Sports Leagues Strategically Build Brands Through Content, Player Moves, and Leadership

The SBJ Morning Buzzcast for January 29th, 2026, reveals a landscape of strategic brand extensions and player realignments across major sports leagues. While immediate gains, such as Paramount+'s million new UFC subscribers, are notable, the deeper implications lie in how these moves signal long-term plays for market share and brand dominance. The conversation highlights the subtle but significant downstream effects of decisions like player departures from LIV Golf, the integration of sports with pop culture via the Atlanta Braves' Country Fest, and the strategic hiring of marketing executives to elevate brands like the College Football Playoff. Those in sports marketing, media rights, and professional league management will find value in understanding these multi-layered strategies, particularly how apparent setbacks can be reframed as opportunities for future advantage, and how seemingly disparate events are part of a larger system of brand building and competitive positioning.

The Million-Subscriber Surge: A Short-Term Win with Long-Term Questions

Paramount+'s debut with UFC programming appears, on the surface, to be a resounding success. The service reportedly generated "about a million new subscribers on Saturday," the day of its first UFC event, making it the second-largest sign-up day in Paramount+'s history. The UFC 324 event itself was the second most-streamed sporting event on the platform, drawing a young, male demographic--a predictable but valuable audience. This immediate influx of subscribers validates the strategy of leveraging high-profile sports content to drive platform adoption.

However, the analysis of this event requires looking beyond the initial surge. The transcript notes that UFC bouts were previously pay-per-view, now accessible with a subscription. This shifts the value proposition significantly. The question isn't just about acquiring new subscribers, but about retention. Will these million new users remain long-term subscribers once the novelty of live UFC fades, or will they churn after a few months? The "long game" between Paramount and UFC is indeed underway, but the true measure of success will be sustained engagement and subscription revenue, not just an initial spike. This immediate payoff, while positive, doesn't yet reveal the downstream consequences for Paramount+'s overall streaming strategy or its competitive standing against rivals who also rely on premium sports content.

"Remember, these were pay-per-view UFC bouts before, and now they are available for anyone with a Paramount+ subscription."

Golf's Great Migration: Competitive Shifts and Brand Realignments

The professional golf landscape is in a state of flux, marked by significant player movement between LIV Golf and the PGA Tour. Patrick Reed's decision to leave LIV Golf and target a return to the PGA Tour, following Brooks Koepka, signifies a potential consolidation of top-tier talent back into more established circuits. Reed's eligibility to return to the PGA Tour in September, without additional discipline but forfeiting equity opportunities until 2030, illustrates the complex trade-offs involved in these career decisions. The implication is that while LIV Golf may attract talent with lucrative initial offers, the long-term career pathways and brand-building opportunities may still lie with the PGA Tour.

LIV Golf, meanwhile, is reportedly seeking to sell minority stakes in its teams, with valuations reaching up to $300 million. This move suggests a pivot from pure investment to seeking strategic partners and potentially a more sustainable financial model, driven by the perceived value of its star players like Dustin Johnson and Phil Mickelson. The hiring of Citi Group to manage this process indicates a serious effort to monetize the LIV brand.

The addition of Rolex as an official partner, a brand known for its premium activations and hospitality, is a significant coup for LIV Golf. It signals an attempt to elevate its brand perception and attract high-value sponsorships, despite the ongoing narrative of player departures.

"Yes, $300 million, it does seem like a lot to me, and the sense is the valuations are driven by the players like Dustin Johnson, Bryson, Mickelson, Jon Rahm."

The return of Brooks Koepka to a PGA Tour event, the Farmers Insurance Open, is presented as a clear strengthening of the PGA Tour's product. His presence is expected to draw significant attention, underscoring the value of established stars within traditional league structures. This dynamic highlights a critical consequence: the PGA Tour, by reabsorbing key players, reinforces its position as the premier destination for golf's biggest names, while LIV Golf navigates a path that involves both seeking new investment and retaining its appeal. The long-term impact of these player movements and investment strategies on the overall ecosystem of professional golf remains to be seen, but the immediate effect is a more compelling PGA Tour product.

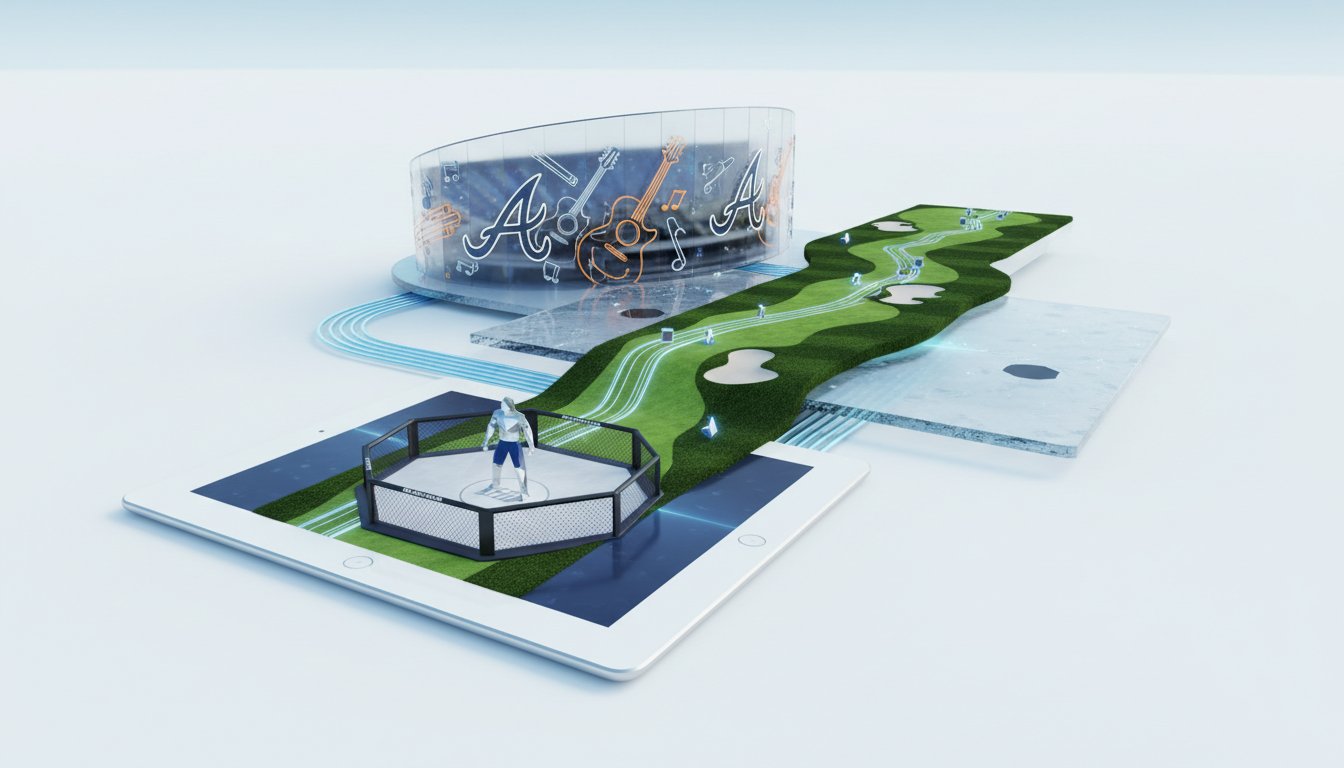

Extending the Brand: From Ballpark to Country Music Stage

The Atlanta Braves' partnership with Live Nation to host the inaugural "Braves Country Fest" exemplifies a sophisticated approach to brand extension. This event, a day-long concert featuring country artists at Truist Park, is more than just a promotional stunt; it's a strategic initiative with multiple downstream benefits. It serves as a direct revenue generator through ticket sales, merchandise, food, and beverage. Crucially, it amplifies the Braves' brand beyond the baseball season and the traditional sports fan base, potentially attracting new demographics to "The Battery," the mixed-use development surrounding the ballpark.

This move taps into the broader trend of sports properties blending with pop culture and entertainment to deepen fan engagement. By hosting a ticketed event with musical performances, the Braves are creating an experience that offers value beyond a typical game day. This can lead to stronger connections with existing fans and introduce the ballpark and its surrounding amenities to a new audience, who might then become interested in attending future games or events.

"I just think it's a smart idea, it's a smart brand builder. Now, of course, the Braves and Live Nation will have to execute, but it's a strong foundation for a successful event."

The success of such an event hinges on execution, but the foundational strategy is sound. It recognizes that brand loyalty can be cultivated through diverse experiences, and that a sports venue can serve as a hub for entertainment year-round. This approach creates a positive feedback loop: increased brand visibility and fan engagement can translate into higher attendance, more merchandise sales, and a stronger overall connection to the team, paying dividends well beyond the event itself.

Elevating Brands Through Strategic Leadership

The appointments of Sandra Idahian as the first commissioner of League One Volleyball's pro league and Eric Tosi as the College Football Playoff's Chief Brand Marketing and Communications Officer underscore a strategic focus on professionalizing and elevating sports brands through experienced leadership.

Idahian, a former executive at Nike and Jordan Brand, brings a wealth of experience in brand building and marketing to LOVB. Her appointment formalizes the league's leadership structure and signals a new phase of growth, aiming to establish LOVB as a significant player in women's volleyball. This move suggests that LOVB is investing in top-tier talent to build a robust and professional league, recognizing that strong leadership is fundamental to long-term success and market penetration. The implication is that building a professional sports league requires more than just athletes; it demands strategic vision and execution from experienced executives.

Similarly, Eric Tosi's move from the Vegas Golden Knights to the College Football Playoff signals an ambition to position the CFP as a premier national event, akin to the Super Bowl. His mandate to "elevate the college football event" and create "more energy, more fan engagement, and an overall bigger feel" highlights a desire to enhance the brand's perception and impact. Tosi's extensive experience in marketing, communications, and events since the Golden Knights' inception suggests a capability to translate brand vision into tangible fan experiences and broader market appeal.

"Well, the buzz from CFP circles that I have heard is that they really want to elevate the college football event, the College Football Playoff brand, and they want to really be thought of like a Super Bowl, that type of national holiday, that type of big event."

These hires are not merely filling positions; they represent strategic investments in brand development. By bringing in executives with proven track records from successful organizations, both LOVB and the CFP are signaling a commitment to long-term growth, enhanced fan engagement, and a stronger market presence. The consequence of such strategic leadership is the potential for significant brand equity building, which can translate into increased viewership, sponsorship opportunities, and overall influence within their respective sports.

Key Action Items

- Paramount+: Develop and execute a robust subscriber retention strategy for new UFC subscribers, focusing on content beyond live events and community building. (Immediate Action)

- Professional Golf Leagues: Monitor player movement and its impact on tour strength and fan engagement, identifying opportunities for cross-promotional content. (Ongoing Investment)

- Atlanta Braves/Live Nation: Rigorously track the ROI of the Braves Country Fest, analyzing attendee demographics, spending patterns, and subsequent engagement metrics to inform future events. (Immediate Action & 6-12 Month Analysis)

- LOVB: Leverage Sandra Idahian's expertise to build a compelling narrative around the professional league, focusing on player development and fan accessibility. (Immediate Action)

- College Football Playoff: Support Eric Tosi's initiatives to enhance fan engagement and brand perception, prioritizing experiences that create a "Super Bowl-like" feel. (Ongoing Investment)

- LIV Golf: Carefully evaluate the impact of selling minority stakes on team operations and investor relations, and assess the long-term sustainability of high valuations. (6-12 Month Analysis)

- Sports Marketers: Invest in understanding the intersection of sports, music, and entertainment to create multi-faceted fan experiences that drive brand loyalty and revenue. (This pays off in 12-18 months through strategic planning and execution)