Prediction Markets Offer Durable Edge Beyond Opaque Sportsbooks

The Prediction Market Revolution: Beyond the Hype to Lasting Advantage

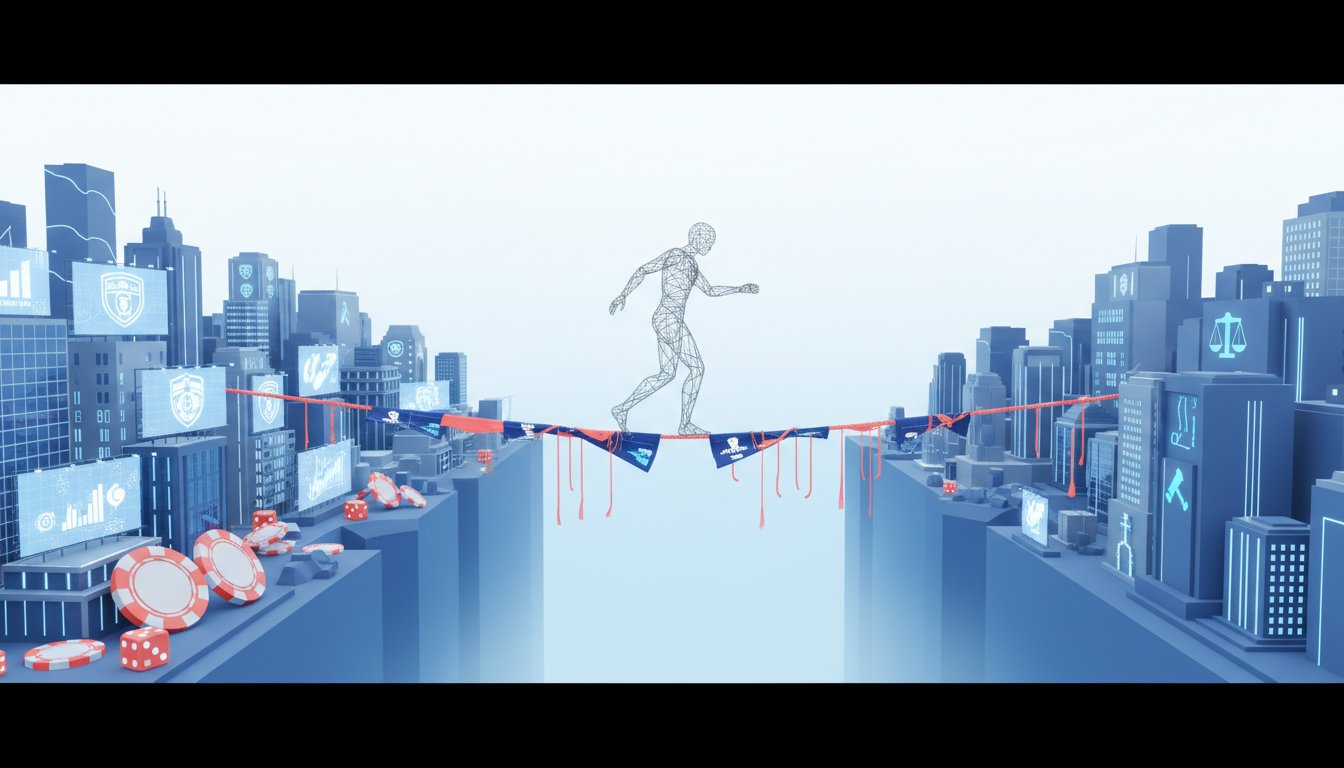

The rise of prediction markets represents a fundamental shift in how we analyze and engage with uncertain outcomes, moving beyond traditional sports betting to a more sophisticated ecosystem of market dynamics and strategic trading. While the immediate allure is undeniable, the true advantage lies not just in predicting events, but in understanding and exploiting the underlying market mechanics that traditional sportsbooks often obscure. This conversation reveals the hidden consequences of opaque markets and highlights how sophisticated bettors can leverage prediction markets to gain a durable edge. Anyone seeking to understand the bleeding edge of quantitative analysis and market strategy, particularly those in the financial and analytical spaces, will find a new lens through which to view competitive advantage.

The Unseen Mechanics of Market Liquidity

The most profound insight from Rufus Peabody's discussion is the stark contrast between the opaque, often restrictive nature of traditional sportsbooks and the transparent, liquid environment of prediction markets. Sportsbooks, with their arbitrary limits on "sharper" bettors, create artificial scarcity, forcing sophisticated participants to navigate a complex web of accounts and brokers. Prediction markets, however, offer a more direct counterparty system where liquidity, rather than arbitrary limits, dictates betting capacity. This fundamental difference opens doors for bettors who can accurately price events but are constrained by sportsbook limitations. The ability to "make a price" at a more favorable rate than a sportsbook offers, even with a slight fee, creates an immediate advantage for those with robust models.

"So, you know, why is prediction markets advantageous from a bettor's perspective? And in particular, let me just say one last thing. Rufus has been an evangelist on the side of the bettor for years. His cause is, you know, better markets, better rules, better access, fair play in some sense for sports bettors, and I think that's one of the reasons he likes prediction markets."

-- Cade Massey

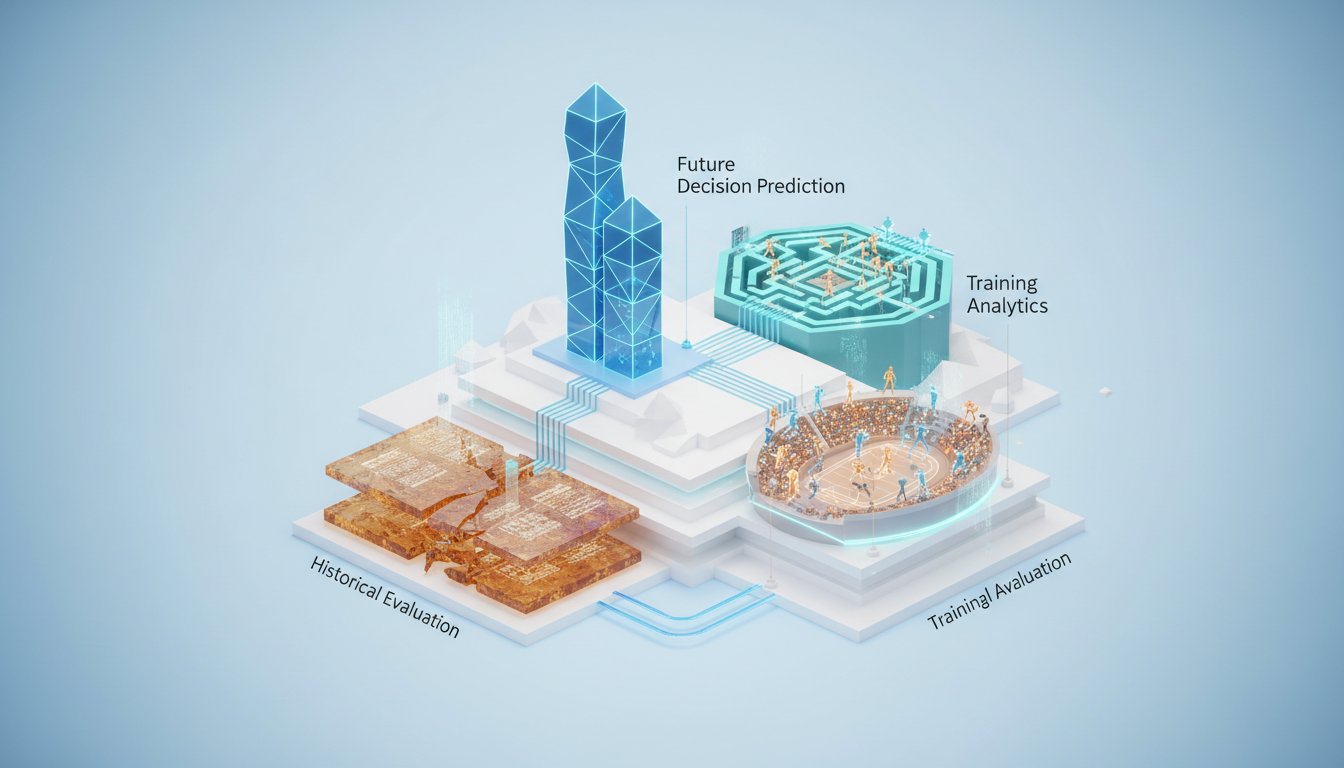

The real strategic advantage, however, emerges when considering the market dynamics themselves. Peabody highlights that prediction markets are not merely platforms for placing bets but arenas for active trading. Understanding the order book, managing queue priority, and employing strategies like "iceberg orders" (orders that are partially revealed to avoid signaling the full size of a position) become critical skills. This introduces a layer of complexity that traditional sports betting often lacks, rewarding those who can navigate both the fundamental prediction of an event and the technicalities of market execution. The implication is that success is no longer solely about building a better predictive model, but about becoming a more adept market participant.

The Bot Wars and the Human Edge

The conversation delves into the increasingly sophisticated landscape of automated market makers, or "bots," that populate prediction markets. Peabody notes that while these bots can be formidable, they possess inherent weaknesses due to their rigid, algorithmic nature. The "GTO" (Game Theory Optimal) approach, while aiming for unpredictability, still operates within a programmed framework. This creates an opportunity for human traders who can adapt to novel situations, exploit predictable bot behavior, and understand the "state of the world" that an algorithm might not fully grasp.

"Every bot has a weakness because they're too rigid, because they're too predictable, because it is algorithmic. There's logic. I mean, they're trying to be human. You're trying to program in all the, all your intuition, understanding markets perfectly. And, and probably there's cases that come up that you haven't encountered before, and a bot is going to behave in a very predictable manner."

-- Rufus Peabody

This dynamic suggests a future where the edge shifts from pure predictive power to a combination of predictive accuracy and superior market execution. The ability to strategically "move a line" on a sportsbook by understanding how their automated systems react, or to exploit the blind spots of bots on prediction markets, represents a significant, albeit difficult-to-master, competitive advantage. The key takeaway is that while AI and algorithms are increasingly prevalent, human intuition and adaptive strategy remain crucial differentiators in these evolving markets.

The Fragility of Edges and the Quest for Obscurity

Peabody's experience with his golf modeling underscores a critical principle: competitive edges are often fragile and ephemeral. What was once a frontier--a novel approach to quantifying skill--can quickly become commoditized as others adopt similar methodologies. This necessitates a continuous pursuit of new, less obvious insights. The fact that Peabody is reluctant to discuss the cutting edge of his golf modeling highlights the inherent value in obscurity. The most durable advantages are often found in areas that haven't yet attracted widespread attention or analytical scrutiny.

"Well, the frontier is doing things that other people aren't doing, Cade, and other people haven't even thought about doing. And, and so if I actually talk about it, then it becomes not as valuable."

-- Rufus Peabody

This principle extends beyond golf modeling to the broader prediction market landscape. The "sweepstakes loophole" that allowed for novel betting structures, now being closed, exemplifies how regulatory shifts can alter market dynamics. Similarly, the rapid evolution of prediction markets means that strategies that work today might be obsolete tomorrow. The enduring advantage lies in a foundational understanding of market principles combined with the agility to constantly seek out and quantify new, nuanced elements of skill or market inefficiency before they become widely recognized.

Key Action Items

-

Immediate Action (Next 1-3 Months):

- Explore Prediction Market Platforms: Sign up for Kalshi, Polymarket, and any other emerging platforms to familiarize yourself with their interfaces, order books, and available markets.

- Analyze Market Spreads: Track bid-ask spreads on various prediction markets and compare them to implied odds on traditional sportsbooks for similar events. Identify instances where spreads suggest potential arbitrage or value.

- Study Bot Behavior: Observe how prices move in illiquid markets. Note instances where automated market makers appear to react predictably to order flow.

-

Short-Term Investment (Next 3-9 Months):

- Develop Market Execution Strategies: Experiment with placing orders at prices you don't necessarily expect to be filled immediately, aiming to gauge liquidity and queue depth. Practice using limit orders to manage your entry and exit points.

- Quantify "Fill Velocity": Begin thinking about how to measure the speed and depth of order fills. Consider what data points might be indicative of future price movements based on current order flow.

- Identify Niche Markets: Focus on prediction markets for events with less mainstream attention where market inefficiencies might be more pronounced and bot activity less sophisticated.

-

Long-Term Investment (9-18+ Months):

- Integrate Fundamental and Market Analysis: Build models that combine event probability prediction with an understanding of market dynamics. The goal is to find events where your fundamental edge aligns with a market structure that allows for favorable execution.

- Automate Execution (Cautiously): If you identify consistent patterns in bot behavior or order flow, explore developing small-scale automated trading scripts to exploit these inefficiencies. Be prepared for these edges to be short-lived.

- Stay Ahead of Regulatory Changes: Monitor legislative and regulatory developments impacting prediction markets, as these can significantly alter market access and opportunities.

- Seek Obscure Edges: Continuously research and develop methodologies for quantifying less obvious factors of skill or prediction that are not yet widely incorporated into market pricing.