Yahoo Leverages User Data and AI for Performance Advertising Growth

TL;DR

- Yahoo's strategy leverages its vast user base and first-party data to drive performance advertising, enabling it to compete effectively against larger players by offering superior conversion rates across its DSP.

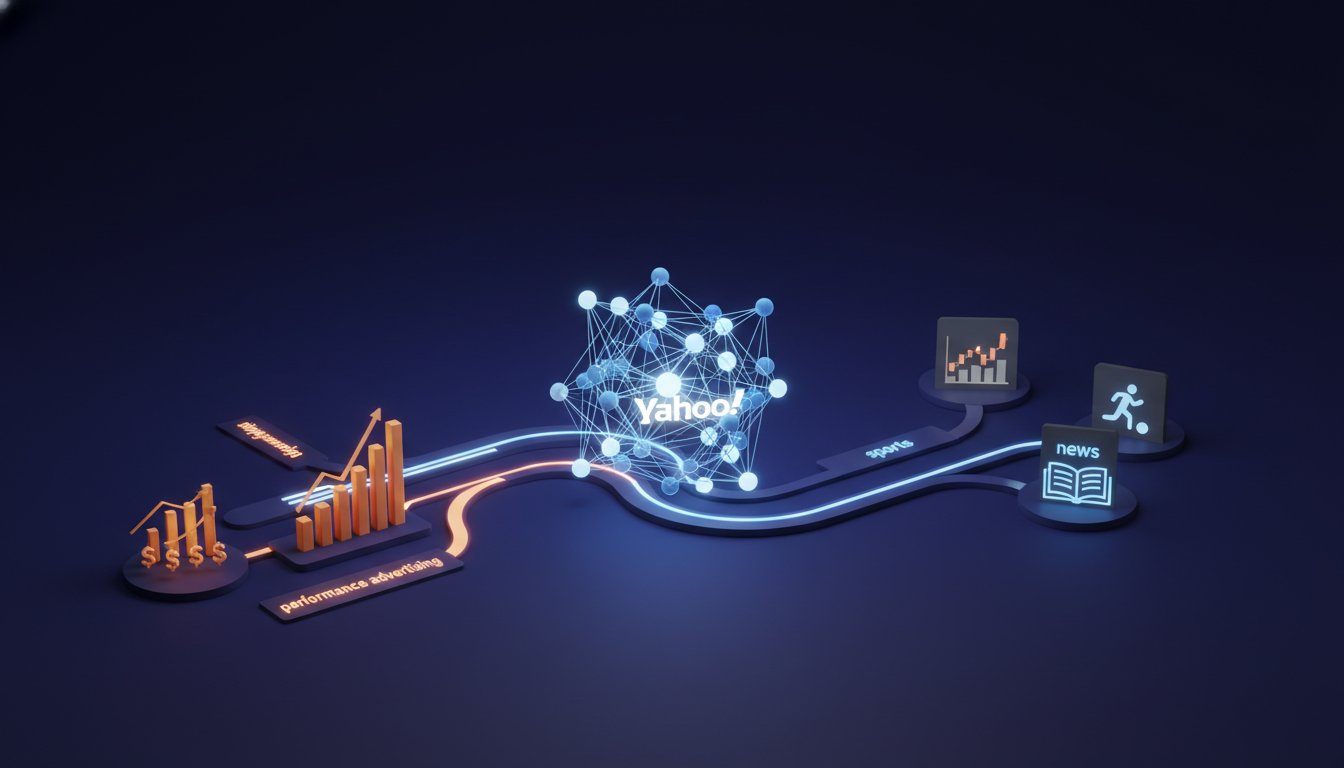

- By acquiring Artifact, Yahoo integrated advanced AI and machine learning capabilities, which became the backbone for new features and a successful relaunch of its news app.

- Yahoo's core strength lies in being a guide to the internet, maintaining top rankings in finance, sports, and news, and utilizing its direct user relationships for monetization.

- The company views itself as a consumer product company, not solely a media entity, competing for ad dollars and talent with major tech players like Meta and Google.

- Yahoo is actively integrating AI across its products, from news digests and email assistance to fantasy sports lineup suggestions, anticipating user expectations for AI-powered features.

- The company's end game involves either an IPO or sale, focusing on sustainable double-digit growth in consumers, revenue, and profit to build significant investor value.

- Yahoo's brand awareness, comparable to established names like Rolex and New Balance, represents a significant asset that the company is actively revitalizing through modern product launches and marketing.

Deep Dive

Yahoo's survival hinges on leveraging its massive, direct user base and historical strength as an internet guide to drive performance advertising, rather than competing directly with search giants. This strategic focus allows Yahoo to capitalize on its existing distribution and data to monetize effectively, while also positioning it to adapt to evolving media consumption patterns and the rise of AI.

Yahoo's core strategy revolves around its enduring role as a guide to the internet, a strength that remains potent in key verticals like finance, sports, and news, where it holds top rankings. The company's significant distribution, with over 75% of its user traffic coming directly to its properties, provides a crucial first-party relationship with hundreds of millions of users. This direct engagement is fundamental to its monetization strategy, which relies heavily on performance advertising powered by its extensive user data. Unlike companies solely focused on branding, Yahoo's ability to convert through targeted advertising on its own properties and through its Demand-Side Platform (DSP) is a key differentiator, especially as Connected TV (CTV) advertising increasingly demands performance metrics. The acquisition of AI companies, including Artifact, signals a commitment to integrating advanced technology across its suite of products, from news digests to fantasy sports lineup optimization, demonstrating an ability to build and acquire strategically to enhance user experience and product capabilities.

The future for Yahoo involves continued investment in its core strengths and strategic expansion, particularly in areas like sports and finance, which drive high user engagement. The company is actively developing its content slate in sports, producing original programming and exploring streaming opportunities through FAST channels, leveraging its scaled sales force and DSP. While Yahoo operates in a media landscape increasingly dominated by niche content and closed ecosystems, its ability to aggregate and distribute traffic, a DNA component from its inception, positions it to thrive. The company views AI not as an existential threat but as an opportunity to enhance its offerings and maintain its relevance, particularly in search and personalized content delivery. Its long-term vision is to operate as a growing, entrepreneurial consumer product company, valuing user growth and revenue profitability, with potential outcomes including an IPO or acquisition by entities that can benefit from its vast audience and data assets. This approach acknowledges the evolving media landscape, where content and technology are intertwined, and positions Yahoo to remain a significant player by focusing on its unique advantages in scale, direct user relationships, and performance-driven monetization.

Action Items

- Audit Yahoo's AI integration: Identify 3-5 core product areas where AI can enhance user experience or operational efficiency, focusing on areas beyond basic content summarization.

- Develop a framework for evaluating AI-driven content generation: Define metrics to assess the accuracy, originality, and user value of AI-generated content across 2-3 key verticals.

- Create a runbook for AI model deployment: Document 5 essential steps for deploying and monitoring AI models, including rollback procedures and performance benchmarks.

- Measure the impact of AI on user engagement: Track key metrics (e.g., session duration, feature adoption) for 2-3 AI-enhanced features over a 4-week period to assess effectiveness.

- Design a strategy for AI-powered personalization: Outline 3-5 approaches to leverage AI for personalized content recommendations and user experiences across Yahoo's network.

Key Quotes

"When you take over a company like this and to do the you know the turnaround job it's about competing with yourself it's about realizing that a huge huge outcome for investors in what we bought is not whether or not we become worth a trillion dollars and you know what can you turn turn this this business into."

Jim Lanzone explains that a turnaround job focuses on internal improvement rather than aiming for massive, industry-defining valuations. He emphasizes that success is measured by the transformation of the existing business into something valuable for investors, rather than by reaching an astronomical market cap.

"The hardest thing to get in this industry is is that level of distribution -- the thing you can always make better are you know improving the company itself the organization the quality of the team and then in the consumer internet you have to have great products it always comes back to that."

Lanzone highlights that securing widespread distribution is the most challenging aspect of the digital industry. He suggests that while organizational improvements and product quality can be enhanced, the foundational element of reaching a large audience is the most difficult to acquire and is critical for consumer internet businesses.

"And so whether it's in finance sports or news those are three categories where we're still number one or number two -- we're number two in in email and personal mail yahoo mail is still hundreds of millions of users and it's definitely smaller than gmail but again to do you know to operate and build a company like this you appreciate it for what it is which is a huge footprint in mail which are extremely loyal active users."

Jim Lanzone points out Yahoo's continued strength in core verticals like finance, sports, and news, where it holds top rankings. He also notes the significant user base of Yahoo Mail, emphasizing that the company's strategy involves appreciating and leveraging its existing assets, even if they are not the absolute market leaders in every category.

"The common thread -- you know really which originally manifested in being this kind of homepage to the internet -- is where we've always been strongest."

Lanzone identifies the historical role of Yahoo as a "homepage to the internet" as its enduring strength. He suggests that this foundational concept of guiding users through the web, even as the internet has evolved, remains a core element of Yahoo's identity and success.

"The artifact deal was we were all users of the product -- our you know internal development that was early enough in our turnaround that we had so much heavy lifting to do just to get our our table stakes to the level which they were good enough and where we needed them to be -- that you know they were out ahead on on ai and machine learning and and their algorithms and the way they did so it was you know look it was a small acquisition but it became the backbone for a lot of things that we did and are still working on."

Jim Lanzone explains that the acquisition of Artifact was driven by its users' positive experience with the product and its advanced AI capabilities. He notes that despite Yahoo's own internal development needs, Artifact's technology provided a crucial foundation for their ongoing AI initiatives.

"The hardest thing to break into that group -- and uh that you know it was hard for them so they wanted to move on to other things -- and we took advantage."

Lanzone discusses the difficulty of breaking into the established group of top internet companies. He implies that the acquisition of Artifact was an opportunity seized because the creators of Artifact found it challenging to scale their product within that competitive landscape.

Resources

External Resources

Books

- "Frankenstein" by Mary Shelley - Mentioned as the basis for a film adaptation.

Articles & Papers

- "Jake Kelly is a fully formed knockout" (LA Times) - Mentioned as a rave review for the film "Jake Kelly."

- "Jake Kelly is one of the best films of the year" (Awards Watch) - Mentioned as a positive review for the film "Jake Kelly."

- "Frankenstein is stunning" (The New York Times) - Mentioned as a rave review for the film "Frankenstein."

People

- Jim Lanzone - CEO of Yahoo, guest on the podcast discussing Yahoo's business strategy, growth, monetization, and AI ambitions.

- Jerry Yang - Co-founder of Yahoo.

- David Filo - Co-founder of Yahoo.

- Mike Krieger - Partner of Kevin Systrom, former Chief Product Officer of Anthropic.

- Kevin Systrom - Co-founder of Artifact, former co-founder of Instagram.

- Guillermo del Toro - Director and writer of the film "Frankenstein."

- Oscar Isaac - Actor in the film "Frankenstein."

- Jacob Elordi - Actor in the film "Frankenstein."

- Mia Goth - Actor in the film "Frankenstein."

- Christoph Waltz - Actor in the film "Frankenstein."

- George Clooney - Actor in the film "Jake Kelly."

- Adam Sandler - Actor in the film "Jake Kelly."

- Noah Baumbach - Director and writer of the film "Jake Kelly."

- Von Miller - Host of the podcast "Free Range."

- Ariel Hawani - Host of a combat sports podcast.

- Kevin O'Connor - Host of an NBA podcast.

- Mark Andreessen - Coined the term "Andreessen's Law" regarding internet homepages.

- Sam Altman - Mentioned in relation to OpenAI and potential future business strategies.

Organizations & Institutions

- Yahoo - Primary subject of discussion, including its acquisition by Apollo, growth strategy, monetization, and AI integration.

- Apollo - Private equity firm that acquired Yahoo.

- Netflix - Mentioned as a presenter of films discussed on the podcast.

- The New York Times - Mentioned for its review of "Frankenstein."

- Awards Watch - Mentioned for its review of "Jake Kelly."

- LA Times - Mentioned for its review of "Jake Kelly."

- Ask.com - Former company where Jim Lanzone worked.

- CBS Interactive - Former company where Jim Lanzone worked.

- Tinder - Former company where Jim Lanzone worked.

- Microsoft - Partner with Yahoo for search since 2008.

- Anthropic - Company where Mike Krieger is Chief Product Officer.

- Google - Competitor in search and other areas, mentioned in relation to Yahoo's history and current landscape.

- Facebook - Mentioned in relation to Kevin Systrom and its evolution as a platform.

- Instagram - Mentioned in relation to Kevin Systrom.

- Amazon - Mentioned as a competitor and player in the CTV ad tech space.

- Apple - Mentioned in relation to Apple News.

- CNN - News organization discussed as a potential competitor, though differentiated from Yahoo's model.

- USA Today - Mentioned as a publication Yahoo sends traffic to.

- Bloomberg - Mentioned as a publication Yahoo sends traffic to, with some overlap in the finance category.

- Puck - Media company, partner in the podcast.

- Odyssey - Partner in the podcast.

- Verzion - Former partner for a sports betting deal.

- Bet MGM - Sports betting company.

- Tubi - FAST channel platform.

- Pluto - FAST channel platform.

- Roku Channel - FAST channel platform.

- Samsung - Smart TV manufacturer with FAST channel offerings.

- Paramount - Mentioned in relation to FAST channels.

- AOL - Acquired by Verizon, with its ad tech business sold.

- Pinterest - Mentioned as a comparable consumer internet company.

- Snap - Mentioned as a comparable consumer internet company.

- OpenAI - Mentioned in relation to AI advancements and potential partnerships.

- Heineken - Brand mentioned for comparison of brand awareness with Yahoo.

- New Balance - Brand mentioned for comparison of brand awareness with Yahoo.

- Rolex - Brand mentioned for comparison of brand awareness with Yahoo.

- Airbnb - Brand mentioned for comparison of brand awareness with Yahoo.

- Reddit - Brand mentioned for comparison of brand awareness with Yahoo.

- MrBeast - Creator associated with a Yahoo fantasy product launch.

- Liquid Death - Brand associated with a Yahoo fantasy product launch.

- Clio Awards - Award won by an advertisement for a Yahoo fantasy product.

- FanDuel - Sports betting platform.

- Optum - Company mentioned for its pharmacy system transformation.

- Stripe - Company mentioned as an example of a long-term private company.

- Uber - Company mentioned as an example of a long-term private company.

Tools & Software

- Yahoo DSP - Yahoo's demand-side platform for advertising.

Websites & Online Resources

- Yahoo.com - The primary website discussed.

- Starbucks.com/partners - Website for information on Starbucks benefits.

- Audacyinc.com/privacy-policy - Website for listener data and privacy practices.

- Podcastchoices.com/adchoices - Website for ad choices.

- Netflix - Streaming service mentioned for its films.

- YouTube - Video platform mentioned for ad performance and content.

- ESPN - Sports platform mentioned for fantasy sports.

- Cbs.com - Mentioned in relation to CBS All Access and CBSN.

- Cbsnews.com - Mentioned in relation to CBSN.

- Cbs.com/sports - Mentioned in relation to CBS Sports HQ.

- Cbs.com/all-access - Streaming service.

- Cbsn.com - FAST channel.

- Cbs sports hq.com - FAST channel.

- Tubi.com - FAST channel platform.

- Pluto.tv - FAST channel platform.

- Roku.com/channel - FAST channel platform.

- Amazon Prime Video - Streaming service.

- Cnbc.com - Mentioned in relation to Yahoo Finance.

- Bloomberg.com - Mentioned in relation to Yahoo Finance.

- Theverge.com - Mentioned in relation to Yahoo Finance.

- Techcrunch.com - Mentioned in relation to Yahoo Finance.

- Sports.yahoo.com - Yahoo Sports website.

- Fantasy.yahoo.com - Yahoo Fantasy Sports website.

- Finance.yahoo.com - Yahoo Finance website.

- News.yahoo.com - Yahoo News website.

- Mail.yahoo.com - Yahoo Mail website.

- Search.yahoo.com - Yahoo Search engine.

- Artifact.app - AI recommendation tool.

- Cnbc.com - Mentioned in relation to Yahoo Finance.

- Bloomberg.com - Mentioned in relation to Yahoo Finance.

- Theverge.com - Mentioned in relation to Yahoo Finance.

- Techcrunch.com - Mentioned in relation to Yahoo Finance.

- Sports.yahoo.com - Yahoo Sports website.

- Fantasy.yahoo.com - Yahoo Fantasy Sports website.

- Finance.yahoo.com - Yahoo Finance website.

- News.yahoo.com - Yahoo News website.

- Mail.yahoo.com - Yahoo Mail website.

- Search.yahoo.com - Yahoo Search engine.

- Artifact.app - AI recommendation tool.

Podcasts & Audio

- The Grill Room - The podcast where the discussion takes place.

- Free Range with Von Miller - Podcast hosted by Von Miller.

Other Resources

- Apollo era - Refers to the period after Yahoo was bought by Apollo.

- AI - Artificial intelligence, discussed in relation to Yahoo's ambitions and product development.

- Metrics that actually matter - Discussed as a key focus for Yahoo's growth strategy.

- Monetization at scale - Discussed as a core aspect of Yahoo's business model.

- Endgame - Refers to the long-term strategy or exit plan for Yahoo.

- Mass-market consumer business - The type of business Yahoo operates.

- Niche and specialized content - The media landscape Yahoo competes within.

- Turnaround job - The process of revitalizing Yahoo's business.

- Private equity - The ownership structure of Yahoo under Apollo.

- Internet consumer internet turnaround - Jim Lanzone's previous experience.

- Distribution - A key asset for Yahoo.

- Consumer internet products - What Jim Lanzone enjoys building.

- Suite of products - The range of services offered by Yahoo.

- Guide to the internet - Yahoo's original mission.

- Yahoo Mail - Yahoo's email service.

- Gmail - Google's email service, a competitor to Yahoo Mail.

- Search - A category where Yahoo competes.

- Google - Competitor in search.

- Yahoo Fantasy - Yahoo's fantasy sports platform.

- News aggregation product - Yahoo's product for curating news.

- Yahoo Finance - Yahoo's financial news and tools platform.

- Network - The interconnectedness of Yahoo's properties.

- Facebook - Mentioned as a network example.

- Instagram - Mentioned as a network example.

- WhatsApp - Mentioned as a network example.

- Metaverse - Mentioned as a potential future platform.

- Google YouTube - Google's video platform.

- Homepage to the internet - Yahoo's historical role.

- Inktomi - Search engine technology Yahoo previously used.

- Open web - The concept of an accessible internet.

- AI recommendation tool - The nature of Artifact.

- Content discovery - A function of Artifact.

- Machine learning - Technology used in Artifact's algorithms.

- Algorithms - Used by Artifact for recommendations.

- Yahoo News app - App that was transformed into Artifact.

- Consumer internet company at scale - The difficulty of building such a company.

- Social web - The evolution of the internet.

- Mobile web - The evolution of the internet.

- Closed garden ecosystem - The trend of app-centric engagement.

- Creators vertical - A new business area for Yahoo.

- Yahoo Sports - Yahoo's sports platform.

- Yahoo Fantasy - Yahoo's fantasy