Market Reacts to Tariffs, Hardware Downturn, and 24/7 Tokenized Trading

This conversation, though brief, reveals a crucial undercurrent in modern finance: the tension between immediate transactional efficiency and the long-term systemic implications of technological adoption. The most striking takeaway isn't just about new trading platforms or tariff adjustments, but how the very infrastructure of financial markets is being re-architected. This analysis is critical for investors and strategists who need to anticipate how these foundational shifts will create competitive advantages for those who understand the downstream effects, while potentially leaving behind those focused solely on short-term gains. Anyone aiming to navigate the evolving landscape of digital assets, global trade dynamics, and corporate strategy will find value in understanding these hidden consequences.

The Ghost in the Machine: Unpacking the Downstream Costs of 24/7 Tokenized Trading

The New York Stock Exchange's exploration into a 24/7 trading platform for tokenized securities represents a significant leap in financial infrastructure. On the surface, it promises immediate benefits: instant settlement, dollar-based orders, and the use of stablecoins. This addresses the friction inherent in traditional trading, offering a seemingly more efficient, modern way to transact. However, a deeper systems-level analysis reveals potential hidden costs and complexities that could cascade through the market.

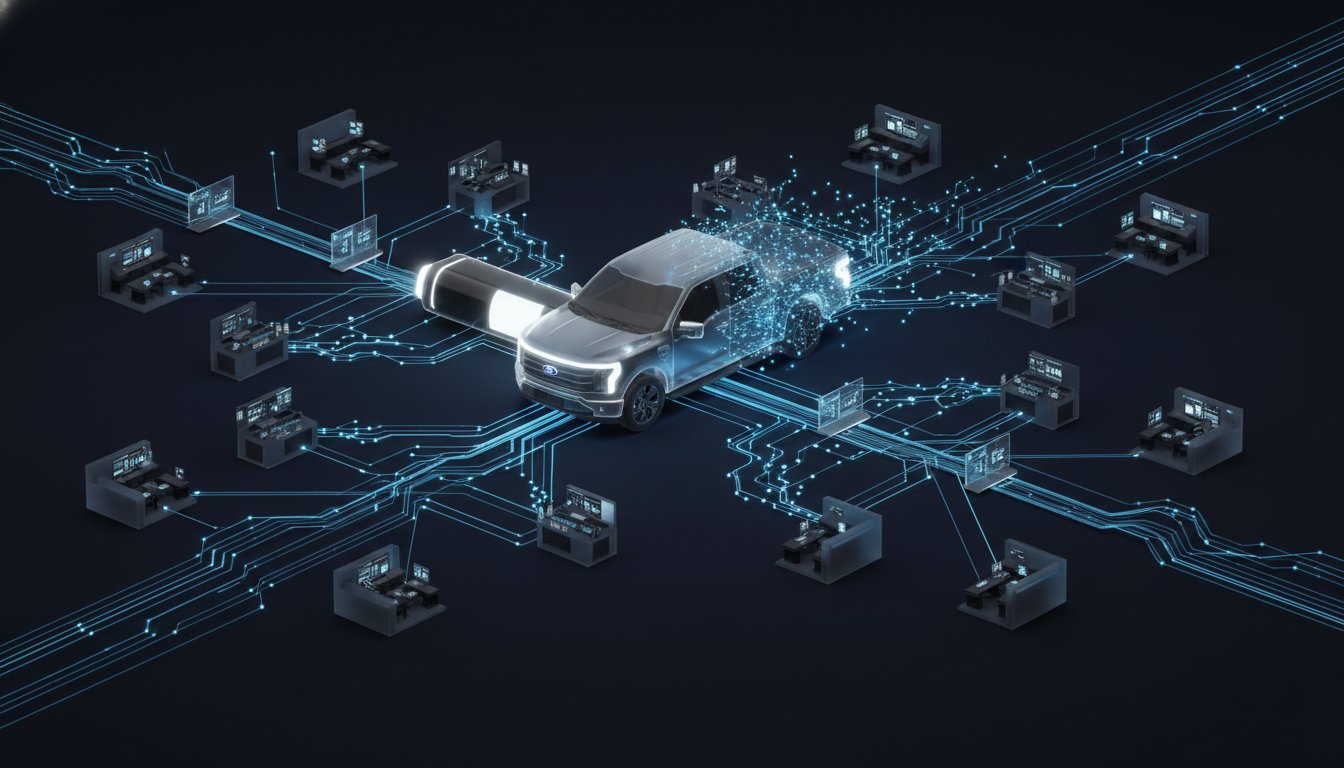

The integration of blockchain technology, while enabling instant settlement, introduces a new layer of technical infrastructure with its own maintenance, security, and upgrade cycles. The NYSE's plan to combine its existing matching engine with blockchain-based post-trade systems, supporting multiple chains, suggests a complex hybrid model. This isn't just a simple software update; it's a fundamental re-architecture. The immediate payoff of instant settlement might be offset by the long-term challenge of managing and securing this distributed infrastructure, especially as it scales.

Furthermore, the concept of tokenized securities, while offering digital representation, raises questions about regulatory oversight and the potential for new forms of market manipulation or systemic risk that we haven't yet encountered. The description notes the platform needs regulatory approval, highlighting that this is not a simple technological rollout but a negotiation with existing frameworks.

"The platform's design combines NYSE's existing matching engine, which matches buy and sell orders, with blockchain-based post-trade systems, including the capability to support multiple chains for settlement and custody."

This statement hints at the complexity. While the immediate benefit is faster settlement, the long-term consequence is a more intricate system to manage. The "capability to support multiple chains" could mean increased operational overhead and potential points of failure if not managed meticulously. This is where conventional wisdom, focused on immediate speed, falters. The true test will be the system's resilience and manageability over years, not just in the initial launch phase. The advantage here lies with those who can anticipate and mitigate the long-term operational complexities, rather than those solely focused on the transactional speed.

Tariffs as Strategic Levers: When Trade Wars Create Unexpected Winners

The mention of President Trump's tariff warnings and Canada's EV tariff adjustments offers a compelling case study in how geopolitical actions can create unexpected beneficiaries within global supply chains. The immediate narrative is one of trade friction, but a systems perspective reveals how these policies can shift competitive dynamics and create opportunities for companies that are strategically positioned.

Canada's decision to lower tariffs on Chinese-made EVs, in exchange for easing tariffs on its own products like canola, is a direct response to economic pressures and strategic negotiation. The report highlights Tesla as a potential early winner. This isn't just about Tesla benefiting from lower import costs; it's about how this policy shift alters the competitive landscape for electric vehicles in Canada. With a significant footprint and a factory capable of producing Canadian-tailored Model Ys, Tesla is poised to leverage this change. The fact that they had to halt shipments in 2024 due to previous high tariffs and switched to Berlin-made vehicles underscores the direct impact of these policies on their operational strategy.

However, the nuance lies in the details. The quota system, with half of the allowed EVs priced under CAD $35,000, could also benefit Chinese brands like BYD, even though they currently have a minimal presence in Canada. This creates a potential opening for new market entrants. The consequence of the tariff change isn't just a simple reduction in cost; it's a recalibration of market access and a potential catalyst for new competitive dynamics.

"Tesla could be one of the biggest winners from Canada's decision to sharply cut tariffs on electric vehicles made in China."

This statement, while direct, points to a larger systemic effect. The tariff adjustment doesn't just make EVs cheaper; it fundamentally alters the economics of importing and selling them in Canada. Companies that can quickly adapt their supply chains and pricing strategies to these new realities will gain a significant advantage. The long-term payoff for Tesla, if they can effectively leverage their Shanghai production for the Canadian market, is a more cost-effective supply chain and potentially increased market share. This requires foresight and the ability to navigate complex international trade regulations, a difficult but ultimately rewarding endeavor.

The Compounding Effect of IT Hardware Downturns: Beyond the Immediate Downgrade

The discussion around Logitech, NetApp, and CDW, and their downgrades by Morgan Stanley, serves as a stark reminder of the cyclical nature of IT hardware spending and the often-underestimated duration of downturns. The immediate news is a stock price drop and a downgrade, but the underlying analysis points to a deeper systemic issue: the "first cut of a hardware down cycle that could last three to five quarters."

The report cites a "perfect storm for IT hardware, as corporate spending slows to its weakest pace in 15 years outside of COVID-19." This isn't just a blip; it's a significant contraction in a critical sector. The combination of softer demand, as indicated by CIO surveys, and resellers anticipating budget cuts for PCs, servers, and storage, paints a picture of a prolonged slowdown. The component-driven price increases exacerbate this, making hardware less attractive for already cautious businesses.

The critical insight here is the duration and compounding nature of such downturns. A three-to-five-quarter cycle means that even after the initial shock, companies will face sustained pressure. This can lead to a buildup of technical debt as companies delay necessary upgrades, or it can force a more fundamental rethink of IT infrastructure needs. The immediate consequence of the downgrade is a stock price correction. The downstream effect is a sustained period of reduced revenue and potentially increased pressure on margins for hardware vendors.

"The firm said this marks only the first cut of a hardware down cycle that could last three to five quarters."

This quote is crucial. It signals that the current pain is not a temporary anomaly but the beginning of a prolonged period of adjustment. Companies that can weather this storm by diversifying their revenue streams, focusing on services, or offering solutions that address efficiency rather than just raw hardware capacity, will emerge stronger. The advantage lies with those who recognize that this isn't just about selling more boxes, but about providing enduring value in a constrained spending environment. The immediate discomfort of slower sales for these companies could, if managed strategically, lead to a more resilient business model in the long run, but only if they resist the temptation to simply wait it out.

Key Action Items

- For Investors:

- Immediate Action: Re-evaluate IT hardware holdings, considering the potential for a prolonged down cycle (3-5 quarters).

- Longer-Term Investment: Identify companies in the tech sector that offer services or solutions focused on efficiency and cost savings, rather than pure hardware sales. This pays off in 12-18 months as the market shifts.

- For Financial Institutions:

- Immediate Action: Begin assessing the operational and regulatory readiness for 24/7 tokenized trading platforms, focusing on security and compliance.

- Longer-Term Investment: Develop strategies and infrastructure to support stablecoin-based transactions and explore the use of tokenized assets as collateral. This positions for future market evolution.

- For Companies Engaged in Global Trade:

- Immediate Action: Analyze the impact of current and potential tariff changes on your supply chain and market access.

- Over the next quarter: Explore opportunities to leverage new trade agreements or tariff adjustments for competitive advantage, particularly in sectors like EVs.

- For Technology Vendors:

- Immediate Action: Focus on solutions that demonstrably reduce operational costs and improve efficiency for clients, rather than solely on selling new hardware.

- This pays off in 12-18 months: Develop robust support and maintenance models for existing infrastructure, acknowledging that clients may delay upgrades.

- For All Market Participants:

- Immediate Action: Cultivate a mindset that looks beyond immediate transactional benefits to anticipate the long-term systemic consequences of technological and policy shifts.

- Requires Patience: Invest time in understanding the full lifecycle costs and benefits of new financial technologies and trade policies, even when immediate gains are less obvious. This creates lasting competitive moats.