Strategic Financial Engineering Drives Ambitious Corporate Ventures

The $250 Billion Question: Why Elon Musk's Latest Merger Is a Masterclass in Strategic (and Risky) Financial Engineering

In this conversation, Jack and Nick dissect a series of high-stakes business moves, revealing how seemingly disparate events like corporate acquisitions, price wars, and data tracking in sports are all interconnected threads in a larger economic tapestry. The core thesis is that immediate financial pressures and the pursuit of long-term dominance often lead companies to make counterintuitive decisions with significant, cascading consequences. This analysis uncovers the hidden implications of these strategies, particularly how companies leverage "sugar daddy" deals or embrace unpopular price cuts to fund ambitious, future-facing ventures. Those who grasp these underlying dynamics will gain a significant advantage in understanding market shifts and anticipating the next wave of innovation, especially within the tech and consumer goods sectors.

The "Sugar Daddy" IPO: When Profitability Becomes a Tool for Ambition

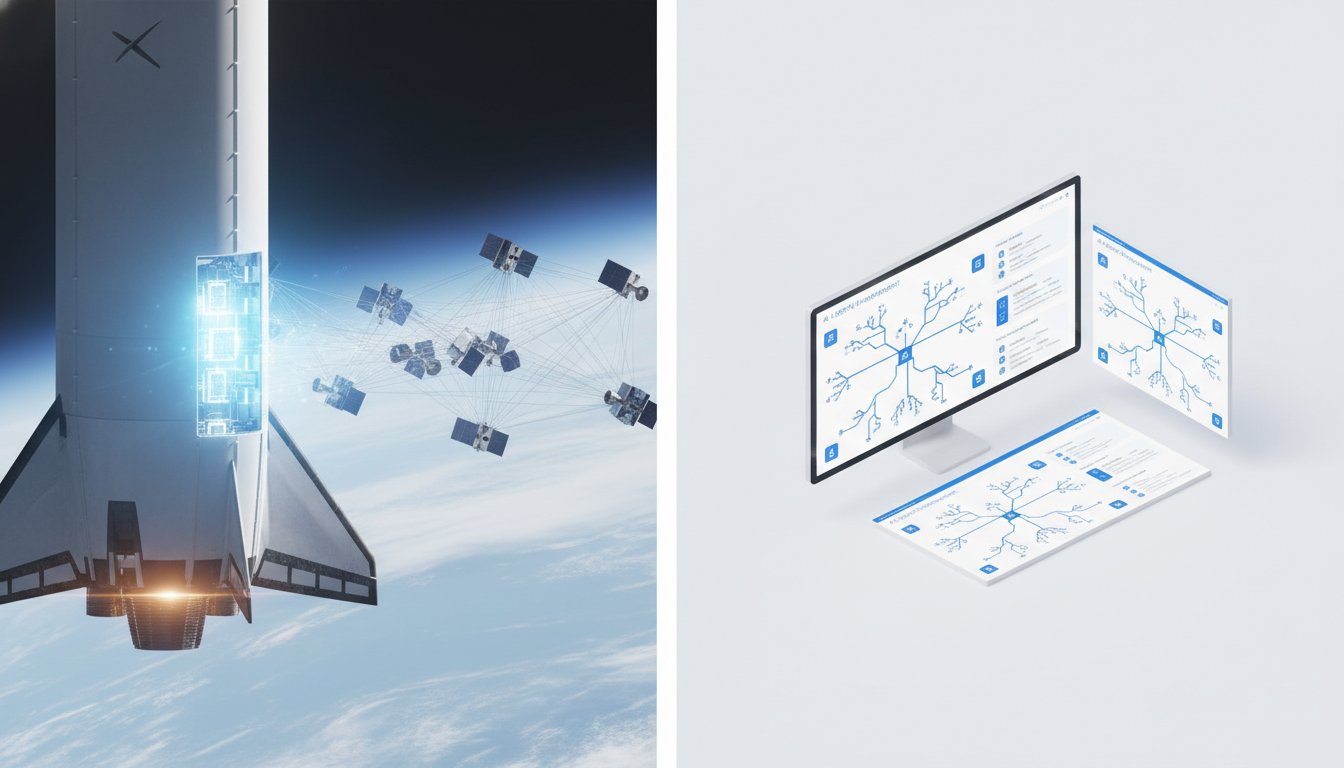

The narrative around Elon Musk's SpaceX is often dominated by rockets and Mars. However, the recent news of SpaceX acquiring his AI venture, XAI, for a staggering $250 billion, and the subsequent anticipation of a massive SpaceX IPO, reveals a more complex financial strategy. While the acquisition price is largely symbolic given Musk's control over both entities, it signals a critical pivot. SpaceX, a surprisingly profitable company with $15 billion in revenue and profits that double Tesla's, is being positioned not just as a space exploration company, but as the financial engine for Musk's AI ambitions.

The immediate implication is that SpaceX's considerable profits, largely derived from its dominant position in rocket launches (84% of US launches) and its burgeoning Starlink internet service (9 million subscribers), are now earmarked to fuel the AI arms race. Companies like Meta, Microsoft, and Google are reportedly spending upwards of $100 billion annually on AI development, with OpenAI alone committing to over $1 trillion. XAI, facing immense capital demands, is effectively getting a "sugar daddy" in SpaceX. This isn't just about funding; it's about structuring for the "Ultimate Public Offering" (UPO) of SpaceX, targeting a $1.5 trillion valuation.

"Basically, SpaceX is driving this summer to Nasdaq money, and XAI is going to hit your ride for free, which is why Jack and I are calling SpaceX's IPO a sugar daddy IPO."

The conventional wisdom might focus on the technological synergy, but the deeper consequence is the financial engineering at play. SpaceX's IPO, slated for June 8th or 9th (optimistically aligned with celestial events), is being framed as a vehicle to consolidate Musk's empire. The potential merger with Tesla, while complex due to Tesla's public trading status, looms as a future possibility. This strategy highlights a willingness to leverage a profitable, established entity to absorb the immense costs of a nascent, capital-intensive venture. The risk lies in whether the market will reward this ambitious consolidation or penalize the perceived bailout of XAI. For investors, understanding this dynamic means looking beyond the rockets and seeing SpaceX as a diversified tech conglomerate, with AI as its next frontier, funded by its current successes.

The Unpopular Price Cut: When Deflation Becomes a Competitive Weapon

PepsiCo's decision to cut prices on its snacks by 15% marks a significant shift from years of "snackflation," where prices rose by approximately 38% between 2020 and 2024. This move, inspired by Greek mythology and consumer outcry, is not merely a response to market pressure; it's a strategic re-evaluation of value proposition in the face of declining sales. For four consecutive years, PepsiCo has seen its snack sales shrink, not because consumers have stopped snacking, but because they've shifted to more affordable store brands like Walmart's Better Goods, Costco's Kirkland, and Trader Joe's private label.

The immediate consequence of years of aggressive price increases was consumer pushback, a phenomenon the hosts describe as "smack back on the snacks." While inflation has cooled, overall prices have remained elevated. Pepsi's move into actual price reductions is a stark contrast, signaling a potential start of deflation in the consumer packaged goods sector. The company is not just offering "more value"; it's being forced to re-establish its price competitiveness after what appears to be a prolonged period of overpricing.

"Now besties, we've said before, you don't know your price until the customer says no. The lesson there is that if your price has never been rejected by your customer, it means you're probably undervaluing yourself. Write that down, it goes for your salary too."

This situation offers a powerful lesson in market dynamics. Companies that push prices too high, even if initially successful, risk alienating their customer base and ceding ground to more value-oriented competitors. Pepsi's stock performance, down 17% over three years, reflects this damage. The 15% price cut is an attempt to recapture market share, but the long-term advantage has already shifted to private labels that capitalized on consumer sensitivity. The underlying system here is a feedback loop: high prices lead to lost sales, which forces price reductions, potentially at the cost of profitability in the short term, but with the hope of long-term customer loyalty and market share recovery. This is a clear example of how ignoring customer signals can lead to significant downstream consequences, turning a perceived strength (premium pricing) into a weakness.

The Invisible Data Engine: How B2B Dominance Becomes Consumer-Relevant

Zebra Technologies, a company founded in 1969 and specializing in RFID and barcode tracking, has quietly become instrumental in the NFL's "moneyball" effect. While many associate NFL analytics with AWS's Next Gen Stats, the foundational data is captured by Zebra's chips embedded in every football, shoulder pad, and end zone pylon. This B2B company, whose stock has seen a 40% decline in the past year despite its critical role, demonstrates how deep technological integration can translate into consumer-facing relevance, even indirectly.

The system at play involves placing approximately 250 Zebra chips on the field, capturing over 200 data points per play--location, speed, height--10 times per second. This granular data allows for unprecedented insights, from Tyreek Hill's top speed to Travis Kelce's pre-halftime glances. Beyond entertainment, this data aids in redesigning helmets to reduce concussions and monitoring player fatigue.

The non-obvious implication here is how a company primarily serving industrial and retail logistics (tracking packages for UPS, security tags for J. Crew) leveraged its core competency into a high-profile partnership with the NFL. While the NFL deal is a reported $50 million contract and represents a small fraction of Zebra's $5 billion in revenue, its marketing value is immense. It transforms Zebra from an obscure "Where's Waldo of tech" into a company whose technology is directly experienced, albeit unknowingly, by millions of sports fans.

"B2B doesn't mean anti-social. B2B better be seen."

This strategy highlights a critical lesson for B2B companies: consumer relevance, even if indirect, can be a powerful driver of brand visibility and client acquisition. By making its technology visible during high-stakes, widely watched events, Zebra demonstrates its capabilities in a way that resonates far beyond traditional business channels. The "competitive advantage" isn't just in the data itself, but in the amplified awareness it creates, potentially influencing future deals with companies like FedEx, who might be swayed by a signed football containing Zebra chips. This approach turns a B2B service into a tangible, albeit invisible, part of the consumer experience.

Key Action Items

- For SpaceX/XAI Stakeholders: Develop a clear, compelling narrative for the SpaceX IPO (UPO) that directly addresses the financial integration of XAI and the long-term vision for AI dominance. Emphasize the profitability of SpaceX as a stable foundation for this ambitious expansion. (Immediate to June IPO)

- For PepsiCo Leadership: Continue to monitor consumer response to the 15% price cuts and be prepared for further adjustments. Focus on rebuilding brand loyalty and demonstrating tangible value beyond just price, as private labels have gained significant ground. (Ongoing)

- For B2B Companies: Identify opportunities to translate your core business-to-business services into consumer-relevant demonstrations, even if indirectly. Leverage high-visibility partnerships or applications to showcase capabilities and build brand awareness beyond traditional channels. (Over the next 6-12 months)

- For Investors: Re-evaluate SpaceX not just as a space company, but as a diversified tech conglomerate with significant AI ambitions, funded by its current profitable ventures. Understand that the IPO valuation will reflect this broader strategy. (Immediate)

- For Retailers and CPG Brands: Recognize that the current consumer environment favors value. For brands like PepsiCo, the challenge is to regain trust and market share after years of price increases, while private labels must continue to innovate to retain their gains. (Ongoing)

- For Technology Providers in Sports Analytics: Explore how to make the underlying technology more visible and understandable to the end consumer, leveraging high-profile events to build brand recognition and attract new clients, similar to Zebra's NFL strategy. (This pays off in 12-18 months)

- For All Businesses: Continuously seek customer feedback, especially regarding pricing. Ignoring signals of customer rejection, even for a limited time, can lead to significant long-term market share erosion and damage brand equity. (Immediate action, ongoing investment)