chase mobile app.

- FDIC - Mentioned as a member of JP Morgan Chase Bank, N.A.

Websites & Online Resources

- chase.com/business - Website to learn more about Chase for Business.

Podcasts & Audio

- Barkley's Brief - Podcast from Barkley's Investment Bank.

- Bloomberg Surveillance podcast - The podcast being transcribed.

Other Resources

- ACA subsidies - Mentioned as expired subsidies impacting healthcare premiums.

- Hyde Amendment - Mentioned in relation to abortion and Republican focus.

- UIPA Act - Mentioned in relation to tariffs and the Supreme Court.

- Harmonized Tariff Schedule - Mentioned in relation to tariff rates and import costs.

- Balance of Payments Authority - Mentioned as a potential mechanism for collecting tariffs.

- 338 - Mentioned as a tariff code that has not been used before.

- Court of International Trade - Mentioned in relation to tariff legal processes.

- Court of Appeals - Mentioned in relation to tariff legal processes.

- Supreme Court - Mentioned in relation to tariffs and the UIPA Act.

- University of Michigan Consumer Sentiment Index - Mentioned as an indicator shaped by politics.