AI's Economic Paradox, Hardware Race, and Cultural Impact

This conversation, recorded amidst the grandeur of Davos, reveals a subtle but powerful truth: the most impactful innovations and cultural shifts often emerge from unexpected intersections, driven by forces that defy conventional wisdom. Beyond the headlines of Elon Musk’s pronouncements and Oscar nominations, the true story lies in how AI is not just a technological upgrade but a fundamental economic and societal disruptor, how cultural phenomena can create tangible economic ripples, and how established industries can be revitalized by embracing seemingly unrelated advancements. This analysis is crucial for anyone seeking to navigate the future, offering a strategic advantage by highlighting the long-term consequences of seemingly niche developments and the often-unseen connections that shape markets and culture. It’s for founders, investors, and strategists who understand that true foresight comes from mapping the second and third-order effects that others miss.

The AI Cascade: From Davos Debates to Toilet Tech

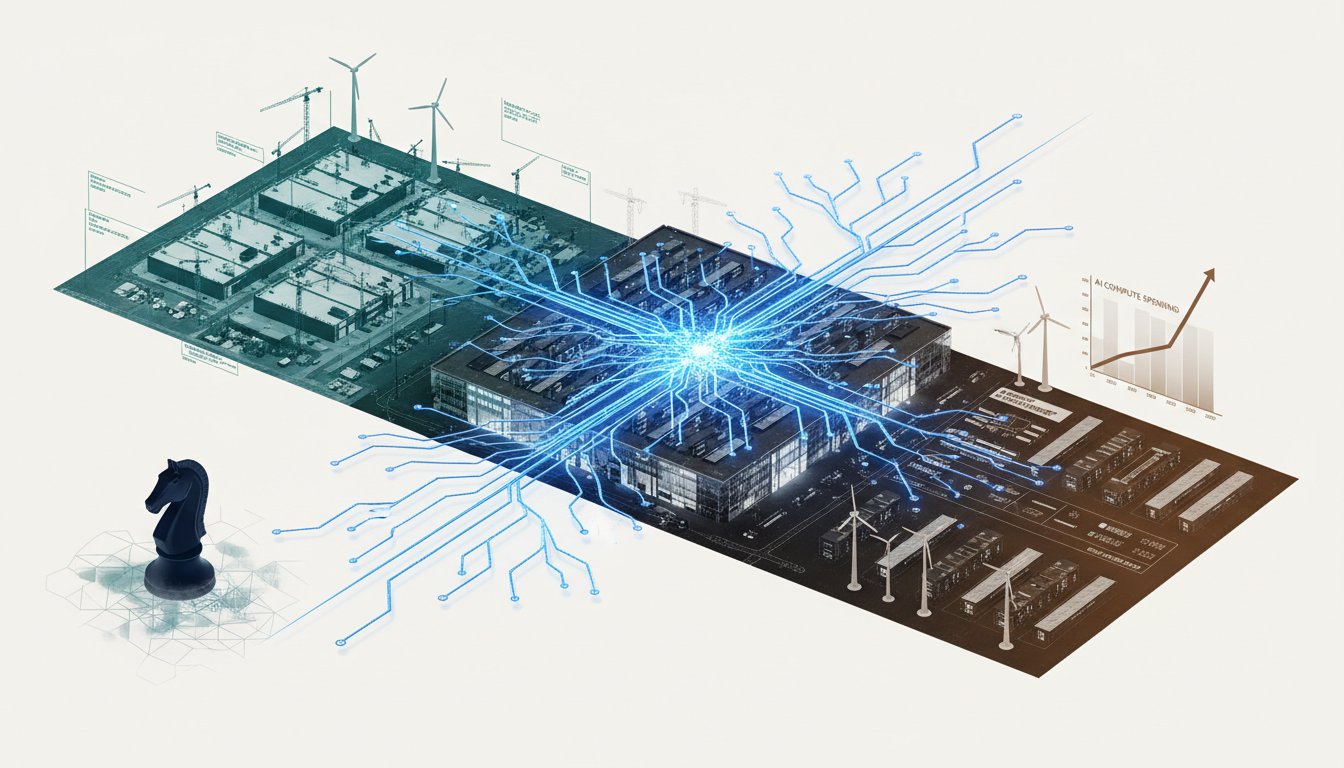

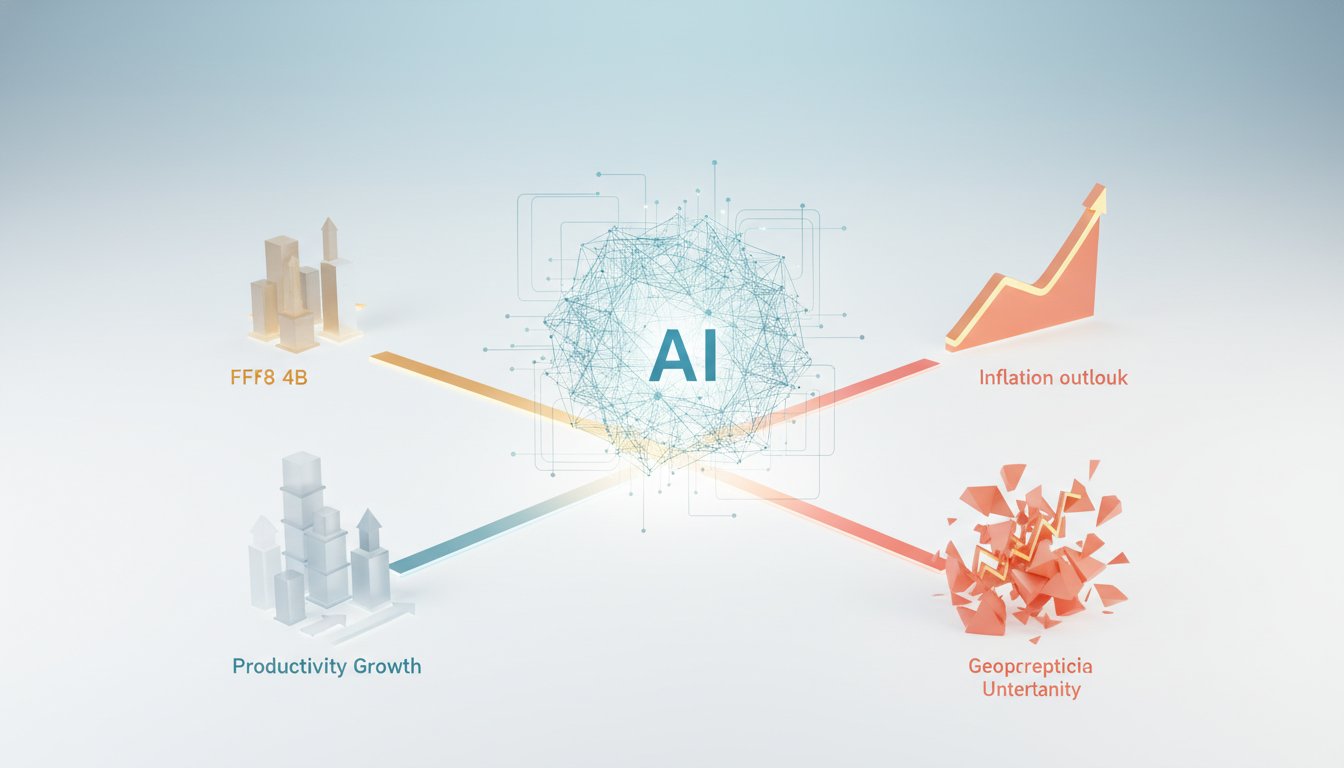

The World Economic Forum, a stage for global discourse, underscored a critical duality in the AI conversation: immense potential for economic growth juxtaposed with the stark reality of widening inequality. While leaders like Larry Fink and Dario Amodei of Anthropic warned of AI exacerbating global disparities, with Amodei predicting a significant portion of society could be "decoupled," the underlying economic engine driving this transformation is often overlooked. This isn't just about smarter algorithms; it's about an unprecedented infrastructure buildout. Jensen Huang of Nvidia declared the AI boom has initiated "the largest infrastructure buildout in human history," with trillions to be invested.

This massive investment has a peculiar beneficiary: Toto, the Japanese toilet maker. Their stock surged not because of a sudden demand for bidets, but due to their secondary business manufacturing electrostatic chucks, crucial components for chipmaking. This connection, seemingly absurd, exemplifies how deep technological expertise, even in disparate fields like ceramics for toilets and semiconductor manufacturing, can find unexpected synergy. The same advanced ceramic technology that makes high-end toilets desirable translates to the precise, non-conductive requirements of chip fabrication.

"Investing in technology is all about almost thinking a little bit outside of yourself to understand that we're on an exponential curve and not just plotting ahead linearly."

This insight from Ravi Matra of Lightspeed Venture Partners is key. The AI revolution isn't a linear progression; it's an exponential curve where traditional industry boundaries blur. Toto’s success, with 42% of its operating income now derived from these chucks, demonstrates a profound shift. What was once a side business supporting a consumer product has become a primary revenue driver, fueled by a global AI infrastructure boom. This highlights a critical lesson: competitive advantage often lies in identifying and leveraging these non-obvious technological adjacencies, where deep expertise in one area unexpectedly unlocks value in another. The immediate payoff for Toto wasn't in selling more toilets, but in supplying a critical component for an industry poised for exponential growth.

Cultural Catalysts: From HBO Hits to Hockey Pucks

The ripple effects of cultural phenomena are often underestimated, yet their economic impact can be substantial. The HBO hit "Heated Rivalry," a show documenting a fictional romance between two hockey players, has demonstrably revitalized interest in the actual sport. This isn't just about increased viewership; it's about tangible economic activity. SeatGeek reported a 20% jump in weekly hockey ticket sales, and StubHub saw searches increase by 75% following the show's debut. First-time hockey ticket buyers on StubHub rose by 5%.

This cultural wave has translated into direct revenue for teams and leagues. The Ottawa Senators’ official team shop sold out of jerseys featuring the show’s fictional players, Shane Hollander and Ilya Rosenoff. This mirrors the phenomenon seen with Taylor Swift and the NFL's Kansas City Chiefs, where her presence led to a threefold increase in home game ticket sales. The "Heated Rivalry" effect extends beyond ticket sales, with SoulCycle hosting nearly 100 themed rides and tattoo parlors seeing an influx of requests for show-related inside jokes.

"The story, which documents a steamy romance between two rival hockey players, is based on the book series from Rachel Reid called 'Game Changer.'"

This quote underscores the power of narrative. The success of the show is rooted in a compelling story, which then acts as a catalyst for broader economic engagement. The NHL and its teams are actively capitalizing on this, demonstrating a strategic understanding of how to leverage cultural momentum. This offers a clear lesson in delayed payoff: while the show's creation was an investment, its downstream effects--increased merchandise sales, soaring ticket demand, and broader fan engagement--represent a significant, and perhaps underestimated, return. It’s a reminder that cultural products, when resonant, can become powerful economic engines, creating advantages for those who can anticipate and harness this energy.

The Unseen Value of Legacy: Hollywood's Catalog and AI Hardware

Hollywood's traditional business model has long been built on the value of its film catalogs. However, deals that grant creators ownership of their work, like Ryan Coogler's agreement for "Creed" which grants him ownership in 2050, are challenging this paradigm. The success of Coogler's "Sinners," which shattered Oscar nomination records with 16 nods, makes his early deal look exceptionally prescient. This move, allowing a director to retain ownership of a massively successful franchise, fundamentally alters the long-term valuation of studios, which typically rely on controlling their intellectual property.

Meanwhile, the race for AI hardware is intensifying, with OpenAI, following a leak suggesting a potential AI earbud developed with Jony Ive, and Apple reportedly working on a wearable AI pin. This follows the failure of Humane’s AI pin, which was acquired for a fraction of its valuation. The competition for new AI form factors--earbuds, pins, and the established glasses--highlights a critical strategic tension. OpenAI's codename "Sweet Pea" for its earbuds suggests a focus on simplicity, a potential counterpoint to the complexity of AI glasses.

"The fact that 'Creed' is now the most nominated movie ever is only going to make this movie even more valuable and make that deal look even more prescient."

This quote, in the context of Coogler's deal, illustrates how an upfront concession (granting ownership) can yield immense long-term dividends when coupled with unexpected success. The "Sinners" nomination surge amplifies the value of Coogler's foresight. Similarly, in the AI hardware race, companies that can anticipate the market's needs for a simple, intuitive interface--whether in earbuds or pins--stand to gain a significant advantage. The failure of Humane’s pin suggests that technological novelty alone isn't enough; it must align with user behavior and demonstrable utility. The true advantage here lies not just in developing new technology, but in structuring deals and product strategies that capture value over extended periods, a strategy that requires patience and a willingness to bet on long-term potential over immediate control.

Key Action Items

-

Immediate Action (Next Quarter):

- AI Infrastructure Mapping: Identify critical infrastructure components or adjacent technologies that support the AI buildout, similar to Toto’s electrostatic chucks. This requires deep dives into supply chains beyond obvious AI companies.

- Cultural Trend Monitoring: Actively track cultural phenomena (e.g., popular shows, music, art) and assess their potential for tangible economic impact on related industries (sports, merchandise, tourism).

- Contractual Review: For any content or IP creation, evaluate deal structures for long-term ownership and revenue-sharing, particularly concerning potential breakout successes.

-

Short-Term Investment (3-6 Months):

- Cross-Industry Expertise Development: Encourage teams to develop expertise in seemingly unrelated fields that might offer technological synergies with AI or other emerging trends.

- User Interface Prototyping: Invest in rapid prototyping of novel AI hardware interfaces (earbuds, pins, etc.) focusing on simplicity and user experience, learning from past failures like Humane.

-

Longer-Term Investments (6-18 Months):

- Strategic Partnerships for Adjacencies: Seek partnerships with companies in unexpected sectors that could benefit from or supply the AI infrastructure boom.

- Catalog Valuation Reassessment: For media companies, re-evaluate the long-term value of IP catalogs, considering the potential for creator-driven ownership models and their impact on franchise value.

- Build "Patience Moats": Focus on initiatives that require significant upfront investment with no immediate visible return but promise substantial long-term competitive advantage, understanding that this delayed payoff deters competitors.