Diagnosing Stalled Growth: Churn, Pricing, NRR, Channels, and Growth Necessity

The hidden levers of stalled growth: A framework for reigniting your product's trajectory

When a product's growth plateaus, it's rarely a single point of failure. Instead, it's a system-wide issue that demands a structured diagnostic approach. Jason Cohen, a seasoned founder and investor, offers a pragmatic five-step framework for uncovering the root causes of stalled growth. This conversation reveals the non-obvious implications of customer churn, the subtle art of pricing, the critical importance of existing customer expansion, the eventual saturation of marketing channels, and the existential question of whether growth is always the right goal. For founders and product leaders grappling with decelerating growth, Cohen's methodical breakdown provides a clear roadmap to identify and address the most impactful issues first, offering a significant advantage over teams relying on guesswork or surface-level fixes. This analysis is essential for anyone looking to understand the deeper dynamics of sustainable growth beyond immediate metrics.

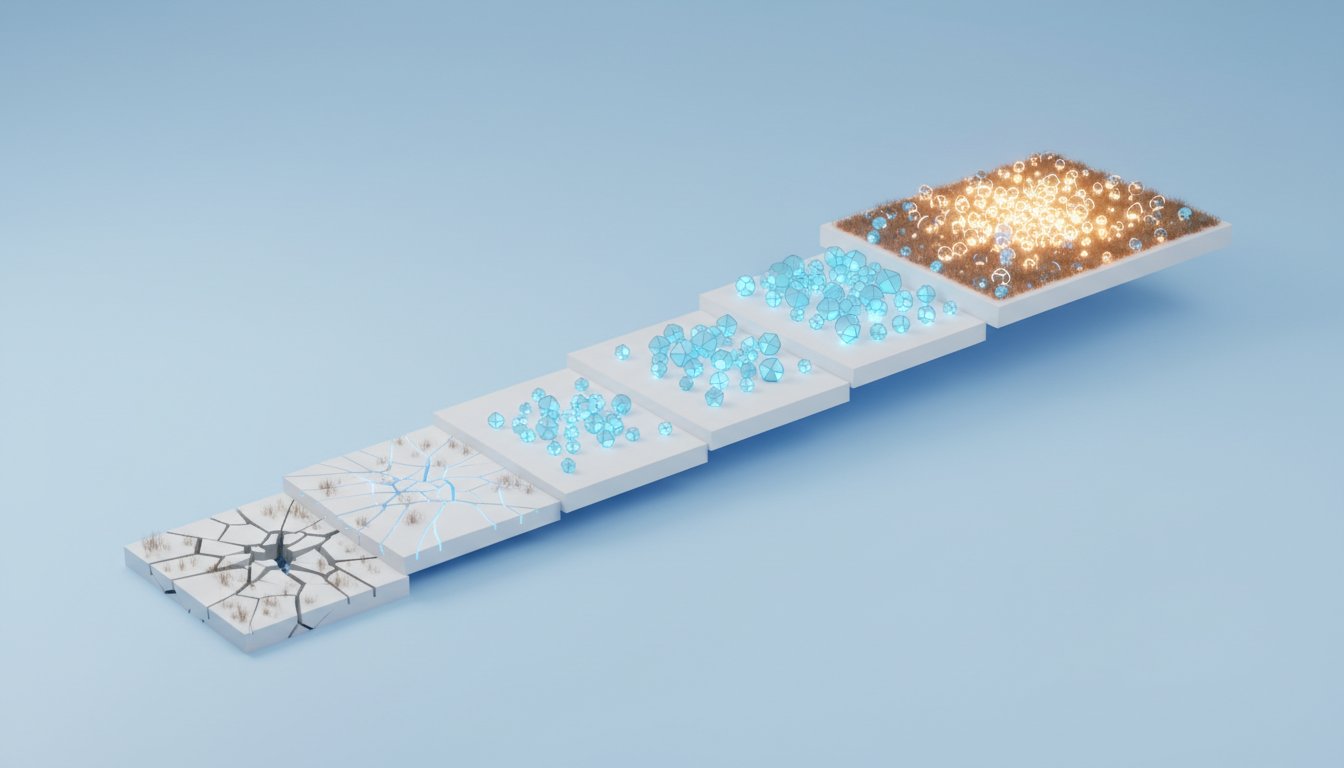

The Leaky Bucket: Why Customers Leaving Is Your First and Biggest Problem

Growth isn't just about acquiring new customers; it's fundamentally about retaining them. Jason Cohen emphasizes that logo churn--customers canceling their subscriptions--is the most critical indicator of stalled growth. The math is stark: cancellations grow proportionally with your customer base, while marketing efforts often yield linear, not exponential, gains. This means that even with successful marketing, a high churn rate creates a ceiling on your potential growth. Cohen illustrates this with a simple calculation: if your monthly churn rate is 5%, your company will never exceed 2,000 customers if you're adding 100 new ones per month. This "leaky bucket" analogy highlights how a high churn rate can cap growth, irrespective of acquisition success.

The visceral impact of customers leaving after navigating a complex acquisition gauntlet--from initial awareness to purchase--underscores the severity of churn. Cohen challenges the common, often superficial, reasons customers provide, like "too expensive." He argues that if a customer bought the product, the price was initially acceptable. The real reasons are often buried deeper, related to unmet expectations, integration issues, or a mismatch with their actual needs. Digging into these root causes requires more than a simple "why did you cancel?" question. Cohen advocates for asking, "What made you cancel?" to elicit more detailed responses. Furthermore, he suggests focusing on customers who are showing signs of trouble before they churn, as they are more likely to provide honest feedback. If all else fails, improving the onboarding process is a reliable strategy, as a significant portion of churn often occurs early in the customer lifecycle.

"After all of that, which clearly means they wanted it to work, they're like, 'No, bye.' What? Just on an emotional level, you got to go, 'Wait a minute, that's terrible.'"

-- Jason Cohen

Beyond the Price Tag: Pricing as a Strategic Lever

Cohen argues that pricing is often too low, not just in terms of the number, but in its strategic positioning. Many companies, especially newer ones, guess at pricing or simply copy competitors, failing to adjust as their product and market evolve. The common fear of raising prices, rooted in the microeconomic concept of a downward-sloping demand curve, often proves unfounded in practice. Cohen shares an anecdote of a company that 12xed its price without any observable drop in signups, indicating they were far from their optimal price point.

The reason for this counter-intuitive phenomenon lies in how pricing signals value. For larger companies, a suspiciously low price can signal low quality, poor support, or a lack of maturity. Conversely, a price point that aligns with the perceived value and the customer's budget can actually increase demand by attracting the right market segment. Cohen emphasizes that pricing is inseparable from positioning and strategy. He uses the example of "Double Down," a tool that halved AdWords costs. Pitched as a cost-saver, it commanded a modest price. However, when repositioned to focus on doubling leads for the same budget--a more desirable outcome for CEOs--it could command eight times the price for the same product. The key takeaway is to frame your offering around what the customer values most, often growth or competitive advantage, rather than mere cost savings. This requires a deep understanding of customer budgets, decision-making processes, and strategic priorities.

"The big point is, where the the largest point is, pricing is not just the number on the page. It's positioning. It's how their budgets work. It's how it's structured."

-- Jason Cohen

The Power of Expansion: Growing Through Existing Customers

While reducing churn is paramount, sustainable growth also relies on expanding revenue from existing customers. This is where Net Revenue Retention (NRR) becomes crucial. Cohen clarifies that NRR is not just about offsets; a 20% loss from churn requires a 25% gain from upgrades to return to the starting point. This highlights why NRR greater than 100% is essential for scaling SaaS companies, with public SaaS companies typically showing median NRRs of 119% at IPO.

The challenge lies in creating genuine value that justifies price increases or upsells. Cohen stresses that this isn't about arbitrary price hikes but about delivering tangible, measurable value to the customer. The core principle is to create more value and then negotiate how to split that value with the customer. This requires understanding what the customer truly values--be it growth, market share, or efficiency--and ensuring your product delivers on those fronts. For consumer products, this might involve introducing new features, tiers, or complementary products. In B2B, it could mean developing integrations, offering tiered pricing based on usage or seats, or even creating entirely new products that leverage existing customer relationships. The ultimate goal is to ensure that as customers pay more, they perceive themselves as receiving significantly more value in return.

"The core idea is how do we create more value for the customer and then split that with them? And when you do that, you're keeping the customer in forefront of mind."

-- Jason Cohen

The Elephant Curve: Navigating Channel Saturation and Decline

Cohen warns against relying solely on existing marketing channels, as they are prone to saturation and eventual decline. He introduces the "elephant curve" concept, illustrating how marketing channels often experience an initial surge, followed by a plateau, and then a decline. This is due to factors like audience saturation, declining channel effectiveness, and increasing competition. Relying on incremental feature additions to flog through existing channels is unlikely to reignite growth once these channels are tapped out.

Instead, companies must proactively explore new channels or creative strategies. Cohen highlights examples like Constant Contact holding workshops in physical cities to re-engage growth and HubSpot's success selling through agencies. He also points to emerging channels like ecosystems and AI app stores as potential avenues for expansion. The critical insight is to constantly question the saturation of current channels and to be proactive in seeking novel ways to reach customers. This might involve leveraging partnerships, exploring indirect sales models, or developing entirely new products for existing markets or adjacent ones. The key is to recognize that what works today may not work tomorrow, necessitating a continuous search for new growth levers.

The Ultimate Question: Do You Actually Need to Grow?

The final step in Cohen's framework is the most philosophical: Do you need to grow? While the mantra "if you're not growing, you're dying" is pervasive, Cohen questions its universal applicability. For bootstrapped companies or those with different strategic goals, maximizing profit or achieving a stable, fulfilling business might be more appropriate than relentless revenue growth. This question forces a re-evaluation of core business objectives, considering founder well-being, company culture, and market realities.

Cohen suggests that sometimes, growth at all costs can lead to decisions that compromise product quality, customer satisfaction, or ethical standards. By questioning the necessity of growth, founders can establish boundaries and focus on sustainable, value-driven strategies. This introspection is crucial for long-term fulfillment and for avoiding the pitfalls of chasing growth for its own sake, especially when the underlying product or market dynamics may not support it. It encourages a more deliberate and intentional approach to business strategy, aligning growth ambitions with genuine company values and customer needs.

Key Action Items

-

Immediate Action (0-3 Months):

- Analyze Logo Churn: Calculate your maximum potential customer ceiling based on current churn rate and acquisition rate. Identify the top 3 reasons customers cite for leaving, digging beyond surface-level excuses like "too expensive."

- Review Pricing & Positioning: Assess if your current pricing and messaging align with the value delivered and the target market's willingness to pay. Consider if repositioning your product could unlock higher price points.

- Enhance Onboarding: Audit your customer onboarding process. Identify friction points and implement improvements to increase early-stage activation and reduce initial churn.

-

Short-Term Investment (3-9 Months):

- Deep-Dive into Churn Drivers: Conduct qualitative interviews with recently churned customers and those showing signs of distress. Focus on understanding the "what made you cancel" rather than just the "why."

- Experiment with Pricing Tiers: Based on your pricing review, test new pricing structures or tiers that better reflect value delivered and target different customer segments.

- Measure Customer Value: Define and track metrics that directly correlate with the value customers receive from your product, not just usage metrics. Use this to inform NRR strategies.

-

Longer-Term Investment (9-18 Months):

- Develop Expansion Strategies: Implement initiatives to increase Net Revenue Retention (NRR) through upsells, cross-sells, or new product offerings for existing customers. Aim for NRR above 100%.

- Explore New Marketing Channels: Proactively research and pilot new acquisition channels before existing ones become fully saturated or decline. Consider indirect channels or ecosystem partnerships.

- Re-evaluate Growth Goals: Critically assess whether aggressive growth is still the primary objective. Consider alternative goals like profit maximization, market stability, or focusing on specific customer segments that align with company values.