TSMC Capital Expansion Drives Semiconductor Equipment Spending Growth

TLDR

This conversation reveals that the most impactful business strategies are often those that involve immediate discomfort for long-term, compounding advantage. While many focus on quick wins and visible improvements, the deeper analysis shows how investing in foundational, often unpopular, capabilities creates durable moats that competitors, constrained by short-term thinking, cannot easily replicate. Those who understand and implement these delayed-payoff strategies, particularly in technology supply chains and complex financial products, can gain significant separation. This is essential reading for leaders, strategists, and investors who want to move beyond reactive tactics and build sustainable, defensible market positions by embracing difficulty.

INTRODUCTION

The most effective paths to lasting success are rarely the most comfortable. We often gravitate towards solutions that offer immediate relief or visible progress, believing these quick wins are the markers of effective strategy. However, this conversation, drawing insights from market movements and company announcements, highlights a critical blind spot: the systematic underestimation of downstream consequences and the power of delayed payoffs. The obvious answer to a problem, while satisfying in the moment, frequently creates hidden costs or vulnerabilities that compound over time, leaving businesses exposed. This is not about fixing immediate issues; it's about understanding the intricate systems at play, how they respond to interventions, and how deliberate, often difficult, choices can engineer significant, long-term competitive advantages. The speakers explore how companies like TSMC and Lam Research are not just reacting to current demand but are actively shaping future market dynamics through substantial, forward-looking investments, while others, like Verizon, grapple with the immediate fallout of system failures. This analysis dives into the deeper system dynamics, revealing why embracing difficulty and anticipating long-term feedback loops is the true engine of sustainable growth.

MAIN NARRATIVE

The Illusion of Immediate Fixes: Why Verizon's Outage Highlights Systemic Fragility

The recent nationwide outage experienced by Verizon serves as a stark reminder of how seemingly robust systems can falter, and how the immediate aftermath reveals deeper vulnerabilities. While Verizon's restoration of service and promise of customer credits represent a necessary, albeit reactive, first-order response, the underlying cause and the ripple effects are where true systemic analysis begins. The fact that over 170,000 outage reports were filed, with AT&T and T-Mobile also experiencing smaller disruptions, suggests that this was not an isolated incident but potentially a symptom of broader network complexities or dependencies.

According to the analysis presented, the immediate benefit of restoring service is to mitigate customer dissatisfaction and prevent churn. However, the hidden cost is the erosion of trust and the potential for customers to explore alternatives, especially if the root cause is not addressed and the risk of recurrence remains. This leads to a downstream effect where competitors, even if they also experienced minor issues, can capitalize on Verizon's significant disruption by highlighting their own reliability. The system response here is that customers, when faced with prolonged inconvenience, begin to re-evaluate their choices, shifting their loyalty not based on price or features, but on fundamental dependability. The obvious solution--fixing the immediate problem--is insufficient because it doesn't address the systemic factors that led to the failure, nor does it build long-term resilience. What happens over time is that such incidents, if not thoroughly investigated and addressed at a foundational level, can lead to a slow, compounding loss of market share as reliability becomes a more prominent decision factor for consumers.

TSMC's Strategic Gambit: Investing in the Future, Not Just Today's Demand

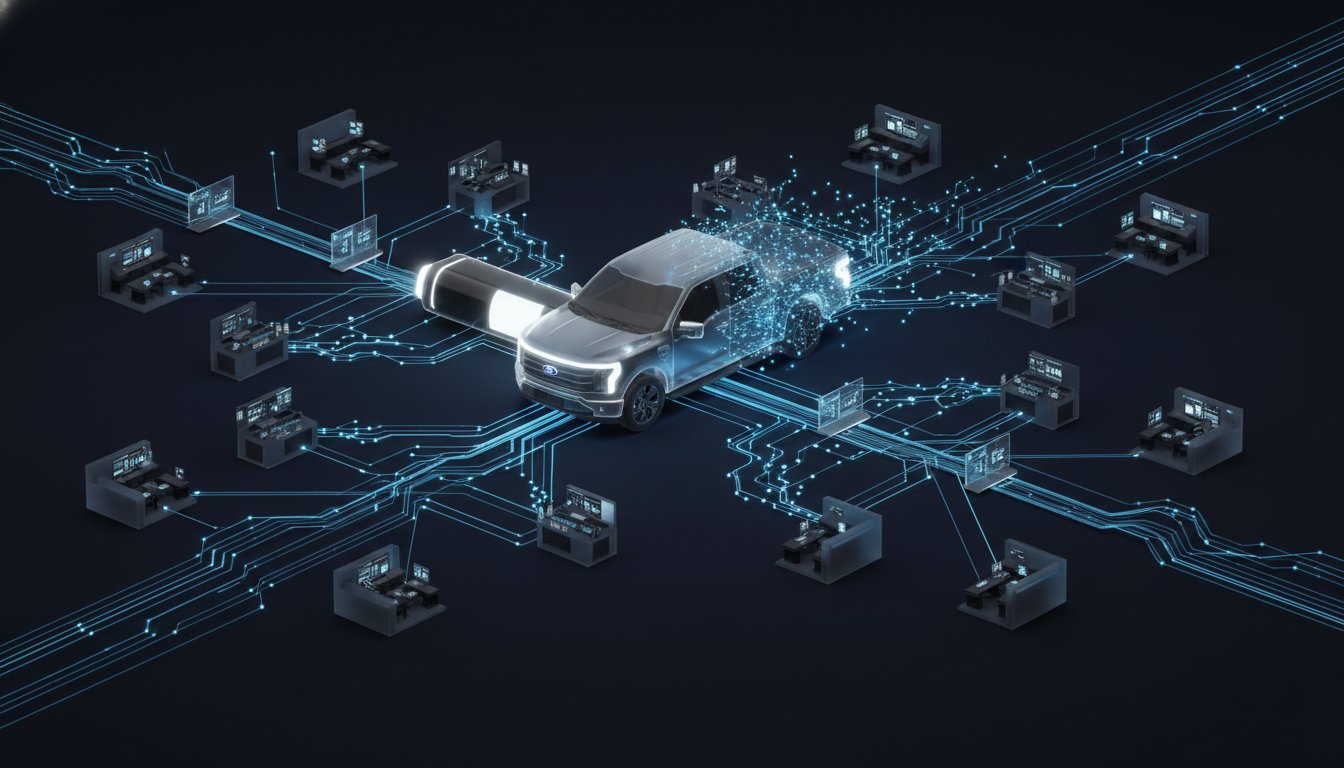

In contrast to reactive problem-solving, the performance of Taiwan Semiconductor Manufacturing Company (TSMC) and its impact on companies like Lam Research and Teradyne exemplify a strategy rooted in foresight and sustained investment. TSMC reported a significant 35% surge in net profit, exceeding analyst expectations, and crucially, announced plans to boost its capital expenditure budget to $52-$56 billion for 2026, a substantial increase from approximately $40 billion last year. This move is not merely about meeting current demand from giants like Nvidia and Apple; it is a deliberate act of shaping the future semiconductor landscape.

The immediate benefit of TSMC's strong performance is a positive market reaction, reflected in its stock price and the pre-market gains of equipment suppliers like Lam Research and KLA. However, the deeper consequence lies in the signal this sends to the entire industry. Stifel forecasts a 10-15% increase in wafer fabrication equipment spending for 2026, driven by advanced foundry logic and DRAM, a revised and more optimistic outlook compared to their previous forecast. This indicates that TSMC's aggressive investment is creating a ripple effect, stimulating demand and growth across its supply chain.

The hidden cost for competitors and those who fail to match this investment is the risk of being left behind. If TSMC continues to invest heavily in advanced manufacturing capabilities, it builds a technological moat that becomes increasingly difficult to breach. This creates a delayed payoff: the significant capital expenditure today will translate into superior production capacity, yield, and technological leadership in the coming years. While other companies might focus on incremental improvements or short-term cost-cutting, TSMC is making a bet on sustained, long-term demand for cutting-edge semiconductors. This strategy requires immense patience and a tolerance for upfront capital outlay with no immediate return, a path that many businesses, constrained by quarterly earnings pressures, are unwilling or unable to take. The system response is that TSMC is not just a supplier; it is an architect of the future technology ecosystem, and its investments dictate the pace and direction of innovation for its customers and partners.

The Competitive Arena: How Credit Card Rates and Tariffs Shape Market Dynamics

The discussions around credit card interest rates and potential tariffs on critical minerals highlight how policy decisions, even those framed for immediate political gain, can have complex and far-reaching systemic effects. President Trump's call for a 10% cap on credit card interest rates, met with pushback from bank CEOs, illustrates a fundamental tension between short-term consumer relief and the long-term stability of financial markets.

The immediate appeal of a rate cap is clear: lower costs for consumers. However, according to the analysis, bank executives are resisting this because it fundamentally alters the risk-reward calculus of lending. If banks cannot charge rates commensurate with the risk of default, particularly for subprime borrowers, they may reduce credit availability or increase fees elsewhere. This leads to a downstream effect where consumers, especially those with less-than-perfect credit, might find it harder to access credit, or the cost of credit, when available, could be higher through other means. The system response is that financial markets adapt to regulatory changes. Banks might shift their strategies, potentially impacting lending volumes or the types of customers they serve. The short-term political win of appearing to help consumers could, over time, lead to a tightening of credit access, which is a hidden cost that might not be immediately apparent.

Similarly, the decision to hold off on critical minerals tariffs, while providing immediate relief to industries reliant on these materials, has its own set of downstream consequences. While the immediate benefit is a more stable supply chain and potentially lower production costs for certain goods, the delayed payoff of imposing tariffs could be a strategic incentive for domestic production and reduced reliance on foreign sources. By delaying, the administration might be foregoing an opportunity to accelerate the development of domestic critical mineral supply chains, a move that could offer long-term national security and economic advantages. The system here is global trade and resource dependency. The choice not to impose tariffs maintains the status quo, which may be comfortable in the short term but could perpetuate vulnerabilities in the long run. Companies like Bilt, by introducing new cards with a 10% introductory APR, are navigating this complex environment, potentially positioning themselves to capture market share if credit conditions tighten elsewhere due to broader economic or regulatory shifts.

The Unseen Value of Difficulty: Building Moats Through Effortful Strategy

The conversation implicitly underscores a powerful principle: competitive advantage is often forged in the crucible of difficulty. Strategies that require significant upfront effort, delayed gratification, and a willingness to endure short-term discomfort are precisely those that create durable moats. TSMC's massive capital expenditure is a prime example. It requires substantial financial commitment, long lead times for new fabrication plants, and a deep understanding of future technological needs. This is not a quick fix; it is an 18-month to multi-year investment with no guarantee of immediate returns, but it builds a capability that is exceptionally hard for competitors to replicate.

Consider the contrast with a hypothetical company that focuses solely on optimizing its current production lines for marginal efficiency gains. While this might yield immediate, visible improvements, it does not fundamentally alter the company's long-term competitive positioning. The true advantage comes from building something that is difficult to copy. This could be a unique technological process, a deeply integrated supply chain, or a customer loyalty built on unwavering reliability. These are the outcomes of strategies that require patience most people lack.

The speakers highlight instances where companies are making these harder, longer-term plays. The decision to invest in advanced semiconductor manufacturing, the strategic positioning in financial products that may benefit from shifting credit landscapes, and even the proactive management of network infrastructure (or the lack thereof, as seen with Verizon) all point to the fact that the most durable advantages are built through foresight and a willingness to undertake effortful initiatives. Where others won't go--into substantial, long-term capital investments, into understanding complex feedback loops in financial markets, or into building truly resilient infrastructure--that is precisely where lasting competitive separation is achieved. The key takeaway is that "solved" problems are often just symptoms; "actually improved" systems are the result of confronting and mastering the underlying complexities, even when it's uncomfortable.

KEY ACTION ITEMS

- Invest in Foundational Capabilities: Instead of focusing solely on immediate performance gains, identify and invest in core competencies and infrastructure that will yield long-term benefits. This requires significant upfront capital and patience. (Example: TSMC's capital expenditure for future fabrication needs.) Pays off in 18-36 months.

- Map Downstream Consequences: Before implementing any solution, rigorously analyze its potential second and third-order effects. Understand how the system will likely respond and what new challenges might emerge. Immediate action required for all new initiatives.

- Embrace Strategic Discomfort: Actively seek out and implement strategies that involve short-term pain or unpopular decisions for the sake of lasting advantage. This is where true competitive moats are built. (Example: Implementing a difficult but necessary process change that competitors avoid.) This pays off in 12-24 months, creating separation.

- Anticipate Systemic Responses: Consider how competitors, customers, and the broader market will react to your strategic moves. Design your actions to leverage or preempt these responses. (Example: Building a service that is so reliable it becomes a differentiator when competitors face outages.) Requires ongoing analysis, with strategic shifts implemented quarterly.

- Build for Durability, Not Just Speed: Prioritize solutions and investments that offer long-term resilience and adaptability over those that provide only fleeting advantages. (Example: Investing in robust network infrastructure rather than just quick-fix software patches.) This pays off over years.

- Understand the Cost of "Solved": Recognize that fixing an immediate problem doesn't equate to fundamental improvement. Focus on addressing root causes to achieve genuine, sustainable progress. Requires a shift in mindset, implemented immediately and reinforced continuously.

- Cultivate Patience: Recognize that the most impactful strategies often have long lead times. Resist the pressure for immediate results and commit to the longer journey. This is a continuous practice, with strategic planning horizons extended to 3-5 years.