Venezuela's Petrostate Model: Resource Curse and Chevron's Geopolitical Strategy

In a world often focused on immediate gains and the allure of abundant resources, the story of Venezuela and Chevron, as explored in this Planet Money episode, reveals a profound paradox: the "blessing" of oil can become a potent curse, not due to the resource itself, but due to the human systems that manage it. This conversation unearths the hidden consequences of petrostates, demonstrating how an economy singularly dependent on a single commodity, while seemingly a path to instant wealth, can unravel into economic instability, corruption, and authoritarianism. For business leaders, policymakers, and anyone interested in the long-term viability of economies built on natural resources, this analysis offers a critical lens on how short-term advantages can pave the way for catastrophic downstream failures, and how true resilience is forged not in abundance, but in strategic foresight and equitable distribution. It highlights why understanding these complex, often counterintuitive, systemic dynamics is crucial for navigating both economic opportunities and inevitable downturns.

The Siren Song of Easy Riches: How Oil Drowns Diversification

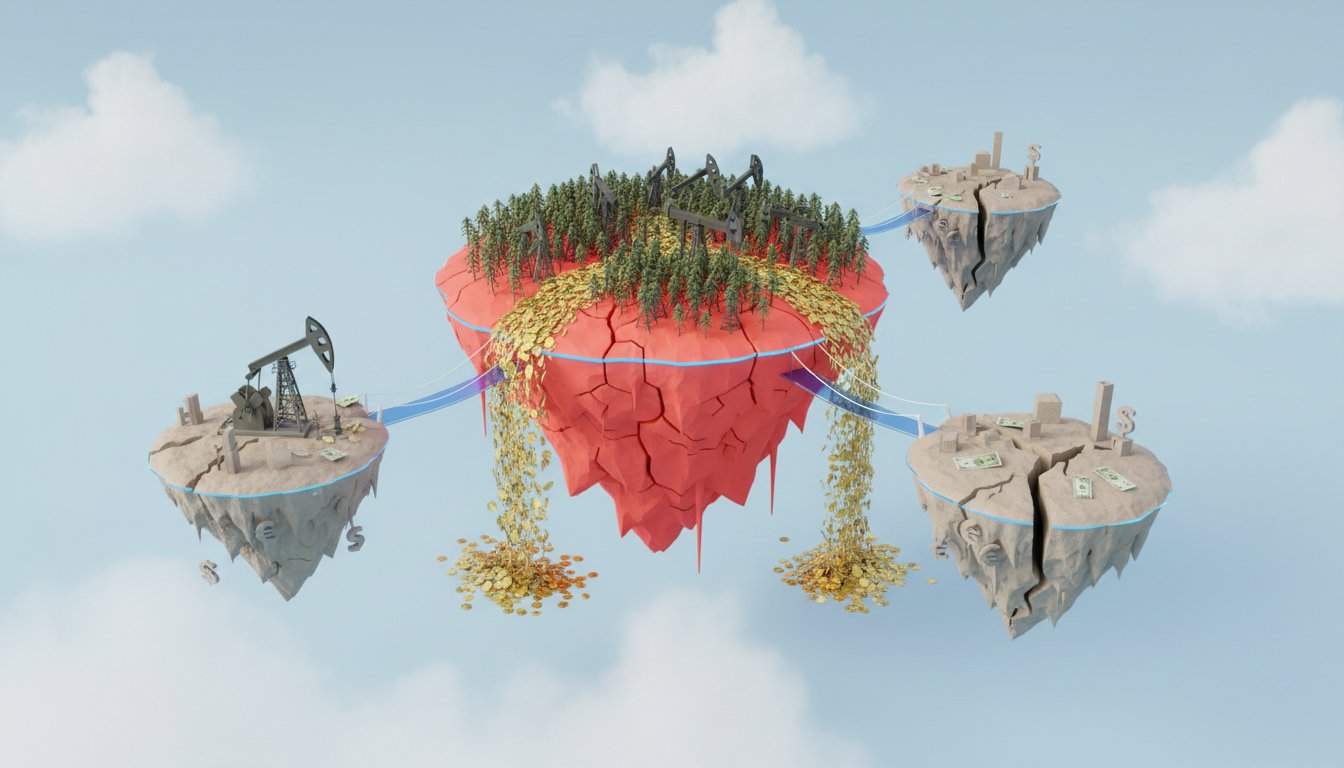

Venezuela's transformation into the world's first petrostate, driven by the discovery of vast oil reserves at Lake Maracaibo, serves as a stark illustration of how a single, lucrative resource can dismantle an entire economy. The immediate influx of wealth, while appearing as a windfall, triggered what economists call the "Dutch disease." As oil revenues surged, the Venezuelan currency, the bolivar, appreciated dramatically. This made the country's traditional exports, like coffee, prohibitively expensive on the global market. In essence, the very abundance that promised prosperity systematically destroyed the existing economic base.

"So Venezuela loses its entire coffee market."

This wasn't just the loss of a single industry; it was the dismantling of the nation's pre-oil economic identity. The narrative here isn't about a simple economic shift, but a systemic collapse of diversification. When an economy becomes singularly focused on extracting and exporting a single commodity, it creates a fragility that is almost impossible to predict from the outside. The immediate payoff -- the immense wealth from oil -- masks the downstream effect of rendering all other economic activities uncompetitive. This creates a dependency that, as history shows, is incredibly difficult to break. The allure of easy money from oil created a feedback loop where investment and attention were funneled exclusively into this one sector, leaving other industries to wither. This is where conventional wisdom fails: optimizing for immediate profit from the most obvious resource leads to long-term economic vulnerability.

The Resource Curse: When Abundance Breeds Corruption and Inequality

The "resource curse," or the "paradox of plenty," is not an inherent property of oil itself, but rather a consequence of how concentrated wealth and power manifest in a petrostate. As Venezuela's oil wealth grew, so did the concentration of power in the hands of a few, primarily the foreign oil companies, later dubbed the "Seven Sisters," and eventually the Venezuelan government. This concentration of wealth created fertile ground for corruption and a distortion of governance. The narrative highlights how this wealth was not equitably distributed, leading to the creation of enclaves like the Creole Petroleum company town, which operated as a "state within a state," independent of the broader Venezuelan society.

The story of Juan Pablo Perez Alfonzo, a key figure in Venezuelan oil policy, encapsulates this dynamic. His stark description of oil as "el excremento del diablo" -- the devil's excrement -- reveals a profound understanding that the resource itself was not the problem, but its corrupting influence on human systems. His observation that a major infrastructure project in a desert region yielded nothing but a giant snake underscores the deep-seated corruption and mismanagement that plagued the nation. This isn't just about money disappearing; it's about the systemic erosion of trust and the misdirection of resources that could have been used for genuine development. The consequence of this concentrated, poorly managed wealth is not just economic instability, but a fundamental breakdown of social contracts and governance. The immediate benefit of oil revenue creates an incentive structure where corruption becomes a viable, even profitable, strategy for those in power, leading to a cycle of decline.

The Long Game: Chevron's Strategy of Persistence in a Volatile System

While many foreign oil companies, like Exxon and Conoco, exited Venezuela due to nationalization and political instability, Chevron's decision to remain stands out as a strategic play for long-term advantage. This persistence, often framed as loyalty or a willingness to "stick it out," can be better understood through the lens of systems thinking. Chevron recognized that Venezuela's oil reserves were substantial and that political winds, however turbulent, would eventually shift. By maintaining a presence, even under challenging conditions and with diminished control, Chevron positioned itself to benefit when opportunities arose.

"Chevron agreed. Why did they make that choice?"

"I believe it's because they saw Venezuela as a long-term investment, not a short-term investment."

The narrative suggests that Chevron's argument to the US government--that their continued presence served a geopolitical interest by preventing Chinese dominance--was a sophisticated maneuver. It framed their economic pursuit as a strategic imperative for American influence. This highlights how companies can leverage systemic dynamics, including international relations and sanctions, to their advantage. While other companies focused on immediate losses and legal recourse for expropriated assets, Chevron played a longer game, understanding that the "uninvestable" conditions for others were precisely what created a unique, albeit risky, opportunity for them. This delayed payoff, requiring patience and a willingness to navigate complex political landscapes, is a classic example of how enduring competitive advantage is often built on actions that are difficult or unappealing in the short term. The immediate discomfort of operating in a volatile environment ultimately yielded a unique position of leverage.

Key Action Items

- Immediate Action (Next Quarter): Conduct a systemic analysis of your core business, identifying any single-resource dependencies or over-reliance on specific markets. Map potential "Dutch disease" effects if a primary revenue stream experiences an artificial boom.

- Immediate Action (Next Quarter): Review internal incentive structures. Are they inadvertently rewarding short-term gains at the expense of long-term stability or encouraging practices that could lead to corruption or waste?

- Short-Term Investment (Next 6 Months): Develop contingency plans for critical supply chain dependencies. Identify alternative suppliers or markets that can absorb shocks if a primary source becomes unstable or politically compromised.

- Short-Term Investment (Next 6 Months): Foster a culture that explicitly values and rewards long-term strategic thinking, even if it means foregoing immediate, easily achievable profits. This might involve performance metrics that account for system resilience.

- Medium-Term Investment (12-18 Months): Explore diversification strategies beyond your core offering. This could involve investing in adjacent markets, developing new product lines, or exploring partnerships that spread risk across different economic activities.

- Long-Term Investment (18-24 Months): Build relationships with diverse stakeholders, including government entities and local communities, not just for transactional purposes, but to foster understanding and resilience in volatile environments. This includes understanding the geopolitical implications of your operations.

- Ongoing Investment: Continuously monitor the "political resource curse" in your operating environments. Understand how governance, corruption, and resource management by local powers can impact your long-term viability, and adjust strategies accordingly.