TikTok Algorithm Control Undermines US Sale; Branding Drives Soda Sales

The TikTok sale is a masterclass in perceived victory masking a fundamental loss, a stark illustration of how branding can override substance, and a testament to the enduring power of strategic leverage. This conversation reveals that in high-stakes deals, the most critical assets are often intangible and fiercely guarded, leading to outcomes that appear decisive but leave the core power dynamic intact. It’s essential reading for anyone involved in M&A, marketing, or public policy, offering a competitive edge by highlighting where true value lies and how perception can be manipulated.

The Algorithm Remains: Why the TikTok Sale is Messy and Ambiguous

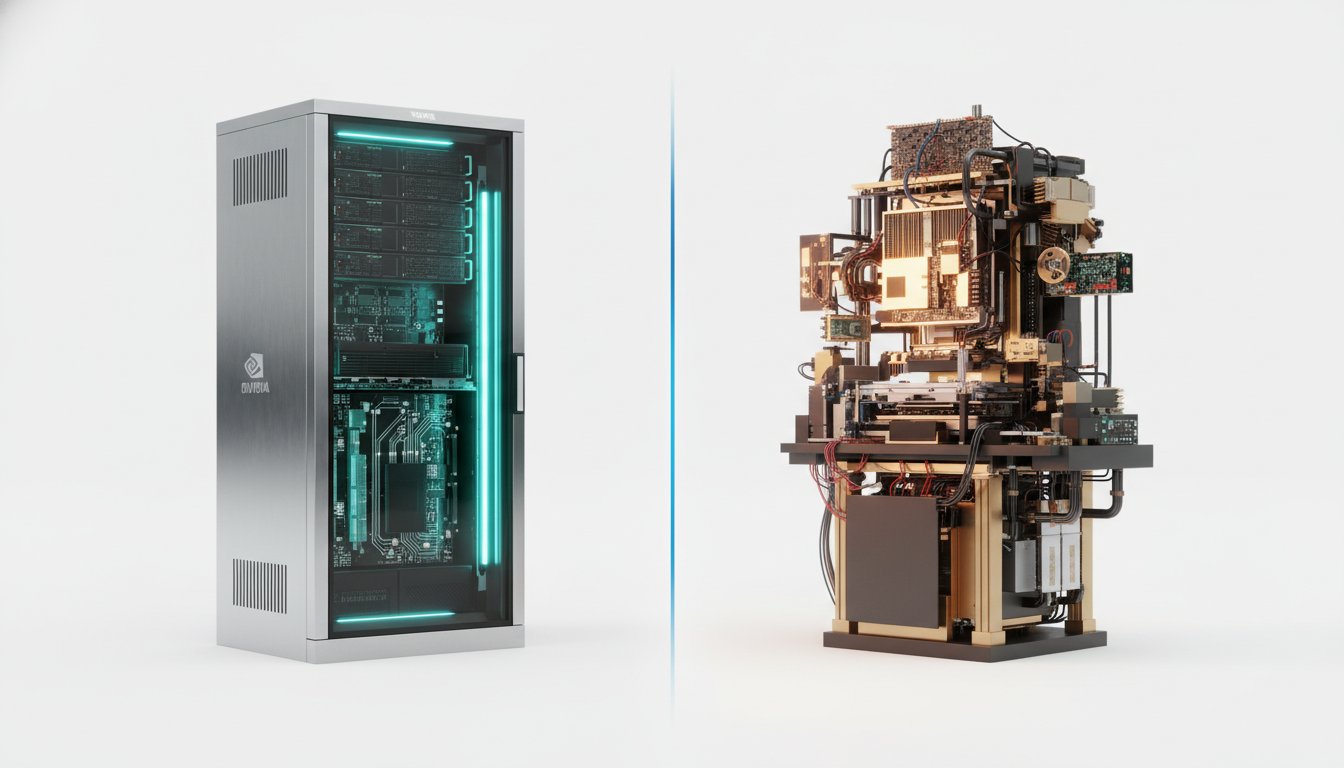

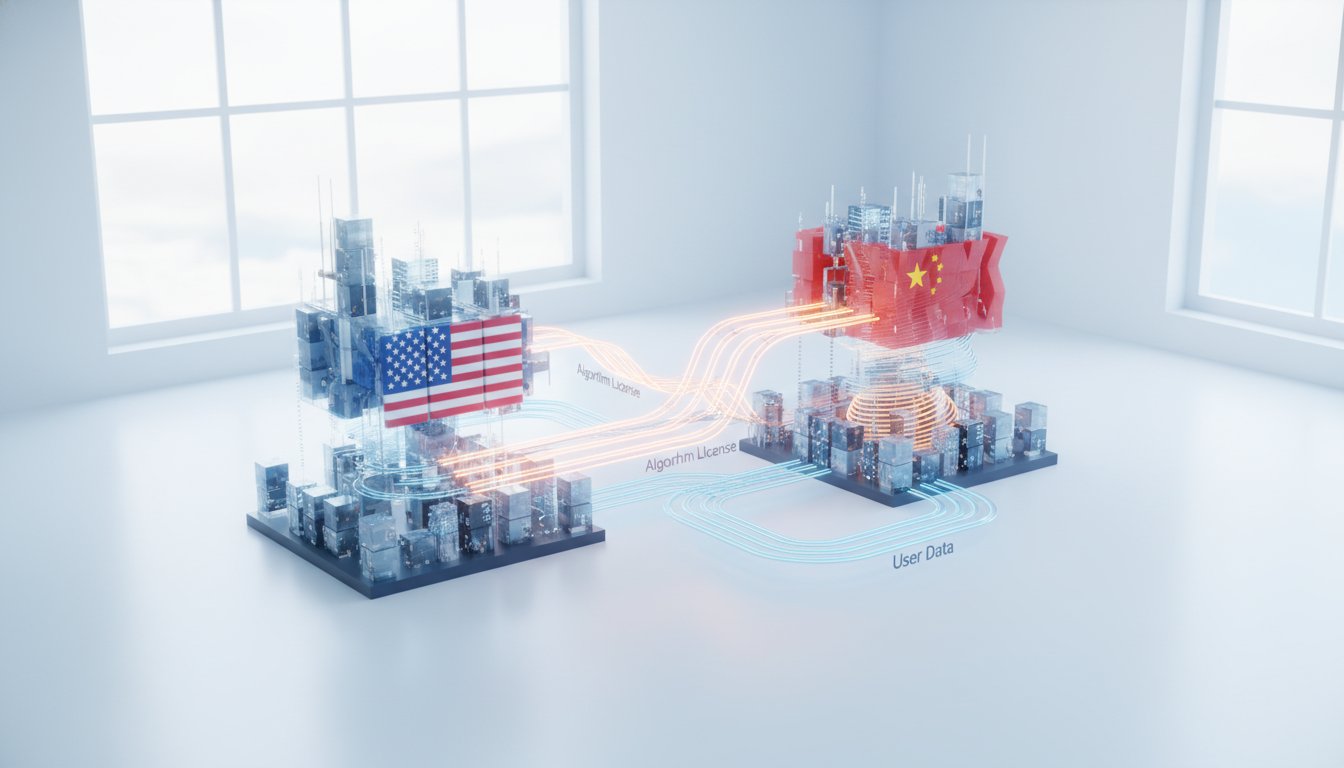

The recent sale of TikTok's US business, a move ostensibly designed to comply with US government demands, is a prime example of how the letter of the law can diverge dramatically from its spirit. While a consortium of mostly American investors now holds a majority stake, the most crucial component of TikTok's success--its powerful recommendation algorithm--remains under the control of its Chinese parent company, ByteDance. This leaves the US with the "chassis" of the car, as described, but China retains the "engine," the very element that drives user engagement and defines the platform's addictive quality. The $14 billion valuation, comparable to Snap's, seems to overlook the fundamental engine that makes TikTok a unique and dominant force.

The structure of this deal is a complex web of investors, including tech giants like Oracle and private equity firms like Silver Lake, alongside a Middle Eastern sovereign wealth fund. Notably, many of these investors previously backed ByteDance, suggesting a continuity of interest that undermines the notion of a complete divestiture. The fact that ByteDance retains a 20% stake and a board seat further complicates the narrative of a clean break. This arrangement, where TikTok US will essentially pay ByteDance for the use of its own algorithm, mirrors a franchise model, highlighting that the core intellectual property and operational core remain centralized.

The implications for US policy and national security are profound. The original concern was China's potential to leverage TikTok for propaganda or data harvesting. By keeping the algorithm, China retains significant influence over the content Americans consume, a powerful tool in shaping public discourse. As one speaker noted, "if TikTok is a car, we Americans got the chassis, but China is keeping the engine." This highlights a critical failure to address the root of the concern, leaving the US in a position where the perceived solution does not fundamentally alter the power imbalance. The true "beef," or in this case, the algorithm, remains with the original owner.

"The M&A of TikTok's US business actually stands for messy and ambiguous."

-- Nick Martell

The Zero Sugar Revolution: Branding Over Substance in the Soda Wars

The stark divergence in performance between "Diet" and "Zero Sugar" sodas, despite offering virtually identical products, reveals a powerful lesson in consumer psychology and the impact of branding. While Diet Coke sales have seen minimal growth, Coke Zero Sugar has surged, and Diet Pepsi has declined while Pepsi Zero Sugar has boomed. This isn't a reflection of product improvement but a shift in consumer perception, particularly across generational lines. "Diet" has become a "radioactive term" for those under 40, conjuring images of past eras of restrictive dieting. "Zero Sugar," conversely, aligns with a modern wellness-minded approach that emphasizes health without the perceived negativity associated with "dieting."

This generational divide is striking. Boomers, who grew up with the advent of Diet Coke in the 1980s, are accustomed to the "diet" label. Gen Z, however, is more attuned to blood sugar levels and overall wellness, finding the "zero sugar" messaging more appealing. The marketing executive's observation that "Diet is a radioactive term for anyone under the age of 40" underscores how deeply ingrained these linguistic associations are. The strategy here is less about the product itself and more about the narrative and emotional resonance of the brand.

The takeaway is that consumers often make "surface-level decisions," driven by labels and immediate associations rather than a deep understanding of the product's composition. This phenomenon extends beyond beverages to areas like online content consumption (thumbnail images) and even political messaging, where the framing of an issue can elicit vastly different reactions. The soda aisle becomes a microcosm of this principle: "we don't drink liquid, we drink the label." This highlights an opportunity for brands to strategically reframe their offerings, understanding that the perceived identity of a product can be far more influential than its objective reality.

"Diet is a radioactive term for anyone under the age of 40."

-- Marketing Executive (as quoted in the podcast)

Penn Station's Veto Power: How a Single Obstacle Can Halt Progress

The long-awaited renovation of New York's Penn Station, a transit hub often criticized for its dismal state, hinges entirely on the strategic leverage held by Madison Square Garden (MSG). The proposed $7.5 billion plan, particularly the "Grand Penn" concept, promises a return to the grandeur of the original Penn Station, featuring a public park and an above-ground commuter hall. However, the existing MSG arena, built directly above the station, requires 1,000 columns that severely constrict the space and prevent any significant redevelopment.

The critical insight here is the power of a veto. MSG Entertainment, as the owner of the arena, holds the ultimate say over whether the station can be transformed. This means that any redevelopment plan, regardless of its merit or the support it garners from Amtrak and government officials, is contingent upon MSG agreeing to relocate. The podcast highlights that this isn't just about moving an arena; it's about unlocking one of the largest development opportunities in New York City. The "veto" held by MSG is incredibly valuable, suggesting that any agreement will involve a substantial financial payout and the construction of a new, state-of-the-art facility for the company.

This situation illustrates how a single, entrenched entity can impede progress on a massive scale. The decades of failed attempts to renovate Penn Station underscore the difficulty of overcoming such a powerful obstruction. The "winner" in this scenario, as identified, is MSG Entertainment, not just for its existing sports franchises and concert bookings, but for its control over a pivotal piece of real estate infrastructure. The implication is that significant public projects often require not just financial backing and political will, but also the strategic appeasement or relocation of key stakeholders who wield disproportionate influence.

"Madison Square Garden also owns the veto to renovate Penn Station, and that veto is very valuable."

-- Jack Crivici-Kramer

Key Action Items

- TikTok: Re-evaluate the true ownership and operational control of critical digital assets, particularly algorithms, when assessing international business deals. Focus on the "engine" of the business, not just the "chassis." (Immediate)

- Branding & Marketing: Conduct a generational audit of brand language. Identify terms that may be perceived negatively by younger demographics and explore reframing strategies, similar to the "Diet" vs. "Zero Sugar" shift. (Over the next quarter)

- M&A Strategy: Prioritize identifying and valuing intangible assets like proprietary algorithms. Understand that control over these core components often dictates the true value and power in a transaction, not just physical or operational assets. (Immediate)

- Urban Development: Recognize that large-scale infrastructure projects often face significant hurdles due to entrenched private interests. Develop strategies for stakeholder negotiation and compensation that account for veto power and long-term value creation for all parties. (This pays off in 12-18 months)

- Consumer Psychology: Invest in understanding the "psychonomics" of consumer choice, acknowledging that labels and perceived brand identity can be more influential than objective product similarities. (Ongoing)

- Policy Making: When addressing national security concerns related to foreign-owned technology, focus on the underlying mechanisms of control (e.g., algorithms, data flow) rather than superficial ownership changes. (Immediate)

- Personal Development: Embrace the discomfort of identifying and addressing the "radioactive terms" or outdated perceptions within your own professional or personal branding. (This pays off in 6-12 months)