AI Investment Framework: Enablers, Enhancers, and End Users

The relentless march of AI is not just a technological shift; it's a fundamental reshaping of industries, creating opportunities for those who can see beyond the immediate hype. This conversation with Denny Fish, Portfolio Manager at Janus Henderson Investors, reveals that the true advantage in tech investing lies not in chasing the latest buzzword, but in understanding the layered, long-term consequences of this transformation. Fish argues that while AI infrastructure is booming, the real enduring value will accrue to companies that strategically embed AI to enhance their existing strengths or become indispensable end-users. Skeptics are urged to look past Wall Street noise and observe the actions of industry practitioners. Those who can discern the subtle, downstream effects of AI adoption across different sectors will be best positioned to build resilient portfolios and capture significant, delayed payoffs, creating a durable competitive moat. This analysis is crucial for investors, technologists, and business leaders aiming to navigate the complex AI landscape and secure long-term success.

The AI Infrastructure Gold Rush and the Looming Software Revival

The current fervor around AI, particularly in the semiconductor and infrastructure space, is undeniable and, according to Denny Fish, fundamentally justified by impressive earnings growth. However, this initial wave, while lucrative, is only the first act. Fish points out that the last three years have been defined by whether a company was "on the right side of AI." This has led to a stark divergence, with AI infrastructure companies soaring while other sectors, notably software, have languished for nearly three years. This prolonged underperformance, however, presents a strategic opportunity. Fish's analysis suggests that as the AI infrastructure build-out matures, the focus will inevitably shift to how these capabilities are integrated into broader business applications.

The conventional wisdom often focuses on immediate gains, leading many to chase the "obvious" AI plays. But Fish's practitioner-driven approach, emphasizing conversations with industry leaders, reveals a more nuanced reality. He notes that even within the "Mag 7," dispersion is increasing, with companies like Google and Meta experiencing significant shifts in fortune based on their AI strategies. This ebb and flow highlights that sustained success requires more than just participation; it demands strategic integration. The current AI infrastructure boom, while powerful, is creating a foundation. The real, long-term value, Fish implies, will be unlocked by companies that can leverage this foundation to enhance their own offerings or become critical end-users, a dynamic that conventional, short-term focused analysis often misses.

"The AI semiconductor ecosystem has been really, really strong for obvious reasons, and that's because the fundamentals have been very, very impressive, and earnings have gone through the roof. So even though a lot of these stocks are up a bunch, their multiples actually aren't up that much. In some cases, their multiples are lower than they were a year ago because their earnings have come through."

-- Denny Fish

This suggests that while the immediate returns in AI infrastructure are substantial, the true competitive advantage will come from understanding the next phase of adoption. Companies that are perceived as "late" to AI, such as some software businesses, might actually be positioned for a significant rebound as the technology matures and becomes more accessible for integration. The delay in their fundamental impact, often seen as a negative, could become a source of delayed payoff, allowing them to build more robust, AI-enhanced offerings once the foundational infrastructure is firmly established. This requires patience and a willingness to look beyond the immediate, high-profile winners.

The Three Pillars of AI Value: Enablers, Enhancers, and End Users

Denny Fish's framework of "Enablers, Enhancers, and End Users" provides a sophisticated lens through which to view the AI investment landscape, moving beyond the simplistic categorization of "AI company" versus "non-AI company." This layered approach, developed before the widespread ChatGPT phenomenon, anticipates distinct phases of AI adoption and their corresponding beneficiaries.

Enablers are the foundational elements: the semiconductors, GPUs, ASICs, data centers, and the power infrastructure required to train and run AI models. This is where much of the current investment and excitement is concentrated, characterized by companies like Nvidia. The immediate impact here is clear: massive demand for hardware and infrastructure. However, Fish implicitly suggests this is the earliest stage, and while profitable, it may not represent the most durable long-term advantage as the market matures and competition, including custom chip development by hyperscalers, intensifies.

Enhancers represent a more subtle, yet potentially more enduring, opportunity. These are companies that were already strong businesses before AI, possessing significant data moats and critical roles in their customers' value chains. AI, for them, is a tool to make their existing offerings even stronger, embedding AI into their applications to enhance value propositions and improve customer engagement. Software companies and consumer internet platforms fall into this category. The impact here lags the Enablers, but the integration of AI into established, valuable businesses can create significant competitive advantages over time. The delay in fundamental impact, compared to Enablers, is precisely what creates the potential for a lasting moat.

End Users are those companies in sectors like healthcare, financial services, or agriculture that aggressively deploy AI to gain a competitive edge. Their thesis is twofold: AI will reduce costs and drive revenue lift. These companies are not creating AI but are becoming sophisticated adopters, leveraging it to extend their existing leadership positions. This requires a deep understanding of their specific industry and a strategic vision for AI integration.

The blurring of lines, particularly with hyperscalers like Microsoft (both an Enabler via Azure and an Enhancer via Copilot) and Amazon (an Enabler through AWS and a future End User/Enhancer through its physical logistics), underscores the interconnectedness of these categories. Fish's optimism stems from the belief that AI will benefit companies on both sides of this coin, driving efficiency and revenue. The strategic allocation across these buckets will shift over time, reflecting the evolving adoption curve of AI.

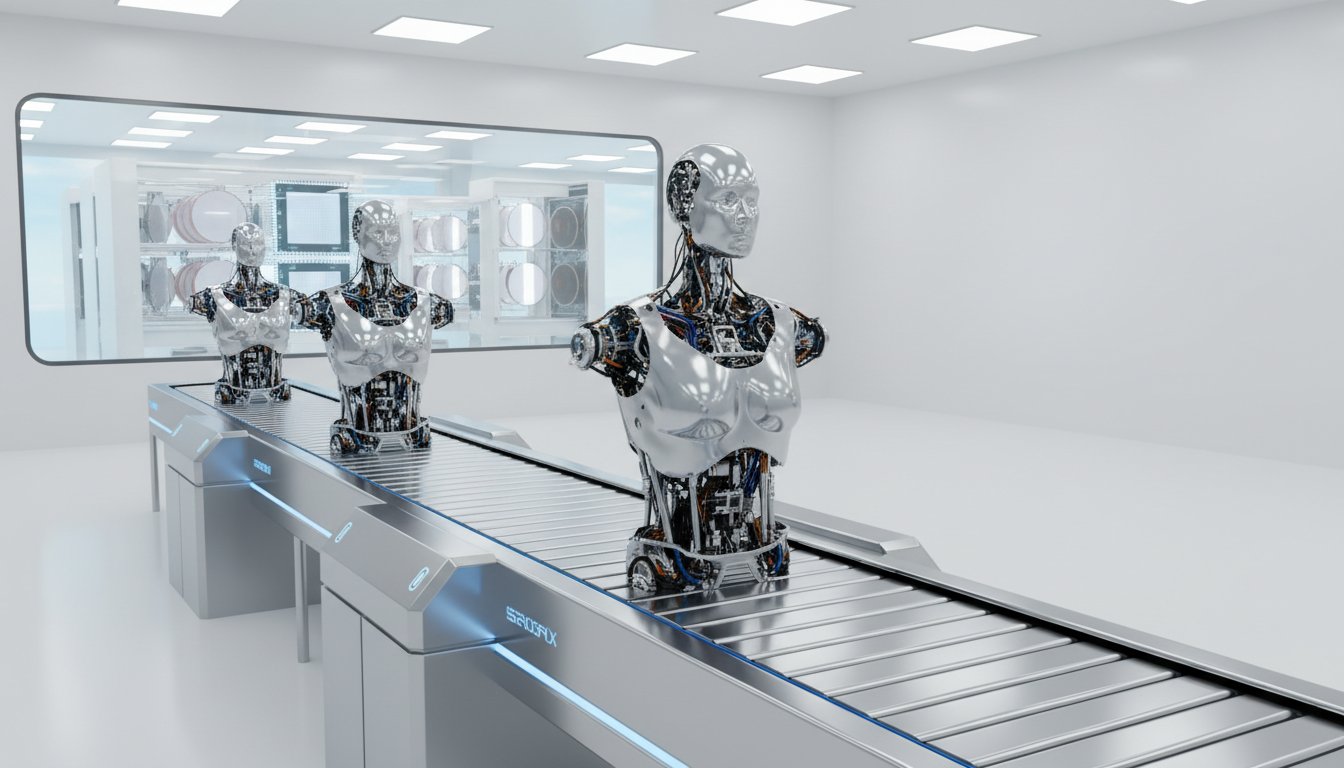

"The physical manifestation of AI through robotics and humanoids, full self-driving automation, things like that, that's going to be really, really profound for companies like Amazon that have a massive physical footprint with fulfillment and distribution, and they should get a tremendous amount of efficiencies from that."

-- Denny Fish

The insight here is that while the "digital manifestation" of AI (like large language models) is grabbing headlines, the "physical manifestation" through robotics and automation holds immense, potentially underestimated, long-term value, particularly for companies with extensive physical operations. This requires looking beyond software and into tangible operational improvements, a consequence that many might overlook in the current AI discourse.

CES Insights: Nvidia's Dominance and the Autonomous Future

The Consumer Electronics Show (CES), often a barometer for technological trends, this year, as Denny Fish observes, was overwhelmingly dominated by AI, to the point where he jokes the name might as well be CES AI. The continued emphasis on Nvidia's advancements, particularly the unveiling of Vera Rubin, the next generation of their GPU systems, highlights a critical dynamic: sustained innovation and efficiency gains in AI hardware. Last year's focus was on Blackwell and scaling laws; this year, it's about the continuation and improvement of those very laws, making AI more powerful and cost-effective. This relentless pursuit of efficiency is key to driving down the cost of AI operations, a factor that will influence adoption across all categories.

Beyond the core AI hardware, CES also showcased the accelerating progress in autonomous systems, particularly in the automotive sector. Fish notes his personal preference for Waymo over traditional ride-sharing in San Francisco and Phoenix, and his experience with driverless technology in London further illustrates the rapid advancements. While Tesla's Full Self-Driving (FSD) has made strides, Fish points out the fundamental differences in approach--Waymo's reliance on extensive mapping versus Tesla's machine vision--suggesting that different paths lead to varying degrees of progress. This divergence in development, coupled with the emergence of new players like Wave, funded by major tech giants, signals that autonomous technology is moving from a futuristic concept to a tangible reality with significant investment backing.

"What I also love about Jensen [Huang], if he sees something, he'll act decisively. You look at the deal that they just did with Groq, GRQ, which was actually founded by a guy by the name of Jonathan Ross, who was the original inventor of the TPU at Alphabet. I've met with them several times over the years and was actually really excited for them to come public at some point and invest in them as a public investor, but unfortunately, it's part of Nvidia now, so we're invested that way."

-- Denny Fish

This quote reveals a critical strategic move by Nvidia: acquiring promising technology and talent (Groq, founded by the inventor of Google's TPU) rather than solely competing. This "quarrying the market" approach, as Fish describes it, allows Nvidia to consolidate its lead and expand its ecosystem, particularly in areas like robotics. This demonstrates a systems-level thinking where acquiring potential competitors or key innovators strengthens their overall position, creating a compounding advantage that is difficult for others to replicate. The implication for investors is that Nvidia's dominance is not just about GPUs but about a comprehensive strategy to own the AI infrastructure stack, including specialized hardware and key talent. The competition among giants, their "frenemies" dynamic, is a key indicator of where innovation and investment are flowing, offering rich ground for analysis beyond the surface-level product announcements.

Building Resilience: The "Peanut Shell" Strategy for Long-Term Investing

Denny Fish's allocation strategy, termed "resilience and optionality," offers a pragmatic approach to navigating the volatile tech landscape. The core idea is to build a portfolio that can withstand various market conditions and capitalize on future opportunities. This involves a dual-pronged approach: securing the core with "resilient" positions and seeding future growth with smaller, higher-risk "optionality" plays.

Approximately 50-70% of the portfolio is dedicated to resilient companies. These are not necessarily the fastest-growing or most hyped stocks, but rather businesses with strong competitive advantages, innovative management, and a high degree of predictability in their outcomes over a five-year horizon. TSMC is cited as a prime example. Regardless of which chip designer ultimately wins in the market, TSMC's role as the essential foundry, with significant global manufacturing presence, makes it a linchpin. This focus on foundational, indispensable companies provides a stable anchor. The delayed payoff here is in the enduring nature of these businesses, offering high returns with a narrower range of potential outcomes, a stark contrast to the often-speculative nature of early-stage tech investing.

The remaining portion of the portfolio is allocated to smaller companies, described as "tomorrow's winners" or the "peanut shell strategy." These positions carry a wider range of outcomes, meaning the fund is likely to be wrong on many of them. However, the potential upside is significant: if one of these smaller bets matures into a resilient company, it can have a substantial positive impact on the overall portfolio. This strategy acknowledges the inherent uncertainty in identifying future market leaders and embraces the possibility of failure in pursuit of finding the next big thing.

"We have this philosophy called resilience and optionality, where we're trying to position 50, 60, 70% of the portfolio resilient, meaning these are companies we really think we could own for five years, not saying we're going to because things can change. We think the range of outcomes are not narrow, but not wide. The returns are going to be high, and their innovative management teams, and we want to get behind them, and we'll run those as big positions, strong competitive advantages."

-- Denny Fish

This quote encapsulates the core of Fish's approach: a deliberate balance between certainty and possibility. The "resilient" positions provide stability and consistent, high returns, while the "optionality" plays offer the potential for outsized gains. The key takeaway is that building a durable portfolio requires both a solid foundation and a willingness to explore nascent opportunities, understanding that the latter often involves a longer time horizon for payoffs and a higher probability of initial setbacks. This contrasts sharply with strategies focused solely on short-term gains or chasing the most visible trends, highlighting the advantage of patience and strategic diversification.

Key Action Items:

-

Immediate Actions (Next 1-3 Months):

- Re-evaluate Software Holdings: For investors with exposure to software, begin identifying businesses with strong data moats and critical customer value chains that have underperformed for three years. These may present opportunities for significant rebound as AI integration matures.

- Analyze Hyperscaler Dynamics: Understand how companies like Microsoft and Amazon are simultaneously enabling AI infrastructure and enhancing their own core businesses. Recognize the strategic importance of both their cloud services and their application-layer AI offerings.

- Observe Autonomous Tech Progress: Pay close attention to advancements in autonomous driving and robotics, recognizing that these "physical manifestations" of AI are gaining traction and investment, potentially creating long-term value for companies with physical operations.

-

Medium-Term Investments (Next 3-12 Months):

- Diversify AI Exposure: Beyond AI semiconductor enablers, explore companies in the "Enhancer" and "End User" categories. Focus on businesses that can strategically embed AI to improve existing products or gain operational efficiencies.

- Identify Foundational Companies: Seek out companies with indispensable roles in their respective industries, akin to TSMC in semiconductors. These "resilient" positions offer stability and long-term growth potential, even amidst market volatility.

- Invest in "Optionality": Allocate a smaller portion of your portfolio to promising, smaller companies with wider ranges of outcomes. This "peanut shell" strategy aims to capture significant upside if these nascent businesses mature into market leaders.

-

Longer-Term Investments (12-24 Months+):

- Monitor Nvidia's Ecosystem Strategy: Understand that Nvidia's lead extends beyond GPUs to a comprehensive strategy encompassing robotics, autonomous driving, and talent acquisition, creating a compounding advantage.

- Assess AI Integration for End Users: Evaluate how aggressively companies in non-tech sectors are deploying AI for both cost reduction and revenue generation. This strategic adoption will be a key differentiator for long-term success.

- Cultivate Patience for Delayed Payoffs: Recognize that the most enduring competitive advantages in the AI era may come from companies that are not the first movers but are strategic adopters who patiently integrate AI to enhance their core strengths, leading to payoffs that are significant but not immediate.