Navigating Mixed Economic Signals With Cautious Monetary Policy

TL;DR

- Businesses are experiencing continued input cost pressures, potentially leading to renewed price increases in Q1 2024, despite efforts to offset these with technology.

- Recent economic data presents mixed signals, with rising unemployment alongside job creation exceeding expectations, complicating the Federal Reserve's interest rate decisions.

- The neutral interest rate is an unobservable theoretical construct, with current financial conditions and economic performance suggesting policy is in a neutral range.

- The Federal Reserve's ample reserves framework is a technical adjustment to accommodate economic growth, ensuring fluid payments and avoiding pressure on financial institutions.

- Fed independence is critical for achieving stable inflation and supporting a healthy labor market, allowing policy decisions to be data-driven rather than politically influenced.

- Artificial intelligence is a multifaceted factor impacting markets and potentially productivity, though its clear effects on the labor market are not yet evident in data.

- Monetary policy is currently well-positioned to observe economic unfolding, requiring clearer evidence of sustained inflation reduction or significant labor market weakening to alter the current stance.

Deep Dive

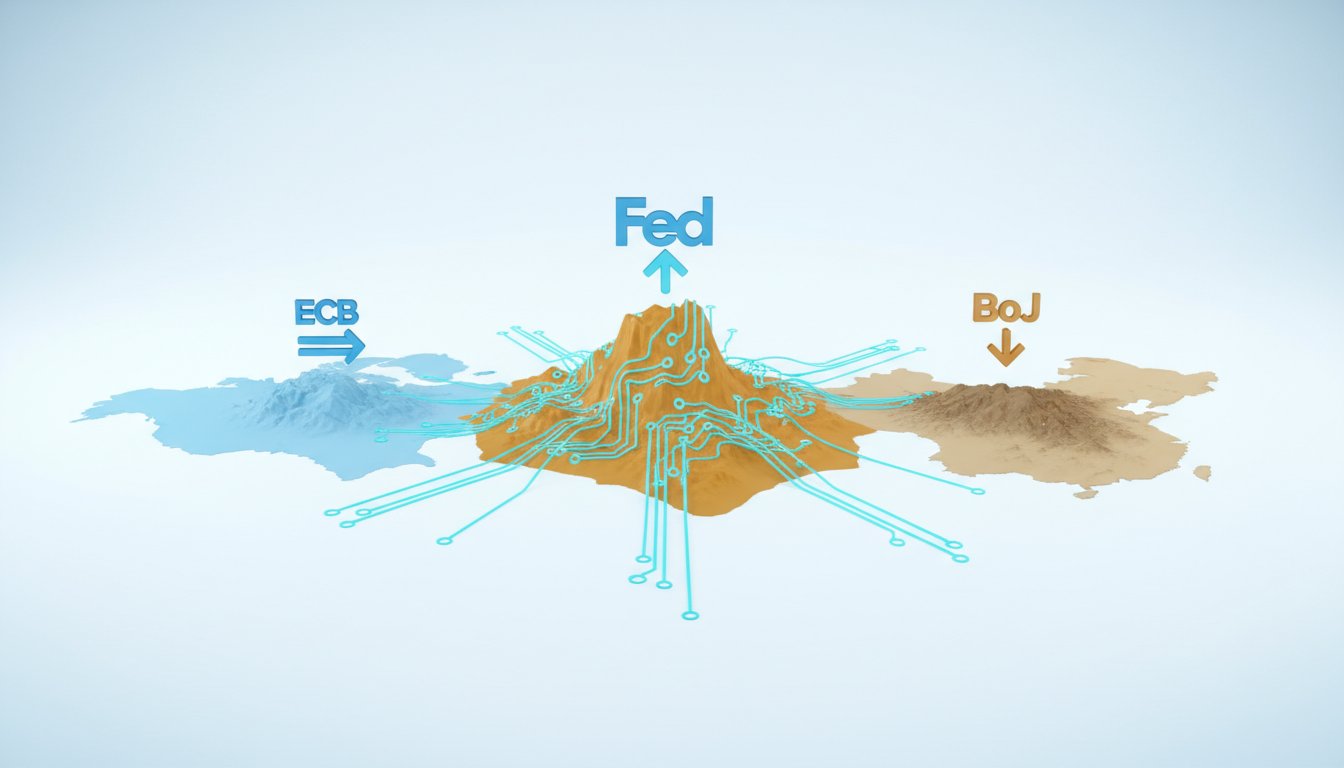

Beth Hammack, President of the Federal Reserve Bank of Cleveland, presents a nuanced view of the current economic landscape, emphasizing a gradual cooling in the labor market alongside persistent inflation above the Fed's target. This dual challenge necessitates a cautious approach to monetary policy, with a focus on data-driven decisions rather than reacting to single economic reports. Hammack's perspective suggests that while economic growth is projected to remain robust, the Fed must remain vigilant in its commitment to returning inflation to its 2% target, a goal that has remained elusive for an extended period.

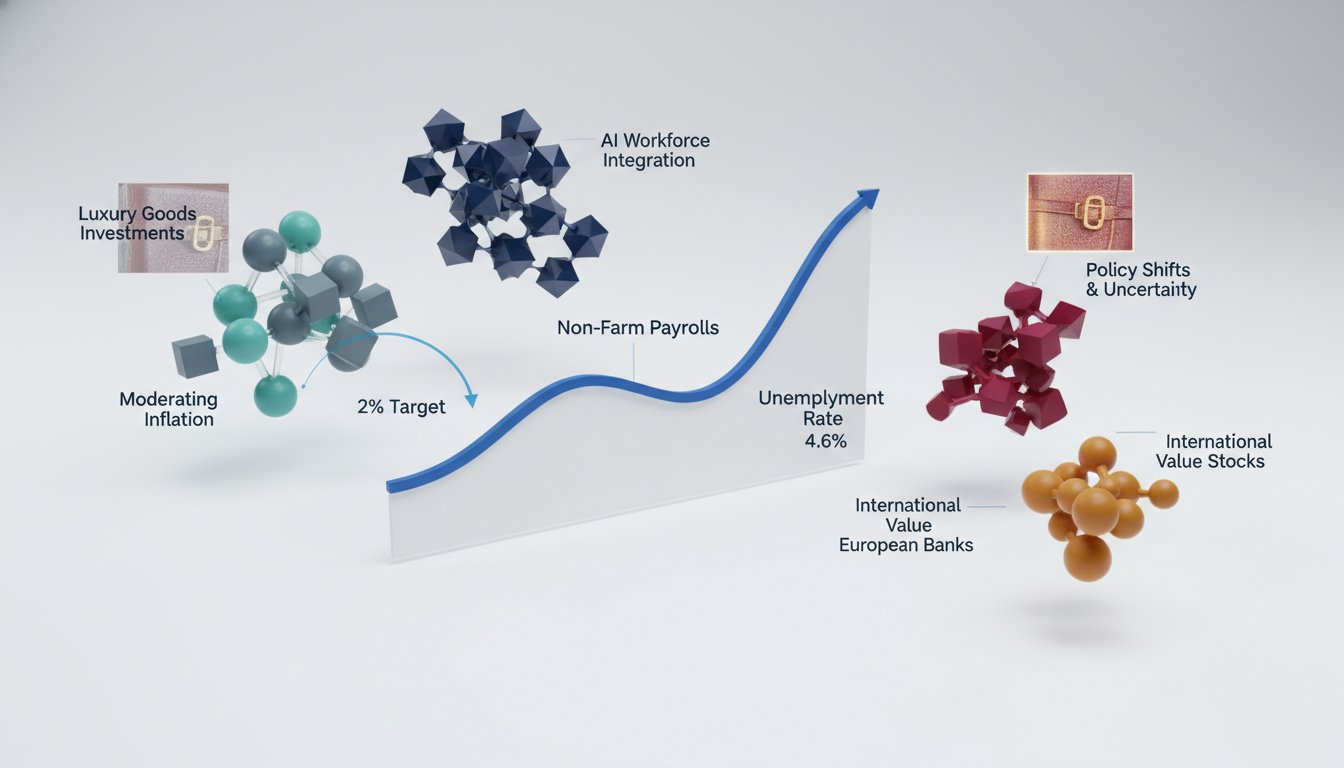

The core of Hammack's analysis centers on the difficulty of interpreting mixed economic signals. Recent data, including a slight rise in the unemployment rate and a lighter-than-expected Consumer Price Index (CPI) report, are viewed with caution due to potential noise from government shutdowns and sampling issues. Hammack highlights that businesses are still experiencing difficulties in finding workers, particularly in manufacturing and skilled trades, and that input costs continue to rise, potentially leading to further price increases in the near future. This contrasts with a projected strong GDP growth for the next year, creating a tension between labor market softening and economic expansion. The concept of a "neutral rate" for interest, which neither stimulates nor restrains the economy, is presented as an unobservable but critical benchmark. Hammack believes current financial conditions, characterized by optimistic equity prices and reasonably tight credit spreads, suggest policy is operating within this neutral range, though she holds one of the higher estimates of this neutral rate within the committee.

Second-order implications emerge from Hammack's discussion of the Fed's operational framework and the broader economic environment. The decision to allow the Fed's balance sheet to grow is framed as a technical adjustment to maintain an "ample reserves" framework, which supports fluid payment systems and avoids undue pressure on financial institutions. This approach, while potentially counter to some calls for a smaller balance sheet, is seen as providing significant financial stability benefits. Furthermore, Hammack acknowledges the potential stimulative effects of regulatory changes, such as discussions around lighter capital requirements for banks, underscoring the need for a somewhat restrictive or neutral monetary policy stance to avoid re-invigorating inflation. The conversation also touches upon the multifaceted impact of artificial intelligence, with businesses generally viewing it as a complement to their workforce rather than a replacement, though its long-term productivity effects remain a significant factor to monitor. Finally, Hammack emphasizes the paramount importance of Federal Reserve independence, arguing that it is crucial for achieving stable, low inflation and, consequently, a healthy labor market, free from short-term political pressures.

The key takeaway is that the Federal Reserve faces a complex balancing act, navigating conflicting economic signals with a commitment to its inflation mandate. Hammack's perspective signals a period of watchful waiting, where policy is likely to remain steady until clearer evidence emerges of inflation's sustained return to target or a more material weakening of the labor market. This cautious stance is reinforced by the understanding that significant economic shifts, such as the full impact of AI or evolving trade policies, will continue to shape the economic outlook, demanding adaptability and a focus on long-term stability.

Action Items

- Audit business cost-offsetting strategies: Identify 3-5 specific technologies or methods businesses use to manage input cost pressures.

- Analyze labor market cooling signals: Track 5-10 indicators for recent college graduates' job search difficulties to assess labor market trends.

- Evaluate AI impact on productivity: Monitor for evidence of AI adoption affecting productivity metrics within the next 1-2 quarters.

- Measure neutral rate sensitivity: Calculate the correlation between bond yields and credit spreads against business credit availability for 3-5 sectors.

- Track inflation persistence: Monitor input cost pressures and business pricing intentions for 3-5 key industries to forecast Q1 2025 price changes.

Key Quotes

"Well I don't make too much from any one individual report we try to look at the whole constellation of the pictures that comes together and it's great that we are getting that gold standard bls data back again um but I expected it and I think most participants expected that number to be a bit noisier given the government shutdown and given that they weren't able to be out there sampling a lot of data."

Beth Hammack, president of the Federal Reserve Bank of Cleveland, expresses caution regarding any single economic report, emphasizing the need to consider a broader range of data. Hammack indicates that recent data, while valuable, may contain noise due to external factors like a government shutdown, suggesting a more nuanced interpretation is required.

"On the pricing side I do hear that businesses have done a lot of work to try to maintain their costs and they've used technology of a variety of different sorts to try to help offset some of those pressures but their input costs continue to go up and that's something that they're feeling and it may mean that they're going to be raising prices again in the first quarter of next year as uh to to help offset some of those those input cost pressures that they felt."

Hammack shares insights from her conversations with businesses, noting that while many have employed technology to manage costs, rising input expenses persist. This suggests that businesses may need to increase prices in the near future to counteract these ongoing cost pressures.

"The labor market has been gradually cooling what I've seen is that um we had a huge a big shift over the late summer from the larger headline payroll numbers to these you know tens of thousands I think we're running somewhere around a 60 000 average over the past several months."

Hammack observes a cooling trend in the labor market, characterized by a significant decrease in the average monthly job creation numbers. This shift from larger payroll gains to tens of thousands indicates a gradual deceleration in employment growth.

"It's a challenging time for monetary policy we're being pressed on both sides of our mandate I think you've heard chair powell talk about there's no risk free path we are seeing a labor market that's been gradually cooling but it doesn't seem to me that we have signs of a more material movement around the corner."

Hammack describes the current environment as challenging for monetary policy, with pressures on both the employment and inflation mandates. She notes that while the labor market is cooling, there are no immediate signs of a significant downturn.

"The neutral rate is unobservable it's one of these tricky things for us as monetary policy makers because you do want to have some sort of a north star that you can judge policy against um but it's completely unobservable so it's it's a purely theoretical construct and the way that I think about it now the way that I thought about it when I was in markets really comes from just seeing how the economy is performing."

Hammack explains that the neutral rate, a theoretical benchmark for monetary policy, is unobservable and thus a challenge for policymakers. Her understanding of it is derived from observing the economy's performance rather than from a direct measurement.

"The action that was taken last week is really a technical adjustment we've said um the fed said back in 2019 that we wanted to operate in what we call an ample reserves framework an ample reserves regime that means that all the banks and financial institutions can have access to however many reserves they deem appropriate for them and we're helping to set monetary policy we're helping to govern interest rates based on administered rates rather than having to be in the market doing open market operations."

Hammack clarifies that the recent adjustment to the Federal Reserve's balance sheet is a technical change to maintain an ample reserves framework. This framework allows financial institutions to hold reserves as needed, enabling the Fed to manage interest rates through administered rates rather than active market operations.

Resources

External Resources

Books

- "Keywords" by Christopher Mims - Mentioned in relation to his column.

Articles & Papers

- "Keywords" (WSJ) - Mentioned as a column by Christopher Mims.

- "The Fed’s Balance Sheet Is Still Too Large" (WSJ) - Mentioned as an argument by the Treasury Secretary.

- "Inside Visa’s Tech-Charged Future: From Crypto to AI" (WSJ) - Mentioned as a past episode of WSJ's Take On the Week.

- "Why This Investor Says the AI Boom Isn’t the Next Dot-Com Crash" (WSJ) - Mentioned as a past episode of WSJ's Take On the Week.

- "This CEO Says Global Trade Is Broken. What Comes Next?" (WSJ) - Mentioned as a past episode of WSJ's Take On the Week.

- "Cleveland Fed’s Beth Hammack Skeptical of Further Cuts" (WSJ) - Mentioned as further reading.

People

- Beth Hammack - President of the Federal Reserve Bank of Cleveland, discussed for her views on the economy, interest rates, and monetary policy.

- Nick Timiraos - WSJ Chief Economics Correspondent, guest host and participant in the discussion.

- Telis Demos - Co-host of WSJ's Take On the Week.

- Jerome Powell - Fed Chair, discussed for his role in leading the committee and setting direction.

- Christopher Mims - Mentioned for his "Keywords" column.

- Tim Higgins - Mentioned for his column.

Organizations & Institutions

- Federal Reserve Bank of Cleveland - Institution where Beth Hammack is president.

- Goldman Sachs - Former employer of Beth Hammack.

- Federal Reserve - Central bank of the United States, discussed in relation to monetary policy and economic stability.

- FOMC (Federal Open Market Committee) - Committee within the Federal Reserve responsible for setting monetary policy.

- WSJ (Wall Street Journal) - Publication mentioned for its coverage and podcasts.

- Instagram - Platform mentioned for its teen account features and online protections.

Websites & Online Resources

- instagram.com/teenaccounts - Resource for information on Instagram's teen accounts and protections.

- wsj.com - Website for The Wall Street Journal.

- megaphone.fm/adchoices - Resource for information on ad choices.

Podcasts & Audio

- Bold Names - Podcast name.

- WSJ's Take On the Week - Podcast mentioned as a special bonus episode.

Other Resources

- Neutral Rate - Economic concept discussed in relation to monetary policy.

- Ample Reserves Framework - Monetary policy operating regime discussed in relation to the Fed's balance sheet.

- AI (Artificial Intelligence) - Technology discussed for its potential impacts on employment, productivity, and the economy.

- Tariffs - Economic policy discussed in relation to inflation and business costs.

- Private Credit - Area of lending discussed in relation to financial stability and market activity.

- Teen Accounts - Feature on Instagram discussed for automatic protections.