Defining True Wealth: Passive Income, Mastery, and Identity Upgrade

TL;DR

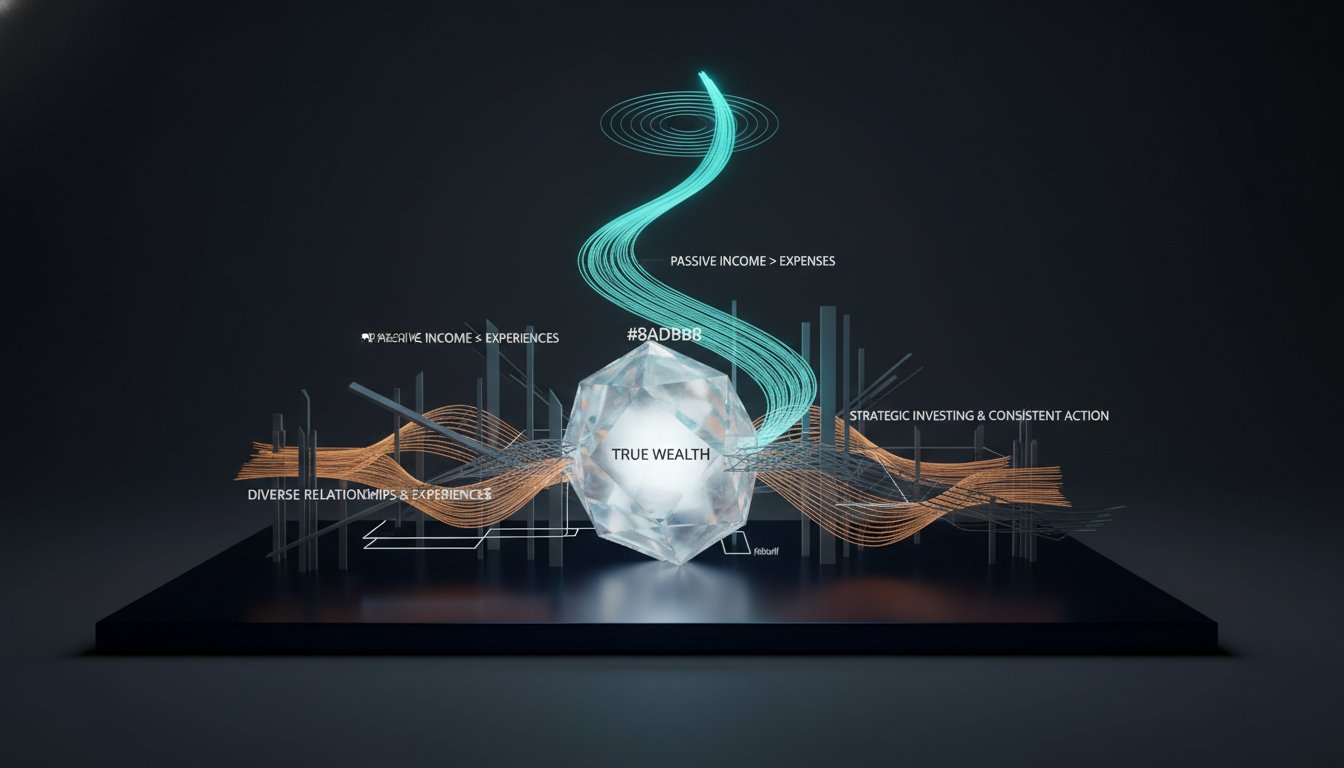

- True wealth is defined by the absence of economic stress, achieved when passive income exceeds personal burn rate, not by visible assets or high current income.

- Developing mastery and achieving top-tier competence in a viable industry, rather than solely pursuing passion, is the most effective path to economic security and fulfillment.

- Embracing diversity in relationships and experiences is crucial for personal growth, happiness, and financial success, as it broadens perspectives and fosters innovation.

- Financial freedom is achieved by creating passive income streams that surpass living expenses, allowing for focus on relationships and experiences over economic worry.

- Identity and mindset upgrades must precede financial ones, as a "bargain basement identity" will limit one's capacity to sustain and grow wealth.

- Strategic investing, consistent action, and a clear financial plan, rather than attempting to time the market, are the foundations for building lasting wealth.

- The "STRIP" acronym--Savings, Total Debt, Retirement, Investing, Plan--provides a structured framework for individuals to build financial momentum and achieve millionaire status.

Deep Dive

True wealth in 2026 is defined not by accumulated savings, but by the absence of economic stress, achieved through passive income exceeding one's expenses. This requires a fundamental shift in identity and strategy, moving beyond traditional saving to cultivate a mindset and habits that attract and sustain prosperity. The following insights explore the strategic and personal transformations necessary to build this form of wealth.

Wealth is fundamentally about achieving financial freedom, which is realized when passive income surpasses daily expenditures, creating an absence of economic stress. This is distinct from high current income, which can be consumed by an equally high burn rate, leaving individuals financially vulnerable. True wealth, therefore, is invisible, enabling individuals to focus on relationships and experiences that matter most. This requires a strategic approach to earning and building, prioritizing mastery and high-value skills over simply following passion, especially in industries with limited opportunity. Passion, it is argued, emerges from competence and the security that mastery provides, rather than being a prerequisite for success.

Beyond financial capital, wealth encompasses a broader spectrum of personal assets, including mindset, habits, spiritual clarity, and emotional freedom. This necessitates an identity upgrade; one must become the person capable of sustaining newfound wealth. This involves raising personal standards, eliminating distractions that dilute potential, and embracing a "bargain basement identity" is insufficient for building an extraordinary life. The pursuit of wealth should be guided by a comprehensive plan, involving saving, managing debt efficiently, consistently investing, and planning for the future by calculating one's "F number" -- the annual cost of a desired lifestyle, projected to be covered by a conservative investment return.

Diversity, in both relationships and experiences, is presented as a crucial pathway to richness and personal growth. Engaging with people from different backgrounds, beliefs, and perspectives challenges ingrained assumptions and broadens understanding. This intentional seeking of varied experiences, rather than remaining within echo chambers, fosters adaptability and resilience. For entrepreneurs, this diversity extends to building teams with varied perspectives, recognizing that unconscious biases can limit growth. This approach not only enriches personal life but also drives business success by offering a wider lens through which to operate and innovate.

The cultivation of true wealth and a fulfilling life is further supported by the concept of "everyday heroes"--individuals who, through small acts of kindness and belief, profoundly impact others. This perspective highlights the importance of mentors, teachers, and even simple human connection in shaping personal trajectories. Beyond financial considerations, wealth is understood as encompassing eight forms, including family, health, self-mastery, and helpfulness. These non-financial assets are crucial for a well-rounded and meaningful existence, often proving more valuable than financial accumulation alone. The pursuit of these broader forms of wealth, combined with strategic financial planning and a commitment to personal growth through diverse experiences, forms the foundation for genuine prosperity and a life of purpose.

Action Items

- Create identity audit: Define 3 core values and 5 supporting behaviors to ensure personal and professional alignment (ref: Robin Sharma's "bargain basement identity").

- Design wealth framework: Calculate personal "burn rate" and target passive income to exceed it, prioritizing financial freedom over current income (ref: Scott Galloway's definition of wealth).

- Implement diversity initiative: Identify 3-5 individuals with significantly different backgrounds for regular, intentional conversations to broaden perspectives (ref: Ed Mylett's "diversity is the pathway to richness").

- Audit career alignment: Assess current role for top 10% potential and natural proclivity, identifying 1-2 alternative high-value lanes if misaligned (ref: Scott Galloway's "find your talent, not your passion").

- Establish device-free zones: Designate 1-2 specific times or locations (e.g., dinner table, family room) for device-free interaction to enhance presence (ref: Ed Mylett's "no devices at the dinner table").

Key Quotes

"Wealth is what you no longer have to worry about. It is passive income greater than your burn. It is the absence of economic stress so you can finally focus on the people and experiences that matter."

Scott Galloway defines wealth not by visible possessions but by the internal state of economic security. This perspective highlights that true wealth allows individuals to prioritize relationships and experiences over financial anxieties. Galloway emphasizes passive income exceeding expenses as a mathematical definition of this state.

"You cannot build an extraordinary life with a bargain basement identity. You must raise your standards, remove the distractions that dilute your greatness, and step into the person who can actually sustain the wealth you want to create."

Robin Sharma argues that personal identity and standards are foundational to achieving and sustaining wealth. He suggests that a low self-concept, or "bargain basement identity," will limit one's capacity for extraordinary financial success. Sharma emphasizes the need for internal growth to match external aspirations.

"I don't want to crush your dreams but unless you get bright flashing green lights that you are in fact in the top point 1 which you'll get that validation immediately if you're messy people will tell you that if you don't think yourself okay what could i be where could i be in the top 10 where making being in the top 10 provides a great living..."

Scott Galloway advises against pursuing highly competitive "romance industries" without exceptional, immediately apparent talent. He suggests focusing on fields where one can realistically achieve top-tier status and earn a good living. Galloway implies that passion should follow mastery and economic security, rather than precede it.

"Diversity is the pathway to richness... the people in your life and the experiences of your life and without that diversity I'm so concerned in our culture today that I see us become more and more tribal less and less diverse both in our friendships and our relationships..."

Ed Mylett posits that diversity in both social connections and life experiences is crucial for personal growth and richness. He expresses concern that modern culture is leading to increased tribalism and a lack of varied interactions. Mylett suggests that embracing diversity is essential for a fulfilling life.

"The definition of wealth is what having an absence of economic stress you can focus on your relationships rich is the kind of the people see wealth is the things that people don't see... and that is the definition of wealth more specifically or more mathematically for me is passive income that's greater than your burn."

Scott Galloway reiterates his definition of wealth, distinguishing between visible riches and the internal state of being free from financial worry. He quantifies wealth as having passive income that exceeds one's regular expenses. Galloway stresses that this financial freedom enables a focus on more important aspects of life.

"I always compare it to the grocery store would you ever have 50 in your pocket go to the grocery store do a whole lap around and then leave and then go home and open the fridge and be like why don't i have any food it's like well you didn't you didn't buy anything that is how investing is too you can't just open the account you can't just put the cash in you have to buy stuff."

Vivian Tu uses a grocery store analogy to explain the necessity of actively investing funds after opening investment accounts. She clarifies that simply having money in an account is not the same as investing it. Tu emphasizes that to see financial growth, one must purchase assets within those accounts.

Resources

External Resources

Books

- "The Algebra of Wealth" by Scott Galloway - Mentioned in relation to his definition of wealth.

- "The Everyday Hero Manifesto" by Robin Sharma - Mentioned as a comprehensive guide to heroism and personal growth.

- "Rich AF: The Winning Money Mindset That Will Change Your Life" by Vivian Tu - Mentioned as a resource for building financial momentum and simplifying money management.

Articles & Papers

- "The Essential Isn't Visible to the Eye" (The Little Prince) - Referenced by Scott Galloway as an analogy for the invisible nature of true wealth.

People

- Scott Galloway - Professor of marketing at NYU, author, and podcast guest discussing wealth and career advice.

- Robin Sharma - Author and leadership expert, discussed as a mentor and author of "The Everyday Hero Manifesto."

- Vivian Tu - Financial expert, entrepreneur, and author of "Rich AF," featured as a guest discussing personal finance.

- Steve Wozniak - Co-founder of Apple, mentioned as a mentor with a focus on coding and generosity.

- Cora Greenaway - Robin Sharma's fifth-grade teacher, highlighted as a pivotal mentor.

- Paul Harris - Founder of Rotary International, quoted regarding service and profit.

- Mrs. Susan Smith - Ed Mylett's fourth-grade teacher, recognized for identifying his intelligence and boosting his self-esteem.

- Paul Gasol - Former NBA player, cited as an example of kindness and making others happy.

- Mihaly Csikszentmihalyi - Originator of the term "flow state," mentioned in the context of peak human experience.

- Nelson Mandela - Quoted regarding perseverance and the nature of sainthood.

- Winston Churchill - Mentioned as an example of using retreats for resilience during difficult times.

- Andrew Wyeth - Artist, mentioned for using retreats to foster creativity.

- J.D. Salinger - Author, noted for his withdrawal from the world to focus on writing.

- Confucius - Quoted regarding focus and the futility of chasing multiple goals.

- Peter Drucker - Management consultant, quoted on the inefficiency of doing the wrong thing well.

Organizations & Institutions

- NYU - Institution where Scott Galloway teaches marketing.

- Royal Navy - Mentioned in relation to Scott Galloway's father's pension.

- Rotary International - Organization associated with Robin Sharma's father's philosophy.

- L.A. Lakers - Professional basketball team, mentioned in relation to Paul Gasol.

Websites & Online Resources

- Ed Mylett Show - Podcast/show hosted by Ed Mylett, mentioned for its content and guest interviews.

- Apple Podcasts - Platform where "The Ed Mylett Show" can be followed.

- Spotify - Platform where "The Ed Mylett Show" can be followed.

- YouTube - Platform where "The Ed Mylett Show" can be watched.

- Instagram - Social media platform associated with Ed Mylett.

- Facebook - Social media platform associated with Ed Mylett.

- LinkedIn - Social media platform associated with Ed Mylett.

- X (formerly Twitter) - Social media platform associated with Ed Mylett.

- Ed Mylett's Website - Online resource for Ed Mylett.

Other Resources

- The Little Prince - A movie referenced for its quote about essential visibility.

- STRIP acronym - A financial planning acronym developed by Vivian Tu (Savings, Total Debt, Retirement, Investing, Plan).

- 401k, 403b, 457, TSP - Employer-sponsored retirement accounts.

- IRA (Individual Retirement Account) - Personal retirement savings account.

- Roth IRA - A type of individual retirement account.

- ROTH 401k - A type of employer-sponsored retirement account with Roth tax treatment.

- Target Date Retirement Funds - Investment funds that adjust their asset allocation based on a target retirement date.

- ETFs (Exchange-Traded Funds) - Investment funds traded on stock exchanges.

- Robo-advisor - A digital platform that provides automated, algorithm-driven financial planning services.

- "F Number" - A financial planning calculation to determine the amount needed for a desired lifestyle.

- "Everyday Hero Manifesto" (8 Forms of Wealth) - A framework discussed by Robin Sharma, including money, family, health, self-mastery, helpfulness, joy, peace, and freedom.

- Epigenetics - The study of heritable changes in gene expression that do not involve alterations to the underlying DNA sequence.

- Psychē - The mind or soul, discussed in relation to mental well-being.

- Morning Exercise - A practice for physical and mental health.

- Supplementation - The use of dietary supplements.

- Sleep - Highlighted as a necessity for brain health and function.

- Two Massage Protocol - A wellness practice mentioned by Robin Sharma.

- Fasting - A practice that can induce autophagy.

- Autophagy - A cellular "clean-up" process.

- Meditation - A practice for mental focus and peace.

- Journaling - A practice for processing emotions and thoughts.

- Spiritual Healers - Individuals who provide guidance for emotional and spiritual well-being.

- AFRA Tool - A tool mentioned for processing suppressed emotions.

- Five Great Hours Rule - A productivity principle suggesting focused work for a limited duration.

- Flow State - A mental state of operation in which a person performing an activity is fully immersed in a feeling of energized focus, full involvement, and enjoyment in the process of the activity.

- Transient Hypofrontality - A neurobiological mechanism associated with flow state.

- Prefrontal Cortex - The part of the brain responsible for reasoning and the "monkey mind."

- Beta, Alpha, Theta, Delta brain waves - Different states of brain activity.

- Stillness, Silence, Solitude - Practices to achieve a meditative state.

- Emotional Residue - The phenomenon of focus being fragmented by repeated digital notifications.

- Cognitive Bandwidth - The capacity of the mind to process information.

- Neuroplasticity - The brain's ability to reorganize itself by forming new neural connections.

- 5:00 AM Club - A concept related to early morning routines.

- 20-20-20 Formula - A formula for structuring morning routines.

- Second Wind Workout - A type of physical activity.

- Weekly Design System - A method for planning one's week.

- "Person who chases two rabbits catches neither" - A quote attributed to Confucius.

- "There's nothing so useless as doing efficiently that which should not be done at all" - A quote attributed to Peter Drucker.