All Episodes

Hope VI's Lasting Impact: Social Integration Drives Child Mobility

Growing up in revitalized neighborhoods boosts children's adult earnings by 50% through social integration, not just better housing.

View Episode Notes →

Psychedelic Churches Leverage Religious Freedom for Sacrament Distribution

Psychedelic churches legally distribute controlled substances as sacraments by demonstrating sincere religious practices. Discover how this model navigates legal gray areas and challenges drug laws.

View Episode Notes →

Name and Theme Crucial for Retail Game Success

Capture attention in seconds: A game's name and theme are critical for retail success, driving impulse buys by resonating with millennial women.

View Episode Notes →

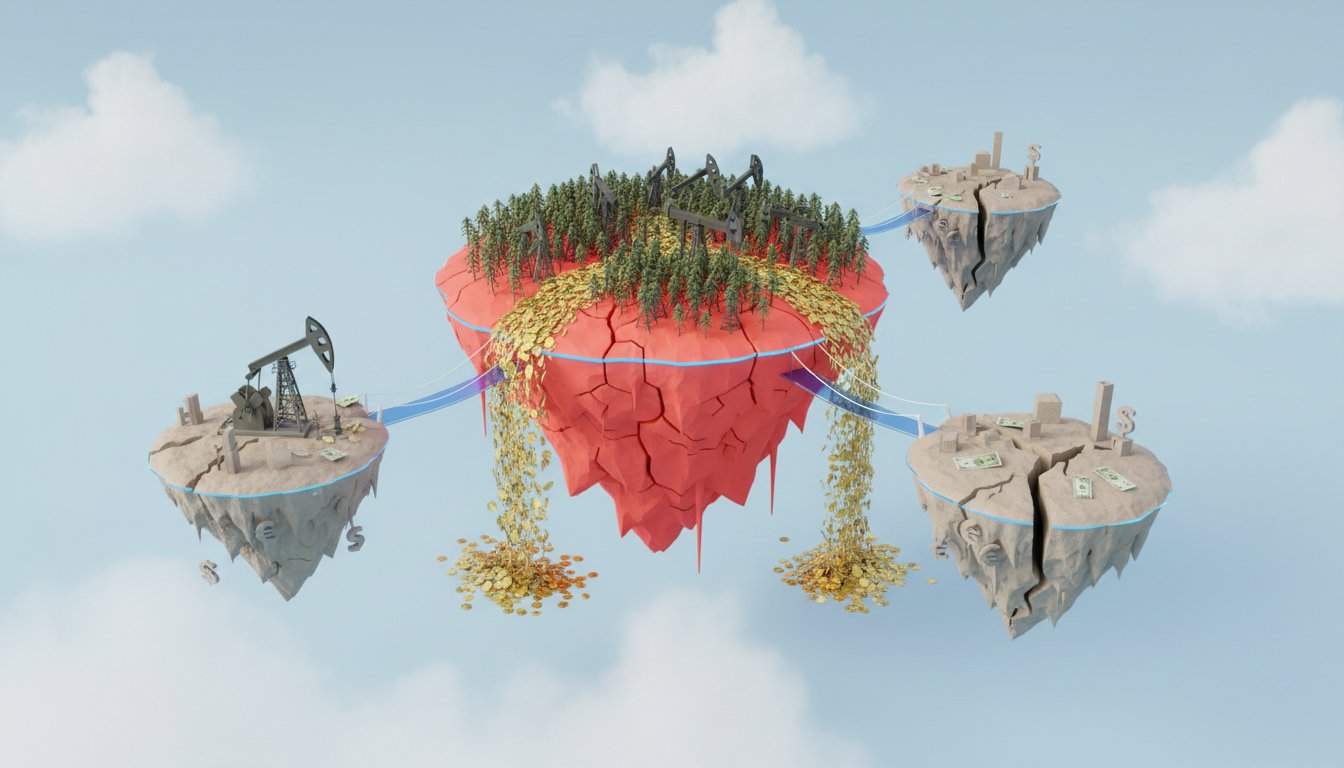

Venezuela's Petrostate Model: Resource Curse and Chevron's Geopolitical Strategy

Venezuela's oil wealth created a "Dutch disease," devaluing other industries and concentrating power, illustrating how resource abundance can become a "curse" when mismanaged.

View Episode Notes →

Trump Family Leverages Presidency for Nearly $4 Billion in Business Gains

President Trump and his family amassed nearly $4 billion by leveraging the presidency for unprecedented business deals, from crypto to hospitality, that likely would not have occurred otherwise.

View Episode Notes →

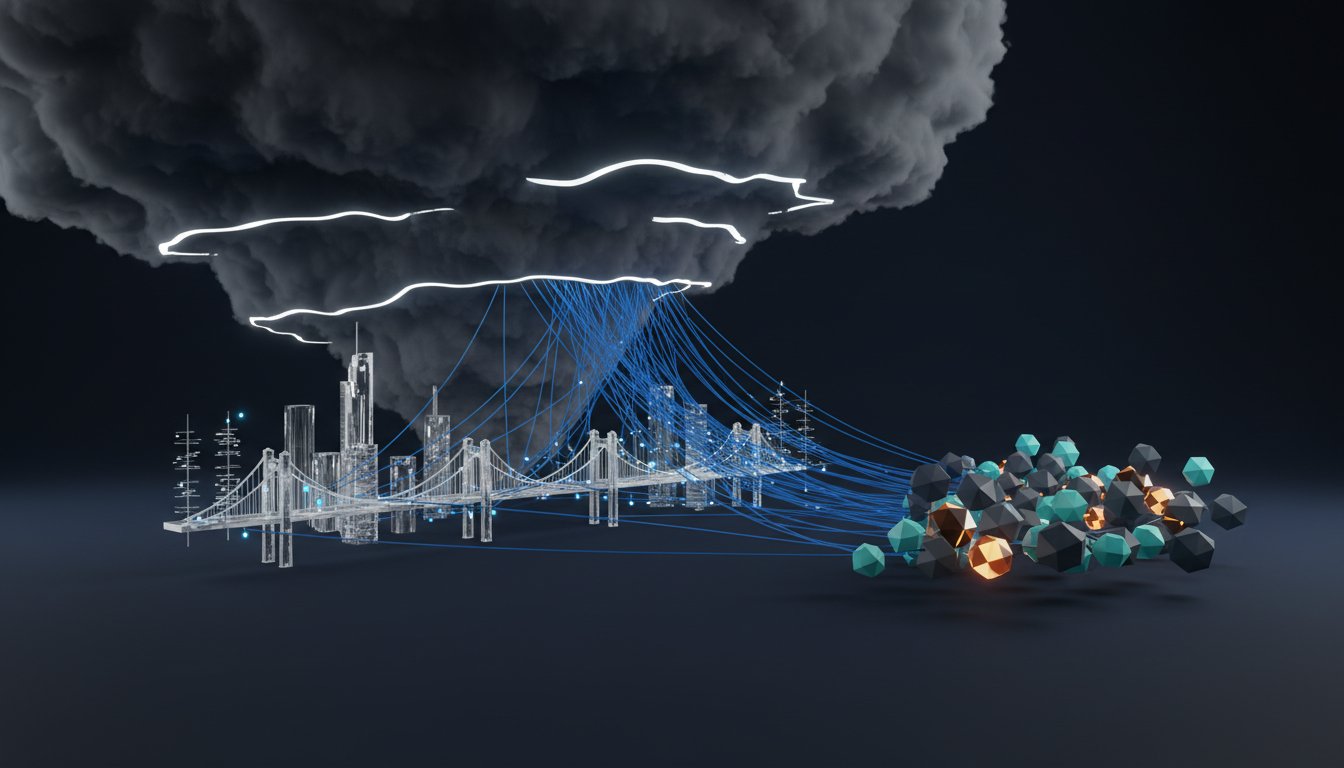

AI Boom: Bubble Characteristics, Uncertain Economic Impact, and Societal Benefits

Bubbles may offer unexpected benefits by correcting market failures and accelerating R&D, even as policymakers debate how to manage their potential fallout.

View Episode Notes →

Johnson Products: Black Entrepreneurship, Market Shifts, and Ownership Challenges

Johnson Products built a Black-owned empire by understanding community needs, pioneering viral marketing, and fostering economic empowerment, yet its story reveals ongoing challenges for Black entrepreneurs.

View Episode Notes →

Venezuela's Economic Collapse: Policy, Oil, and Dollarization

Venezuela's economic collapse reveals how over-reliance on oil, fixed exchange rates, and price controls created hyperinflation and shortages, with dollarization now stabilizing the economy but deepening inequality.

View Episode Notes →

2025 Diverging Economy: Tariffs, Low Sentiment, High Markets, Rising Costs

Tariffs surge to 16.8%, the highest since 1935, while consumer sentiment plummets. Discover how concentrated spending and an overheated stock market mask growing economic fragility.

View Episode Notes →

China Shock Devastated Localized Communities, Challenging Economic Models

The "China Shock" devastated manufacturing communities, causing prolonged joblessness and social damage that mainstream economic models failed to predict or address.

View Episode Notes →

Ongoing Consequences of Economic and Regulatory Shifts

Subscription cancellations are complex, lab-grown diamonds disrupt pricing, and Gaza faces severe economic hardship despite a ceasefire.

View Episode Notes →

Binge Drops Increase Churn; Drip Models Boost Retention

Weekly episode releases reduce subscriber churn by 50%, fostering longer subscriptions and content discovery, a stark contrast to binge-drops that exhaust viewers and drive cancellations.

View Episode Notes →

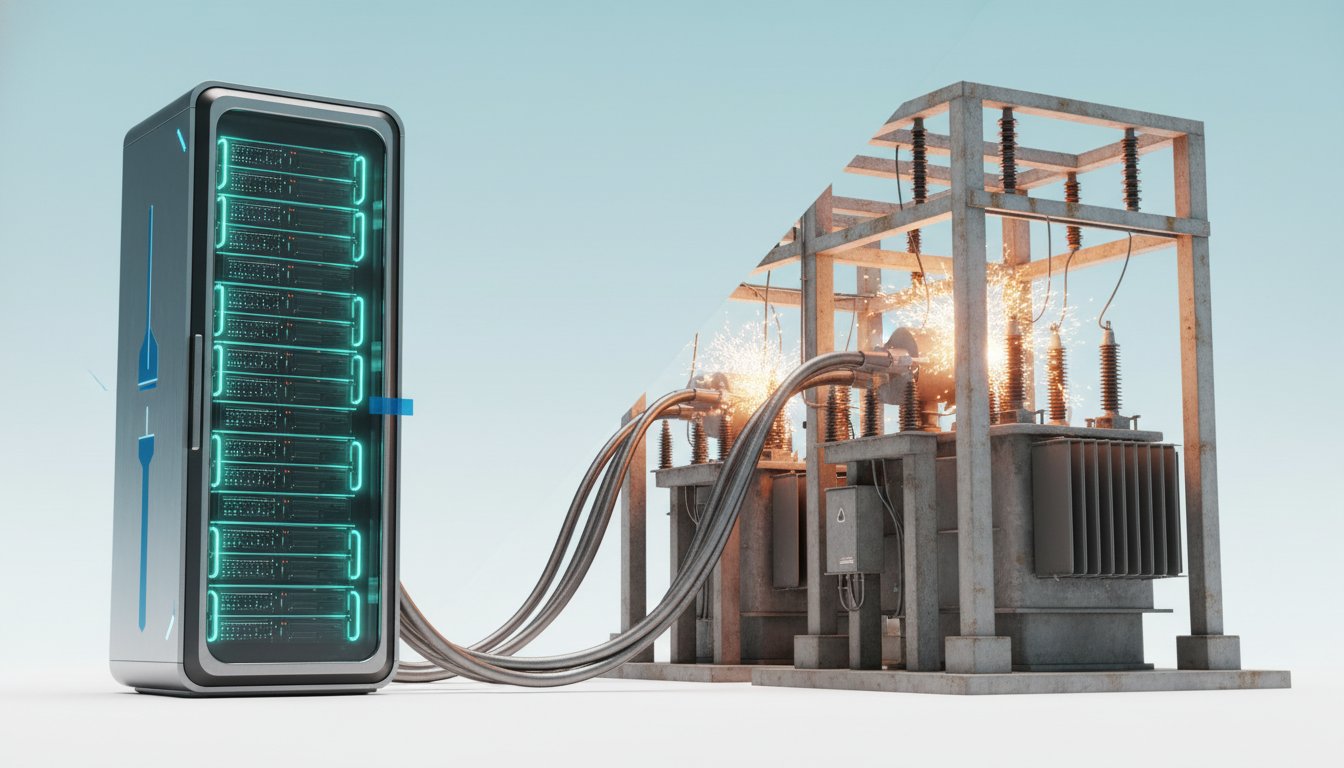

AI Data Center Demand Strains Deregulated Electricity Markets

AI data center demand is doubling residential electricity prices by straining grids and exploiting deregulated markets, forcing consumers to subsidize tech growth.

View Episode Notes →

1999 Pop Culture Reveals Economic Principles and Societal Shifts

1999 pop culture reveals surprising economic truths, from *Blair Witch*'s massive ROI to Napster's industry disruption and *House Hunters*' housing market influence.

View Episode Notes →

Chicago Parking Meters: Privatization's Long-Term Cost

Chicago drastically undervalued its parking meters, selling 75 years of revenue for $1.16 billion. This deal cost the city an estimated $1 billion, highlighting privatization's long-term pitfalls for immediate cash.

View Episode Notes →

Military Influence Shapes Civilian Apparel Design, Market, and Innovation

Military innovation shapes your wardrobe. Discover how WWII layering systems and surplus economics forged modern outdoor gear and fashion trends.

View Episode Notes →

Catastrophe Bonds Shift Disaster Risk From Insurers to Investors

Catastrophe bonds shift disaster risk to investors, providing rapid rebuilding funds and diversifying portfolios with higher yields, even covering pandemics.

View Episode Notes →

AI Transforms Hiring: Less Bias, More Offers

AI is transforming hiring, with an AI interviewer proving more effective than humans, leading to more job offers and better retention. This shifts the recruiter role to analytical tasks.

View Episode Notes →

Taylor Swift's Variant Strategy: Superfans Buy Multiple Albums

Swift’s record-breaking sales reveal a sophisticated strategy of releasing numerous album variants, incentivizing superfans to buy multiple copies, a tactic now prevalent across the music industry.

View Episode Notes →

Giving Less, Saving More: GiveWell's Data-Driven Aid Crisis

GiveWell rapidly deploys $1.9 million to a vital Cameroon healthcare project facing closure, balancing urgent need with data-driven due diligence in a world of shrinking aid.

View Episode Notes →

K-Shaped Economy: Wealth Fuels Spending Amidst Pessimism

Consumer sentiment plummets, yet spending soars, revealing a K-shaped economy where only the wealthy truly thrive, creating a precarious illusion of prosperity.

View Episode Notes →

Tariffs Quietly Surge, Raising Prices For Everyday Shoppers

Tariffs dramatically inflate imported goods by 6% and domestic prices by 3.5%, significantly contributing to inflation and impacting everyday shoppers, not just premium buyers.

View Episode Notes →

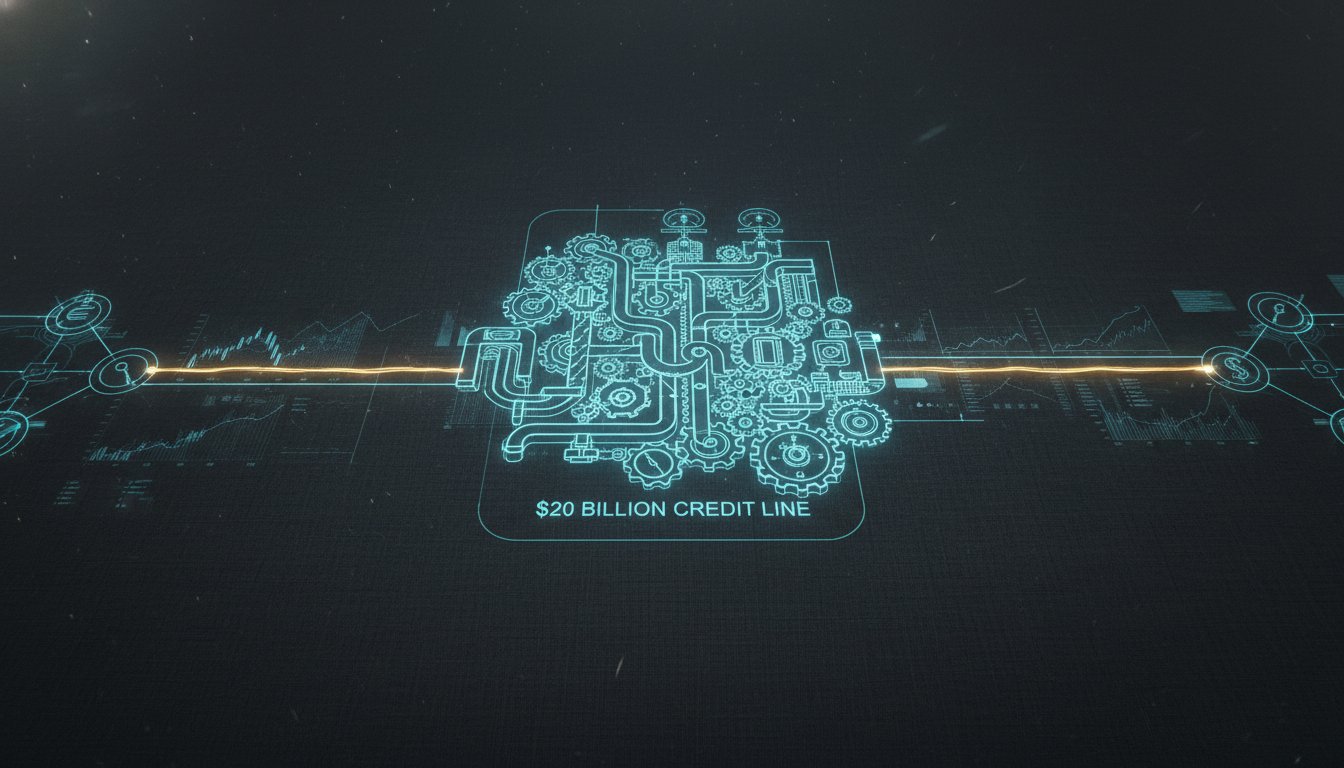

Slush Fund Bailout: US Treasury's Argentina Gamble Revisited

The U.S. Treasury's opaque "slush fund" deploys $20 billion to Argentina, echoing a risky 1995 Mexico bailout and raising concerns about transparency and future crisis capacity.

View Episode Notes →

Buy Now, Pay Later: Hidden Merchant Fees Fuel Consumer Debt

Buy Now, Pay Later's hidden merchant fees fuel consumer debt cycles, especially for younger demographics, as financial institutions scramble to adapt to this disruptive payment trend.

View Episode Notes →