Sphere Entertainment's Pivot to Smaller, Franchised Venues

The $2.3 billion Las Vegas Sphere, initially perceived as a colossal financial gamble, is now revealing a sophisticated strategy centered on scaling down. This announcement of a second, smaller venue in National Harbor signifies a calculated pivot away from the high-risk, high-cost model of its flagship. The hidden consequences of this shift are profound: it transforms Sphere Entertainment from a capital-intensive operator into a potentially asset-light licensor, leveraging content and technology across a wider network. This conversation is crucial for investors, entertainment industry strategists, and anyone charting the future of large-scale experiential ventures, offering a blueprint for how to de-risk ambitious projects by embracing smaller footprints and delayed, compounding returns.

The J-Curve and the Unseen Economics of Experience

The initial narrative surrounding the Las Vegas Sphere was dominated by sensational headlines highlighting its massive construction cost and early operating losses. This perspective, while attention-grabbing, fundamentally misunderstands the economics of building and operating a venue of such unprecedented scale. The transcript clearly illustrates this by detailing the significant capital expenditure (capex) and fixed costs associated with the Sphere. These include not only the $2.3 billion construction price tag but also ongoing expenses for operations, staffing, maintenance, and technology upkeep. This inherent cost structure naturally leads to a J-curve financial performance: initial periods are characterized by high overhead and inefficiencies, followed by improving profitability as utilization increases, content is amortized, and operational expertise grows.

The narrative of failure, perpetuated by viral YouTube videos, overlooks the crucial distinction between reported operating losses and adjusted profitability. While the Sphere reported substantial losses in its first fiscal year, these figures were heavily influenced by depreciation and amortization. By the third quarter of the following year, the Sphere had already turned profitable on an adjusted basis, demonstrating a significant turnaround. This turnaround is driven by multiple revenue streams, including the immersive "Sphere Experience" films, lucrative concert residencies, high-impact external advertising, and corporate event rentals. The success of "The Wizard of Oz" production, generating over $260 million in ticket sales and serving as a template for future IP adaptations, exemplifies how content reuse dramatically improves return on investment. The average revenue per show for "Postcard from Earth" ($408,000 against $125,000 in operating expenses) highlights the substantial profit margins achievable once initial content development costs are absorbed.

"So, while it is true that the Sphere reported operating losses of more than $500 million in its first fiscal year, the numbers have been and will continue to improve over time."

This financial trajectory underscores a critical lesson: immediate financial performance is often a poor indicator of long-term success for capital-intensive, experience-driven businesses. The market's positive reaction, with the stock price more than doubling, suggests investors are looking beyond the initial J-curve and recognizing the underlying value of the model.

From Global Ambition to Networked Mini-Spheres: De-Risking Expansion

The initial vision for Sphere Entertainment involved a global network of large-scale venues, aiming to leverage economies of scale and brand ubiquity. However, the astronomical cost of the Las Vegas Sphere ($2.3 billion against an initial $1.2 billion estimate) and challenges in securing international locations--such as the rejection in London due to light pollution concerns, resulting in a $116.5 million impairment charge--highlighted the inherent risks of this replication-heavy strategy. The demand for additional 20,000-seat, multi-billion-dollar venues proved to be lower than anticipated, making self-financed expansion a precarious proposition.

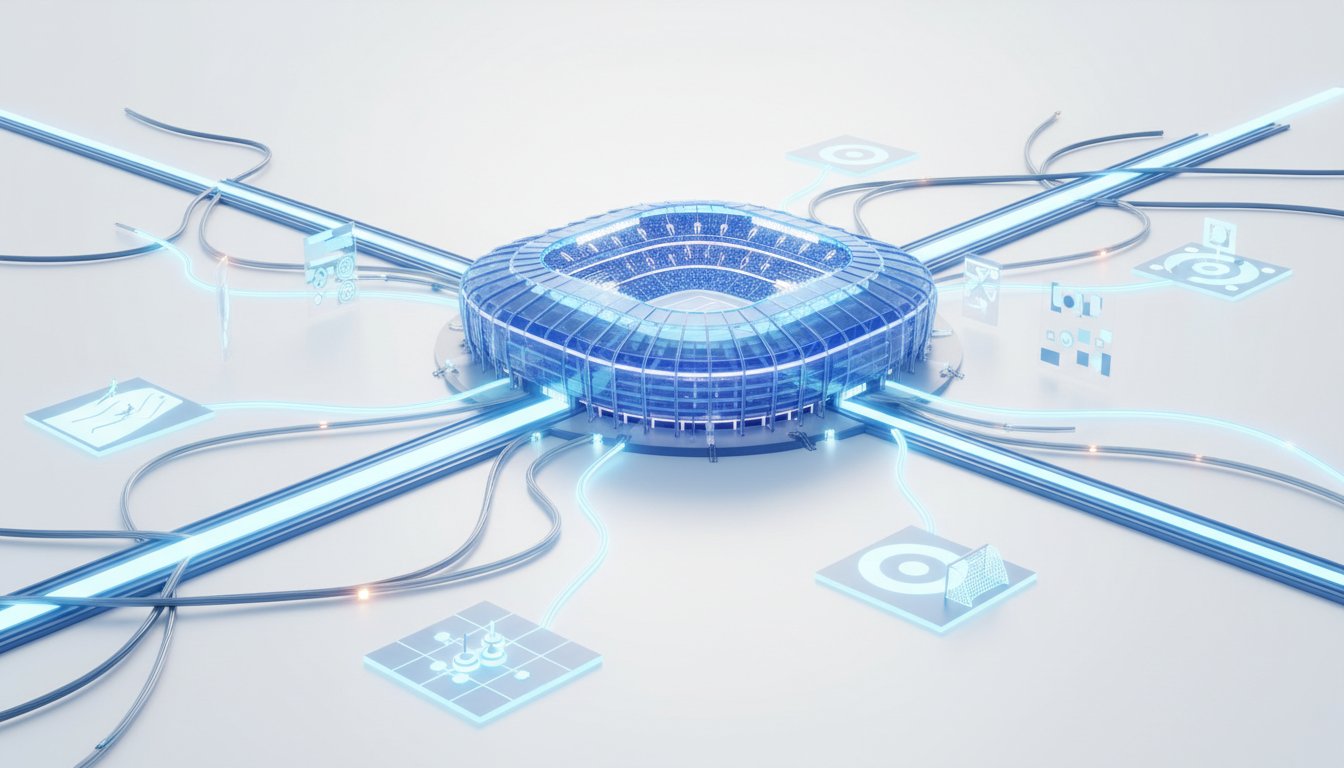

This realization necessitated a strategic pivot towards de-risking expansion. Sphere Entertainment is now pursuing two primary avenues: a franchise model and the development of "mini-Spheres." The Abu Dhabi deal, where the region acquired rights to build and operate Sphere Abu Dhabi and regional exclusivity for additional venues, exemplifies the franchise approach. This transforms Sphere Entertainment from a capital-intensive operator into an asset-light licensor, earning initiation fees and ongoing royalties. This model, however, is best suited for markets willing to pay a premium.

The more significant shift is the introduction of smaller, 6,000-seat venues, exemplified by the National Harbor project near Washington D.C., estimated to cost around $1 billion. While these smaller venues still require significant investment in core technology, they dramatically reduce capex and construction complexity. Crucially, they expand the addressable market. While perhaps only a dozen cities could support a $2.3 billion Sphere, the transcript suggests over 100 cities could potentially support a $1 billion, 6,000-seat venue. This strategy also aligns better with local government incentives, as seen with the reported $200 million in state, local, and private incentives for the National Harbor project. This makes the economic case for expansion cleaner and more palatable, reducing the financial burden on Sphere Entertainment's balance sheet.

"To make the business model work, expanding from one venue to dozens, Sphere Entertainment had to find an alternative solution to de-risk its expansion process."

This strategic recalibration moves Sphere Entertainment from a model reliant on singular, massive bets to a networked approach, where the success of individual components contributes to a larger, more resilient ecosystem.

The Compounding Advantages of Smaller Footprints

The shift to smaller venues unlocks several compounding economic advantages that extend beyond simply reducing upfront costs. Firstly, it revolutionizes content networks. The original Sphere productions, costing $80 million to $100 million each, become assets that can be deployed across multiple cities. The marginal cost of programming "The Wizard of Oz" in a new location is significantly lower than creating a new original production, thereby dramatically improving the return on investment for that content. This model leverages the initial creative investment across a wider base, making the economics of each original production far more sustainable.

Secondly, this strategy enhances content adoption. The high cost of programming--estimated at upwards of $400,000 per song--previously necessitated multi-show residencies for artists to make financial sense. Smaller venues, however, allow for the creation of standardized "Sphere-ready" show packages. This broadens the potential roster of artists and performers who can utilize the technology, moving beyond a select few with the ability to commit to extended engagements.

Finally, and perhaps most critically, smaller venues increase utilization. The "wow factor" of the Sphere's immersive technology is paramount, and this can be achieved with a smaller capacity. A 6,000-seat venue is inherently easier to fill than an 18,000-seat one, increasing the likelihood of sold-out shows and supporting more frequent residencies and corporate events. This focus on maximizing the utilization of the core technology, rather than the sheer scale of the venue, is a key differentiator. It suggests that the Sphere's ultimate value proposition lies in its unique technological capabilities, which can be effectively monetized across a broader spectrum of venue sizes and event types. By focusing on filling a smaller, more manageable space, Sphere Entertainment can achieve higher per-seat revenue and a more consistent operational rhythm, turning a perceived limitation into a strategic advantage.

Key Action Items

- Immediate Action (Next Quarter): Analyze the financial reports of Sphere Entertainment, focusing on adjusted operating income and revenue per show for "Sphere Experience" films, rather than just headline operating losses. This provides a clearer picture of underlying profitability.

- Immediate Action (Next Quarter): Monitor news and financial disclosures related to the National Harbor "mini-Sphere" project, paying close attention to construction timelines, reported costs, and any additional incentive packages secured.

- Short-Term Investment (Next 6-12 Months): Evaluate the performance of existing concert residencies and advertising packages in the Las Vegas Sphere. Assess how these revenue streams are contributing to profitability as the venue matures.

- Short-Term Investment (Next 6-12 Months): Track the success of "The Wizard of Oz" and other Sphere Experience films in generating revenue across multiple showings and potential future deployments. This indicates the scalability of Sphere's content model.

- Medium-Term Investment (12-18 Months): Assess the impact of the National Harbor venue (or any subsequent mini-Spheres) on Sphere Entertainment's overall revenue diversification and market penetration.

- Medium-Term Investment (12-18 Months): Observe how Sphere Entertainment leverages its technology and content library to attract a broader range of artists and corporate clients to its smaller venues.

- Long-Term Investment (18+ Months): Evaluate the success of the franchise model by tracking new international deals and the financial performance of venues like Sphere Abu Dhabi, assessing its contribution to an asset-light growth strategy.