Policy Choices Compound Disadvantage, Eroding American Affordability

In a world grappling with escalating costs and diminishing opportunities, a recent conversation on Prof G Markets with Neera Tanden, President and CEO of the Center for American Progress, offers a stark, systems-level diagnosis of America's affordability crisis. Beyond the surface-level debates on inflation and interest rates, Tanden illuminates how seemingly disparate policies--from trade tariffs to housing development--interact to create a cascading effect that disproportionately burdens working and middle-class Americans. This discussion reveals the hidden consequences of prioritizing existing wealth over future opportunity, and the profound, often unacknowledged, trade-offs embedded in policy decisions. Those who understand these complex, interconnected dynamics will gain a significant advantage in navigating the economic landscape and advocating for more equitable solutions.

The Unseen Architecture of Affordability: How Policy Choices Compound Disadvantage

The prevailing narrative around affordability often fixates on immediate economic indicators--inflation rates, interest hikes, or the price of a single good. Yet, Neera Tanden’s insights from her conversation on Prof G Markets reveal a far more intricate system at play, where policy decisions, often framed with good intentions, create downstream effects that exacerbate the very problems they aim to solve. This analysis moves beyond the surface to map the consequence layers, demonstrating how seemingly isolated actions contribute to a systemic decline in opportunity and economic well-being for a significant portion of the American population.

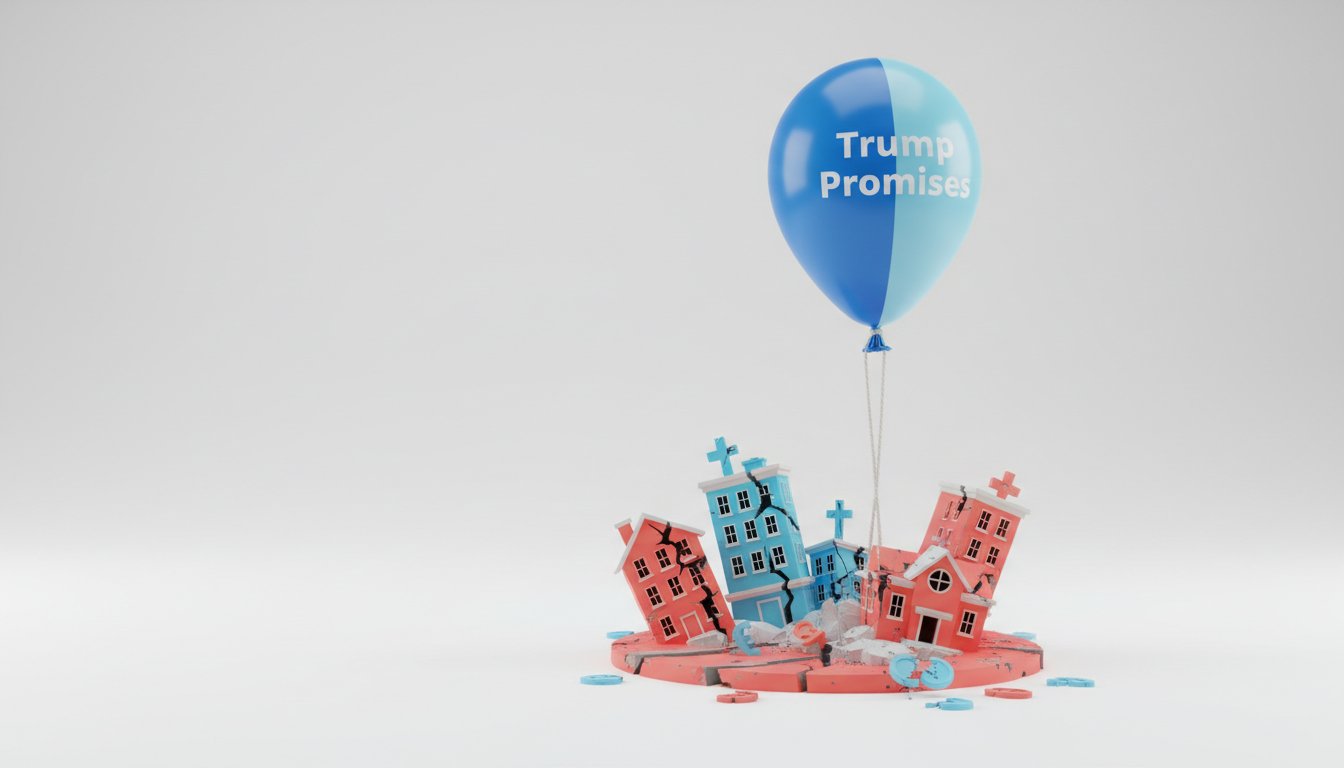

One of the most striking revelations is the inherent conflict within housing policy, particularly highlighted by Donald Trump's seemingly contradictory statements. While presenting a platform to address affordability, he also expressed a desire for housing prices to increase. Tanden unpacks this, not as a simple gaffe, but as a window into a core tension: the prioritization of existing homeowners' wealth versus the need for accessible housing for first-time buyers and renters. The consequence of prioritizing existing homeowners is clear: it actively works against increasing housing supply, which is a fundamental driver of affordability. This dynamic creates a feedback loop where older, wealthier Americans benefit from rising property values, while younger generations and those on fixed incomes face escalating rents and an ever-receding dream of homeownership. The average age of a first-time homebuyer hitting 40 is not an isolated statistic; it is a symptom of a system that has, intentionally or not, made it exponentially harder for new entrants to build wealth through real estate.

"And you know, I think this is an issue where you kind of have to choose. I mean, this is an issue about policymaking. And when you work in policy, you have to make a choice often times between two different groups."

-- Neera Tanden

This choice, as Tanden observes, often defaults to favoring those with established assets. The implication is that policies designed to "help" homeowners by keeping prices high directly contribute to the "rent shock" experienced by millions. This isn't just about market forces; it's about a deliberate policy leaning that entrenches existing wealth disparities. The conventional wisdom that all politicians aim to lower housing costs is challenged here, revealing a more complex reality where political expediency and the interests of a vocal, asset-rich constituency can actively work against broader affordability goals. The long-term consequence is a stratification of opportunity, where access to stable housing, a foundational element of economic security, becomes increasingly exclusive.

The healthcare system presents another complex web of interconnected issues where opacity and fractured responsibility drive up costs. Tanden explains that the high per-unit cost of medical services in the U.S. stems from a multitude of "middlemen"--hospitals, insurers, pharmacy benefit managers (PBMs), and drug companies--each operating with limited transparency and wielding significant market power. This fractured system allows costs to be inflated, with no single entity possessing enough leverage to effectively drive them down. The consequence of this opacity is a perpetual cycle of blame-shifting and a failure to implement systemic reforms. Hospitals may shift costs to cover uncompensated care for the uninsured, while PBMs operate with opaque rebate systems that obscure true drug pricing.

"The way I bottom line healthcare costs in America is the per unit cost of things in America is much more expensive. Going to a doctor, getting a medical device, getting a surgery is much more expensive here than in Europe or other places."

-- Neera Tanden

The conventional approach of simply acknowledging the "complexity" of healthcare fails to address the root cause: a system designed to benefit intermediaries rather than consumers. Tanden’s proposed solution--radical transparency and the elimination of PBMs--points to a systemic intervention. The downstream effect of such transparency would be to expose inflated costs and self-dealing, forcing a more competitive and consumer-focused market. Furthermore, her advocacy for concentrated negotiating power, whether through government-backed options or Medicare’s ability to negotiate drug prices, illustrates how consolidating leverage can counteract the power of near-monopolies. This approach highlights a key principle of systems thinking: increasing transparency and centralizing negotiation can disrupt entrenched, self-serving feedback loops, leading to more equitable outcomes over time. The delayed payoff for such reforms--truly affordable healthcare--is immense, creating a healthier, more productive populace.

Beyond housing and healthcare, Tanden’s discussion touches on broader economic policy, particularly concerning wealth inequality and taxation. Her critique of the tax code's historical bias favoring capital over labor, and her support for policies that reward work, underscore a systemic issue: the increasing concentration of wealth at the top, which erodes economic mobility. The implication of a tax code that benefits capital gains over traditional income is that it incentivizes wealth accumulation for the already wealthy, while making it harder for those who rely on wages to advance. This creates a widening chasm in opportunity, where upward mobility becomes less about talent and effort, and more about inherited wealth.

"I think we have a real kind of cancer in the country in declining opportunity. And I'll also say, you know, we had Raphael Warnock here at CAP a few months ago and he was talking about, you know, essentially a spiritual crisis in the country. And he identified it really with a sense that millions of Americans, most Americans in fact, don't think that they can, that they have a real fair shot in the country."

-- Neera Tanden

The "cancer of declining opportunity," as Tanden terms it, is a direct consequence of policies that have, over decades, rigged the system in favor of the wealthy. The resistance to ideas like wealth taxes, while understandable due to potential legal and implementation challenges, masks a deeper reluctance to fundamentally alter a system that disproportionately benefits a select few. Tanden’s preference for more achievable, yet still impactful, reforms--such as eliminating stepped-up basis, increasing estate taxes, and raising capital gains taxes--points to a strategy of incremental systemic change. These actions, while perhaps less dramatic than a wealth tax, aim to rebalance the scales, making the tax code fairer and creating more pathways for economic advancement. The delayed payoff here is the restoration of a belief in the American dream--that hard work and talent can lead to prosperity, not just for a few, but for many.

Key Action Items

- Advocate for Housing Supply: Support local and state initiatives that encourage the development of mixed-income and affordable housing in suburban and wealthier areas. This is a long-term investment in upward mobility.

- Demand Healthcare Transparency: Push for policies that mandate radical transparency in healthcare pricing from hospitals, insurers, and PBMs. This immediate action can begin to unravel systemic cost inflation.

- Eliminate Pharmacy Benefit Managers (PBMs): Support legislative efforts to remove PBMs from the healthcare supply chain, as Tanden suggests, to reduce self-dealing and opaque pricing. This is a medium-term reform with significant potential payoff.

- Reform Tax Code for Labor: Advocate for changes that reduce the differential between capital gains and traditional income tax rates, thereby rewarding work over passive wealth accumulation. This is a long-term structural shift.

- Support Increased Minimum Wage: Champion efforts to raise the federal minimum wage to a living wage, recognizing that current rates ($7.25 in many areas) are insufficient. This provides immediate relief and fosters broader economic participation.

- Invest in Public Transportation: Embrace and utilize public transit options like subways and trains as a cost-effective and environmentally sound alternative to private transportation, freeing up personal capital. This is an immediate lifestyle choice with financial benefits.

- Champion Mandatory National Service: Support the concept of mandatory national service as a means to foster civic engagement, build social cohesion, and provide structured opportunities for young Americans. This is a long-term societal investment.