AI's Foundation Differs Fundamentally from Dot-Com's Collapse

The AI spending boom is not a rerun of the dot-com crash, but understanding why requires looking beyond stock valuations to the fundamental differences in how this wave is being financed and the nature of the technology itself. This conversation reveals that while speculative corrections are inevitable, the underlying strength of AI's infrastructure and the deep pockets of its funders differentiate it from the systemic collapse of the late '90s. Those who grasp this distinction--particularly founders and investors navigating the "long tail" of AI opportunities beyond the hype--can gain a significant advantage by focusing on durable value creation rather than fleeting trends. This analysis is for anyone building or investing in technology who wants to understand the forces shaping the current AI landscape and avoid the pitfalls of misdiagnosing the market.

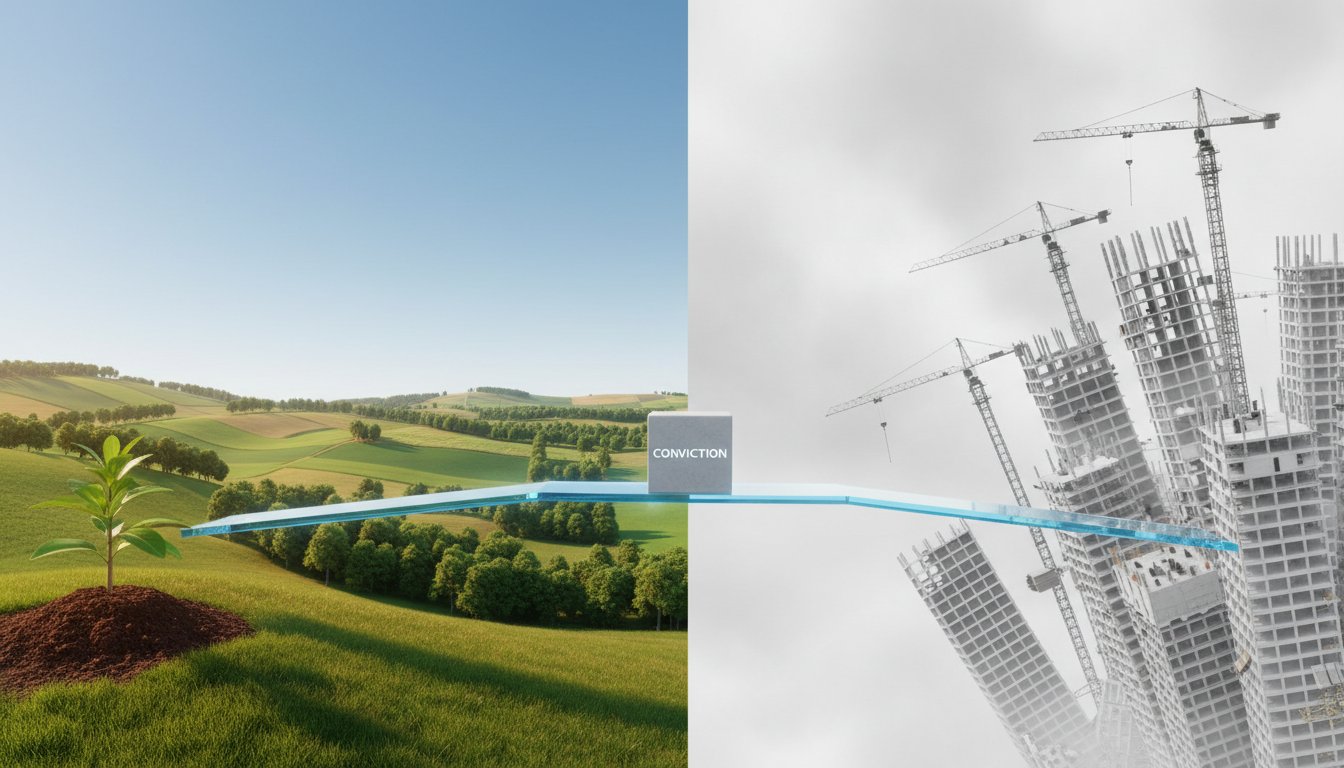

The Illusion of the Bubble: Why AI's Foundation Differs from Dot-Com's Collapse

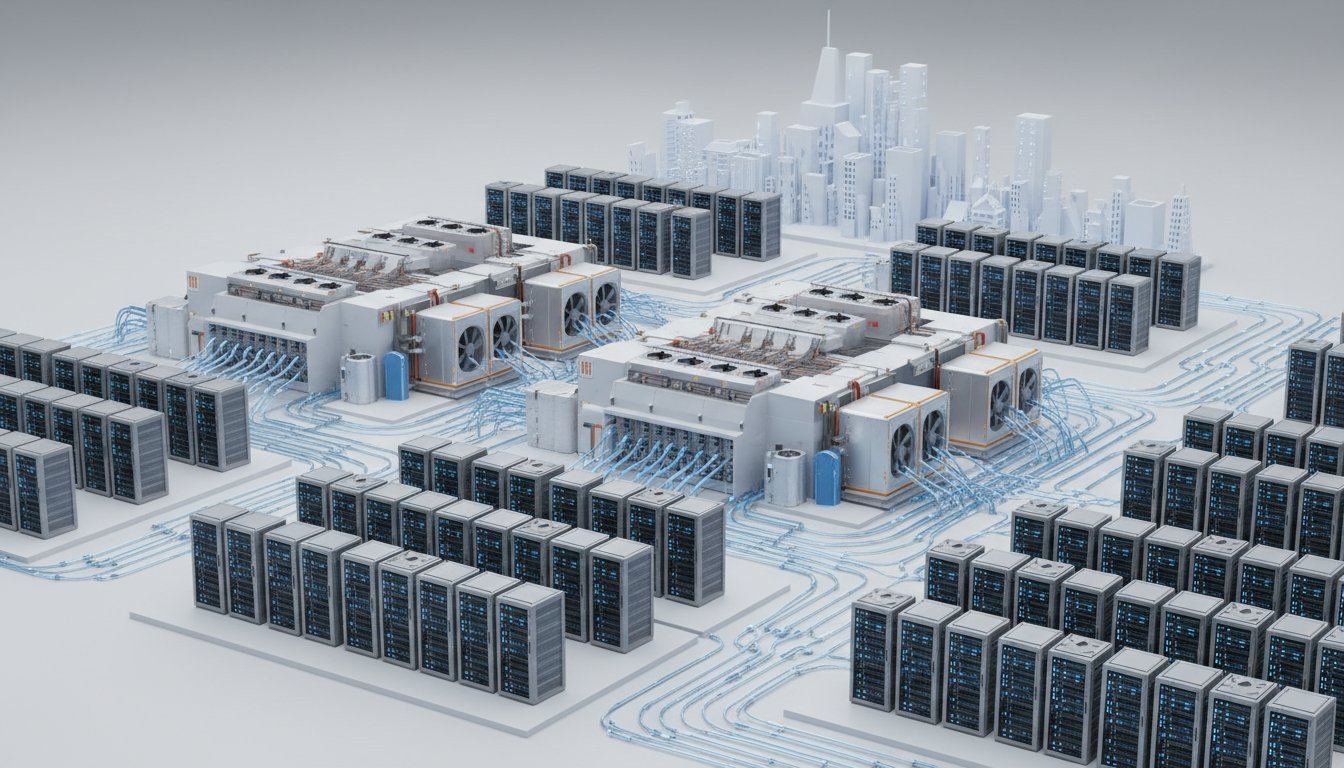

The current frenzy surrounding AI spending, with hundreds of billions flowing into data centers, GPUs, and power, naturally invites comparisons to the dot-com bubble. Skeptics point to the massive investment required and the potential for a speculative correction. However, Martin Casado, a general partner at a16z, argues that this comparison misses a crucial distinction: the difference between a speculative valuation bubble and systemic economic collapse. The dot-com crash was a perfect storm of a fiber glut, massive corporate debt (exemplified by WorldCom's $40 billion), and external shocks like 9/11. Today's AI build-out, while requiring substantial investment, is largely financed by companies with enormous cash reserves, not leveraged debt.

"The dot-com crash wasn't just overvalued stocks. It was a fiber glut financed by WorldCom, a company with $40 billion in debt that was cooking its books, compounded by 9/11. The companies funding today's AI build-out have hundreds of billions of cash on their balance sheets."

This fundamental difference in financial backing is paramount. While market valuations can and will fluctuate--a speculative bubble, as Casado notes, is "very hard... to see how just because you could have a speculative bubble, absolutely, this somehow denotes that we're going to have a systemic issue"--the underlying infrastructure and the companies building it are on far more solid footing. The comparison to the coffee pot webcam, which evolved into Netflix, serves as a potent reminder that transformative technologies often begin with seemingly trivial use cases. The current AI wave, with its potential for creativity and emotional connection, is not just a technical movement but a cultural one, rewriting the rules of company building and user behavior, much like the early internet.

The Hidden Costs of "Peak Disruptive Glory"

The "peak disruptive glory" Casado describes--the chaotic energy of the late '90s, with taxi drivers offering stock tips and janitors seeking equity--is a far cry from the current landscape. While excitement is palpable, it's tempered by a more sober understanding of adoption timelines and operational realities. This isn't to say a speculative correction won't occur; it's a natural part of market cycles. However, conflating this with a systemic collapse is a critical error. The vast sums being invested in AI infrastructure are not solely dependent on new AI revenue growing 40x by 2030 to justify the spend. Instead, a significant portion of this investment represents existing tech giants shifting budgets from other areas, like VR, to AI.

"The companies that are implementing a lot of this AI spend have existing businesses, right? And the AI portion has to grow 40x, which is a lot, but it is actually not a lot relative to their businesses. And if you look at their existing businesses, you'll actually see this is the largest shift in budget we have ever seen."

This internal reallocation within massive, cash-rich companies provides a crucial buffer. It means that even if the AI revenue projections are overly optimistic in the short term, the fundamental infrastructure build-out is supported by existing, profitable businesses. The risk of a "fiber glut" scenario, where a specific infrastructure component becomes massively oversupplied and bankrupts its financiers, is significantly lower. The challenge for investors and founders lies in navigating this environment, recognizing that "peak disruptive glory" can mask underlying complexities and that true value creation often comes from patience and a focus on durable, long-term applications.

Beyond the State-of-the-Art: Opportunities in the AI Long Tail

The narrative often fixates on state-of-the-art large language models (LLMs) like OpenAI. Casado, however, emphasizes that this represents only a small subset of the AI landscape. The real opportunity, he suggests, lies in the "long tail" of AI companies--those focused on image diffusion, video generation, speech, music, and other specialized generative AI applications. These areas, while less hyped, are ripe for innovation and the creation of new, iconic companies. The economics of AI have historically been challenging, with many applications offering only incremental improvements. The generative wave, however, represents a qualitative leap, a "thousand times better than the traditional way," creating the conditions for super cycles and new generational companies.

"The state-of-the-art models is a very small subset of the long tail of AI companies. So we're very interested in the long tail, in addition to, of course, like the, you know, the OpenAIs, et cetera."

The difficulty in identifying long-term defensibility for AI companies is a valid concern. However, Casado points out that profitable, growing AI-based companies are already a reality. Traditional forms of defensibility, such as building two-sided marketplaces or deep integrations, can still apply. The key for investors is to move beyond the immediate hype and identify where new capabilities and behaviors are creating genuine, sustainable value. This requires a nuanced understanding of the market, recognizing that not every AI company needs to be an OpenAI, and that significant opportunities exist beyond the most visible players. The challenge, and the advantage, lies in discerning enduring value amidst the current exuberance.

Key Action Items:

- Immediate Actions (Next 1-3 Months):

- Re-evaluate AI investment theses: Shift focus from pure LLM hype to the broader "long tail" of specialized AI applications (image, video, speech, etc.).

- Analyze existing business budgets: Identify where AI investments represent a strategic shift of existing resources rather than solely new, speculative spend.

- Scrutinize funding sources: Prioritize companies with strong balance sheets and existing revenue streams over those solely reliant on massive, unproven future AI revenue.

- Short-to-Medium Term Investments (3-12 Months):

- Map AI's operational impact: Understand the true infrastructure costs (data centers, power, cooling) and compare them against realistic adoption timelines for specific use cases.

- Develop criteria for AI company defensibility: Look beyond proprietary models to factors like network effects, deep integrations, and unique datasets.

- Explore niche AI markets: Investigate companies addressing specific industry problems with generative AI capabilities that offer substantial improvements over traditional methods.

- Long-Term Investments (12-18+ Months):

- Build for durable value: Focus on AI applications that create new behaviors or solve fundamental problems, rather than incremental improvements.

- Invest in companies with strong teams and clear product-market fit: These fundamentals remain critical, even in a rapidly evolving technological landscape.

- Consider the impact of private market capital: Understand how the availability of private funding influences company growth strategies and exit potentials, potentially delaying IPOs.