Solving Core Business Model Challenges Unlocks Enterprise Value

In this conversation, Alex Hormozi breaks down the fundamental "shapes" of businesses, revealing that common challenges are often inherent features, not bugs, of a chosen model. Understanding your business's shape is crucial for navigating its unique growth constraints and unlocking significant enterprise value. The hidden consequences of this framework lie in recognizing that what feels like a problem might simply be the inherent difficulty of your chosen path, and conquering this difficulty is precisely where massive rewards are found. Entrepreneurs, founders, and aspiring business owners should read this to gain clarity on their current business model, anticipate its unique hurdles, and strategically invest resources to overcome them, thereby creating a sustainable competitive advantage.

The Four Shapes of Business: Navigating Inherent Challenges for Exponential Growth

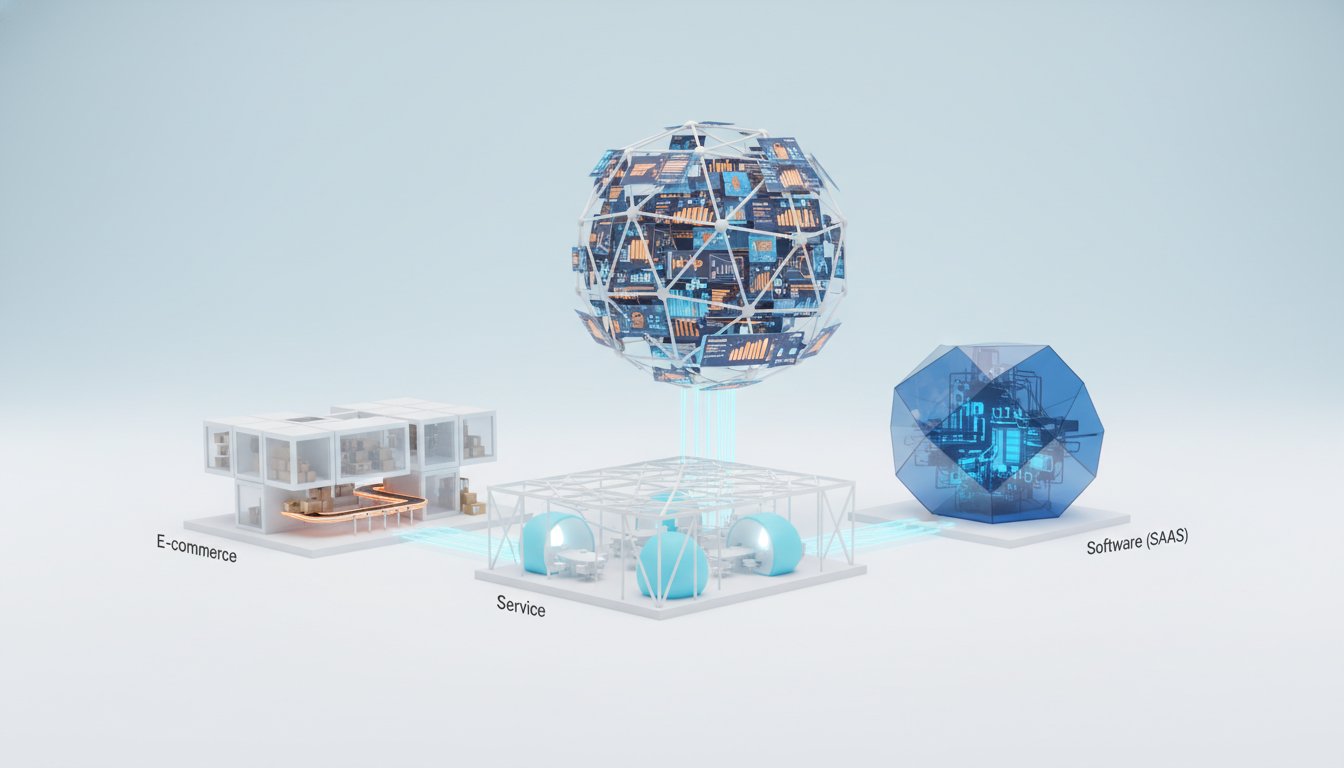

The business landscape is often perceived as a chaotic, unpredictable realm where success hinges on a series of brilliant, often lucky, decisions. However, in a recent conversation on "The Game with Alex Hormozi," Alex Hormozi offers a counterintuitive insight: most businesses, regardless of their industry, conform to one of four fundamental "shapes." These shapes are not merely classifications; they are blueprints that dictate the inherent challenges and opportunities within a business model. The conventional wisdom often mistakes these inherent features for critical flaws, leading entrepreneurs down paths of frustration and stagnation. Hormozi argues that understanding your business's shape is the key to unlocking its true potential, not by fighting its nature, but by mastering its unique set of problems. This deeper understanding reveals the systematic blind spots that plague many businesses, allowing those who grasp it to gain a significant competitive edge.

The E-commerce Enigma: Rapid Ascent, Steep Plateaus

E-commerce businesses, characterized by their ability to scale rapidly in the initial stages, often present a deceptive curve of growth. The allure lies in the relatively low operational infrastructure required to begin selling physical products online. Inventory can be acquired, a digital storefront established, and sales can begin to flow. However, this initial momentum is frequently met with hard-hitting breaking points. These plateaus are not arbitrary; they are direct consequences of the business's shape.

As Hormozi explains, these constraints typically manifest as cash limitations, where the need to purchase more inventory outstrips available capital. Alternatively, traffic constraints can emerge, as advertising platforms reach their saturation point or ad performance declines beyond a certain threshold. Distribution also presents a significant hurdle; whether it's securing shelf space in physical retail or optimizing ad and affiliate networks, expanding reach is a finite, often challenging process. Furthermore, supply chain disruptions--manufacturers unable to meet escalating demand or logistical partners overwhelmed by volume--can bring growth to an abrupt halt.

Hormozi draws on his experience with Prestige Labs, a physical products business that utilized both brick-and-mortar and online sales channels, and the e-commerce-like launch of his Guinness World Record-breaking book. These experiences underscore a critical point: the challenges encountered in e-commerce are often not bugs, but features. The "sauce," as Hormozi puts it, lies in recognizing these fundamental issues and dedicating disproportionate effort to solving them, thereby outcompeting those who are merely reacting to surface-level problems.

The Hidden Cost of Inventory Cycles

The capital intensity of e-commerce is a direct consequence of its reliance on physical goods. While a business might show profit on paper, the reality is that this profit is often immediately reinvested into more inventory to fuel growth. This creates a perpetual cycle where cash flow is tightly linked to inventory turnover. As Hormozi notes, an e-commerce business can appear "asset-rich" with substantial inventory, but founders may find themselves living solely on salaries, a stark contrast to models where profits are more readily distributed.

This capital constraint is amplified by the external dependencies inherent in the model. Few e-commerce businesses are vertically integrated. They rely on third-party manufacturers, raw material suppliers, and logistics providers. A failure at any point in this chain can cripple the business. The need for redundancies across raw materials, manufacturing, and logistics is paramount. Moreover, the growth rate itself becomes dictated by free cash flow, creating a ceiling on how quickly a business can expand unless external financing is secured.

Building a Brand: The Ultimate Competitive Moat

The most significant challenge in e-commerce, beyond managing cash flow and supply chains, is building a defensible brand. In a market where competitors can easily replicate products, brand becomes the most formidable competitive moat. Hormozi emphasizes that while manufacturing processes, unique ingredients, or proprietary formulations can offer temporary advantages, a strong brand is inimitable.

The value of a brand in e-commerce is multifaceted: it drives higher click-through rates due to established trust and positive word-of-mouth, fosters repeat purchases, and allows for premium pricing on products. This translates directly into lower customer acquisition costs, higher customer lifetime value, and improved gross margins. Investing in brand building, through top-of-funnel marketing and consistent brand associations, is therefore not a discretionary expense but a strategic imperative. The optimal allocation, Hormozi suggests, is a 70/30 split--70% towards brand awareness and top-of-funnel activities, and 30% towards direct purchase conversion. This contrasts sharply with many nascent e-commerce businesses that focus almost exclusively on immediate sales, inadvertently building "smash-and-grab" operations with no sustainable advantage.

The Path to E-commerce Dominance

Winning in e-commerce requires a long-term vision that extends beyond immediate sales. The ideal e-commerce company, as described by Hormozi, possesses its own manufacturing capabilities, enabling direct shipping from production facilities. This vertical integration minimizes supply chain risks and reduces shipping costs. Furthermore, it allows for proprietary manufacturing techniques or unique ingredient sourcing, creating barriers to replication.

On the distribution side, the perfect model integrates robust online performance marketing with a brand-first approach. This means investing heavily in top-of-funnel activities that build brand equity. Over time, this can extend to strategic physical retail partnerships or the establishment of flagship stores in key locations, reversing the traditional model of building brick-and-mortar first. At the ultimate scale, when brand awareness is saturated, ubiquitous physical presence can eliminate shipping costs and enhance the customer experience. Finally, exceptional email marketing and an outstanding product are non-negotiable. A product that disappoints will erode brand equity, and in an environment of rising customer acquisition costs, compounding growth relies on repeat purchases and customer referrals. Demonstrating high repeat purchase rates (60-70%) is a strong indicator of product quality and brand loyalty.

The Service Business Slow Burn: People as the Bottleneck

Service businesses, which constitute the vast majority of enterprises in the United States, are characterized by their slow, steady growth. This shape is intrinsically people-centric, with human capital at the core of attraction, conversion, and delivery. While the front end--marketing and advertising--can be highly scalable, the conversion and delivery phases typically involve direct human interaction.

The primary challenge in scaling a service business lies in the scarcity and cost of exceptional talent. As Hormozi points out, finding more product to sell is significantly easier than finding exceptional people. When the core offering is premium service, the quality of personnel directly impacts the business's ability to deliver value and command higher prices. This necessitates higher gross margins to absorb the inevitable volatility introduced by training new staff who are, by definition, less experienced than seasoned veterans.

The Double-Edged Sword of Founder Expertise

A common dynamic in service businesses is the founder's deep technical expertise. While this allows for superior service delivery and a strong initial reputation, it also creates a bottleneck. Customers often gravitate to the founder for complex problems, limiting the founder's ability to step away from the day-to-day operations and focus on strategic growth. This can lead to a situation where the business is dependent on the founder's direct involvement, hindering scalability.

Systematizing Service for Sustainable Growth

Winning in the service sector hinges on addressing the core constraint: talent. This means building robust systems for recruiting, onboarding, and training. The business must become adept at transforming underskilled individuals into valuable assets, effectively "productizing" its own knowledge and teaching capabilities. This requires a commitment to comprehensive training, far beyond what many businesses are willing to invest.

The path to scaling involves narrowing the focus. As a service business grows, it must identify its ideal customer profile and refine its service offerings to a maximum of three core deliverables. This allows for systematization and "productization" of services, moving away from bespoke solutions towards repeatable processes. This operational efficiency then feeds back into the talent pipeline, enabling more effective training and onboarding. Ultimately, the goal is to reach a point where demand outstrips supply, a rare but achievable state that allows for consistent price increases and sustained profitability. Reinvestment in talent and brand are paramount, as a strong brand not only attracts premium customers but also top-tier talent.

The Education/Consulting/Infomedia Rocket: Fast Ascent, Sharp Descent

Education, consulting, and infomedia businesses are known for their rapid initial growth. This shape is characterized by a steep upward trajectory followed by a distinct plateau or decline. The core driver of this shape is the inherent low retention rate. Once a student acquires a skill or knowledge, they graduate, leaving the business to constantly refill its customer base.

The allure of this model is its low cost of acquisition and high potential margins. If one possesses a valuable, difficult-to-acquire skill, it can be duplicated through educational content at a minimal incremental cost. This creates an attractive value proposition, allowing for substantial revenue generation from a small initial investment. The global education market, valued in the trillions, underscores the economic significance of this model.

The Challenge of Dilution and Competition

The rapid ascent is often followed by a sharp decline due to two primary factors: customer graduation and created competition. As individuals are successfully educated, they leave, necessitating continuous marketing efforts to acquire new students. Furthermore, by teaching others a valuable skill, the educator inadvertently creates competitors who can then offer similar services. This dynamic, coupled with the low barrier to entry for creating educational content, leads to intense competition and downward pressure on pricing.

Hormozi uses the analogy of milk: a smaller amount of high-quality milk is preferable to a larger amount of diluted, lower-quality milk. Many education businesses falter by attempting to scale delivery by training individuals quickly and offering services at the same premium price, resulting in a diluted customer experience and reputational damage.

Creating Stickiness in an Unsticky Model

The key to winning in the education and infomedia space lies in creating "stickiness" in a fundamentally unsticky model. This involves a strategic split of value into one-time purchases and recurring components. Consumable elements, such as updated content, trending information, or community access, can form the basis of recurring revenue. The high-priced, one-time purchase should deliver core, enduring value, while recurring elements are priced appropriately for their ongoing consumption.

Additional stickiness can be achieved through discount buying programs, where collective purchasing power offers savings that offset subscription costs, or through continuous education that keeps individuals updated on industry trends and best practices. Ultimately, brand is the most powerful defense against competition. A strong brand, built on demonstrable real-world proof of success, confers credibility and reduces perceived risk for customers, allowing for premium pricing and sustained demand.

The SaaS Marathon: Slow Start, Infinite Potential

Software as a Service (SaaS) businesses represent the slowest starting of the four models, requiring significant upfront capital investment in product development and engineering talent, often with no immediate revenue. This long, unprofitable runway is a direct consequence of the complexity and cost of building robust, scalable software. The venture capital industry's prominence in SaaS is largely due to this capital-intensive nature.

However, once product-market fit is achieved, SaaS businesses exhibit unparalleled scalability. Y Combinator's analogy of pushing a boulder uphill until product-market fit, after which the boulder chases you downhill, aptly describes this phenomenon. The potential for infinite scale and high gross margins, combined with sticky revenue streams that become integrated into customer workflows, leads to substantial long-term enterprise value.

The Perils of Early-Stage Burn

The primary challenge in SaaS is surviving the initial years before achieving product-market fit. This requires immense patience and resilience, as the business burns cash without generating significant revenue. The willingness of customers to pay for software, especially at the consumer level, is often limited by the perceived low incremental cost of delivery. This necessitates achieving tremendous volume to generate substantial profits.

The long period of unprofitability can be emotionally taxing and often leads to a dependency on venture capital. Founders must possess a deep understanding of product development and customer retention to navigate this phase. The core problem to solve is not just building a product people want, but ensuring they continue to want it and use it, leading to high revenue retention--ideally over 100% when factoring in customer upgrades.

Obsession with Quality and Virality

Winning in SaaS demands an unwavering obsession with product quality and customer feedback. However, this does not mean blindly implementing every customer request. Exceptional product design involves judiciously adding features that enhance user experience without introducing unnecessary complexity. The goal is to remove friction between the user and their desired outcome, a principle exemplified by the iPhone.

Beyond product excellence, a viral component is crucial for sustainable growth. A positive viral coefficient, where each customer brings in more than one new customer, can dramatically reduce customer acquisition costs over time. Companies like Facebook and ChatGPT achieved rapid growth through built-in virality. Furthermore, SaaS is a quality-over-quantity game for talent. Investing in exceptional engineers, even at a higher cost, is essential for building scalable, well-documented code from the outset. This foundation allows the software to "rip" once product-market fit is achieved, enabling compounding growth through referral, upgrade, and retention loops.

The Core Hairy Problem: The Key to Unlocking Enterprise Value

Across all four business shapes, a common thread emerges: what is difficult for you is likely difficult for everyone else. The "features" that define each business model--supply chain constraints in e-commerce, talent acquisition in service businesses, low retention in education, and the long development cycle in SaaS--are precisely the areas where immense enterprise value can be unlocked by solving them.

Hormozi emphasizes that these are not problems to be lamented, but opportunities to be seized. By dedicating resources--financial, temporal, and intellectual--to mastering these core hairy problems, entrepreneurs can create significant competitive moats. A service business that excels at recruiting and training two new high-caliber individuals per month, for instance, could unlock millions in enterprise value. Similarly, an e-commerce business that perfects its supply chain or a SaaS company that achieves exceptional revenue retention is creating a formidable advantage.

The choice of business model should align with an entrepreneur's personality and strengths. Those who thrive on promotion might find success in e-commerce or education, while detail-oriented individuals with a tolerance for suffering might be suited for SaaS. Those who love building culture and nurturing people will find their home in service businesses. Ultimately, the journey of entrepreneurship is long, and the ability to adapt and change business models over time is a testament to resilience and strategic foresight. The greatest reward comes not from avoiding difficulty, but from confronting and conquering it.

Key Action Items

- Identify Your Business's Core "Hairy Problem": Dedicate time to deeply understand the inherent challenges of your chosen business model. Is it supply chain, talent, customer retention, or product development? This clarity is the foundation for strategic investment. (Immediate)

- Invest Disproportionately in Solving Your Core Problem: Allocate significant resources--financial, human, and temporal--to tackling your business's most significant constraint. View this investment not as an expense, but as the primary driver of enterprise value. (Immediate to 6 months)

- For E-commerce: Prioritize Brand Building: Shift focus from pure performance marketing to top-of-funnel brand awareness and association. Aim for a 70/30 split in marketing spend, with 70% dedicated to brand. (Ongoing, with initial shift within the next quarter)

- For Service Businesses: Systematize Talent Acquisition and Training: Develop robust, repeatable processes for recruiting, onboarding, and training new team members. This is your primary lever for scalability. (Immediate to 12 months)

- For Education/Infomedia: Engineer "Stickiness": Strategically split your offering into high-value one-time purchases and recurring revenue streams. Focus on consumable elements and community to drive retention. (Implement within the next 6 months)

- For SaaS: Obsess Over Product Quality and Retention: Relentlessly iterate on your product to remove friction and enhance user experience. Focus on achieving high revenue retention rates (ideally over 100%). (Immediate and ongoing)

- Develop a Long-Term Vision for Competitive Moats: Beyond solving immediate problems, identify how mastering your core challenge can create lasting competitive advantages that competitors will find difficult or impossible to replicate. (This pays off in 12-18 months and beyond)