The Palantir Paradox: Short-Term Gains vs. Long-Term Competitive Advantage

This conversation on Palantir's Q4 performance and broader market movements reveals a critical, often overlooked dynamic: the tension between immediate market validation and sustainable, long-term competitive advantage. While Palantir's stock surged on stellar results and optimistic guidance, the underlying narrative highlights how conventional metrics can obscure deeper strategic challenges and opportunities. The non-obvious implication is that true success lies not just in beating quarterly estimates, but in building systems that create durable value, even when that path involves delayed payoffs or initial discomfort. Investors and leaders who grasp this distinction gain an advantage by looking beyond the immediate stock price pop to the fundamental drivers of enduring enterprise value, understanding how market reactions can sometimes be a distraction from the harder, more impactful work of building truly resilient businesses.

The Palantir Paradox: Beating Expectations vs. Building an Enduring Enterprise

Palantir's recent surge, with its stock jumping on Q4 results that blew past Wall Street's forecasts, serves as a potent case study in the immediate gratification economy. The company reported a 69.2% year-over-year revenue increase, with US commercial revenue growing an astonishing 137%. This kind of performance is precisely what the market rewards, driving a 10% pre-market jump and validating the company's current trajectory. However, the narrative glosses over a deeper question: are these short-term wins building a foundation for long-term dominance, or are they merely a reflection of current market enthusiasm that could evaporate?

Julian Lin, leader of Best of Breed Growth Stocks, touches on this by noting the "increasing brand name momentum" but immediately pivots to the crucial question of valuation. He cautions that "time will tell if these strong results are strong enough to justify the outlandish valuation, which represents a stunning 10 times premium as compared to other large-cap enterprise software peers." This highlights the core tension. Palantir is achieving impressive growth, but its premium valuation suggests an expectation of sustained, outsized performance that goes beyond typical market rewards. The immediate success is undeniable, but the consequence of that success is the immense pressure to continue delivering at an even higher rate, potentially leading to decisions optimized for short-term stock performance rather than long-term strategic advantage.

The forward-looking guidance further amplifies this. Palantir's Q1 2026 revenue projections and full-year outlook significantly exceed consensus estimates. This is the kind of news that fuels investor confidence and drives stock prices higher. Yet, the underlying system dynamics are complex. This accelerated growth, particularly in the US commercial sector, implies an increasing reliance on market adoption and a potentially more volatile customer base compared to long-standing government contracts. The consequence of this rapid expansion is a heightened need for operational scalability, robust sales execution, and continuous innovation to maintain that premium valuation. If Palantir falters even slightly in meeting these sky-high expectations, the market's reaction could be swift and severe, a stark reminder that immediate success can create its own downstream risks.

"time will tell if these strong results are strong enough to justify the outlandish valuation, which represents a stunning 10 times premium as compared to other large-cap enterprise software peers."

-- Julian Lin

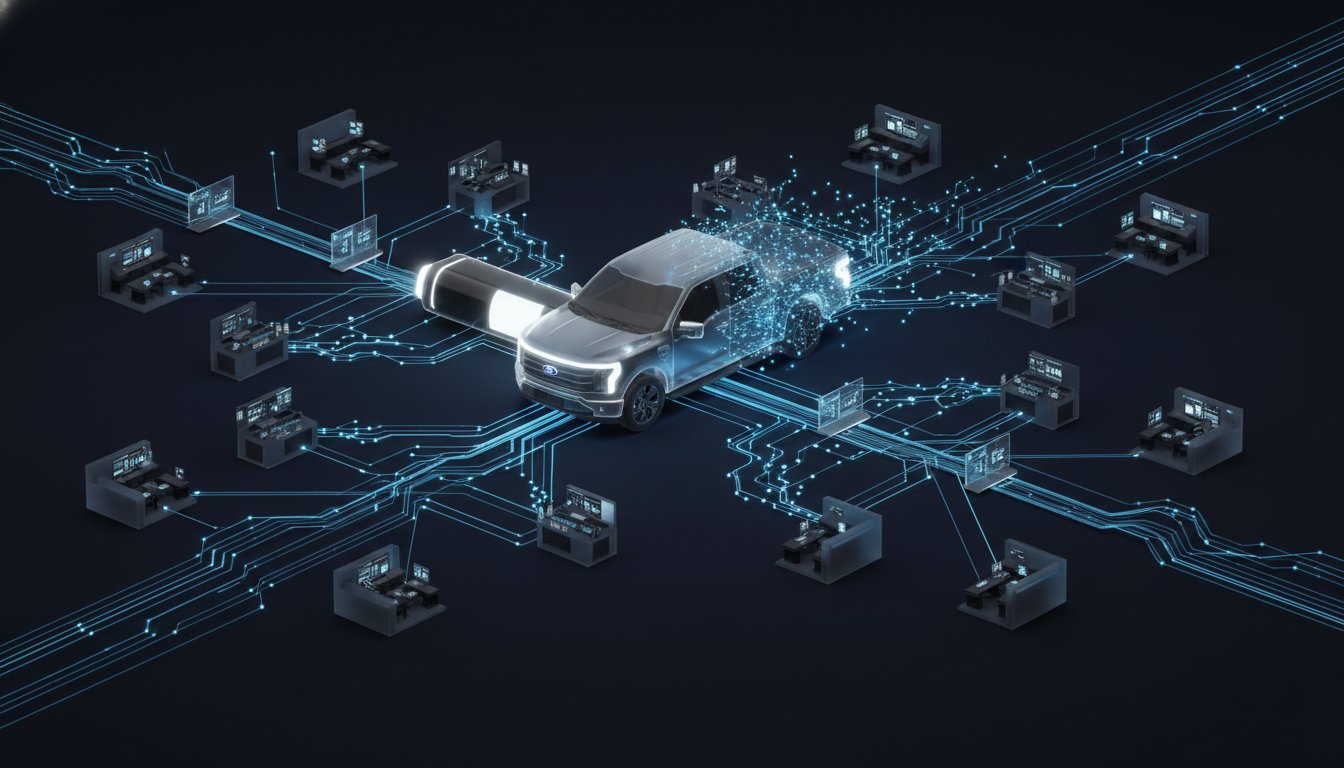

The Ripple Effect: California's EV Incentives and Amazon's Restructuring

Beyond Palantir, the episode touches on other significant economic shifts that illustrate consequence mapping. California's proposed $200 million EV rebate program, aimed at first-time buyers, is a clear attempt to stimulate demand. However, the condition that participating manufacturers must offer matching incentives introduces a complex feedback loop. This doesn't just subsidize buyers; it forces manufacturers, including Tesla, to potentially absorb a portion of the cost or adjust pricing strategies. The immediate benefit is increased accessibility for consumers, but the downstream effect could be compressed margins for automakers or a strategic reallocation of resources away from other R&D or production initiatives. This is a classic example of how a seemingly straightforward policy intervention creates cascading effects across an industry, influencing competitive dynamics and profitability in ways that are not immediately apparent.

Similarly, Amazon's further headcount reduction of 2,200 corporate jobs, following earlier rounds, points to a system optimizing for efficiency and cost control. The stated goal is to "strengthen the organization by reducing layers." This immediate action aims to streamline operations and likely improve profitability metrics. However, the long-term consequence of such significant corporate layoffs can be a dilution of institutional knowledge, a potential decrease in employee morale among remaining staff, and a slower pace of innovation if critical teams are understaffed. While the company might see a short-term boost in its stock price or operational ratios, the hidden cost could be a less agile and innovative organization down the line. This illustrates how decisions made to address immediate financial pressures can inadvertently undermine the very capabilities needed for future growth and adaptation.

"Amazon plans the job separations to begin on April 28th, across various locations in Washington. The notification also shows more than 400 positions in the state will be lost due to the closure of one or more facilities."

-- Wall Street Breakfast

Navigating the Noise: Catalysts, Movers, and Economic Signals

The "Catalysts to Watch" and "Biggest Movers" segments, while seemingly disparate, also offer insights into system dynamics. Western Digital's innovation day, focused on AI-driven data storage demand, highlights a direct response to a macro trend. Their focus on supporting the "AI-driven economy" is a strategic bet on a future demand wave. The consequence of successfully navigating this trend could be significant market share gains, but the investment required and the competitive landscape are substantial. Shareholders voting on Adobe's acquisition offer for Semrush represent a point of strategic decision-making, where immediate financial certainty (acquisition offer) is weighed against potential future independent growth.

Rambus's stock drop due to a "near-term supply chain disruption" is a stark reminder of how fragile even seemingly robust growth can be. This immediate operational hiccup directly pressures future revenue and earnings, demonstrating that even companies with strong underlying products can be derailed by external factors. The market's sharp reaction underscores the unforgiving nature of investor expectations, especially when valuations are high. The economic calendar, with Fed speakers and conferences, represents the broader system attempting to signal stability and direction. However, as the varied market reactions show, interpreting these signals and translating them into durable business strategies requires a sophisticated understanding of how immediate events cascade into longer-term consequences.

Key Action Items

-

For Investors:

- Over the next quarter: Analyze companies' stated growth strategies against their underlying operational realities. Distinguish between growth driven by market momentum and growth built on sustainable competitive advantages.

- This pays off in 12-18 months: Develop frameworks for assessing the long-term viability of high-valuation companies, looking beyond quarterly beats to understand how they are building durable moats.

- Immediate action: Scrutinize guidance and forward-looking statements for potential disconnects with operational capacity or market realities.

-

For Business Leaders:

- Over the next 6 months: Map the second and third-order consequences of current strategic decisions. Where might immediate gains lead to future vulnerabilities?

- This pays off in 18-24 months: Invest in building operational resilience and deep institutional knowledge, even if it means slower visible progress in the short term. This creates a moat that competitors focused on immediate wins cannot easily replicate.

- Immediate action: Challenge assumptions about growth drivers. Are you optimizing for the next earnings call or the next decade?

- Requires discomfort now: Prioritize initiatives that build long-term strategic advantage, even if they are unpopular or require significant upfront investment with delayed returns. This is where true competitive separation occurs.

- Over the next quarter: Consider the impact of corporate restructuring on remaining employees' morale and long-term innovation capacity.