Ford's EV Pivot and Nasdaq's 23-Hour Trading Proposal

TL;DR

- Ford's strategic pivot to hybrids and smaller EVs, coupled with a $19.5B EV write-down, signals a de-prioritization of current EV models due to weak demand and high costs, impacting future product development and investment allocation.

- Nasdaq's proposed 23-hour, five-day trading week aims to expand market access and liquidity, potentially altering trading strategies and operational demands by creating distinct day and night session implications for trade execution.

- The significant $19.5B write-down by Ford on its EV business, primarily impacting 2025-2027, indicates a substantial re-evaluation of EV investment returns and a shift in capital allocation towards more immediate profitability drivers like hybrids.

- Ford's repurposing of battery plants for grid energy cells and data center power addresses emerging market demands beyond automotive, diversifying revenue streams and leveraging existing infrastructure for new applications.

- The NRF's forecast of over $1 trillion in holiday sales, with Super Saturday shoppers embracing omnichannel strategies, highlights consumer resilience and evolving purchasing behaviors, impacting inventory management and sales channel optimization.

- Nasdaq's move to round-the-clock trading, with trades in the night session considered for the following day, introduces a new temporal dynamic for market participants, potentially affecting price discovery and risk management.

Deep Dive

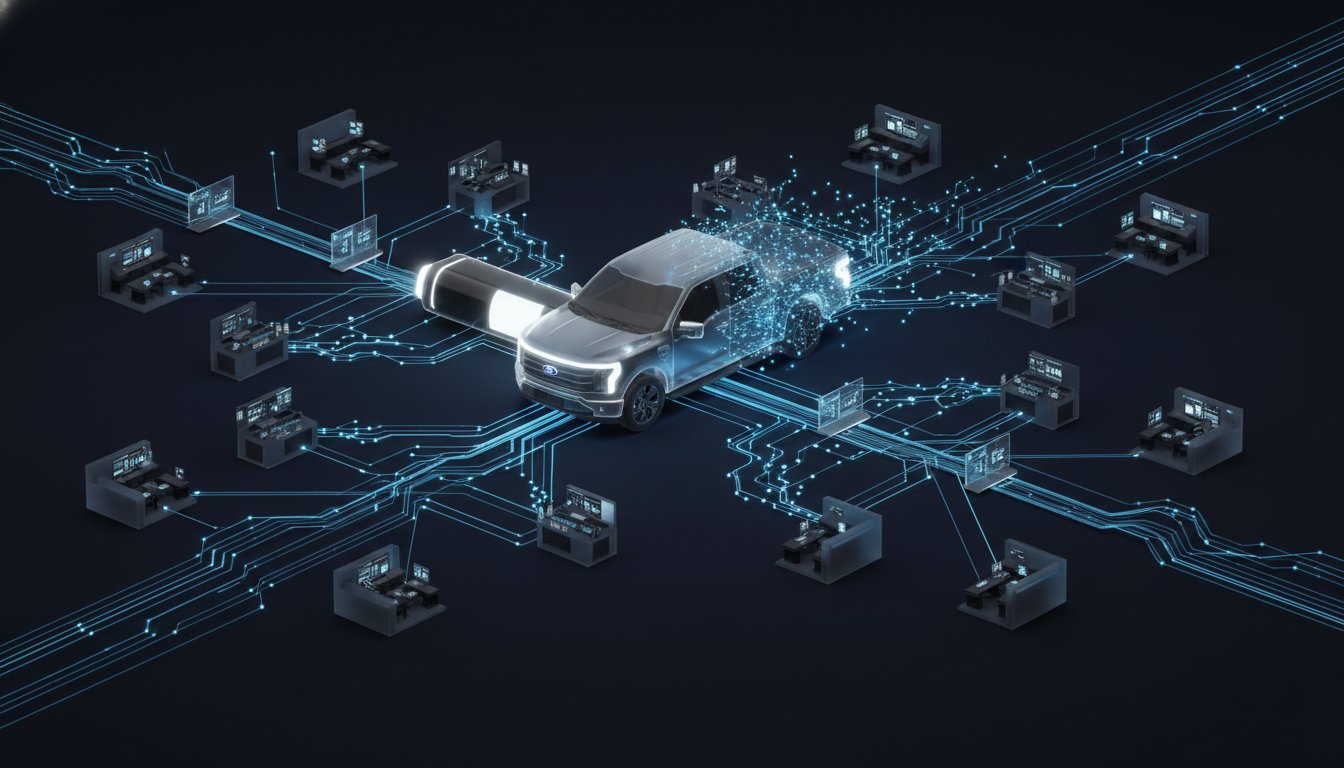

Ford is fundamentally reorienting its electric vehicle (EV) strategy, acknowledging weak demand and high costs by taking a $19.5 billion writedown and shifting production priorities. This move signals a pragmatic pivot away from current EV scaling challenges toward a more balanced approach that includes hybrids and extended-range models, indicating that the rapid transition to full electrification may be more complex and protracted than initially anticipated. Concurrently, Nasdaq is proposing a significant expansion of trading hours, aiming for round-the-clock operations, which could reshape market dynamics by enabling continuous price discovery and potentially altering global trading flows.

Ford's strategic reset reveals a critical tension between ambitious electrification goals and market realities. The company is scaling back current Lightning production and reallocating resources, signaling that current EV models are not meeting expectations in terms of sales volume or profitability. This decision is not an abandonment of EVs but rather a recalibration, with plans to reintroduce a next-generation Lightning as an extended-range EV and repurpose battery plants for grid and data center applications. This suggests Ford is seeking more immediate revenue streams and operational efficiencies by leveraging its battery technology beyond just vehicle powertrains. The elevated 2025 Ebit estimate and reaffirmed free cash flow guidance, despite the writedown, indicate that management believes this strategic shift will ultimately improve financial performance, even if it means a slower path to electrification. The implication is that the economics of EVs, particularly for high-volume models, require further maturation or innovation to align with established automotive business models.

In parallel, Nasdaq's proposal for 23-hour trading, five days a week, represents a significant operational shift that could have broad implications for market participants. By extending trading beyond current post-market hours and into the early morning, Nasdaq aims to provide continuous access to price discovery. This move could benefit investors seeking to react to global news events outside of traditional trading hours and potentially attract new participants to the market. However, it also raises questions about market liquidity during off-peak hours, the impact on operational staffing for financial institutions, and how trades executed in these extended sessions will be accounted for in daily settlements. The proposed two-session structure (day and night) with a maintenance break suggests a complex operational framework designed to manage the continuous trading flow.

The holiday shopping season also presents a notable economic indicator, with projections for Super Saturday to potentially exceed previous records in consumer turnout. The expected increase in shoppers utilizing both in-store and online channels highlights the evolving consumer behavior and the ongoing integration of e-commerce with traditional retail. This trend, coupled with an overall forecast for holiday sales to surpass $1 trillion, suggests underlying consumer resilience and spending power, which could provide a backdrop for broader economic activity.

The takeaway is that established industries are undergoing significant strategic adjustments in response to evolving market demands and technological opportunities, while infrastructure providers like Nasdaq are pushing operational boundaries to accommodate these shifts. Ford's EV recalibration and Nasdaq's expanded trading hours underscore a period of dynamic change, where companies are forced to adapt profitability models and operational frameworks to navigate new economic landscapes.

Action Items

- Audit Ford's EV strategy: Analyze 2025 Ebit and 2030 hybrid/EV sales targets against current demand and cost realities.

- Measure retail channel shift: Track in-store vs. online shopping for 150 million Super Saturday consumers to inform future inventory and marketing.

- Evaluate Nasdaq's 23/5 trading model: Assess operational impact and potential for 23-hour trading sessions on market liquidity and participant behavior.

- Analyze Tesla director stock awards: Calculate the correlation between $3B+ awards and company performance metrics for 3-5 key periods.

Key Quotes

"Ford is taking a 19 and a half billion dollar writedown in its EV business and hitting reset, after weak demand, high costs, and changes in the regulatory environment. The CEO told CNBC that EVs just weren't selling."

The host, Julie Morgan, reports that Ford is significantly restructuring its electric vehicle (EV) division due to insufficient demand and escalating costs. This strategic shift involves a substantial financial write-down, indicating a reassessment of the company's EV market approach.

"Strategically, Ford is ending production of the current generation F-150 Lightning and shifting towards hybrids, extended range EVs, and smaller EV models. By 2030, about half of Ford's global sales are expected to come from hybrids and EVs, up from 17% today."

Julie Morgan explains Ford's new product strategy, which moves away from the current F-150 Lightning model. The company plans to focus on a mix of hybrid vehicles, longer-range EVs, and more compact EV designs to meet future sales targets.

"Reuters is reporting that Nasdaq is planning to submit paperwork with the Securities and Exchange Commission to launch round-the-clock trading. The company previously said it expected to launch non-stop trading in the second half of next year."

According to Julie Morgan, Nasdaq is preparing to formally propose an expansion of its trading hours to the SEC. This move aims to introduce continuous, 24-hour stock trading, a significant departure from the current weekday session structure.

"The National Retail Federation expects an estimated 158.9 million consumers to shop on the last Saturday before Christmas. This would edge past the prior record of 158.5 million consumers in 2022."

Julie Morgan highlights the anticipated consumer activity for Super Saturday, noting that the National Retail Federation forecasts record-breaking shopper numbers. This projection suggests a strong surge in holiday shopping on the final Saturday before Christmas.

"Super Saturday shoppers are expected to embrace multiple channels this year, with nearly half planning to shop both in-store and online, up from 44% in 2024. For the remainder who are planning to shop a single channel, 29% will do so exclusively in-store, while 26% will shop online only."

Julie Morgan details consumer shopping preferences for Super Saturday, indicating a significant trend towards omnichannel purchasing. A substantial portion of shoppers plan to utilize both physical stores and online platforms, reflecting a blended approach to holiday shopping.

"B. Riley Financial is on our list of the biggest movers of the day pre-market. RILY is up 28%, primarily due to the company finally filing its overdue second quarter 10Q reports, which revealed a massive swing back to profitability."

Julie Morgan reports on B. Riley Financial's significant stock increase, attributing it to the company's timely filing of its financial reports. These reports demonstrated a strong return to profitability, positively impacting the stock's performance.

Resources

External Resources

Articles & Papers

- "Ford shifts EV strategy, takes $19.5B write-down and drops current Lightning production" (seekingalpha.com) - Discussed in relation to Ford's EV strategy changes.

- "Nasdaq seeks SEC nod for round-the-clock stock trading" (seekingalpha.com) - Referenced for Nasdaq's plans for extended trading hours.

- "The holiday shopping season ramps up again with Super Saturday on December 19" (seekingalpha.com) - Mentioned as context for holiday shopping trends.

- "Biggest stock movers Tuesday: RILY, ORGO, KYTX, RC, LWLG and more" (seekingalpha.com) - Listed as a trending article on Seeking Alpha.

- "Tesla directors won over $3 billion in stock awards - Reuters" (seekingalpha.com) - Noted as a trending article on Seeking Alpha.

- "Cathie Wood buys the dip: Ark Invest loads up on Bitmine, CoreWeave" (seekingalpha.com) - Mentioned as a trending article on Seeking Alpha.

- "Trump sues BBC over speech edit in documentary, seeks $10B in damages" (seekingalpha.com) - Referenced as a trending article on Seeking Alpha.

People

- Julie Morgan - Host of Wall Street Breakfast.

Organizations & Institutions

- Ford (F) - Discussed for its EV strategy reset and production changes.

- Nasdaq (NDAQ) - Referenced for its plans to launch round-the-clock stock trading.

- National Retail Federation (NRF) - Mentioned for its forecast on holiday shopping spending.

- Reuters - Cited as the source for reporting on Nasdaq's trading plans and Tesla directors' stock awards.

- Seeking Alpha - The platform hosting the podcast and providing trending articles.

- Ark Invest - Mentioned in relation to Cathie Wood's investment activity.

- BBC - Referenced in the context of a lawsuit filed by President Trump.

- SunPower - Participating in the Northland Virtual Growth Conference.

- Calix - Participating in the Northland Virtual Growth Conference.

- Shore Software - Participating in the Northland Virtual Growth Conference.

- Arthur Gallagher and Co. - Holding an investor meeting.

- Vital Farms - Holding an investor day.

- Cisco Systems - Holding an annual meeting.

- NBIX - Holding an R&D day.

- Firm Holdings - Holding an investor meeting.

- Pfizer - Holding a conference call for financial guidance.

- B. Riley Financial (RILY) - Mentioned as a significant pre-market mover due to 10Q filings.

Websites & Online Resources

- seekingalpha.com/wsb - Provided as the link for episode transcripts.

- seekingalpha.com/subscriptions - Provided for information on subscribing to Seeking Alpha Premium.

Other Resources

- Super Saturday - Discussed as a significant shopping day before Christmas.

- Ebit - Mentioned in relation to Ford's financial estimates.

- 10Q reports - Referenced in the context of B. Riley Financial's filings.

- Employment situation - Part of the economic calendar.

- Housing starts and permits - Part of the economic calendar.

- Retail sales - Part of the economic calendar.