Geopolitical Instability, AI Energy Demand, and Silicon Renaissance

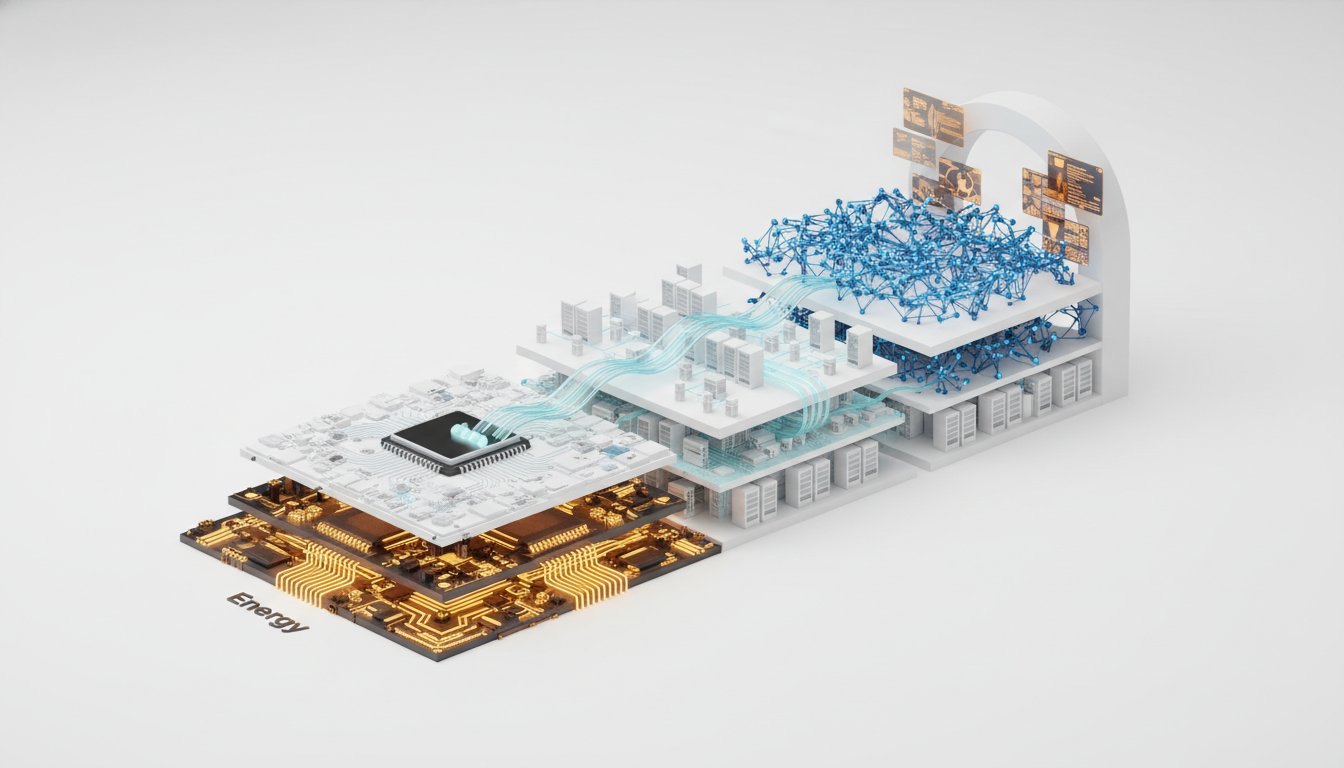

The AI infrastructure boom is reshaping not just technology, but fundamental economic models, revealing hidden consequences for energy consumption, grid stability, and corporate responsibility. This conversation unpacks how the insatiable demand for computing power, driven by AI, presents a critical challenge that conventional approaches are ill-equipped to handle. By examining the downstream effects of rapid data center expansion and the potential for innovative solutions, we uncover a path toward sustainable growth that rewards foresight and proactive problem-solving. This analysis is essential for tech leaders, policymakers, and anyone seeking to understand the complex interplay between technological advancement and societal well-being, offering a strategic advantage by highlighting opportunities others may miss.

The relentless march of artificial intelligence is creating an unprecedented demand for computing power, a reality that is fundamentally altering the energy landscape. As companies like Microsoft race to build out massive data centers to fuel AI development, the implications extend far beyond the immediate benefits of faster processing. This podcast discussion delves into the often-overlooked second and third-order consequences of this infrastructure build-out, revealing how seemingly straightforward solutions can create cascading problems if not approached with a systems-thinking mindset.

One of the most significant revelations is the strain these data centers place on existing energy grids and water resources. While the initial impulse is to build more capacity, the conversation highlights a critical failure in conventional wisdom: the assumption that grids can simply absorb this new demand without consequence. David Sacks points out that the president has been ahead of the curve on this, understanding that AI companies would need to become power generators themselves.

"When I've talked to the hyperscalers, they also tell me that their plan is not to draw from the grid. It's to basically set up their own power generation behind the meter."

-- David Sacks

This shift toward self-generation, or colocation, is not merely a technical detail; it represents a fundamental change in how energy infrastructure is conceived. The implication is that the era of data centers relying solely on public utilities for power is ending, and this transition, if managed correctly, could actually lead to lower residential rates. This occurs as the massive fixed costs of power generation are spread over a larger supply, and as these collocated facilities can potentially feed excess power back into the grid.

However, the challenge is compounded by decades of underbuilding and overregulation in the energy sector. Friedberg notes that the problem isn't the demand from data centers but the difficulty in scaling up power generation due to regulatory hurdles. This creates a scenario where even willing corporate partners, like Microsoft, pledging to cover their energy costs, may not fully alleviate the pressure on consumers. The immediate solution of paying more for electricity, while a step in the right direction, doesn't address the underlying shortage.

A more systemic solution, proposed by Chamath Palihapitiya, involves a significant investment in residential solar and storage. This approach tackles the problem from multiple angles: it reduces the direct load on the grid, empowers homeowners with energy resilience, and provides hyperscalers with a "social license to operate" by mitigating local concerns. The idea is to create a massive tax equity fund to subsidize solar and storage for millions of American households, effectively making residential electricity costs negligible.

"If you put these two things together, I think step one is you go into a local area, you tell the local residents, we'll pay for the water, we'll make sure there's minimal noise, and we'll only make sure that we take absolutely no discount. We pay our fair share, even if it means paying more than you do for electricity. That's step one. But now I think we need to go in with step two."

-- Chamath Palihapitiya

This strategy, while requiring substantial upfront investment, offers a delayed but significant payoff: a more stable energy system and improved public perception for the AI industry. It addresses the "affordability issue" not by cutting costs, but by shifting the burden and creating new, distributed energy resources. The conversation highlights that this is not just about environmentalism; it's about economic pragmatism and ensuring the long-term viability of the AI revolution.

The discussion also touches upon the geopolitical implications, particularly regarding Iran. The protests there, fueled by economic hardship exacerbated by sanctions, underscore how systemic pressures can lead to societal upheaval. Friedberg posits that the current situation is an inevitability driven by sanctions, leading to shortages and driving people to protest. The role of technology, like Starlink, in facilitating information flow and potentially influencing outcomes, is also noted as a critical element in modern conflict and information warfare.

"The key question that everyone's asking is, is Trump going to act in supporting the revolution, which theoretically, I would imagine, would involve attacking IRGC sites..."

-- David Friedberg

This brings us to the complex transition that would follow any regime change, a scenario rife with potential for instability, echoing concerns raised about Venezuela. The challenge lies in managing the intricate government infrastructure and ensuring a smooth handover, a task that often falters during periods of transition.

Finally, the conversation touches on the burgeoning field of AI silicon. The significant compute deal between OpenAI and Cerebras, a company developing wafer-scale chips, signals a renaissance in specialized hardware. Jason Calacanis emphasizes the opportunity for young, agile teams to innovate in this space, comparing it to the PC wars of the past. This diversification of compute providers is crucial for OpenAI to secure its long-term infrastructure needs, a strategy that requires patience and a long-term view, precisely the attributes that create enduring competitive advantages.

Key Action Items:

-

For Tech Leaders:

- Adopt Microsoft's model: Commit to covering the full energy and water costs associated with new data center deployments, foregoing tax breaks and discounts. (Immediate Action)

- Invest in residential energy solutions: Explore and fund programs for widespread solar and battery storage installation for homes, creating a social license to operate and reducing grid strain. (Longer-term Investment, 12-18 months payoff for grid stability)

- Diversify AI compute infrastructure: Secure multiple compute providers and architectures to ensure resilience and avoid dependencies, similar to OpenAI's strategy. (Ongoing Investment)

- Proactively address community concerns: Engage transparently with local communities regarding energy and water usage, and implement mitigation strategies beyond regulatory requirements. (Immediate Action)

-

For Policymakers:

- Streamline energy generation regulations: Expedite approvals and reduce bureaucratic hurdles for new power generation projects, particularly renewables and colocation facilities. (Immediate Focus)

- Incentivize distributed energy: Develop policies that encourage and support the adoption of residential solar, storage, and other distributed energy resources. (Strategic Investment, 2-3 year payoff for grid flexibility)

- Explore "energy dividend" models: Consider mechanisms where large energy consumers contribute directly to offsetting residential energy costs, fostering public acceptance of infrastructure growth. (Conceptual Exploration, 18-24 month implementation)

-

For Investors:

- Identify opportunities in specialized silicon: Recognize the potential for innovation and significant returns in companies developing custom AI chips and related hardware. (Strategic Investment)

- Assess companies on their long-term sustainability: Prioritize investments in companies demonstrating a clear understanding and proactive management of their environmental and community impact, not just immediate performance. (Discipline for future advantage)