Trump's Transactional Diplomacy Strains Alliances and Challenges Institutional Independence

In a world increasingly defined by transactional diplomacy and the erosion of established norms, this conversation from NPR's "Up First" podcast offers a stark, unvarnished look at the consequences of a disruptive leadership style. It reveals how immediate tactical gains, pursued with aggressive rhetoric and veiled threats, can unravel decades of alliance-building and sow seeds of distrust that bloom into long-term instability. This analysis is crucial for anyone navigating the complexities of international relations, business strategy, or policy-making, providing a vital advantage by highlighting the hidden costs and delayed payoffs that conventional wisdom often overlooks. It’s a guide for understanding not just what is said, but the systemic reactions it provokes, offering clarity on why patience and adherence to established principles can be the most potent competitive weapons.

The Unraveling of Alliances: When Coercion Becomes the Default

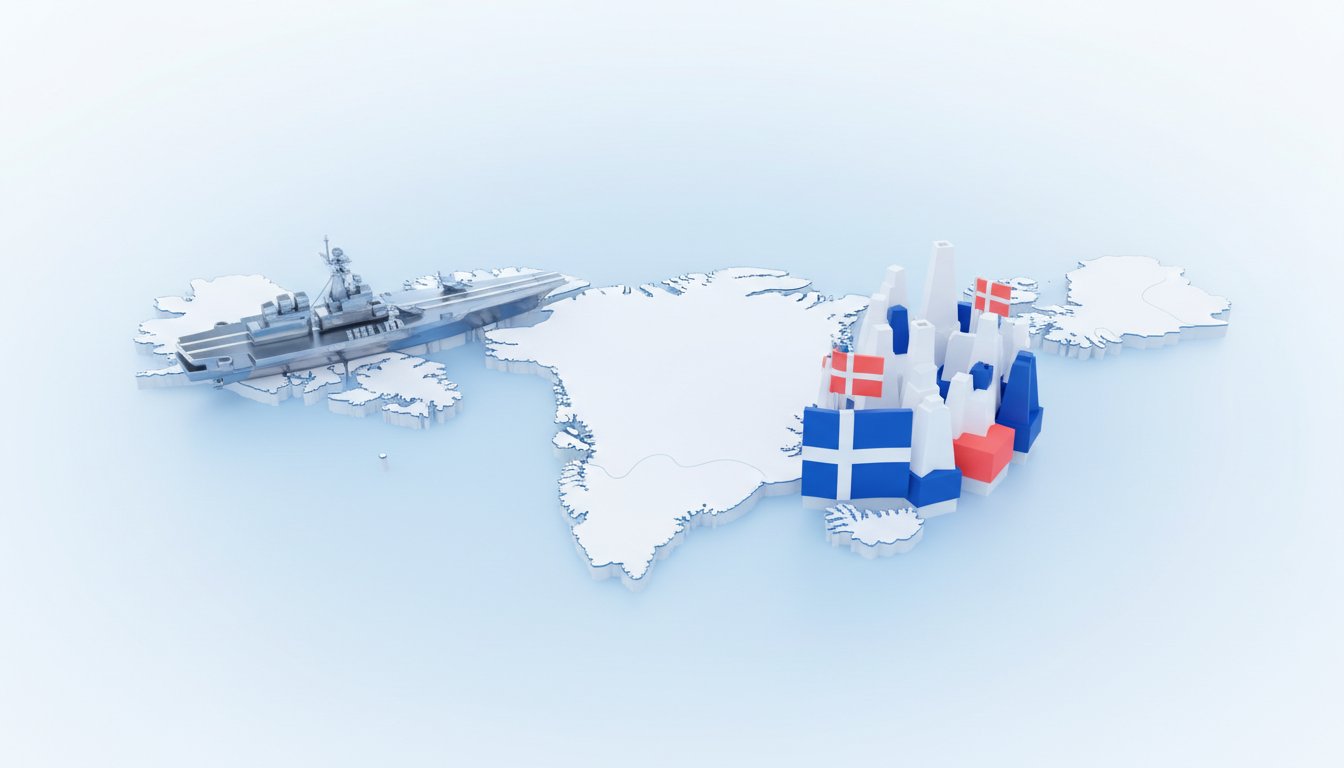

The recent diplomatic maneuvers surrounding Greenland, while seemingly a minor territorial dispute, serve as a potent case study in the cascading effects of a disruptive foreign policy. President Trump's approach, characterized by overt threats of military action and tariffs, aimed for a swift, decisive acquisition. However, the immediate fallout was not capitulation, but a profound fracturing of trust among long-standing allies. Canada's Prime Minister Mark Carney articulated this shift starkly, declaring the US-led world order "dead" and not merely transitioning. This wasn't just rhetoric; it signaled a systemic response where economic integration, once a tool for cooperation, was weaponized, and financial infrastructure became an instrument of coercion.

The implication here is profound: when a nation’s primary diplomatic tools become threats and ultimatums, the predictable response from other global actors is to seek alternative partnerships and fortify their own positions. Carney’s visit to China and subsequent agreement for electric vehicle purchases, coupled with his assertion that China was now a more reliable partner than the US, illustrates this pivot. This isn't about a single leader's preference; it's about how the global system adapts when its foundational stability is challenged. The US, by alienating allies, risks creating a vacuum that other powers will inevitably fill, leading to a less predictable and potentially more dangerous international landscape. The immediate satisfaction of a perceived tactical win--like a framework deal on Greenland--is overshadowed by the long-term strategic disadvantage of being isolated.

"Great powers have begun using economic integration as weapons, tariffs as leverage, financial infrastructure as coercion, supply chains as vulnerabilities to be exploited."

-- Mark Carney

This dynamic extends beyond geopolitical spheres, resonating deeply within corporate strategy. Companies that rely on established partnerships or a stable regulatory environment could face similar disruptions if their leadership adopts a similarly aggressive, transactional approach. The "Greenland" of their business might be a key supplier relationship, a crucial market, or a regulatory pathway. Employing "excessive strength and force" in these areas, as Trump alluded to regarding Greenland, might yield a short-term advantage but risks alienating partners, inviting regulatory scrutiny, and ultimately undermining the very foundations upon which their long-term success is built. The delayed payoff of strong, trust-based relationships is sacrificed for the immediate, but often illusory, gain of a forceful assertion.

The Perilous Dance with Central Bank Independence

The Supreme Court's hearing on President Trump's attempt to remove Federal Reserve Governor Lisa Cook reveals another critical system where short-term political expediency clashes with long-term institutional stability. Trump's stated desire for lower interest rates, driven by a political imperative to boost the economy before an election, directly targets the Fed's independence. The argument presented by Cook's lawyer, Paul Clement, highlights a century of precedent where presidents, despite the temptation for easier money, have respected the Fed's insulation from political pressure. This insulation is not an arbitrary construct; it's a systemic design choice to ensure that monetary policy serves the broader economic health of the nation, even when those decisions are unpopular in the short run.

The justices' skepticism, particularly Justice Kavanaugh's observation about the potential for reciprocal removals and the shattering of independence, underscores the fragility of this system. If the bar for removing a Fed governor is lowered to accommodate political pressure, the central bank’s ability to combat inflation or manage economic downturns without fear of reprisal is compromised. This creates a dangerous feedback loop: political pressure leads to potentially suboptimal monetary policy, which can exacerbate economic problems, leading to further political pressure. The "immediate benefit" of lower rates could lead to long-term economic instability, inflation, or a loss of confidence in the currency.

"The whole idea is the Fed sometimes has to make decisions that are unpopular in the short run, like keeping interest rates high to fight inflation, in order to achieve the best economic outcome in the long run."

-- Scott Horsley

This battle over the Fed's independence is a powerful illustration of how conventional wisdom--that presidents should have maximum control over economic levers--fails when extended into a system designed for checks and balances. The "advantage" Trump seeks, lower interest rates, is a first-order benefit. The second-order consequence is the erosion of the Fed's credibility, which can have far more damaging and durable economic repercussions. The long-term payoff of an independent central bank--stable inflation, sustainable growth, and investor confidence--is sacrificed for the immediate political gratification of a potentially artificial economic boost. This highlights a key principle: true competitive advantage often lies not in asserting immediate control, but in preserving the integrity of systems that deliver durable, long-term value.

Corporate Complicity and the Erosion of Rule of Law

Rahm Emanuel's critique of corporate America provides a compelling analysis of how a failure to uphold principles can create systemic vulnerabilities, particularly when enabling a leadership style that disregards the rule of law. Emanuel argues that corporations, by benefiting from a nation built on laws, have "sold out America" by remaining silent observers while that foundation is eroded. His analogy of the "three monkeys: see no evil, hear no evil, speak no evil" captures the essence of complicity. This isn't merely about ethical shortcomings; it's about a systemic failure that weakens the very framework upon which businesses depend.

The core of Emanuel's argument is that the rule of law provides the essential predictability and stability for economic activity. When that rule is undermined, even by a leader who promises short-term gains or deregulation, the long-term consequences are severe. Companies that benefit from this system but fail to speak out against its erosion are, in effect, undermining their own future. This creates a delayed but significant disadvantage. The "immediate benefit" might be avoiding conflict with a powerful administration, but the downstream effect is a weakening of the legal and institutional structures that guarantee property rights, enforce contracts, and ensure fair competition.

"I think corporate America, they've sold out America. And what I mean by that is you benefit from a nation built on laws, and you're watching from the sidelines a nation being destroyed and walking away from the rule of law. Everything you have is built on the premise of the rule of law."

-- Rahm Emanuel

Emanuel also touches on the ideological drift within both major parties, suggesting a "monopolist mindset" in the Republican party and a "Marxist mindset" in the Democratic party, both of which he argues are detrimental to the economy. This observation, while perhaps a simplification, points to a systemic issue where rigid ideologies, whether focused on unchecked market power or state control, can stifle innovation and economic dynamism. The challenge for businesses, therefore, is to advocate for a balanced approach that upholds the rule of law and fosters a competitive, dynamic economy, even when it requires confronting uncomfortable truths or risking short-term political fallout. The advantage lies in championing the durable principles that sustain prosperity, rather than capitulating to transient political winds.

Key Action Items

- Immediate Action (Within the next quarter):

- Map the "Greenland" of your own business: Identify critical partnerships, regulatory frameworks, or market access points that rely on established norms and trust.

- Assess your organization's stance on the rule of law: Ensure that stated values align with actions, particularly in interactions with regulatory bodies or in public statements.

- Review internal decision-making processes for short-term versus long-term trade-offs: Actively challenge assumptions that prioritize immediate gains over durable systemic health.

- Short-Term Investment (Next 3-6 months):

- Engage in proactive stakeholder dialogue: Strengthen relationships with allies (partners, regulators, industry groups) by demonstrating a commitment to shared principles, not just transactional benefits.

- Develop contingency plans for systemic disruptions: Consider scenarios where established norms are challenged and how your organization would adapt and maintain resilience.

- Invest in understanding the "second-order effects" of your strategic decisions: Dedicate resources to analyzing the downstream consequences beyond immediate outcomes.

- Longer-Term Investment (6-18 months and beyond):

- Champion institutional independence: Where applicable, support and advocate for the independence of critical institutions (like central banks or regulatory bodies) that ensure long-term economic stability.

- Build resilience through diversification: Reduce reliance on single points of failure in supply chains, partnerships, or market access, creating a more robust system.

- Foster a culture that values principled action over expediency: Encourage ethical decision-making and long-term thinking, even when it involves short-term discomfort or unpopularity. This pays off in 12-18 months as trust and reliability become competitive moats.