The current economic discourse, dominated by immediate concerns like inflation and job market fluctuations, often overlooks the profound, long-term systemic shifts driven by AI and widening wealth inequality. This conversation with Stacey Vanek Smith reveals how these forces are not just impacting individual livelihoods but are fundamentally reshaping the economic landscape, creating a precarious K-shaped recovery where the wealthy prosper while the majority struggle. Understanding these hidden consequences is crucial for anyone navigating the modern economy, offering a strategic advantage to those who can anticipate and adapt to these downstream effects, rather than being blindsided by them.

The Widening Chasm: When AI and Inequality Create an Unbalanced Economy

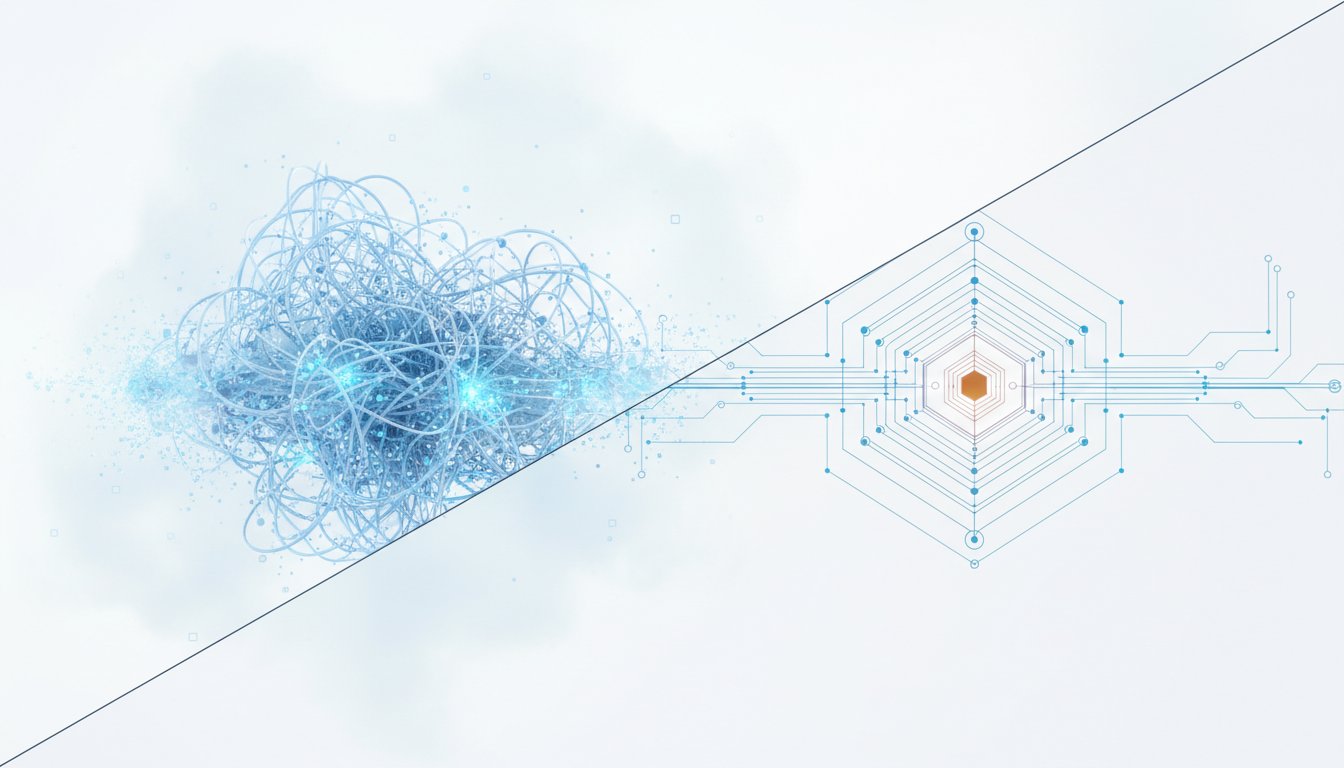

The economic narrative often focuses on the immediate pain points: the rising cost of living, the mixed signals from the job market, and the ever-present specter of inflation. Yet, beneath this surface-level anxiety lies a more profound, systemic transformation driven by two powerful forces: the rapid advancement of artificial intelligence and the persistent widening of wealth inequality. In a recent conversation, Bloomberg Businessweek reporter Stacey Vanek Smith illuminated how these forces are not merely creating temporary discomfort but are actively shaping an economy that is becoming increasingly unbalanced and, potentially, unsustainable. The prevailing K-shaped economy, where the wealthy see their fortunes soar while the majority tread water or sink, is not just an ethical concern; it’s a structural vulnerability that threatens the very foundations of economic stability.

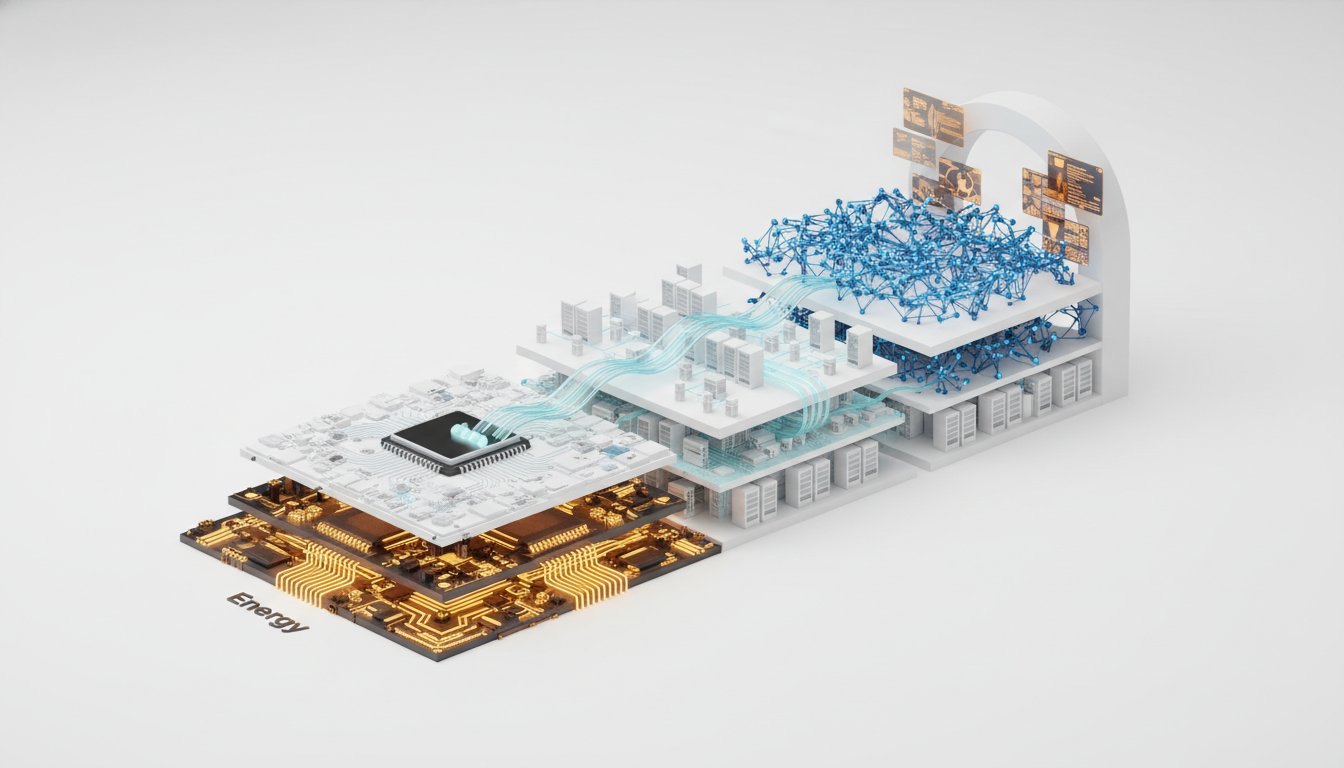

The K-shaped economy, as Vanek Smith explains, is a stark visual representation of divergent economic realities. At the top of the 'K', the wealthiest individuals, primarily those in the top 1%, are experiencing unprecedented gains. Their wealth is skyrocketing, largely fueled by the booming stock market, which in turn is being propelled by AI-driven innovation. This creates a feedback loop: AI advancements boost company valuations, benefiting shareholders (who are disproportionately wealthy), which in turn fuels more investment in AI. For this segment of the population, the economy is not just good; it's exceptionally prosperous.

However, for the vast majority of the country, the story is dramatically different. Wages have stagnated, failing to keep pace with the rising cost of living. This means that while the wealthy are accumulating more, the average person is struggling to afford basic necessities. This disparity isn't just a matter of fairness; it's an economic imbalance that has significant downstream consequences.

"I think there's a lack of balance happening and it doesn't feel morally right, you know, that the economy is getting richer and richer and richer and most of the people in the economy aren't feeling that or are really struggling. But it's also a big problem for, it's not a healthy economy if people aren't feeling good about their ability to get jobs, to get paid, to afford things."

Vanek Smith highlights that this imbalance is inherently unstable. A healthy economy relies on broad-based consumption. When only the wealthiest few are driving demand, the system becomes fragile. A downturn in their spending, or a shift in their investment strategies, could have catastrophic effects on the broader economy. This is precisely the kind of consequence that conventional economic thinking, focused on aggregated metrics like GDP, often misses. It’s not just about how much money is being made, but who is making it and how that distribution impacts overall economic health and resilience.

The AI Tsunami: From White-Collar Anxiety to a Frozen Job Market

The looming specter of AI is no longer a distant theoretical concern; it's actively injecting fear and uncertainty into the workforce, particularly among white-collar professionals. The recent "Claude crash," where the AI program's new legal and financial service plugins caused significant stock drops for major firms, serves as a potent example. This event signaled a tangible threat: many jobs, previously thought to be secure due to their cognitive demands, could be significantly automated or augmented by AI, diminishing the need for human labor.

This fear is not just hypothetical. Vanek Smith points to data showing AI being cited in tens of thousands of layoffs last year, with major companies like Amazon explicitly mentioning AI as a factor in their workforce reductions. While the exact impact on job creation versus job destruction remains uncertain, the immediate consequence is a palpable anxiety among professionals who previously felt insulated from technological displacement.

This AI-driven uncertainty appears to be contributing to a significant slowdown in hiring, creating what Vanek Smith terms a "jobs recession." While headline unemployment rates may remain low, the number of new jobs being created has plummeted to decade-lows.

"The thing that we are also seeing at the same time is no hiring. There's kind of a frozen job market right now. Hiring levels are the lowest they've been in a decade. They're calling it a jobs recession because hiring rates are so low."

This "frozen" job market is a critical downstream effect. Companies, perhaps anticipating AI's impact or simply reacting to economic uncertainty, are hesitant to expand their workforces. This creates a holding pattern where layoffs are not widespread, but new opportunities are scarce. For individuals, this means reduced bargaining power, fewer career advancement prospects, and a general sense of economic insecurity, even if they haven't been directly impacted by layoffs. The conventional wisdom that a low unemployment rate signifies a robust job market fails to capture this nuanced reality of suppressed hiring.

The Profit Imperative: When Layoffs Become a Strategy, Not a Necessity

The decision by highly profitable companies, such as Amazon, to lay off significant portions of their workforce underscores a concerning shift in corporate strategy. These are not companies struggling to survive; they are entities maximizing profits, and layoffs are becoming a tool to further boost those profits, rather than a last resort necessitated by dire financial straits.

Vanek Smith notes that this is a stark departure from the tight labor market of a few years prior, when companies were desperate to retain talent and workers held considerable power. Now, with AI potentially offering a cheaper, more scalable alternative to human labor, and with a general economic slowdown, companies feel empowered to prioritize profit margins over employee retention.

This dynamic has profound implications for workers. Historically, periods where companies wield significant power often lead to stagnant wages, reduced benefits, and a general decline in worker well-being. The comparison to the Industrial Revolution is apt: a period of immense technological change that, while ultimately leading to progress, was marked by significant worker hardship and exploitation.

The current trend suggests that AI could exacerbate this power imbalance, allowing companies to experiment with automation and reduce their reliance on human workers, thereby concentrating more wealth and power at the top. The immediate consequence of this profit-driven approach to labor is a feeling of precarity for workers, a sense that their contributions are secondary to the relentless pursuit of shareholder value.

Building a Durable Advantage: Navigating the Transition with Foresight

The current economic climate, characterized by AI-driven disruption and widening inequality, presents a challenging landscape. However, understanding these systemic forces also offers an opportunity to build durable competitive advantages. The insights from Vanek Smith’s analysis suggest that those who can anticipate and adapt to these shifts will be best positioned for future success.

The delayed payoff of investing in understanding and leveraging new technologies, rather than succumbing to fear, is a key area. Similarly, recognizing that economic stability is undermined by extreme inequality points towards strategies that foster broader economic participation. The conventional approach of focusing solely on immediate gains or short-term efficiencies will likely prove insufficient in a rapidly evolving economic system. Instead, a longer-term perspective, one that acknowledges the systemic consequences of technological advancement and wealth distribution, is essential.

This requires a willingness to embrace discomfort now for the sake of future advantage. The transition to an AI-integrated economy and the management of extreme inequality will not be seamless. It will demand strategic planning, adaptability, and a commitment to building systems that are resilient and equitable, even if those efforts are not immediately rewarded. The companies and individuals who undertake this difficult work will be the ones who not only survive but thrive in the years to come.

- Immediate Action: Begin assessing how AI tools can augment, rather than replace, current roles. Focus on developing skills that complement AI capabilities, such as critical thinking, creativity, and complex problem-solving.

- Immediate Action: Advocate for and adopt transparent compensation practices within organizations to address wage stagnation and ensure fair distribution of economic gains.

- Short-Term Investment (3-6 months): Companies should conduct an audit of their current workforce's AI readiness and develop targeted training programs to upskill employees.

- Short-Term Investment (3-6 months): Individuals should actively seek out industry reports and expert analyses on AI's impact on their specific fields to stay informed about emerging trends and potential job shifts.

- Medium-Term Investment (6-12 months): Explore opportunities to invest in companies or sectors that are developing AI responsibly or are positioned to benefit from the economic shifts without exacerbating inequality.

- Medium-Term Investment (6-12 months): Consider how to build personal financial resilience by diversifying income streams and investments, acknowledging the potential volatility of traditional employment models.

- Long-Term Strategy (12-18 months+): Focus on building personal and organizational adaptability. This involves fostering a culture of continuous learning and embracing change as a constant, rather than an exception.