Market Shift: From Tech Cash Flow to Alpha Generation

TL;DR

- The current market's "rivers of cash flow" from large tech companies are unprecedented, enabling significant reinvestment in R&D and competitive moats, though AI's ultimate return on investment for many remains a question.

- Next year is expected to be more normalized with increased volatility, potentially favoring mid and small caps if M&A activity rises and valuations adjust, especially with potential rate cuts.

- Productivity gains through technology and improved logistics are leading to job reductions across various sectors, creating a social problem of underemployment despite aggregate economic strength.

- Tariffs are a significant factor for the U.S. deficit, potentially covering a substantial portion of the projected shortfall over the next decade, making them a critical policy watchpoint.

- Housing velocity is crucial for the U.S. economy, impacting labor mobility and wealth creation for a majority of citizens; lower mortgage rates are needed to stimulate activity.

- The Fed is expected to lower the funds rate to 3%, with the 10-year Treasury yield stabilizing between 3.5% and 4% being a critical indicator for market and economic stability.

- Fixed income investing success hinges on broad diversification and consistent income generation ("breadth"), contrasting with equities where upside convexity and specific company performance are key.

Deep Dive

The current market environment, characterized by all-time highs and significant free cash flow generation from large technology companies, presents a complex landscape for investors. While the robust cash flow provides a strong foundation, the elevated multiples and evolving economic dynamics suggest a coming shift towards higher volatility and a need for more nuanced investment strategies. This transition will likely move away from the "easy money" of recent years, driven by broad market trends and stimulus, towards a more discerning approach focused on generating alpha through careful selection and risk management.

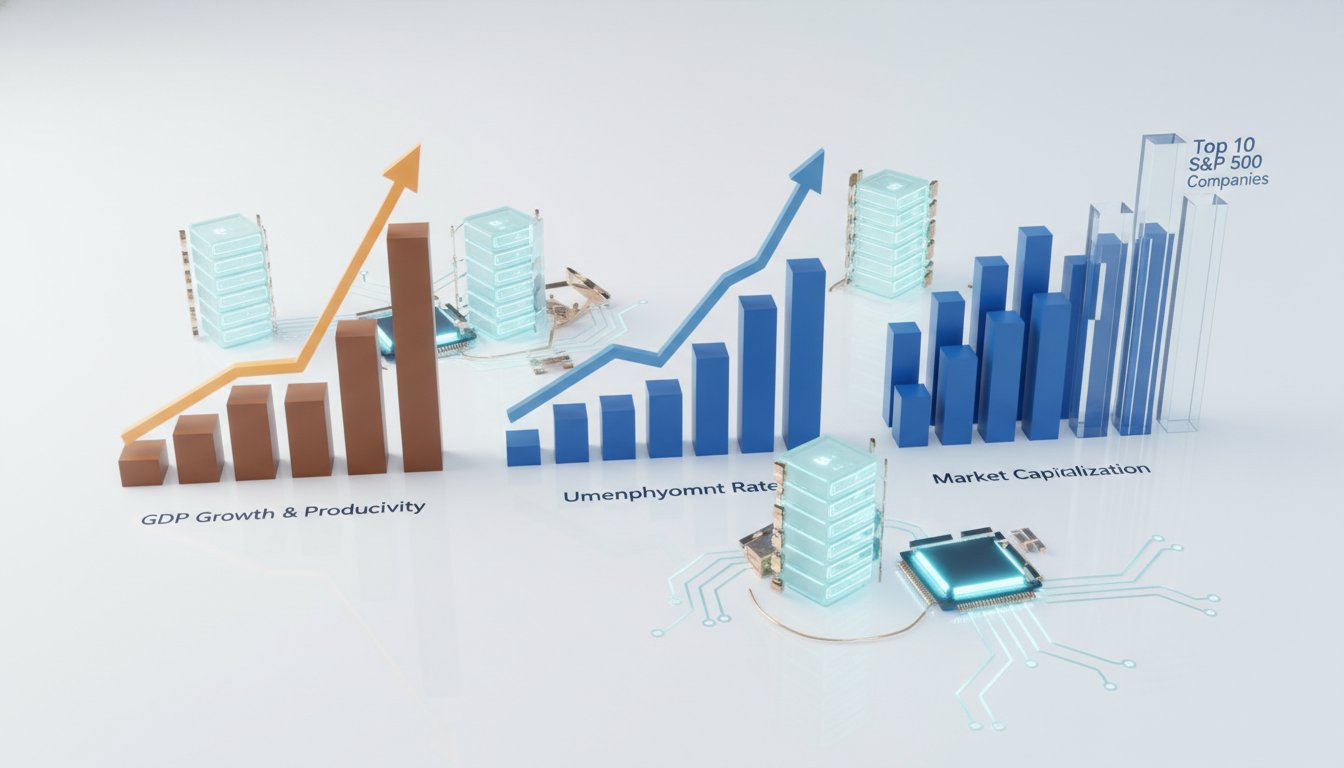

The extraordinary free cash flow generated by major tech firms, fueled by top-line revenue growth and high returns on equity, continues to be a dominant market force. This cash allows companies to reinvest in research and development, buy back stock, and expand their competitive moats. However, questions are emerging about the sustainability and future returns of AI investments for many, even as infrastructure and data-utilizing companies are poised to maintain strong cash flow for the next few years. While equities are expected to perform their function, the S&P 500's broad composition, with many companies not experiencing such "fast rivers of cash flow," makes a generalized strong performance more challenging. Multiples are high, indicating that while markets may not necessarily decline, volatility will increase.

Looking ahead, 2026 is anticipated to be a year of "more alpha, less beta," meaning that broad market movements will be less reliable for generating returns, and active selection will become paramount. This shift is partly driven by the increasing productivity across various sectors, from inventory management to logistics, which is leading companies to focus on cost reduction, including human capital. This trend, while boosting corporate margins, poses a significant social challenge regarding employment. Furthermore, the housing market's critical role in wealth and labor mobility is highlighted, suggesting that lower interest rates are essential to revive housing velocity and support broader economic activity. The Federal Reserve's path of rate cuts is seen as necessary, with a potential target for the funds rate around three percent, but the stability of the 10-year Treasury yield between 3.5% and 4% is deemed more crucial for broader economic and market stability.

The distinction between gambling and investing is becoming increasingly relevant as the market moves from a period of broad gains to one requiring more specific insight. Gambling, characterized by short timeframes and a focus on events, contrasts with investing, which involves owning durable assets with long-term value creation potential. The success of athletes like Nadal, who win by excelling in crucial points rather than every single point, serves as an analogy for investors needing to tilt the odds in their favor through rigorous research, analytics, and risk management, especially in more inefficient markets where alpha generation is more probable. While private credit is not a "nothing burger" and will experience episodic issues, it is not expected to cause a seismic shock due to generally better economic conditions and more robust leverage structures compared to past crises. Ultimately, investors must retrain their approach for the coming years, anticipating higher volatility and focusing on discerning winners in technological advancements and data utilization, rather than relying on the broader market trends that characterized the preceding easier period.

Action Items

- Audit big-tech free cash flow: Identify 3-5 companies with the highest free cash flow generation to understand drivers of sustained moat expansion.

- Analyze AI impact on jobs: Quantify potential displacement of lower-skilled roles by productivity gains across 5-10 support functions.

- Measure housing market velocity: Track existing home sales and mortgage rate correlations to assess labor mobility and wealth creation impact.

- Evaluate emerging market dollar-denominated debt: Assess 3-5 key emerging markets for stability and potential currency exposure benefits.

- Track precious metals diversification: Monitor gold reserve manager allocation trends to understand shifts in global currency diversification strategies.

Key Quotes

"I have to say in November felt worse than it ended up being you know there was a lot of all a lot of volatility it ended up but it ended up the equity market ended up in the black bond market ended up in the black and if you if you took the month off sometimes I feel like that would have been good but if I took the month off you come back and say yeah it was okay but it was some hand wringing times during during November for sure but you know it's part part of you know I've learned over the years it's like cleanses them you need a bit of a cleansing there's something about year end decade end that sort of marks passages you know the end of the late 90s the millennium I don't know what led Japanese bubble into the 80s it feels like there's something about just year end I I 100 agree with you there's nothing magical about year end but for some reason the passage of time you know on this strange calendar year we have it seems to mark these type of turning points"

Rick Rieder observes that market sentiment and trading activity often intensify around year-end, even if the underlying economic differences between months are minimal. He notes that while November presented volatility, both equity and bond markets ultimately finished positively, suggesting that periods of "hand-wringing" can be a cleansing experience. Rieder agrees that year-end often feels like a marker for turning points, similar to past significant market transitions.

"the fast rivers of cash flow I've never I mean I've been doing this I'm about to do my fourth decade I still can't believe it is the case but I've never seen anything like it at this scale as these companies can create this sort of top line revenue growth this sort of return on equity and throw off free cash flow of this size so you know free cash flow is like the lifeblood of any company because if you have free cash flow you can spend on capex you spend on r d you buy back your stock and it just becomes this self fulfilling prophecy of gosh when you're when you're performing at that level particularly at that scale it just allows you to keep motivating it higher because you're just extending your the your your moat you're building because you can spend more on r d etc"

Rick Rieder expresses astonishment at the scale of free cash flow generated by large companies, a phenomenon he has not witnessed in his nearly four decades of experience. He explains that free cash flow is crucial for a company's operations, enabling investments in capital expenditures, research and development, and stock buybacks. Rieder highlights that this strong cash flow allows companies to continuously strengthen their competitive advantages, or "moats," by reinvesting in their businesses.

"I think it'll be a more normalized return dynamic so you know we've spent some time I don't like small caps I don't like them and I think like the shows we've talked about on past we'll say what do I think of small caps I like not very often because I think digital and the utilization of data is so powerful that I just think it's very hard to compete as a small cap business however I think there's a couple there are a few things that play that could make it a bit different one I think you'll see m a that will be high so you'll see some of these companies that will get through vertical integration otherwise will get taken out"

Rick Rieder anticipates a more normalized return environment in the upcoming year, particularly regarding small-cap stocks. He expresses a general skepticism towards small caps due to the power of digital technology and data utilization, which he believes makes it difficult for smaller businesses to compete. However, Rieder suggests that potential mergers and acquisitions (M&A) could create opportunities for some small-cap companies, as they might be acquired through vertical integration strategies.

"I think the fed has to kind of interest rates is I think all the ordinary you know the ordinary jobs are going you know the lower skilled jobs are going away and I think it's a travesty and I know I don't it's like nobody not anybody's fault I think that is the evolution and it's not ai or today it's not ai it's productivity through inventory management logistics predictive maintenance client procurement like you can go across the board in every area of support so I think what happens these companies say okay my top line revenue is not growing as fast as it used to it's still okay but okay but if I can keep my margins up how do I keep my margins up i get my cost of goods sold down i get my sg a down i get my human capital lower"

Rick Rieder discusses a significant trend where ordinary, lower-skilled jobs are disappearing due to productivity gains across various business functions, not solely driven by AI. He views this as a societal issue, a "travesty," that is an evolution of business operations. Rieder explains that companies are focusing on maintaining margins by reducing costs, including human capital, as top-line revenue growth may slow, leading to job displacement.

"I think the key to investing is everybody talks about the same thing at the same time and it's like predicting where we're going to we're going to be I always say this we're not in the business of being right we're in the business of generate return for clients oftentimes it's not being right it's what do people what do we have to anticipate and what will others think over the next six months a year and if and if you can get in you know think it out at a different level around that it's hugely powerful"

Rick Rieder emphasizes that successful investing is not about being correct in predictions but about generating returns for clients. He suggests that the key is to anticipate market movements and understand how others will perceive them over a specific timeframe, such as six months to a year. Rieder believes that thinking about these dynamics at a different level of analysis is crucial for effective investment strategy.

"I think 2026 is going to be in particular in fixed income more alpha less beta meaning like I just don't think we're gonna ride spreads tighter I don't think we're gonna ride like a surfboard of yield improvement that's gonna really help us I think it's gonna be you know we see it today you are seeing some of the credit quality deteriorate in some areas we talked about lower incomes harder so you know like things like subprime auto tough and some of the underwritten credit markets or some of the they say underwritten not underwritten private credit markets some of the privates like I have to say I've definitely seen a bunch more of lending and things like software uh middle market that is definitely trickier I think 2026 we'll see not shockingly higher defaults that is the systemic problem but I think you're going to be more landmines"

Rick Rieder predicts that 2026 will be characterized by more alpha (skill-based returns) and less beta (market-driven returns) in fixed income. He believes investors will

Resources

External Resources

Books

- "The Money Game" by Adam Smith - Mentioned for a quote about market sentiment at all-time highs.

Articles & Papers

- "The Idea Farm" - Mentioned as a resource for following.

People

- Rick Rieder - Chief Investment Officer of Global Fixed Income at BlackRock, guest on the podcast.

- Meb Faber - Host of "The Meb Faber Show - Better Investing," co-founder and Chief Investment Officer at Cambria Investment Management.

- Ed Thorp - Past guest on the podcast.

- Richard Thaler - Past guest on the podcast.

- Jeremy Grantham - Past guest on the podcast.

- Joel Greenblatt - Past guest on the podcast.

- Campbell Harvey - Past guest on the podcast.

- Ivy Zelman - Past guest on the podcast.

- Kathryn Kaminski - Past guest on the podcast.

- Jason Calacanis - Past guest on the podcast.

- Whitney Baker - Past guest on the podcast.

- Aswath Damodaran - Past guest on the podcast.

- Howard Marks - Past guest on the podcast.

- Tom Barton - Past guest on the podcast.

- Russ - Partner of Rick Rieder, discusses AI's democratization of business.

- Annie Duke - Past guest on the podcast, discussed for her insights on decision-making versus outcomes.

- Paul Tudor Jones - Mentioned as a technical investor.

- Scott Galloway - Mentioned for a quote about aging.

- Elon Musk - Mentioned for comments on the future of phones.

- Peter Lynch - Mentioned for his approach to trying new things.

Organizations & Institutions

- BlackRock - Employer of guest Rick Rieder.

- Cambria Investment Management - Employer of host Meb Faber.

- The Podcast Consultant - Provided editing and post-production work for the episode.

- Liberty Mutual Insurance Company - Sponsor of the podcast.

- Godaddy Arrow - Sponsor of the podcast.

Websites & Online Resources

- acretrader.com/meb - Website for sponsor AcreTrader.

- mebfaber.com/podcast - Website for show notes.

- cambriafunds.com/351 - Website for information on 351 ETF exchange.

- cambriainvestments.com - Website for Cambria Investment Management.

- The Meb Faber Show (X, LinkedIn, Instagram, TikTok) - Social media for The Idea Farm.

- megaphone.fm/adchoices - Website for ad choices.

Podcasts & Audio

- The Meb Faber Show - Better Investing - The podcast featuring the episode.

Other Resources

- BINC ETF - Mentioned in relation to fixed income outlook.

- Meta Ray-Ban Glasses - Mentioned as a useful personal item for calls and photos.

- Tesla Full Self-Driving - Discussed as a rapidly advancing technology impacting jobs.

- Waymo - Mentioned as an example of autonomous vehicle presence on roads.

- Peloton - Mentioned as a technology that was tried out.

- Apple Store - Mentioned as an example of a retail presence that was impressive.

- Vision Pro - Mentioned as a new technology being tried.

- Baby Bonds, Freedom Dividends, Trump Accounts, Invested America - Mentioned as new initiatives for investing for young people.