AI Trend Reshapes Venture Capital Valuations and Investment Strategies

The Venture Capital Model's AI-Fueled Reckoning: Navigating the New Landscape of Growth, Litigation, and Monetization

This conversation reveals a stark truth: the venture capital model, once fueled by predictable growth and clear exit paths, is undergoing a seismic shift, driven by the explosive, yet complex, rise of AI. The non-obvious implication is that traditional metrics and strategies are rapidly becoming obsolete, creating both immense opportunity for those who adapt and significant risk for those who cling to the past. Investors, founders, and strategists who grasp the cascading consequences of AI adoption, the evolving nature of competitive advantage, and the strategic implications of high-stakes litigation will gain a critical edge in this rapidly changing environment. This analysis is crucial for anyone involved in tech startups, venture capital, or corporate strategy seeking to understand the underlying forces reshaping the industry.

The venture capital landscape, once characterized by a relatively stable playbook, is now grappling with a confluence of disruptive forces, chief among them the pervasive influence of Artificial Intelligence. This discussion unpacks how the very definition of growth, competitive advantage, and even the structure of successful companies is being rewritten. The core tension lies in the venture model's historical reliance on predictable revenue multiples and exit strategies, which are now being challenged by the unpredictable, yet potentially astronomical, returns promised by AI-centric businesses.

The AI Gold Rush: Monetizing the Unmonetizable

A central theme is the dramatic re-evaluation of what constitutes a valuable business in the age of AI. The conversation highlights how companies that were once considered niche or even struggling are finding new life by aligning with AI trends. This isn't merely about adopting AI tools; it's about fundamentally re-architecting business models to leverage AI's capabilities. The implication is that companies failing to pivot towards AI risk becoming obsolete, much like older technologies were superseded.

"Your job is how are you going to attach to AI trends? So if you look at RevenueCat, the whole vibe, Cody Mobile thing, I think they tripled the number of developers on their platform in the last four months or three to four months of the year."

This quote underscores the transformative power of AI tailwinds. Companies that were previously growing at a steady, but unexciting, pace are now experiencing exponential growth simply by integrating AI into their core offerings. The downstream effect of this is a widening gap between AI-native or AI-adapted companies and those that remain on older technological paradigms. For founders of established SaaS companies, the imperative is clear: find an AI angle, or risk becoming irrelevant to venture capital. This isn't about a minor tweak; it's about a fundamental reorientation, a strategic pivot that can unlock previously unimaginable growth. The delayed payoff for this pivot is significant, creating a competitive moat that is difficult for slower-moving incumbents to breach. Conventional wisdom, which might suggest focusing on optimizing existing revenue streams, fails when faced with the sheer velocity of AI-driven market shifts.

The Litigation as a Spectator Sport: Elon vs. OpenAI and the Unfolding Consequences

The high-profile legal battle between Elon Musk and OpenAI serves as a potent case study in the complex, often messy, consequences of ambitious ventures. What began with ostensibly pure intentions--a desire to advance humanity--has devolved into a protracted legal dispute, revealing the inherent tensions between non-profit ideals and for-profit realities, and the personal stakes involved when billions are on the line.

"Elon's in an asymmetric win-win situation, and OpenAI is not."

This statement encapsulates the strategic advantage Elon Musk holds. Regardless of the legal outcome, the litigation serves as a platform to scrutinize OpenAI's operations, potentially slow its progress, and generate significant public attention. For Musk, the legal fees are a cost of doing business; for OpenAI, it represents a significant distraction and potential dilution of value. The downstream effects of this litigation are multifaceted: it creates uncertainty for investors, impacts OpenAI's ability to attract talent, and sets a precedent for future disputes in the rapidly evolving AI landscape. The conventional wisdom that legal disputes are best settled quickly is challenged here, as Musk appears to leverage the protracted nature of the trial for his own strategic ends. The "bad facts" that emerge during depositions, as highlighted in the discussion, can have long-lasting reputational and operational consequences, even if the core legal argument is ultimately decided. This is not just a legal battle; it's a public relations war with profound implications for the future of AI development.

The Monetization Maze: From Free Users to Ad Revenue

The discussion around OpenAI's potential advertising model reveals another critical consequence of scaling AI: the urgent need for sustainable revenue streams. As the cost of serving free users escalates, companies are forced to explore monetization strategies that were once anathema to their core mission.

"Advertising is not valueless to consumers when it's perfectly executed."

This quote offers a nuanced perspective on advertising, suggesting that when implemented thoughtfully, it can enhance, rather than detract from, the user experience. The challenge for companies like OpenAI is to strike this delicate balance. The immediate payoff of introducing ads is revenue generation, but the long-term consequence lies in maintaining user trust and product integrity. The failure of traditional search engines to manage ads effectively--leading to "enshittification"--serves as a cautionary tale. The competitive advantage for OpenAI, if they can successfully integrate ads, lies in capturing a significant portion of the digital advertising market, a market historically dominated by Google and Facebook. This requires understanding user intent and providing relevant, non-intrusive advertising, a feat that requires a deep understanding of consumer behavior and a commitment to product excellence. The risk is that a poorly executed ad strategy could alienate users and undermine the very value proposition that attracted them.

The New Frontier: Category Winners in AI Infrastructure

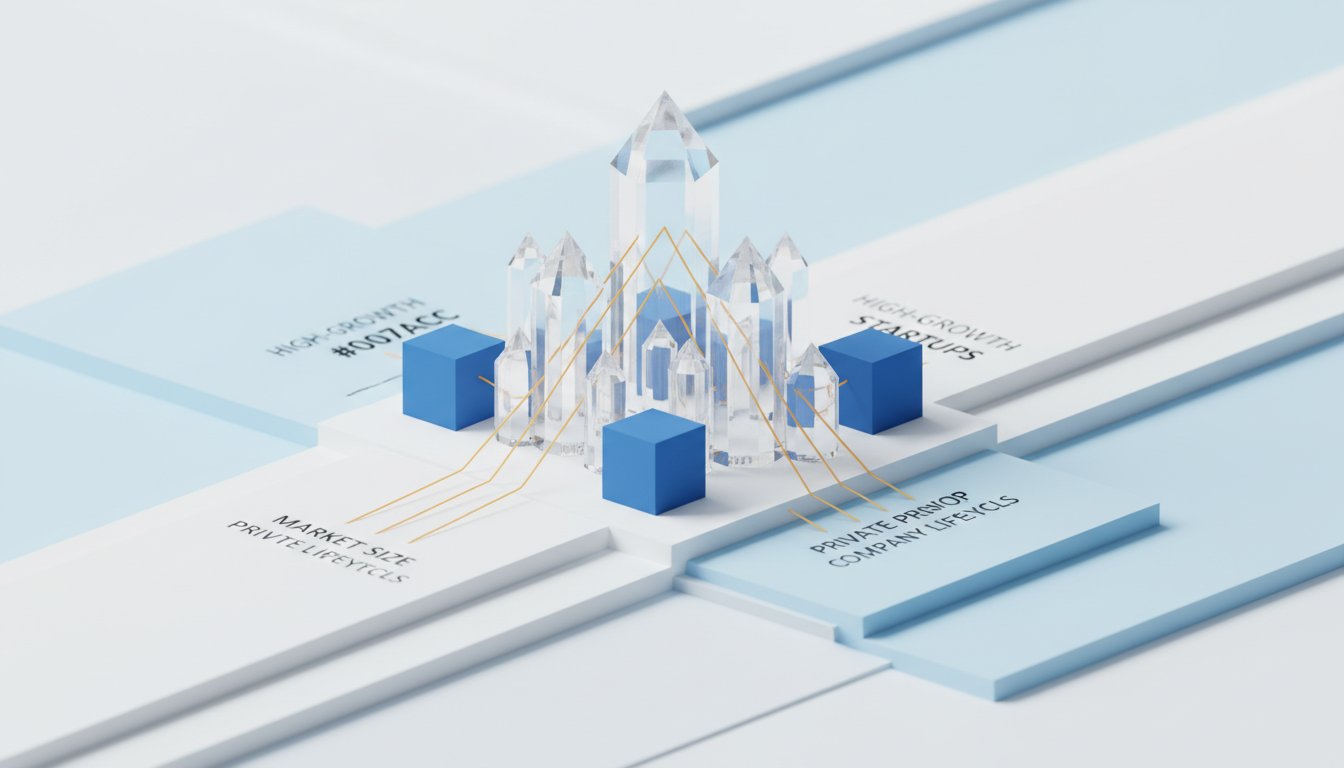

The analysis of ClickHouse, Replit, and Cerebras highlights the emergence of new categories and the intense competition within them. Valuations are soaring, driven by the assumption that current growth rates will persist and that these companies will capture significant market share.

"You're basically underwriting growth persistence. So next level down from that, what does that mean? What you're basically saying is this is a category, they're the winner, and it's a big enough category to keep going for two or three more years at least at this growth rate, and then they accelerate slowly."

This observation cuts to the heart of late-stage venture investing. The bet on companies like ClickHouse, a database optimized for analytical processing, is a bet on the continued explosion of data and the AI's insatiable appetite for it. The downstream effect of AI's data demands is the creation of distinct categories, such as OLAP databases, which may not have been viable as standalone markets in the past. The conventional wisdom of investing in broad, established categories is being challenged by the emergence of specialized, high-growth niches. The delayed payoff here is immense for category leaders, creating substantial moats. However, the risk is that these categories may not be as large as projected, or that competition will erode market share, leaving investors with inflated valuations and stalled growth. The discussion around Replit, for instance, emphasizes how a product that was once unstable has become a powerful platform, justifying its increased valuation. This highlights the importance of product evolution and the potential for significant value creation when a product truly "works" and scales.

Key Action Items

-

Immediate Action (Next Quarter):

- AI Integration Audit: For established SaaS companies, conduct an immediate audit of existing products and services to identify opportunities for AI integration. Prioritize features that leverage AI for enhanced user experience or operational efficiency.

- Competitive Landscape Analysis: For all tech companies, analyze how competitors are integrating AI. Identify areas where AI is creating new competitive advantages or rendering existing strategies obsolete.

- Litigation Risk Assessment: For companies with complex corporate structures or historical disputes, conduct a risk assessment regarding potential litigation and its impact on fundraising and operations.

-

Medium-Term Investment (6-12 Months):

- Talent Acquisition & Development: Invest in attracting and retaining AI talent. This may involve rethinking compensation structures, offering compelling mission-driven work, and providing opportunities for researchers to work on intellectually stimulating problems.

- Monetization Strategy Refinement: For AI-driven products offering free tiers, develop and test a well-executed advertising or premium subscription model. Focus on delivering value to both users and advertisers.

- Category Leadership Consolidation: For companies operating in emerging AI categories, focus on solidifying market leadership through product innovation and strategic partnerships.

-

Longer-Term Investment (12-18 Months):

- AI-Native Product Development: For new ventures, prioritize building AI-native products from the ground up, rather than retrofitting AI onto existing frameworks. This allows for deeper integration and more significant competitive advantages.

- Diversified Revenue Streams: Explore multiple monetization avenues beyond traditional advertising, especially for consumer-facing AI products, to ensure long-term financial stability.

- Strategic M&A for Talent and Technology: Consider strategic acquisitions to acquire specialized AI talent or complementary technologies that can accelerate product development and market penetration. This pays off in 12-18 months as it consolidates market position and integrates critical capabilities.