This conversation, drawn from the Wall Street Breakfast podcast, offers a stark look at corporate restructuring and strategic pivots, particularly through the lens of ASML's significant job cuts alongside record orders. The non-obvious implication is that even peak performance can mask underlying inefficiencies and the need for radical streamlining. This analysis reveals how companies, when faced with complexity, may choose to shed layers of management and coordination overhead, not due to a lack of success, but precisely because of it. Investors and business leaders should read this to understand how to identify and leverage the hidden costs of growth and the strategic advantages of preemptive, albeit painful, organizational adjustments.

The Paradox of Peak Performance: Streamlining Amidst Record Orders

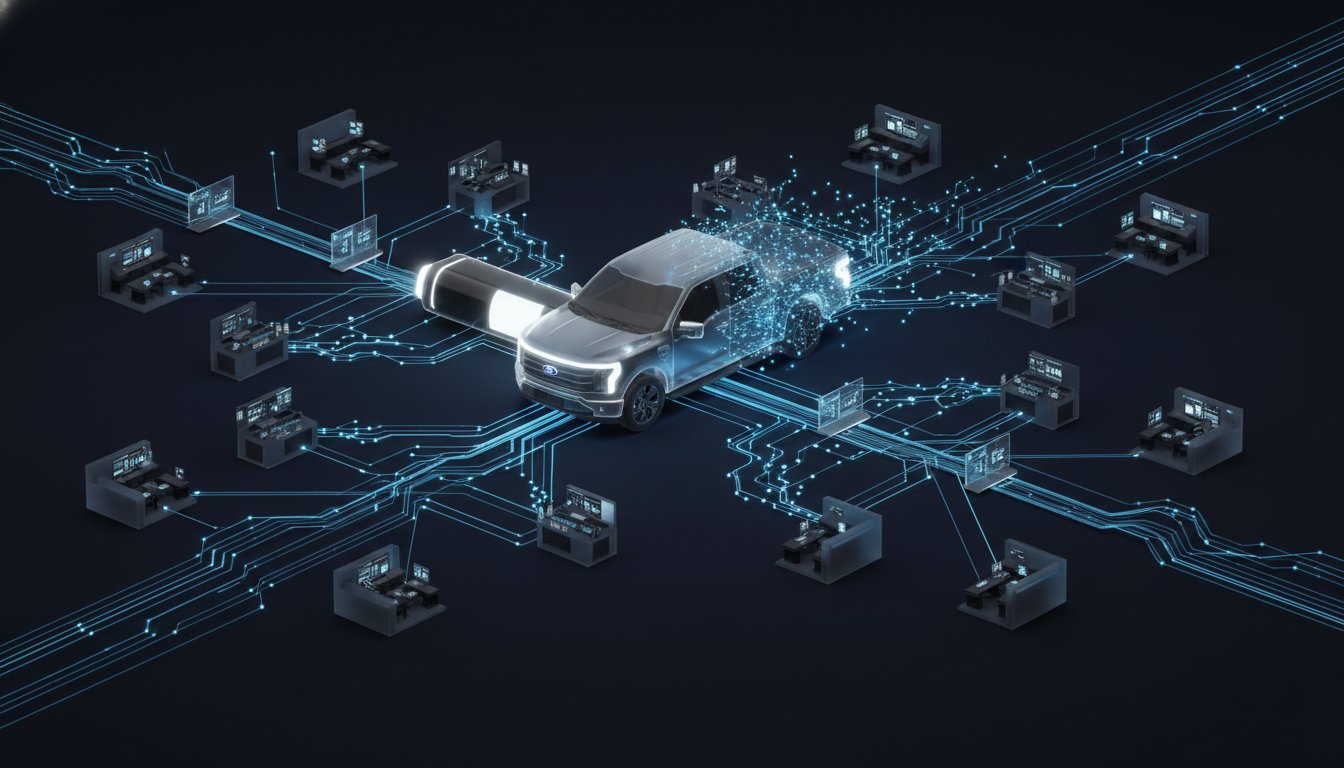

ASML's recent announcement of approximately 1,700 job cuts, primarily affecting management and IT roles, presents a fascinating paradox. The company is simultaneously reporting record orders and robust sales growth. This situation isn't a sign of distress, but rather a deliberate act of organizational recalibration. The core insight here is that massive success can breed its own form of inefficiency, creating layers of coordination and management that, while perhaps necessary during growth, become a drag when the organization matures or faces new operational challenges.

The CFO’s statement highlights this: "ASML has a complex organization, often requiring excessive coordination." This isn't about engineers not being engineers; it's about management and IT structures becoming so intricate that they impede the very engineers they are meant to support. The stated aim is to "streamline operations so that engineers can be engineers again." This implies a recognition that the process of doing business has become more complex than the product itself, a common second-order effect of rapid expansion.

"ASML has a complex organization, often requiring excessive coordination."

-- ASML CFO

The consequence map here is critical. On the surface, job cuts signal trouble. However, in ASML's case, the context of record orders and increased sales guidance for the future suggests these cuts are a proactive measure to sustain that growth. The immediate pain of layoffs is designed to unlock future efficiency, creating a competitive advantage by shedding organizational weight. This is where conventional wisdom fails: most would expect cuts only when orders are falling, not when they are soaring. The delayed payoff is a more agile, responsive organization capable of handling its massive order book more effectively, reducing the risk of operational bottlenecks that could derail future performance.

Amazon's Grocery Gambit: Shifting Sands in Retail

Amazon's strategic shift in its grocery sector, closing some Amazon Fresh and Go stores to double down on Whole Foods Market expansion and grocery delivery, illustrates a similar theme of adaptation driven by downstream consequences. The immediate implication is a consolidation of effort. However, the deeper analysis reveals a recognition that their initial foray into physical grocery had hidden costs and complexities that were not yielding the expected returns.

The analyst Dan Ives notes the importance of this move: "The Whole Foods Market's announcement is an important step forward in Amazon's broader strategy. He thinks the initiative should help the company capture incremental share in perishable categories where they have struggled historically." This points to a critical systems-level insight: Amazon's broader retail dominance, built on logistics and e-commerce, faced unique challenges in the high-touch, perishable grocery market. The existing infrastructure and customer perception for Whole Foods, a brand with established credibility in quality groceries, offers a more direct path to capturing share than their disparate Amazon Fresh and Go formats.

The grocery mix at large general merchandisers such as Walmart, Target, and Costco has made the category of critical importance to Amazon.

This strategy shift is a clear example of consequence mapping. The initial investment in Amazon Fresh and Go likely aimed for broad market penetration. However, the downstream effect was a struggle to compete directly with established players like Walmart and Target, who have historically integrated grocery sales effectively. By pivoting to a more focused approach--expanding Whole Foods and enhancing delivery--Amazon is not just changing tactics; it's reconfiguring its position in a critical market segment. The delayed payoff here is not just incremental share, but a more defensible, profitable position in a category that has proven stubbornly difficult to conquer with their initial approach. This requires patience, as building out the Whole Foods brand and delivery infrastructure will take time, but it addresses a historical weakness more directly than their previous efforts.

The AI Maelstrom: Consolidation and Strategic Investments

The news surrounding C3.AI and OpenAI offers a glimpse into the dynamic and often turbulent landscape of the artificial intelligence sector. C3.AI's reported merger talks with Automation Anywhere, following a significant plunge in its stock, exemplifies how companies in nascent, high-growth sectors can face immense pressure to consolidate or pivot when their initial strategies don't yield immediate market validation or financial performance.

The report that Automation Anywhere would acquire C3.AI and go public as part of the transaction suggests a move towards creating a more robust entity capable of competing in the enterprise AI space. This is a common pattern where initial, often ambitious, standalone ventures find it more advantageous to combine forces to achieve scale and offer a more comprehensive solution. The "declining financial performance and uncertainty around its strategy and leadership" at C3.AI are the immediate signals, but the underlying systemic consequence is the intense competition and capital requirements in AI.

Meanwhile, the report of SoftBank potentially investing an additional $30 billion in OpenAI underscores the massive capital flowing into foundational AI models. This isn't just about funding research; it's about strategic positioning in what is perceived as a next-generation technology platform. The consequence of such large-scale investment is the acceleration of development, but also a potential bifurcation of the market. Companies that can attract massive funding, like OpenAI, can push the boundaries rapidly, while others, like C3.AI, may find themselves needing to merge to survive or find a niche.

The implications for the market are significant. On one hand, consolidation can lead to more streamlined, powerful AI solutions for enterprises. On the other, massive investments in foundational models can create a winner-take-most dynamic, making it harder for smaller or less-funded players to compete. The delayed payoff for investors in OpenAI, if SoftBank's investment materializes, is the potential for massive returns if the company becomes a dominant force. For C3.AI, the merger could offer a path to renewed growth, but it also represents a concession that their independent strategy was insufficient.

Key Action Items

- Immediate Action (ASML): Analyze internal coordination overhead. Identify management and IT layers that do not directly support core engineering or customer-facing functions.

- Immediate Action (Amazon): Evaluate the efficiency of current physical retail footprints against direct-to-consumer delivery capabilities in perishable goods.

- Immediate Action (AI Sector Watchers): Monitor consolidation trends in enterprise AI. Understand how merged entities are integrating offerings and addressing customer needs.

- Medium-Term Investment (ASML): Implement streamlined operational processes and potentially realign management structures to empower engineering teams. This may involve discomfort due to initial resistance or process changes.

- Medium-Term Investment (Amazon): Aggressively expand Whole Foods Market presence and refine same-day grocery delivery logistics. This investment will pay off in 12-18 months as market share in perishables grows.

- Longer-Term Investment (AI Sector): Assess the strategic implications of massive investments in foundational AI models. Identify opportunities to build specialized applications or services that complement these platforms, rather than competing directly.

- Strategic Consideration (All): Recognize that periods of peak performance can be the optimal time to implement difficult structural changes, as the underlying business health can absorb the short-term pain for long-term competitive advantage.