AI Spending: Systemic Transformation Beyond Bubble Hype

The AI Spending Spree: Beyond the Bubble Hype, Towards Systemic Transformation

The prevailing narrative around AI spending is dominated by bubble comparisons, yet this conversation with Martin Casado reveals a more nuanced reality. The true significance lies not in whether valuations are inflated, but in the fundamental differences between today's AI build-out and past speculative frenzies like the dot-com era. Hidden consequences of this AI wave, such as the sheer scale of infrastructure investment and the shift in corporate budgeting, suggest a profound, long-term transformation rather than a transient market correction. Anyone involved in technology investment, strategy, or infrastructure development will gain a critical advantage by understanding these deeper systemic shifts, moving beyond the superficial "bubble" debate to grasp the enduring economic and technological implications.

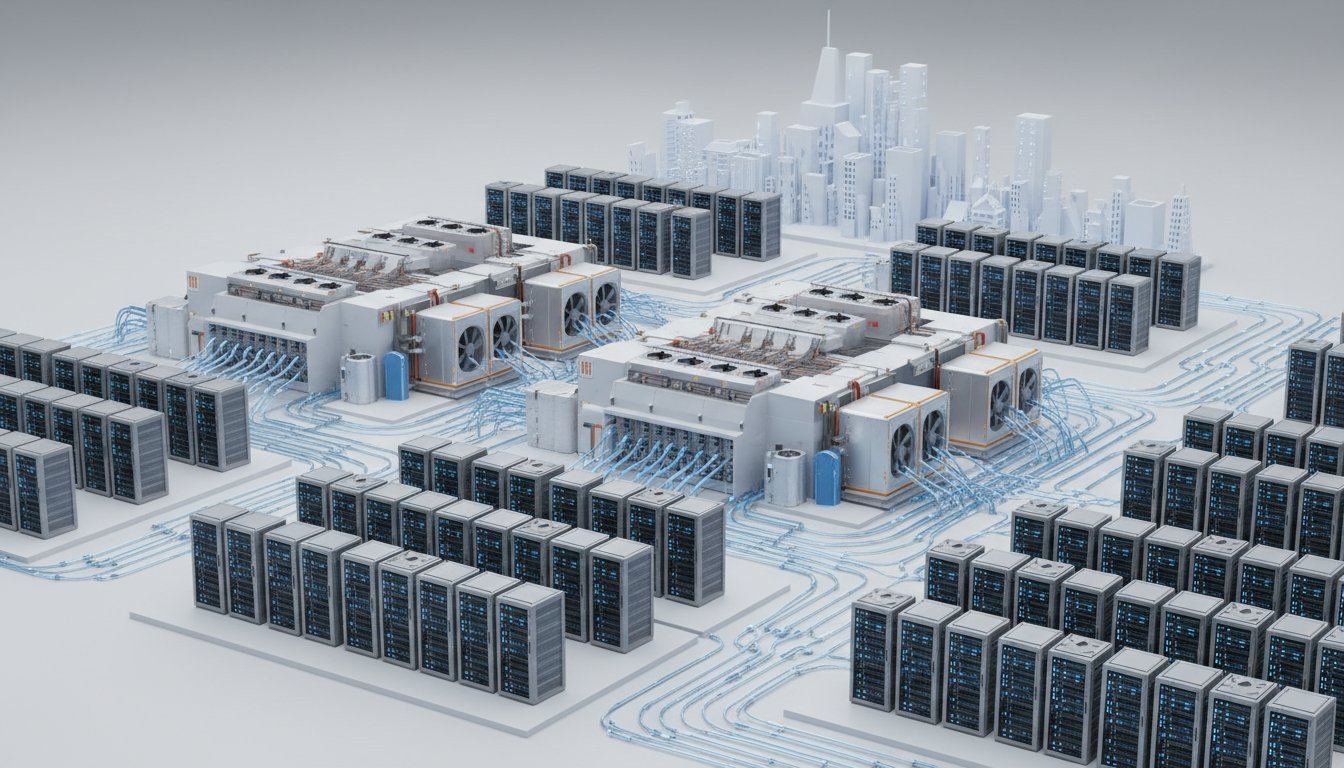

The Infrastructure Avalanche: More Than Just GPUs

The current deluge of capital into AI is primarily fueling a massive build-out of physical infrastructure, a detail often lost in discussions about software and models. Martin Casado highlights that the "vast majority" of these hundreds of billions are flowing into data centers: GPUs, real estate, power, and cooling systems. This isn't just about the algorithms; it's about the tangible, foundational hardware required to run them at scale. The comparison to the dot-com era, where infrastructure was often financed by debt-laden companies like WorldCom, is starkly different. Today's AI build-out is being funded by tech giants with "hundreds of billions of dollars on their balance sheets," indicating a more robust, albeit massive, financial underpinning.

This infrastructure focus has critical downstream effects. The sheer demand for specialized hardware, particularly GPUs, creates bottlenecks and drives up costs, influencing the pace and accessibility of AI development. It also shifts the competitive landscape, favoring companies with the capital to invest heavily in this physical layer. The implication is that success in AI will not solely depend on brilliant software or model innovation, but also on the ability to secure and manage this essential, capital-intensive infrastructure.

"The vast majority is going into actual data center capacity so this is gpus this is real estate this is power this is hvac systems to cool them then of course there is the standard you know software costs of the teams themselves and everything else but it's really dominated by the infrastructure."

-- Martin Casado

This infrastructural investment is not merely a short-term surge; it represents a fundamental retooling of computing capacity. The scale of this build-out implies a long-term commitment to AI, suggesting that even if speculative valuations correct, the underlying infrastructure will remain, shaping future technological advancements. This is where the distinction between a speculative correction and systemic collapse becomes crucial. While some AI valuations might be overextended, the physical infrastructure being built is unlikely to disappear, serving as a foundation for future innovation, much like the fiber optic networks laid during the dot-com era, albeit with different financing and market dynamics.

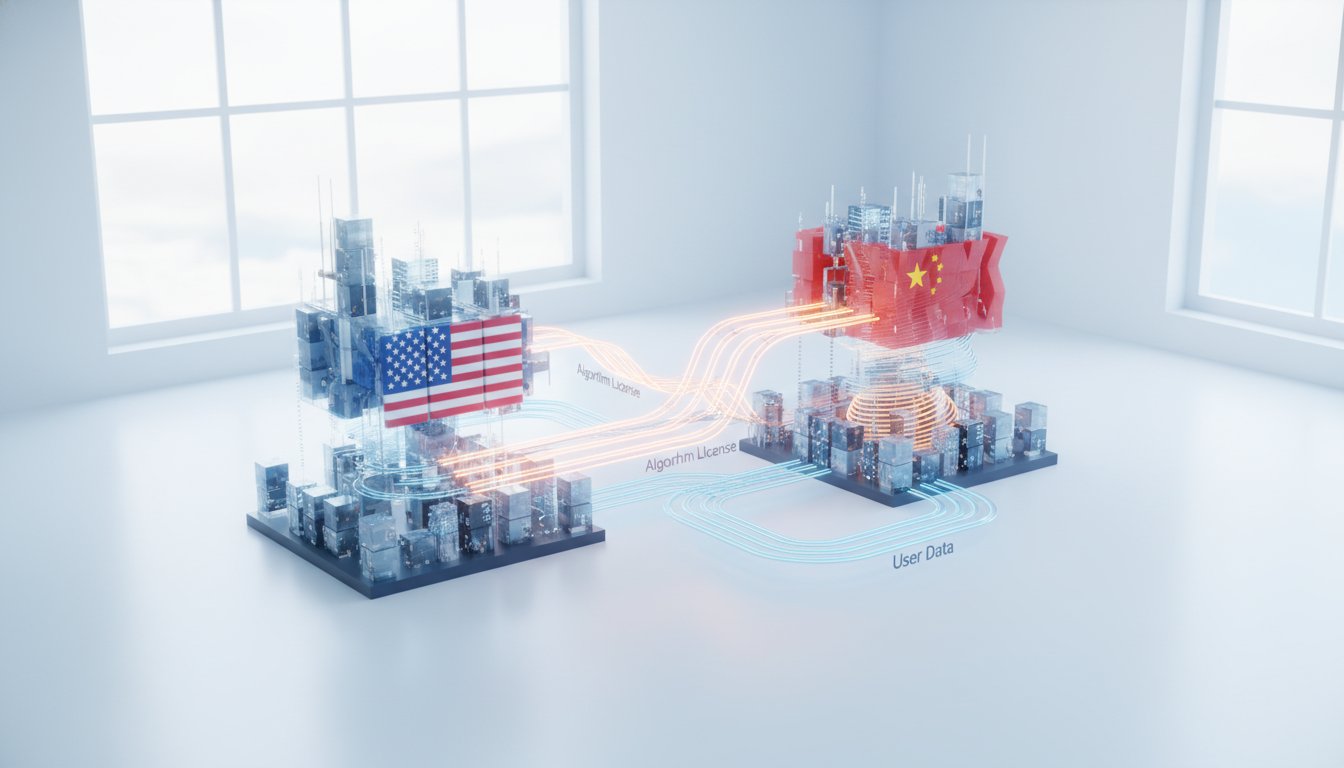

The Budgetary Black Hole: Shifting Corporate Spend

Beyond the infrastructure itself, the AI boom is triggering a seismic shift in corporate budgeting. Casado points out that for companies like Meta, the AI investment isn't just new spending; it's a significant reallocation of existing budgets. This isn't about adding a new line item; it's a "largest shift in budget we have ever seen," moving funds from one area to another. This dynamic is often confused with net-new revenue growth required for justification.

The consequence of this internal budget shift is that AI adoption becomes deeply intertwined with a company's existing business. Instead of AI being a separate, speculative venture, it becomes an integral part of operational strategy. This creates a powerful feedback loop: as companies invest more in AI, they reconfigure their operations around it, making AI adoption stickier and more essential. This internal reallocation, while potentially less visible than external market valuations, is a powerful indicator of AI's long-term integration into the corporate world. It suggests that the "AI revenue" needed to justify investment isn't solely from new AI-native companies, but also from the efficiency gains and new product capabilities AI enables within established businesses.

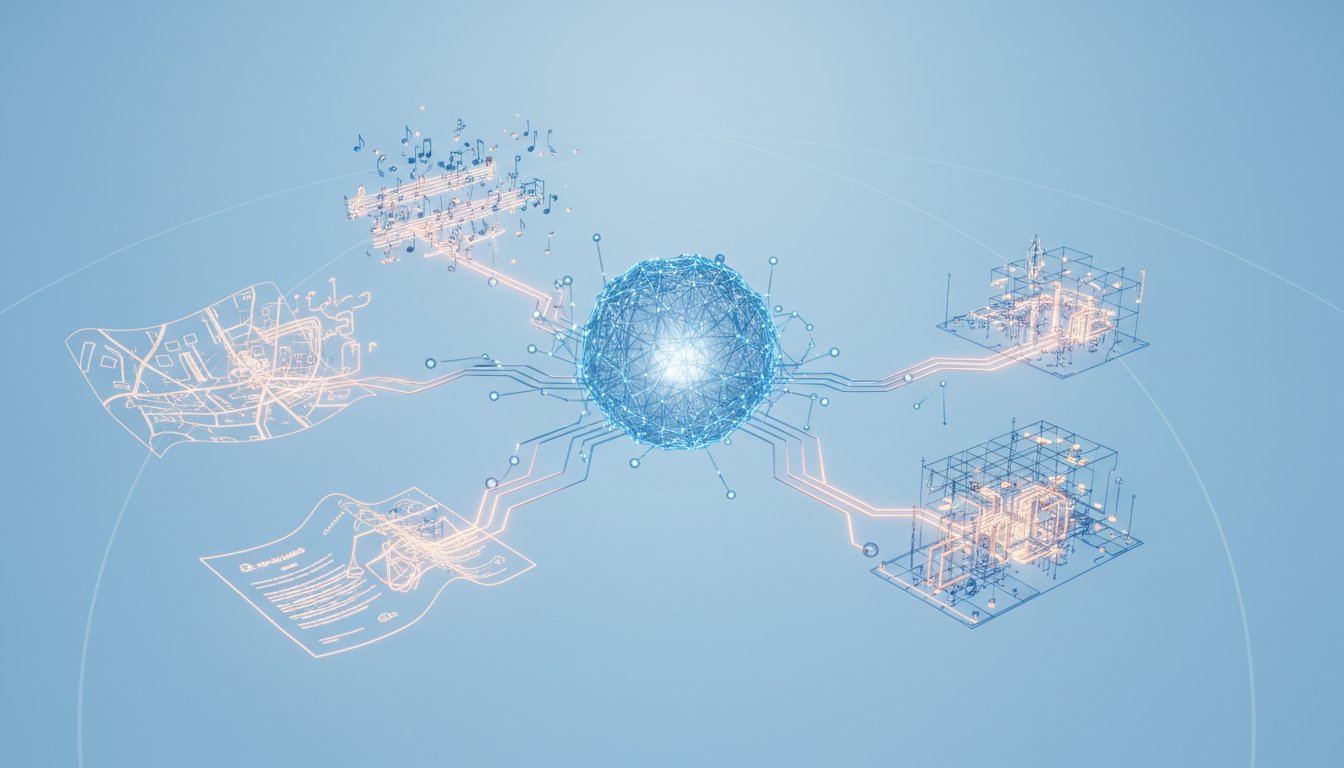

The "Toy" to "Netflix" Arc: Trivial Beginnings, Transformative Futures

Casado repeatedly emphasizes the historical pattern of transformative technologies beginning with seemingly trivial use cases. The first live video stream--a coffee pot webcam--is a prime example. Initially dismissed as a "toy" or "gimmick," it laid the groundwork for services like Netflix. This pattern is directly applicable to AI. While much of the current AI excitement might be focused on "anime and silly use cases," Casado argues that this is precisely how future foundational technologies emerge.

This perspective challenges the conventional wisdom that dismisses early, non-enterprise applications of AI. The implication is that by focusing only on immediate, proven enterprise ROI, one misses the nascent stages of truly disruptive technologies. The "long tail" of AI companies, encompassing image diffusion, speech, and music generation, represents these early, often playful, explorations. Investing in this "long tail," as a16z does, is a bet on these seemingly trivial beginnings evolving into significant future applications, mirroring the journey from a coffee pot webcam to a global streaming giant. This requires patience and a willingness to look beyond immediate, quantifiable business value to recognize the seeds of future, large-scale adoption.

"The pattern repeats every major technology wave starts with use cases that look trivial and every time skeptics confuse silliness with insignificance thirty years later hundreds of billions of dollars are pouring into ai infrastructure."

-- Martin Casado

The advantage for investors and strategists lies in recognizing this arc. By identifying and supporting these early, "silly" applications, one can gain early access to technologies that will become indispensable. The "delayed payoff" here is significant; by investing in the "toys" of today, one positions for the "Netflixes" of tomorrow, creating a durable competitive advantage that others, focused on immediate returns, will miss.

Beyond the "Bubble": Systemic Resilience

The core argument against conflating the current AI boom with a dot-com style bubble rests on systemic resilience. Casado distinguishes between a "speculative valuation bubble" and a "systemic issue" or "systemic collapse." While valuations may indeed be overextended in certain areas, the underlying economic fundamentals and the nature of the investment are vastly different from the late 1990s.

The key differences lie in the funding sources (companies with massive cash reserves versus heavily indebted entities), the existence of established business models (unlike the pre-monetization internet), and the fact that AI is largely an evolution and enhancement of existing technological paradigms (cloud, mobile, SaaS) rather than an entirely new, unproven economic engine. Even past overvaluations in mobile and cloud did not lead to systemic collapse. This suggests that while a market correction is possible, a widespread economic crisis triggered by AI spending is unlikely. The "discomfort now" of potential valuation corrections is outweighed by the "lasting advantage" of AI's integration into existing, profitable businesses and the robust infrastructure being built.

"It's very hard for me to see how just because you could have a speculative bubble absolutely this somehow denotes that we're going to have a systemic issue remember we overvalued things in you know mobile we overvalued things during the early cloud boom we overvalued things during the early sas boom all of these things we overvalued that did not result in systemic collapse."

-- Martin Casado

This resilience is a critical insight. It means that even if individual AI companies falter or valuations correct, the underlying technology and the infrastructure supporting it will continue to mature and drive progress. The advantage lies in understanding this systemic robustness, which allows for continued investment and development even amidst market volatility.

Key Action Items

- Immediate Action (Next Quarter): Re-evaluate current infrastructure spend for AI. Identify where capital is flowing beyond immediate model training and into long-term data center capacity, power, and cooling.

- Immediate Action (Next Quarter): Analyze internal corporate budgets. Understand how AI investments are being funded--are they net new, or reallocations from other critical areas? This reveals the stickiness of AI adoption.

- Short-Term Investment (6-12 Months): Investigate the "long tail" of AI companies. Look beyond state-of-the-art LLMs to generative AI applications in image, video, speech, and music, which may represent the "trivial" beginnings of future giants.

- Mid-Term Investment (12-18 Months): Develop strategies for securing AI infrastructure resources. Given the dominance of GPUs and data center capacity, proactive planning for hardware acquisition and management will be crucial.

- Long-Term Strategy (18+ Months): Map AI's integration into core business functions. Focus on how AI can enhance existing operations and create new value streams within your sector, rather than treating it as a standalone technology.

- Strategic Consideration: Distinguish between speculative valuation corrections and systemic economic risks when assessing AI investments. Understand that infrastructure build-out may persist even if specific company valuations decline.

- Behavioral Shift: Cultivate patience for AI's developmental arc. Recognize that transformative technologies often begin with seemingly insignificant use cases that mature over time into widespread applications.