Strategic Investment Placement Optimizes Tax Efficiency and Wealth Accumulation

The most significant, yet often overlooked, financial strategy isn't about picking winning stocks, but about strategically placing them within the right accounts. This conversation reveals that a failure to align investments with account types--tax-deferred, tax-free, and taxable--leads to substantial, avoidable tax bills and limits future flexibility. Individuals who understand and implement this "account placement strategy" can unlock tens of thousands of dollars in savings over their lifetime, gain psychological resilience against market volatility, and ensure their money is accessible when needed for life's crucial moments. This analysis is crucial for anyone looking to optimize their wealth beyond just investment selection, offering a distinct advantage by preventing common, costly errors.

The Hidden Costs of "Location, Location, Location" in Your Portfolio

Most investors obsess over what to buy, pouring over stock charts and fund prospectuses. Tyler Gardner, in his conversation on "Your Money Guide on the Side," argues that this focus is misplaced. The real financial leverage, he contends, lies in where those investments reside--the account placement strategy. This unglamorous topic, he explains, quietly dictates how much of your hard-earned money you actually get to keep. The non-obvious implication? A failure to strategically align investments with account types--tax-deferred, tax-free, and taxable--doesn't just lead to minor tax inefficiencies; it can cost you tens of thousands of dollars over a lifetime, create psychological traps during market downturns, and restrict crucial access to your funds when life demands it.

The Tax Divide: Where Your Investments Pay the IRS

The fundamental difference between investment accounts boils down to their tax treatment, and this is where the most significant downstream effects emerge. Gardner meticulously breaks down three core account types: tax-deferred, tax-free, and taxable.

Tax-deferred accounts, like traditional 401(k)s and IRAs, offer an immediate tax deduction, a tempting "instant gratification." However, this comes at the cost of paying ordinary income tax on withdrawals in retirement. Gardner warns that this can be a substantial hit, potentially pushing retirees into higher tax brackets, especially if they retire in high-tax states. The money grows tax-free within the account, but the government collects its due later, often at a higher rate than anticipated.

"The big disadvantage here when you do take it out every dollar is taxed as ordinary income which could be as high as 37 at the federal level plus state taxes."

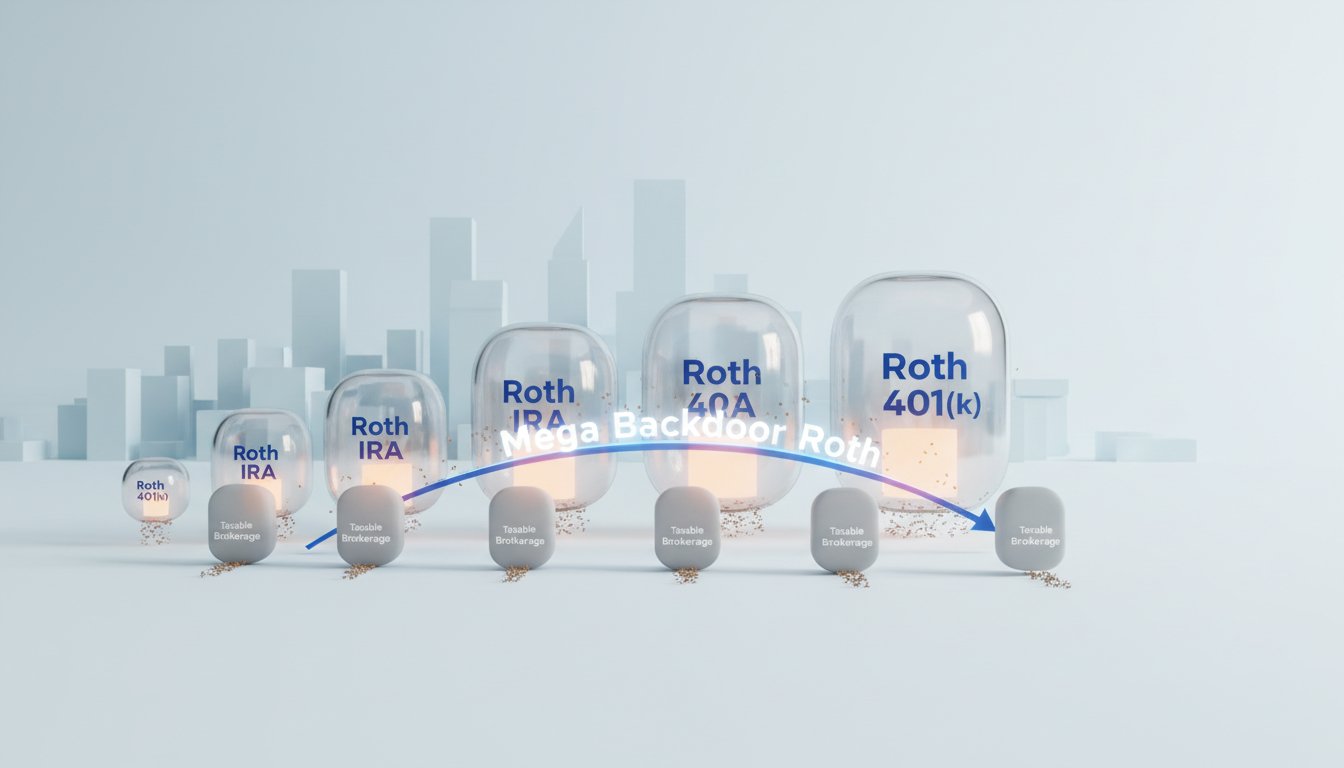

Conversely, tax-free accounts, such as Roth IRAs and Roth 401(k)s, require after-tax contributions but offer entirely tax-free growth and withdrawals in retirement. Gardner frames these as "rip the band-aid accounts"--you pay taxes now, but the government can never touch the growth. The immediate pain of no tax deduction can feel significant, especially for those in high tax brackets, but the long-term payoff of tax-free compounding is immense. This is where the concept of delayed gratification creates a powerful advantage. By paying taxes now at potentially lower marginal rates, individuals can shield decades of future growth from taxation.

The taxable brokerage account, while offering ultimate flexibility and no withdrawal restrictions, comes with the most immediate tax burden. Interest, dividends, and short-term capital gains are taxed annually. However, Gardner highlights a critical distinction: holding investments for over a year qualifies for lower long-term capital gains rates. This means that tax-efficient investments, like index funds and growth stocks that don't pay dividends, are prime candidates for taxable accounts, allowing their growth to compound with a more favorable tax outcome upon sale.

The consequence of misplacing investments is stark. Gardner illustrates this with a $50,000 example: putting bonds (tax-inefficient) in a taxable account versus a Roth IRA. The wrong placement could cost $240 annually in taxes, compounding to $5,500 over 30 years, and tens of thousands when factoring in growth. This demonstrates how a seemingly minor decision--where to put bonds--creates a significant, compounding financial drag over time.

The Psychological Tug-of-War: Volatility and Your Nervous System

Beyond taxes, account placement profoundly impacts psychological resilience during market downturns. Gardner explains that losing money in a taxable brokerage account feels different--and often worse--than losing money in a retirement account. Why? Because you can access the taxable funds. This immediate access amplifies the urge to panic sell when the market drops.

"But your 401k, you know that money's locked up until you're 59 and a half or willing to pay the penalties. So when it drops your brain is like meh, I wasn't going to use that for 30 years anyway."

This psychological dynamic creates a powerful feedback loop. Volatile investments, like individual stocks, cryptocurrencies, or emerging market funds, are best housed in accounts with penalties for early withdrawal (like Roth IRAs or 401(k)s). The inherent illiquidity acts as a buffer, preventing impulsive decisions that lock in losses. Gardner’s personal anecdote of a significant drop in a single stock held within his Roth IRA, which he didn’t panic sell due to its locked-up nature, underscores this point. Had that same stock been in his taxable account, he admits he likely would have sold at the bottom, forfeiting future gains.

Conversely, less volatile investments, or those that generate tax liabilities, can be more appropriately placed in taxable accounts, especially as one approaches retirement. This ensures that stable assets, needed for near-term cash flow, are accessible without penalty and that the psychological impact of market fluctuations on these critical funds is minimized. The COVID-19 crash example of two friends--one who panicked and sold from a taxable account, missing the rebound, and another who held steady in a Roth IRA--vividly illustrates how account structure can dictate investment behavior and outcomes.

Access and Liquidity: The Unsexy Foundation of Life Choices

The third pillar of account placement strategy is access and liquidity. Gardner stresses that rigidly locking away all funds until retirement can severely limit life choices, a lesson he learned firsthand after maxing out his traditional 401(k) in his late twenties and subsequently being unable to fund a desired year off to hike the Appalachian Trail.

"The worst financial decision you can make is deferring all your dreams until you're 65 and then you realize that once you're 65 the idea of sleeping in a communal hut infested with mice and damp at through hikers who haven't showered in months is about as appealing as realizing the only person who will now join you on said hike at that age is someone trying to sell you fixed index annuities before you reach Katahdin."

This highlights a critical downstream effect: over-optimization for tax deferral can lead to a lack of flexibility, forcing individuals to forgo important life experiences or career changes. Gardner advocates for a balanced approach, ensuring that money needed within zero to ten years is held in accessible accounts like taxable brokerages or money market funds, not volatile stock market investments. Even Roth IRAs, while primarily retirement vehicles, offer a degree of flexibility by allowing contributions to be withdrawn tax- and penalty-free, a lesser-known benefit that can serve as a medium-term savings tool or emergency fund. The core principle is alignment: matching the money's purpose and timeframe with the account's accessibility and tax implications.

Key Action Items

-

Immediate Action (Next 1-3 Months):

- Inventory Your Accounts: List all your investment accounts (401k, IRA, Roth IRA, taxable brokerage, HSA, etc.) and their current balances.

- Categorize Investments: For each account, list the primary types of investments held (e.g., bonds, index funds, individual stocks, REITs).

- Assess Tax Inefficiency: Identify investments generating significant annual taxable income (e.g., bonds in taxable accounts, high-dividend stocks in taxable accounts).

- Assess Volatility: Identify highly volatile investments (e.g., individual tech stocks, crypto) and where they are currently held.

- Review Liquidity Needs: Determine any significant upcoming expenses (e.g., down payment, education, sabbatical) within the next 5-10 years.

-

Short-Term Investment (Next 3-6 Months):

- Rebalance Tax Inefficient Assets: If possible, begin shifting tax-inefficient investments (like bonds or REITs) into tax-advantaged accounts (traditional 401k/IRA, Roth IRA) and tax-efficient assets (index funds, growth stocks) into taxable brokerage accounts. This may involve selling and rebuying, so consider tax implications.

- Fortify Volatile Holdings: Move highly volatile investments into accounts with penalties for early withdrawal (Roth IRAs, 401ks) to mitigate panic selling.

- Establish Liquidity Buffer: Ensure funds needed within 0-5 years are in safe, accessible accounts like money market funds or high-yield savings accounts, not the stock market.

-

Longer-Term Investments (6-18 Months and Beyond):

- Optimize Roth IRA for Growth: Prioritize using Roth IRA space for high-growth potential investments, as all future gains will be tax-free. This is where you can afford to be more aggressive.

- Strategic Use of Traditional Accounts: For those in high tax brackets now, continue to leverage traditional 401(k)s/IRAs for tax-inefficient assets to gain immediate deductions, but be mindful of future tax liabilities.

- Build a "Bridge" Portfolio: For those planning early retirement or needing funds before age 59.5, build a conservative portfolio within a taxable brokerage account to cover the gap years, balancing growth with accessibility.

- Regularly Re-evaluate Alignment: Periodically (annually or bi-annually) review your account placement strategy as your income, tax bracket, time horizons, and life goals change. This isn't a one-time fix but an ongoing process of alignment.