Automate Savings and Investments for Financial Freedom

The "Automatic Economy" is creating unprecedented wealth, but it's leaving 70% of people behind. This conversation with David Bach reveals how to harness its power, not be consumed by it. If you're struggling paycheck-to-paycheck, feel trapped by debt, or simply doubt your ability to build wealth, this episode offers a clear, actionable path forward. Bach's insights cut through the noise, exposing the hidden consequences of conventional financial advice and offering a system designed for lasting financial freedom. Understanding these dynamics gives you a significant advantage in navigating an economy that rewards proactive, automated financial planning.

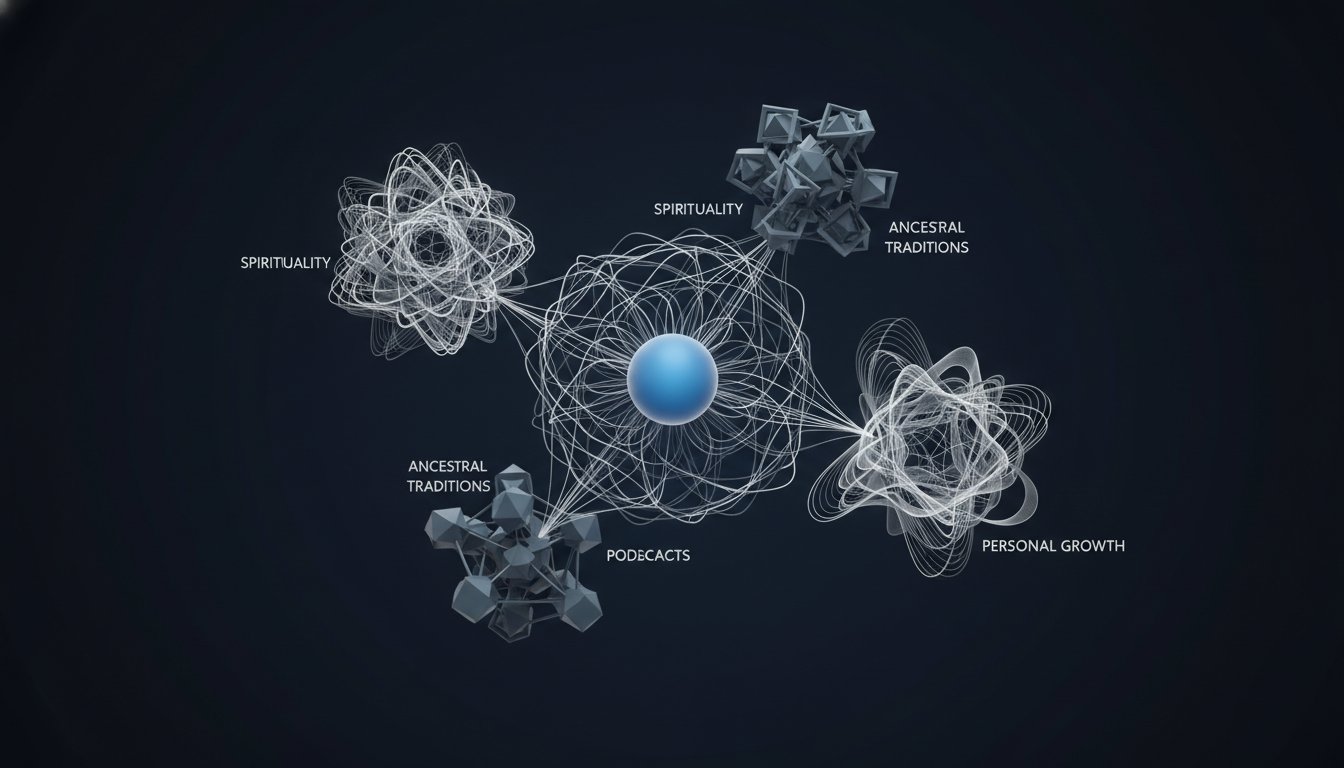

The prevailing narrative in personal finance often focuses on immediate gains and obvious solutions, but David Bach, in his conversation with Mel Robbins, illuminates a more profound truth: the modern economy, which he terms the "automatic economy," is a double-edged sword. It's a system designed to generate immense wealth, yet it simultaneously preys on those who lack a deliberate plan, creating a widening chasm between the financially secure and those living paycheck-to-paycheck. This analysis delves into the layered consequences of inaction and the strategic advantages of embracing an automated approach to wealth building.

One of the most significant, yet often overlooked, consequences Bach highlights is the passive erosion of wealth through a lack of planning. He posits that if you don't have a plan for your money, "someone else has a plan for your money." This isn't a vague philosophical point; it's a direct observation of how technology and subscription models are designed to extract value from consumers continuously. Your phone, a ubiquitous tool, becomes a "money magnet," either actively building your wealth or passively draining it through automatic deductions for services, subscriptions, and impulse purchases. The "no plan plan," as Bach calls it, is the default state for many, leading to a perpetual cycle of earning and spending without any accumulation. This passive leakage, compounded over years, represents a significant lost opportunity for growth, directly contributing to the statistic that seven out of ten people live paycheck-to-paycheck. The immediate gratification of convenience and access, facilitated by technology, creates a downstream effect of financial stagnation.

"The phone that we hold all day long is a money magnet. That means this tool is either helping you build wealth or it's taking wealth away from you. And by the way, in both cases, it's automatic."

-- David Bach

The second critical insight lies in the deceptive nature of income increases. The common belief that "if I make more money, I'll be rich" is a dangerous myth. Bach argues that wealth is not solely about earning more, but about "keeping some money." This distinction is crucial for understanding delayed payoffs. The "automatic economy" incentivizes spending, and without a system to automatically redirect a portion of income towards savings and investments, increased earnings often just translate into increased expenses. The concept of "paying yourself first," specifically allocating a portion of income to retirement accounts before discretionary spending, is presented not as a sacrifice, but as a strategic imperative. By automating this savings, typically one hour of income per day (around 12.5% of gross income), individuals create a buffer against immediate temptations and ensure that future wealth is being built systematically. The delayed gratification inherent in this approach is what creates a lasting competitive advantage. While others might spend their raises, those who automate savings are building a foundation that compounds over time, a payoff that is invisible in the short term but transformative in the long run.

"The biggest myth we have about money is if I make more money I'll be rich. You won't be rich if you make more money if you don't keep some money. You got to make money and then keep some money."

-- David Bach

A third profound consequence Bach unpacks is the hidden cost of financial inertia, particularly evident in retirement planning and rollovers. Many individuals meticulously save in their 401(k)s, only to derail their progress through simple, yet costly, mistakes when changing jobs. The act of rolling over a 401(k) into an IRA or a new employer's plan, while often necessary, can inadvertently lead to significant losses if the funds are not reinvested appropriately. A common pitfall is the money being held in cash, missing out on market growth. Vanguard's study highlighting that this single mistake can cost the average person $300,000 underscores the systemic impact of seemingly minor oversights. This reveals a critical failure point in conventional advice: it often stops at the action (e.g., "rollover your 401(k)") without adequately detailing the downstream consequences of how that action is executed. The implication is that true financial mastery requires not just taking steps, but ensuring those steps are integrated into a continuous, automated system that accounts for life transitions.

"Vanguard thinks that that single mistake alone--you switch from one plan to another, you were saving at a certain rate, you got opted in at a lower rate, you didn't bump it back up again--is costing the average person $300,000 in retirement."

-- David Bach

Finally, Bach challenges the notion that time is an insurmountable barrier to financial freedom, particularly for those starting later in life. The narrative that "it's too late" is a self-defeating mindset that the "automatic economy" thrives on. He illustrates with the story of a woman in her 50s who could still build significant wealth by saving a modest amount daily. This highlights that while compounding interest is powerful, proactive saving and disciplined investment, even with a shorter time horizon, can yield substantial results. The key is to create an "automatic plan"--a system of saving for retirement, emergencies, and dreams--that functions consistently. The discomfort of making small sacrifices now--like reducing discretionary spending by $20 a day--is presented as the direct precursor to future financial security. This requires a proactive "money date" with oneself or a partner to assess values against expenses, ensuring that spending aligns with long-term goals rather than immediate impulses. The conventional wisdom that you must start early to win the wealth-building game fails to account for the power of consistent, automated action, even when time is limited.

Key Action Items:

- Automate Your Savings: Immediately set up automatic transfers from your checking account to a retirement account (IRA or 401k) and an emergency fund. Aim for at least one hour of your income per day (approx. 12.5% gross).

- Immediate Action: Set up one automatic transfer this week.

- Longer-Term Investment: Gradually increase your automated savings rate over the next 6-12 months.

- Rip the Band-Aid on Your 401(k): If you have a 401(k) at work, ensure you are contributing at least 12.5% of your gross income. If you are changing jobs, initiate a rollover to an IRA immediately and ensure funds are invested, not held in cash.

- Immediate Action: Review your current 401(k) contribution rate and investment choices.

- This pays off in 12-18 months: By consistently contributing and investing correctly, you will see the power of compounding begin to work.

- Establish an Emergency Fund: Dedicate a separate, liquid account (like a money market account) for emergencies. Aim to save 3-5% of your income towards this fund.

- Immediate Action: Open a dedicated savings or money market account.

- This pays off in 6-12 months: Having 3-6 months of living expenses saved provides significant financial security.

- Prioritize Values Over Expenses: Conduct a "money date" to compare your current spending habits against your core values. Identify and cut expenses that conflict with what truly matters to you.

- Immediate Action: Schedule your first money date within the next two weeks.

- This pays off in 3-6 months: Aligning spending with values reduces financial stress and frees up capital for savings.

- Tackle Credit Card Debt Strategically: Implement the "Done on Last Payment" (DOLP) system by paying off the smallest balance credit cards first, regardless of interest rate, to reduce the number of accounts and potential late fees.

- Immediate Action: List all credit cards and their balances, identify the smallest.

- This pays off in 6-24 months: Rapidly reducing the number of cards simplifies management and builds momentum.

- Invest in Diversified Index Funds: For retirement and long-term goals, invest in low-cost, diversified index funds (like Vanguard's VTI). Avoid trying to pick individual stocks.

- Immediate Action: Research and select a broad-market index fund for your IRA or brokerage account.

- This pays off in 5+ years: Consistent investment in diversified funds provides steady, long-term growth.

- Prepare for Life's Curveballs: If married, conduct a "financial drill" with your partner to understand all accounts, passwords, insurance policies, and wills. If single, ensure you have an updated will and understand your financial landscape.

- Immediate Action: Schedule a discussion with your partner about financial preparedness or start organizing your own financial documents.

- This pays off immediately: Reduces future stress and ensures your wishes are met during difficult times.