Perceived Risk Arbitrage: Monetizing Spectacle in Media Production

This conversation reveals a critical arbitrage opportunity in perceived versus actual risk, particularly in media production. While Alex Honnold’s free solo of Taipei 101 presented a visceral, life-or-death spectacle to millions, the underlying technical difficulty for him was significantly lower than the public perceived. This gap allowed Netflix to leverage a relatively low-cost, high-impact event to boost its live programming initiatives, expand its brand in Asia, and generate significant earned media. The true advantage lies not in the event itself, but in Netflix's ability to capitalize on the audience's perception, offering a model for creating business value from carefully managed risk. This analysis is essential for media strategists, content creators, and anyone seeking to understand how to monetize perceived danger in the digital age.

The Illusion of Peril: How Perceived Risk Fuels Media Value

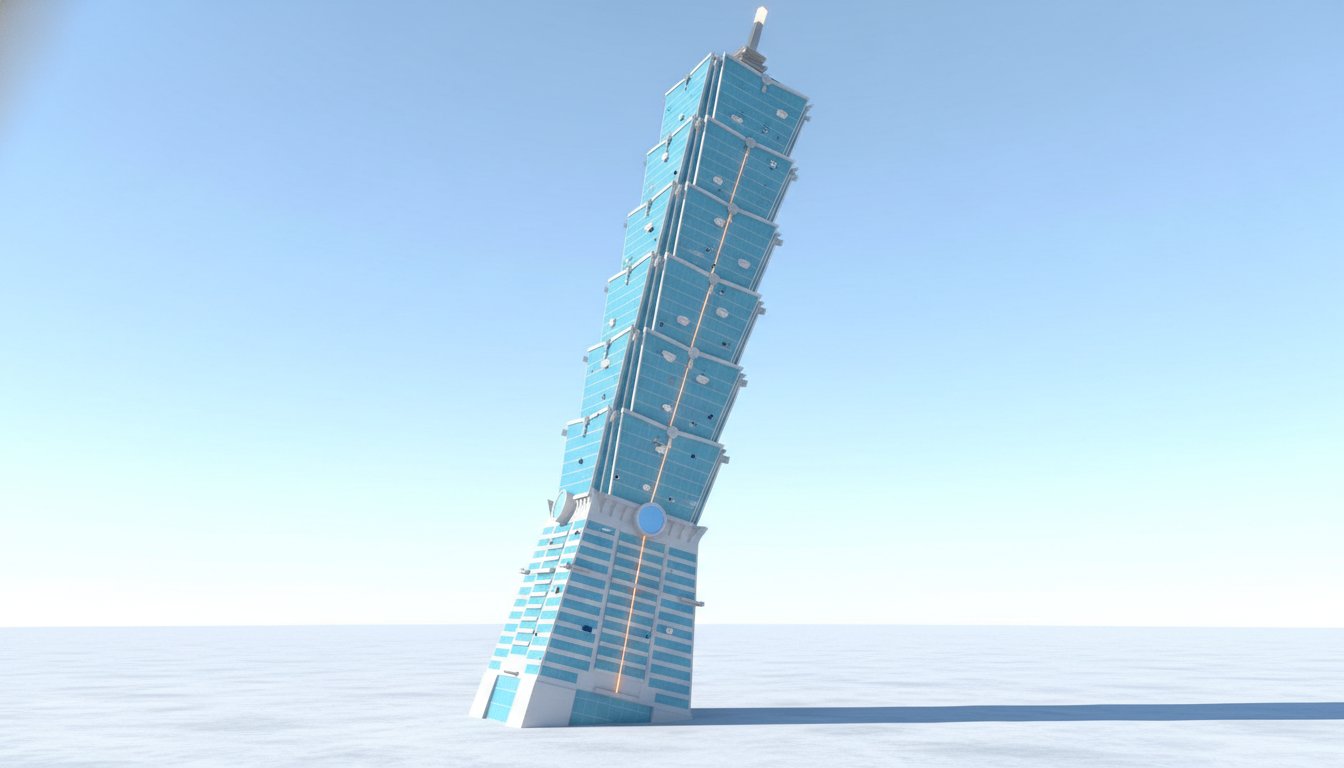

The narrative surrounding Alex Honnold's Taipei 101 climb is a masterclass in how perception can outstrip reality, creating a potent business opportunity. While viewers and even Honnold's own family watched with bated breath, anticipating a catastrophic fall, the reality for Honnold was a climb with built-in safety margins and repetitive movements. This discrepancy between the visceral "life-or-death" spectacle and the calculated, manageable risk for the climber is the core of Netflix's strategic play.

The podcast highlights that Honnold himself estimated the Taipei 101 route to be a 5.11 C on the Yosemite Decimal System, a full two grades below his proven capability on El Capitan (rated 5.13 A). This wasn't just a slight difference; the building's structure offered advantages absent in natural rock formations: identical, repetitive movements, rest edges every 120 feet, strong horizontal grip beams, and even balcony bail-out points. These factors transformed what appeared to be an extreme stunt into a technically achievable feat for a climber of Honnold's caliber.

"Netflix commissioned a visually spectacular event with genuine perceived risk, but minimal actual risk given Honnold's skill level."

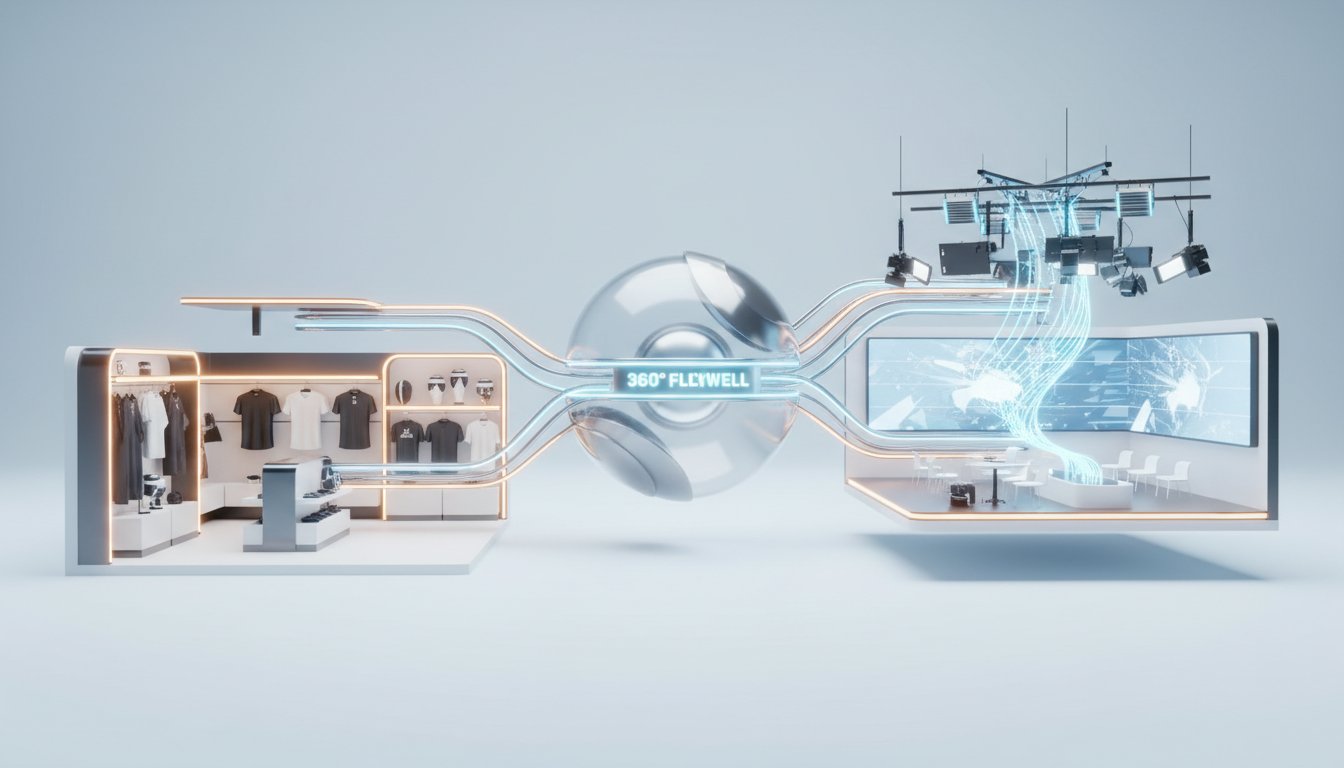

This knowledge gap is precisely where Netflix found its advantage. They could broadcast an event that looked incredibly dangerous, tapping into the universal human fascination with extreme risk, without facing the catastrophic downside of a live failure. The production, while visually impressive, was relatively inexpensive compared to securing major sports rights. This allowed Netflix to achieve significant audience engagement and brand visibility, particularly in Asia, a key growth market. The event served multiple strategic goals: bolstering their live event capabilities, generating earned media through widespread discussion, and creating cultural resonance that could support future price increases in emerging markets.

The Arbitrage of Attention: Monetizing the Spectacle

Netflix's bet wasn't on Honnold's survival, but on the audience's belief that he might not survive. This is the essence of the perceived risk arbitrage. The $500,000 payment to Honnold, while seemingly low given the stakes, reflects this calculation. One-off events, unlike serialized content, rarely drive massive subscriber acquisition. Furthermore, Netflix handled the complex logistics of permits and local government coordination, adding significant value beyond the talent fee. Honnold, who had previously stated he would have done the climb for free due to his long-standing desire to ascend the building, was compensated for his participation and the immense public attention he would draw.

The podcast suggests that even if Honnold had demanded more, Netflix likely would have found another climber. However, this overlooks Honnold's unique brand value. He is, by a significant margin, the world's most recognizable free soloist. Without him, the event's allure and its ability to generate widespread media attention would have been considerably diminished. His name alone amplified the perceived risk and, consequently, the audience's engagement.

"Netflix wasn't placing a bet on whether or not Honnold would survive the climb. They were betting that the rest of the world would believe he might not."

This strategy bypasses the need for deep narrative context or prior sports knowledge. The risk-reward proposition is universally understood: success means a spectacular achievement; failure means tragedy. This clarity, combined with the potential for massive earned media, makes such stunts a cost-effective customer acquisition channel compared to purely paid marketing. The event also serves as a practical demonstration of Netflix's live streaming capabilities, building confidence among both audiences and potential advertisers.

The Long Game: Brand Building in Emerging Markets

Asia represents a significant growth frontier for Netflix, yet it currently contributes a smaller portion of revenue with lower average revenue per user compared to North America. Events like Honnold's climb are crucial for building brand equity in these regions. By associating Netflix with globally recognized, culturally relevant spectacles, the company can cultivate a stronger brand presence that supports future monetization strategies. The time difference between Taiwan and the US, for instance, turned a Sunday morning climb into a prime-time viewing opportunity for a significant portion of Netflix's global audience.

The success of such events lies in their universal appeal and minimal ongoing costs. Unlike the perpetual expense of acquiring live sports rights, a single, well-executed stunt generates immediate attention spikes and long-tail viewership through clips and highlights. It demonstrates Netflix's capacity to produce high-impact live content without requiring viewers to be sports aficionados. This positions Netflix not just as a content provider, but as a producer of cultural moments that capture global attention, a strategy that pays off over the long term through increased brand loyalty and market penetration.

- Immediate Action: Analyze current content offerings for opportunities to create "perceived risk" spectacles that have manageable actual risk for performers.

- Immediate Action: Develop a framework for evaluating the arbitrage between perceived and actual risk in potential media productions.

- Immediate Action: Identify key Asian markets for targeted brand-building events that leverage cultural relevance and global appeal.

- Longer-Term Investment (6-12 months): Explore partnerships with high-profile individuals in fields with inherent visual risk (e.g., extreme sports, specialized crafts) for unique live event productions.

- Longer-Term Investment (12-18 months): Invest in technology and production capabilities to enhance the visual spectacle of live events, maximizing perceived danger.

- Discomfort Now, Advantage Later: Focus on events that generate significant earned media and cultural conversation, even if the direct subscriber acquisition is not immediately quantifiable. This builds brand equity that pays dividends over time.

- Discomfort Now, Advantage Later: Prioritize events that require complex logistical coordination (permits, government relations) as this creates a barrier to entry for competitors and demonstrates robust operational capability.