Western Allies Prioritize China Trade Amid US Friction and China's Imbalances

The United States' increasingly assertive stance on trade and national security has inadvertently created an opening for China to court American allies, pushing them towards a "softer trade policy." This podcast episode, "China Decode: Did the U.S. Push Its Allies Closer to China?" by Alice Han and James Kynge, reveals a complex geopolitical and economic dance where immediate financial incentives clash with long-term strategic concerns. The conversation highlights how nations like Canada and the UK, despite their deep ties to the U.S., are actively seeking economic engagement with China, driven by the substantial financial opportunities on the table. This analysis is crucial for policymakers, business strategists, and anyone seeking to understand the shifting global alliances and the intricate interplay between economic pragmatism and geopolitical pressure. By examining China's lopsided economy and the growing loneliness epidemic, the episode uncovers hidden consequences that challenge conventional wisdom about international relations and economic sustainability.

The Unraveling of Alliances: When Economic Gravity Pulls Allies Away

The current international order feels less like a carefully constructed edifice and more like a "tumble dryer of international affairs," as James Kynge aptly describes it. The United States' aggressive posture, particularly under the Trump administration, has inadvertently created an environment where its staunchest allies--Canada and the UK, and by extension, Europe--are finding reasons to recalibrate their relationships with China. This isn't a sudden pivot, but a series of calculated moves driven by the undeniable lure of economic opportunity. Canada's decision to slash tariffs on Chinese EVs, for instance, directly contradicts Washington's stance and signals a willingness to prioritize immediate economic gains over geopolitical alignment.

The narrative emerging from Beijing is increasingly one of "strategic autonomy from Washington." Chinese media outlets, like the China Daily, are not subtly encouraging allies to distance themselves from U.S. policy, framing it as a necessary step for "mending ties with Beijing." The implications are far-reaching: as allies inch closer to China's sphere of influence, U.S. leverage diminishes, creating a vacuum that Beijing is eager to fill. This dynamic is not merely about trade deals; it's about a fundamental shift in global power structures, where economic self-interest can override long-standing alliances. The risk for these nations is walking a tightrope, attempting to balance the economic benefits of engaging with China against the potential backlash from their most significant economic and security partner, the U.S.

"If Ottawa still chooses to subject its China policy to the will of Washington again in the future, it will only render its previous efforts to mend ties with Beijing in vain."

-- China Daily

The Canadian experience, as detailed by Alice Han, illustrates this tension. Less than a year after Mark Carney campaigned on China being a significant threat, the economic rationale has taken precedence. The agricultural sector benefits from reduced tariffs on exports to China, while the automotive industry faces a new reality with the slashing of EV tariffs. This demonstrates how domestic economic winners and losers can influence a nation's foreign policy, creating a complex web of incentives that pull in different directions. Similarly, the EU's cautious engagement with China's C919 jet and its testing of price minimums for Chinese EVs suggest a pragmatic approach to economic realities, even as geopolitical tensions with the U.S. persist. The Greenland dispute, a seemingly minor issue, has even served to unify Europeans against what they perceive as U.S. aggression, further highlighting the cracks in the transatlantic alliance.

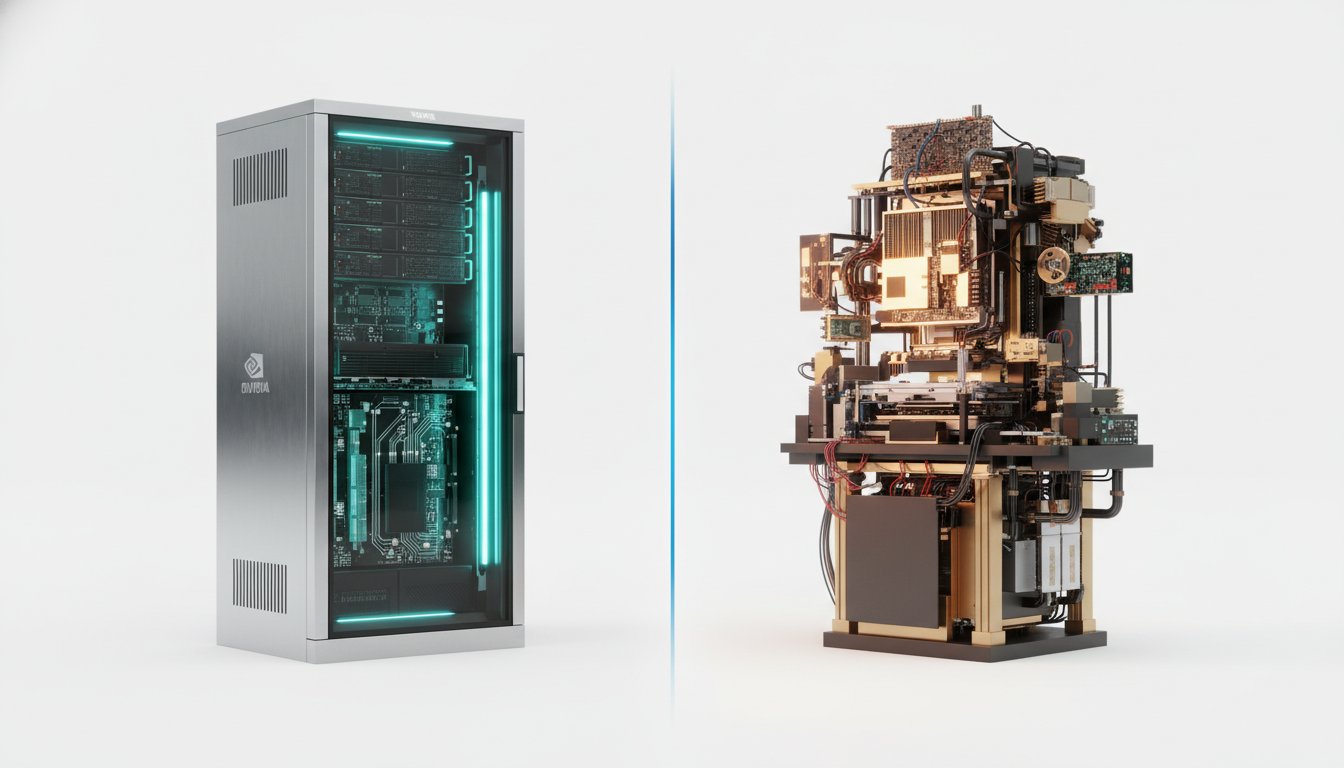

The Paradox of China's Economic Engine: High-Tech Growth Amidst Stagnant Domestic Demand

China's economy presents a stark paradox: a world-leading high-tech manufacturing powerhouse that struggles to direct the fruits of its advancements to its own people. While exports and high-tech output surge, domestic consumption remains sluggish, birth rates plummet, and the property sector grapples with a deepening crisis. This "lopsided economy," as Kynge terms it, is heavily reliant on exports, making up a third of GDP--a level not seen since 1997. This imbalance is a direct consequence of Beijing's efforts to manage domestic economic challenges, such as cracking down on the real estate sector and local government debt.

The data is telling: high-tech manufacturing output rose 9.4% last year, while retail sales grew by a mere 3.7%. This disparity underscores a fundamental weakness: an inability to translate economic prowess into improved living standards that encourage domestic spending and family formation. The consequence is a society where economic growth is not effectively "returning the fruits of labor to people so that they feel that they can have families," leading to a birth rate at its lowest since 1949. This situation creates a deflationary spiral, where cheap Chinese products flood global markets, boosting exports at the expense of competitors worldwide, while domestic demand remains insufficient.

"So what you've got is high-tech manufacturing growing at more than double the speed of the amount of money that people are spending on things to buy."

-- James Kynge

The reliance on exports and fixed asset investment, rather than domestic consumption, is a strategic choice driven by China's commitment to annual growth targets. The upcoming March National People's Congress meeting is expected to reaffirm a 5% GDP target, necessitating continued economic stimulus. While there's fiscal space for increased government debt, the underlying structural problems--particularly the depressed property sector, which historically accounts for a quarter of GDP--remain largely unaddressed. The knock-on effects on household wealth, spending, and confidence are significant, suggesting that without a fundamental shift towards boosting per capita disposable incomes and wage growth, China's economic trajectory is precarious.

The Digital Echo Chamber: Loneliness in a Connected World

The viral success of the app "Demou" (formerly "Are You Dead?"), designed to check in on individuals living alone, is a poignant indicator of China's growing loneliness epidemic. With an estimated 200 million one-person households projected by 2030, this app taps into a deep societal need for connection and safety. The founders' explanation of the name--combining death with nonsense syllables--hints at a morbid humor born from a genuine crisis. This phenomenon is not confined to the elderly; young people, often only children in a society historically driven by family, are increasingly isolated.

The digital matrix has become a substitute for real-world interaction, contributing to a sense of detachment and a "tang ping" (lie flat) mentality, where the drive to work and strive diminishes. This is exacerbated by declining marriage rates--down 50% over the last decade--and a lack of economic momentum that discourages family formation. The pressure of being the sole caregiver for aging parents in the future adds another layer of anxiety. This societal shift, moving away from a family-centric model rooted in Confucian thought towards a more isolated, digitally-mediated existence, represents a profound cultural transformation.

"I think we end up with a society in China that is actually more isolated than it has ever been. And remember, this is a very family-driven society."

-- Alice Han

The contrast between the societal emphasis on family and the reality of increasing isolation is stark. While some turn to religion, like Buddhism, for solace, many remain immersed in the digital ecosystem. This creates a societal vacuum, a self-questioning about the purpose of life and achievement in the absence of strong social bonds and perceived economic opportunity. The challenge for China lies in fostering genuine community and ensuring that individuals feel their lives "matter," a need that cannot be fully met through subsidies or digital platforms alone.

Key Action Items:

-

Immediate Actions (Next 1-3 Months):

- Diversify Trade Relationships: For businesses, actively explore and cultivate trade relationships beyond traditional U.S. partners, particularly in Asia, to mitigate risks associated with shifting geopolitical alliances.

- Monitor Chinese Economic Policy: Closely track the outcomes of the March National People's Congress for signals on China's approach to domestic consumption, real estate, and export support.

- Assess Supply Chain Resilience: For companies with significant ties to China, conduct a thorough review of supply chain vulnerabilities and identify alternative sourcing or manufacturing locations.

- Engage with Local Communities: For organizations operating in or with ties to China, explore initiatives that foster genuine community engagement and support social well-being beyond purely economic interactions.

-

Longer-Term Investments (6-18 Months and Beyond):

- Develop "Strategic Autonomy" Frameworks: For nations and corporations, develop policies and strategies that prioritize long-term resilience and independent decision-making, reducing over-reliance on any single geopolitical bloc. This pays off in 12-18 months by creating flexibility.

- Invest in Domestic Demand Drivers: For economies heavily reliant on exports, prioritize policies that stimulate domestic consumption, such as increasing per capita disposable incomes and wage growth. This is a multi-year investment with delayed but significant payoffs.

- Foster Digital Well-being Initiatives: Invest in and support programs that address digital isolation and promote mental well-being, recognizing the growing trend of digital-first interactions. This requires patience, as cultural shifts take time.

- Build Cross-Cultural Understanding: Support initiatives that bridge cultural divides and foster empathy, recognizing that geopolitical tensions are often amplified by a lack of nuanced understanding. This creates lasting advantage by building trust.

- Anticipate Chip War Evolution: For technology firms, prepare for continued volatility in the AI chip market, anticipating China's increasing domestic capabilities and potential shifts in market share. This requires ongoing R&D and strategic partnerships.