This conversation, presented as a brief market update, subtly reveals how interconnected global events and speculative trading create volatile, cascading effects across seemingly disparate asset classes. The hidden consequences lie not just in price swings, but in the psychological impact of rapid wealth destruction and the delicate balance of geopolitical tensions that can be upended by a single statement. Investors and traders who can look beyond immediate headlines to understand these systemic feedback loops--how a geopolitical de-escalation impacts oil, which in turn influences broader market sentiment, and how speculative leverage amplifies every move--will gain an advantage in navigating this choppy environment. This is essential reading for anyone seeking to understand the forces shaping today's markets beyond the daily ticker.

The Dominoes Fall: How Geopolitics and Leverage Amplify Market Shocks

The daily rhythm of financial markets is often dictated by a complex interplay of geopolitical events, economic indicators, and the mechanics of trading itself. What might appear as isolated news items--a de-escalation in the Middle East, a government funding debate, or a surge in cryptocurrency volatility--are, in reality, interconnected nodes in a larger system. This podcast episode, while brief, offers a window into how these elements conspire to create significant, often unpredictable, market movements, particularly when amplified by speculative leverage.

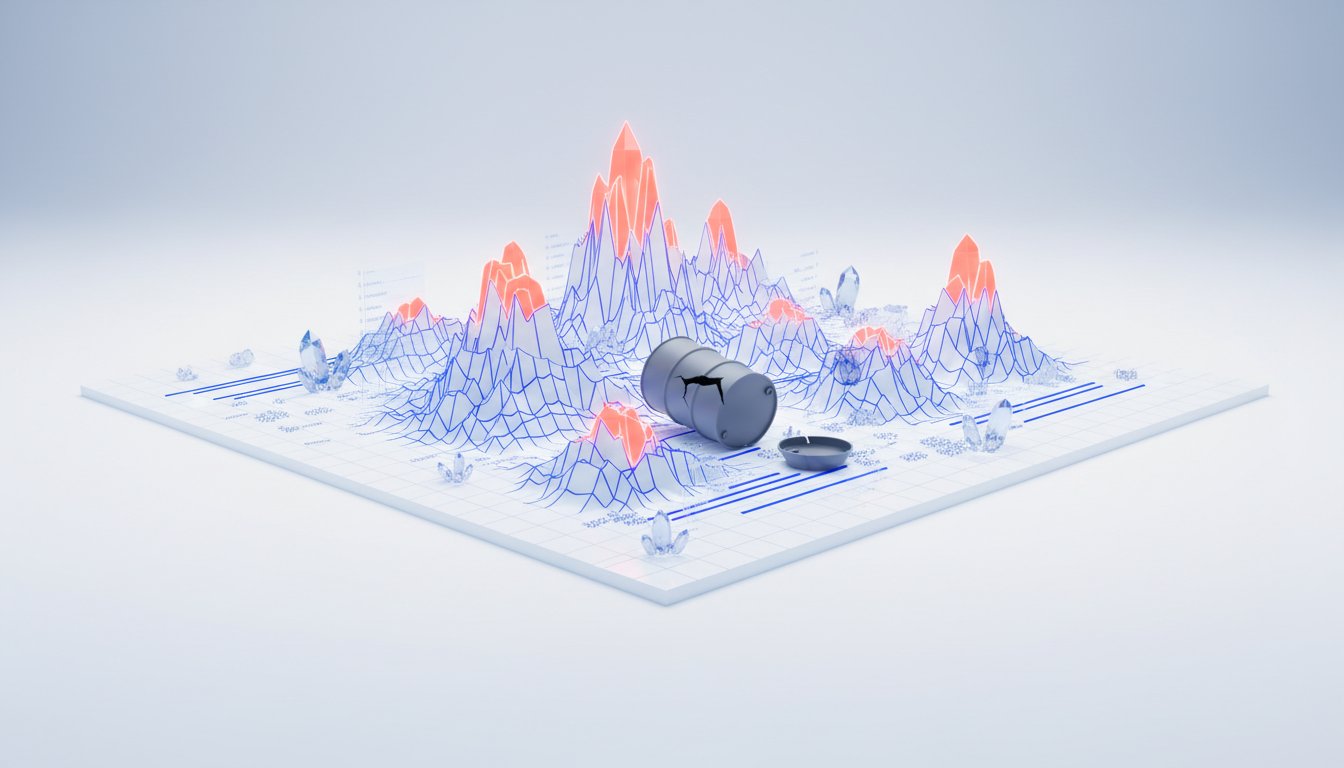

The immediate takeaway is the sharp decline in oil prices. President Trump's comments suggesting "Iran was seriously talking with Washington" acted as a significant catalyst. This single statement, signaling potential de-escalation, immediately eased fears of supply disruptions. Brent crude and West Texas Intermediate futures both slid, reversing recent gains. The ANZ analysts noted this shift, stating, "The distinct shift in his messaging has eased concerns of supply disruptions. This removes some risk premium out of the market, even as US military presence in the region continues to build." This illustrates a core principle of consequence mapping: a perceived reduction in geopolitical risk directly impacts commodity prices, even if the underlying tensions remain. The market, in this instance, priced in a future state of lower risk, leading to an immediate sell-off.

However, the narrative doesn't stop at oil. The same speculative fervor and rapid price shifts are evident in the cryptocurrency market, specifically with Bitcoin. The episode highlights a "V-shaped recovery" after Bitcoin briefly dipped below support, but the real story is the massive liquidation of bullish bets. Over $850 million in leveraged positions were wiped out in hours on Saturday, escalating to nearly $2.5 billion. This occurs when traders borrow money to amplify their bets. When the price moves against them, exchanges automatically sell their holdings to cover the debt, creating a "domino effect" of selling that drives prices lower and triggers more liquidations. The report details how nearly 200,000 traders saw their accounts liquidated, with a further $510 million in leveraged positions wiped out in the preceding 12 hours. This demonstrates a critical feedback loop: leverage doesn't just magnify gains; it magnifies losses and accelerates price movements, turning a moderate downturn into a sharp crash.

"These liquidations occur when traders borrow money to bet that the price will rise. Once the price hits a certain trapdoor, exchanges automatically sell their holdings to repay the debt. This creates a domino effect, for selling leads to lower prices, which trigger even more liquidations."

This dynamic is not unique to crypto. While not explicitly detailed for other markets in this snippet, the principle of amplified volatility due to leverage is a constant in financial systems. The "obvious solution" for traders might be to use leverage to capture larger gains. The hidden consequence, however, is the increased vulnerability to sudden, sharp downturns and systemic risk when many leveraged positions are unwound simultaneously. This is where conventional wisdom--that leverage is simply a tool for greater profit--fails when extended forward into scenarios of rapid price reversal. The system doesn't just absorb these liquidations; it actively contributes to the downward spiral.

The brief mention of a potential government shutdown adds another layer to the systemic view. While expected to be brief, the very fact that a partial shutdown occurred highlights the fragility of legislative processes and the potential for political uncertainty to ripple through markets. Speaker Mike Johnson's confidence in a swift resolution suggests a degree of control, but the initial event itself can create jitters. In this context, the market's reaction to oil prices might be partially influenced by a general sense of global instability, even as specific de-escalation talks occur. The system is always processing multiple, often conflicting, signals.

The episode also touches on other trending articles, such as Ford and Xiaomi denying EV partnership talks, and Disney nearing a CEO change. While these are specific corporate events, they contribute to the broader market sentiment. Uncertainty around major corporate strategies or leadership transitions can introduce idiosyncratic risk, which, in a generally nervous market, can add to the downward pressure. The market is not a collection of independent entities; it's a web where news about one sector or company can influence investor psychology and capital allocation across others.

The key insight here is that immediate price movements are often the result of complex, cascading effects. A geopolitical statement triggers a commodity price drop, which in turn can influence broader market sentiment. Simultaneously, speculative leverage in assets like Bitcoin can create massive, rapid liquidations that further destabilize markets. The conventional approach of analyzing each event in isolation misses the systemic amplification.

"The distinct shift in his messaging has eased concerns of supply disruptions. This removes some risk premium out of the market, even as US military presence in the region continues to build. It said nevertheless, tension remains high."

This quote from ANZ analysts perfectly encapsulates the duality of market reactions. While de-escalation eases immediate fears, the underlying tensions--and the "risk premium"--remain. This suggests that quick market reactions might be premature, and that a more patient, systemic view is required to understand true, lasting shifts. The "risk premium" is a form of insurance against future shocks. When it's removed too quickly, the market becomes more vulnerable to those very shocks.

The mention of Lululemon's co-CEO transition and the National Automobile Dealers Association convention points to catalysts that could create localized volatility or sector-specific interest. However, in the context of the broader market narrative presented, these are secondary to the systemic forces at play. The rapid unwinding of leveraged positions, as seen in Bitcoin, is a powerful example of how internal market mechanics can override external news.

Ultimately, this brief market update underscores the importance of understanding not just what is happening, but how it connects and how it is amplified. The immediate pain of liquidations, particularly for those who over-leveraged, is a stark reminder that quick profits often come with hidden, compounding risks. The advantage for sophisticated investors lies in anticipating these downstream effects and recognizing when the system itself is creating momentum, independent of the initial news.

Key Action Items

- Immediate Action (Today/This Week): Monitor geopolitical statements and their immediate impact on oil prices, understanding that this can set a broader market tone.

- Immediate Action (Today/This Week): Review any leveraged positions across all asset classes. Consider reducing leverage to mitigate the risk of cascading liquidations, especially if market volatility is high.

- Short-Term Investment (Next Quarter): Analyze how news of geopolitical de-escalation or escalation is being priced into commodities versus other risk assets. Look for disconnects that might signal overreaction.

- Short-Term Investment (Next Quarter): Track major cryptocurrency exchanges for signs of significant leveraged position build-up, as this can be a leading indicator of potential sharp downturns.

- Longer-Term Investment (6-12 Months): Develop a framework for assessing the durability of price movements. Was the move driven by fundamental shifts or by speculative mechanics that can reverse quickly?

- Longer-Term Investment (12-18 Months): Understand the feedback loop between government policy (like funding packages) and market stability. Identify sectors or assets most sensitive to legislative uncertainty.

- Strategic Consideration (Ongoing): Build a "consequence map" for key decisions, explicitly charting immediate benefits against potential second- and third-order effects, particularly those involving leverage or geopolitical sensitivity.