Growth At Reasonable Price Strategy Outperforms Market Volatility

Beyond the Obvious: Unpacking the Systemic Advantage in Steven Cress's 2026 Stock Picks

In this conversation, Steven Cress, Seeking Alpha's Head of Quantitative Strategy, maps the full system dynamics of identifying high-growth stocks, revealing how conventional wisdom often overlooks the compounding advantages of disciplined, data-driven selection. The hidden consequences of this oversight are significant: missing out on opportunities that offer superior long-term returns by focusing solely on immediate performance or popular trends. Investors and analysts who understand these deeper systemic forces will gain a significant edge by identifying undervalued growth, even amidst market volatility and the allure of speculative bubbles.

The Illusion of Simplicity in Stock Selection

The conventional approach to stock picking often feels straightforward: identify a popular trend, find a company capitalizing on it, and expect a rapid ascent. This was particularly evident in the market dynamics of 2025, a year characterized by the "AI frenzy." While technology stocks, especially those in the AI sphere, surged, the narrative often stopped at the immediate gains. However, as Steven Cress illustrates in his discussion of the "Top 10 Stocks for 2026," this surface-level analysis misses critical downstream effects and systemic patterns that ultimately dictate long-term success. The obvious answer--chasing the hottest trend--is insufficient because it fails to account for valuation, sustainable growth, and the market's inevitable recalibration. This conversation reveals that true investment advantage lies not in predicting the next big thing, but in understanding the underlying quantitative factors that predict durable growth and value, even when they are unpopular or overlooked.

The Systemic Cascade: From Market Volatility to Quantifiable Advantage

Steven Cress's analysis of the 2025 market and his subsequent top 10 stock picks for 2026 offer a masterclass in consequence-mapping and systems thinking. The year 2025 was a period of intense volatility, marked by a significant correction between February and April, where even the top-performing stocks from the previous year saw declines of over 20%. This turbulence was fueled by a confluence of factors, including the "Deep Seek shock" that questioned the capital expenditure required for AI infrastructure, and the imposition of tariffs. While many investors reacted with fear, rotating into perceived safe havens like gold, Cress highlights how this period of uncertainty created opportunities for those with conviction in strong fundamentals.

The AI Frenzy: A Double-Edged Sword of Opportunity and Overvaluation

The narrative around Artificial Intelligence dominated 2025. Companies heavily invested in AI, particularly the "Mag 7" stocks, traded at significant PE premiums. Cress points out that by the end of Q4 2025, the forward PE for the Mag 7 was around 31 times, compared to a more modest 22 times for the S&P 493 (excluding these giants). This massive capital expenditure, with hyperscalers dedicating up to 60% of their operating cash flow to AI infrastructure, raised questions about the sustainability of these valuations.

The market's reaction to Nvidia's strong third-quarter earnings, where the stock initially sold off despite good news, exemplifies this tension. Investors were grappling with whether the immense spending on AI was generating sufficient returns. Cress notes that while fears of overvaluation persisted, the market's subsequent rebound, driven by strong earnings across AI-related companies, underscored a central theme: an AI connection, direct or indirect, still seemed to run through many successful stocks.

However, the "Deep Seek shock" on January 27th served as a stark reminder of how quickly sentiment could shift. Nvidia dropped 17%, the semiconductor index fell 9.2%, and broader markets saw declines. This event triggered a deeper market correction, with the S&P 500 at one point down 15% (and Cress later clarifies this reached nearly 20%). The consequence of this fear-driven sell-off was that even fundamentally sound stocks were hit hard. Cress's key insight here is the distinction between fear-driven market rotations and conviction-driven investment: "fear creates losses. If you panic during these corrections and you sell, you will lose money. However, conviction creates opportunity, and the conviction lies in stocks with good fundamentals." This highlights how the system responds to fear by seeking safety, often at the expense of growth potential.

Economic Data and the Rate Cut Conundrum

Conflicting economic data in late 2025, particularly weakening labor data, prompted the Federal Reserve to enact three rate cuts in the fourth quarter. While inflation remained a concern, the labor market's performance was the primary catalyst for monetary easing. Ironically, Moody's downgrade of the US credit rating in May coincided with the end of the correction, a point Cress identifies as a contrarian indicator. The market rallied strongly after the downgrade, suggesting that such events often signal the worst has passed.

Looking ahead to January 2026, interest rate traders largely anticipated no immediate rate cut, preferring to observe further economic data and corporate earnings. This cautious stance reflects a system seeking stability after a period of flux, prioritizing data over immediate speculation.

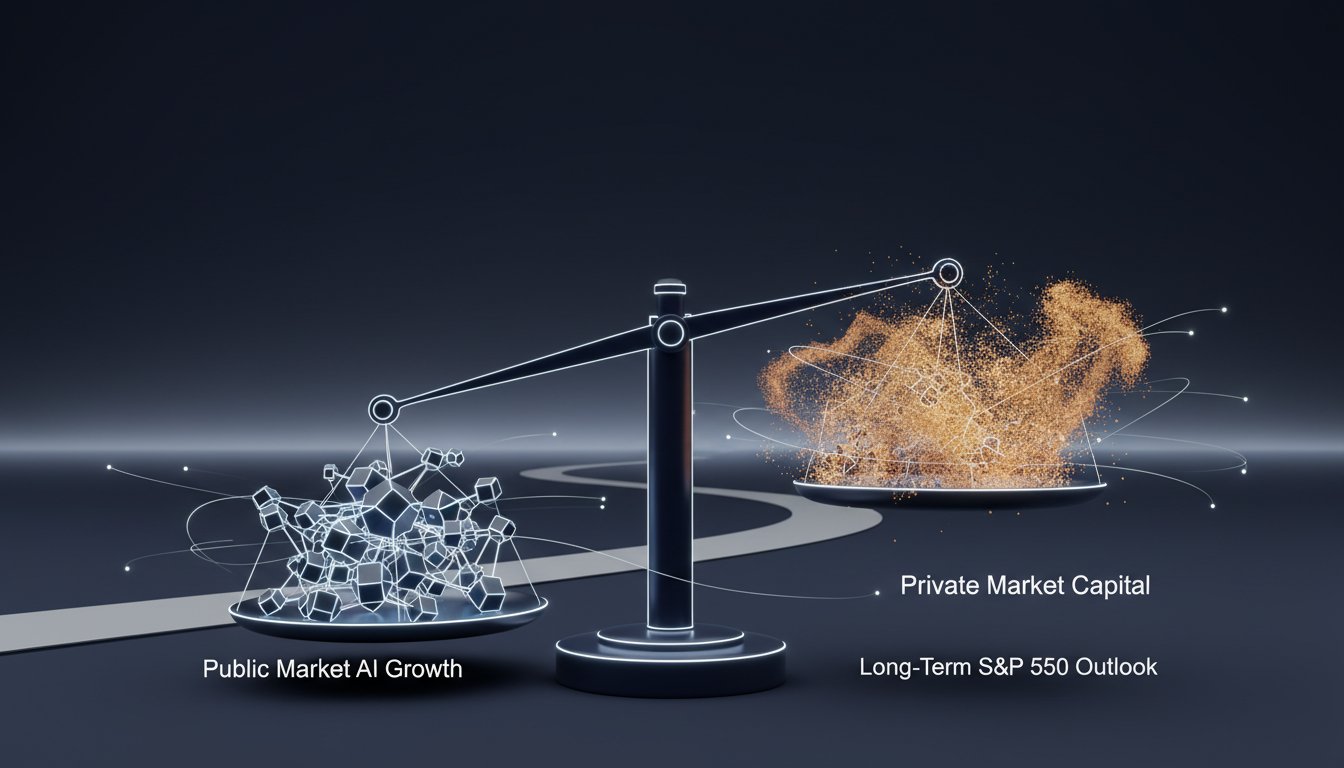

The Power of Quantifiable Performance: A Track Record of Durable Advantage

Cress presents a compelling track record for his quantitative approach. His top 10 stock picks for 2025 returned 45.68%, significantly outperforming the S&P 500's 17.6%. The performance becomes even more striking when looking at longer holding periods: holding the 2024 picks until December 2025 yielded a 356% return, dwarfing the Mag 7's 103% and the S&P 500's 47%. Similarly, holding the 2023 picks from January 2023 to December 2025 resulted in a 187% gain, versus the S&P 500's 85%.

This consistent outperformance is not a matter of luck, but a result of a systematic process that filters for specific, quantifiable attributes. The core of this strategy is identifying companies with exceptional growth--both top-line revenue and bottom-line earnings--at a reasonable price, often referred to as GARP (Growth at a Reasonable Price), with additional quantitative filters.

The Top 10 Stocks for 2026: Systemic Selection in Action

Cress's 2026 picks demonstrate how this systematic approach navigates market complexities:

-

Micron Technology (MU): Despite a 254% one-year return, Micron is presented as a "quant strong buy" with a valuation grade of B, cheaper than six months prior. Its A-rated growth (51% forward revenue growth, 211% forward EPS growth) and profitability, coupled with a forward PE of 9.7x (a 60% discount to the sector) and a PEG of 0.2 (an 87% discount), showcase how strong fundamentals can persist even after significant price appreciation. The system identifies that the market has not fully priced in its growth potential.

-

Advanced Micro Devices (AMD): Ranking 17th in the IT sector, AMD shows a 70% one-year return. Its valuation has improved to C-minus, and its momentum grade is an A. With a 45% long-term EPS growth rate and a PEG at a 25% discount to the sector, AMD exemplifies a company where improving quantitative factors signal continued potential.

-

Ciena Corporation (CIEN): With a 166% one-year return, Ciena's growth is rated A-minus, and its momentum is an A. Crucially, analyst revisions are a B, up from a D, indicating increasing positive sentiment. The system highlights that 15 analysts revised earnings estimates up in 90 days, with zero down, signaling a strong upward revision trend that the market may not yet fully appreciate.

-

Celestica (CLS): A repick due to its strong performance (191% one-year return), Celestica maintains a C-minus valuation but sees its growth grade improve to A-minus. Manufacturing complex hardware for hyperscalers, its 51% forward EPS growth rate and 52% year-over-year EPS climb demonstrate sustained operational excellence. The system recognizes that despite past gains, its growth trajectory remains compelling.

-

Allstate Corporation (ALL): Moving outside of IT, Allstate offers a different kind of systemic advantage. Its valuation is a B-minus, with a forward PE at a 37% discount and a PEG of 0.37 (a 65% discount). The standout metric is its EPS growth: 99% year-over-year and an astonishing 193% forward diluted growth rate, compared to the sector's 10.46%. Analyst revisions are an A-plus, with 21 analysts revising estimates up. This illustrates how a fundamentally strong, yet overlooked, company can offer significant value.

-

Incyte Corporation (INCY): In the biotech sector, Incyte stands out with positive earnings. Its valuation is an A, growth an A-plus, and profitability an A. With a 206% forward EPS growth rate and a PEG of 0.07 (a 96% discount to the sector), Incyte represents a rare blend of growth and value in a typically speculative industry.

-

Barrick Gold Corporation (GOLD): While known for gold, Barrick's focus on copper, a metal crucial for electrification, provides a forward EPS growth rate of 46%. Its cash from operations is substantial, and its PEG ratio offers a 69% discount to the sector. This pick demonstrates how diversification into strategic, future-oriented commodities can create systemic advantage.

-

Walden Group (WLDN): A smaller cap company (market cap $1.57 billion), Walden Group shows a 190% one-year return but maintains its valuation grade. Its growth is an A-minus, profitability a B-minus, and analyst revisions an A-minus. With a 61% EPS growth rate (542% premium to the sector) and a trailing PEG at a 53% discount, it signifies potential in specialized consulting services.

-

ATI Inc. (ATI): In aerospace and defense, ATI has a 114% one-year return, with stable valuation and growth. Its profitability has improved to a B, momentum is an A-plus, and analyst revisions are an A. With a 25% EPS growth rate (110% premium to the sector) and positive cash from operations, it represents a solid industrial play.

The overarching theme across these picks is the pursuit of companies with exceptional growth rates--an average forward revenue growth of 20% and an EPS growth of 73% for the top 10, compared to the S&P 500's 6% and 10% respectively. This demonstrates a systemic preference for companies that are not just participating in trends, but fundamentally outperforming their peers and the broader market through robust, quantifiable growth.

Key Action Items

- Embrace Quantitative Rigor: Move beyond surface-level trends. Implement a systematic, data-driven approach to stock selection, focusing on quantitative factors like growth rates, profitability, valuation metrics (PE, PEG), and analyst revisions. This provides a durable framework for identifying opportunities that others miss.

- Distinguish Between Fear and Opportunity: During market corrections or periods of high volatility (like those seen in 2025), recognize that fear-driven selling often creates buying opportunities. Focus on companies with strong underlying fundamentals that are temporarily undervalued due to market sentiment. This requires conviction and patience. (Immediate Action)

- Prioritize Sustainable Growth: Look for companies exhibiting high forward revenue and EPS growth rates, not just past performance. The average 73% forward EPS growth for Cress's top 10 stocks highlights the significance of future potential over current popularity. (Immediate Action)

- Analyze Valuation in Context: Do not be deterred by strong past performance if valuation metrics (like PE and PEG ratios) remain attractive relative to the sector and growth rates. Micron's example shows that a stock can be cheap even after a significant run-up if its growth potential is sufficiently high. (Immediate Action)

- Monitor Analyst Revisions: Pay close attention to trends in analyst earnings estimate revisions. An increasing number of upward revisions, as seen with Allstate and Ciena, signals growing confidence and can be a precursor to price appreciation. (Over the next quarter)

- Diversify Beyond Popular Sectors: While AI and tech are dominant themes, seek opportunities in sectors like financials (Allstate), healthcare (Incyte), materials (Barrick Gold), and industrials (ATI, Walden Group) where strong quantitative signals may be overlooked. This diversification mitigates concentration risk and uncovers hidden value. (Immediate Action)

- Invest in Long-Term Systems: Understand that the most significant advantages are often built through sustained application of a disciplined strategy. Consider products like Alpha Picks or PQP (Pro Quant Portfolio) for systematic idea generation and portfolio management, recognizing that these strategies pay off over multiple years, not just months. (This pays off in 12-18 months and beyond)