Investing in Skills Outperforms Traditional Savings for Wealth Accumulation

The conventional wisdom for financial planning is dangerously out of sync with reality, leading many to set goals that will leave them impoverished in their retirement years. This conversation with Alex Hormozi reveals the hidden consequence of inflation on long-term wealth: a million dollars today is a fraction of that in purchasing power decades from now. Those who understand this dynamic can strategically adjust their income, spending, and investment horizons to build truly sustainable wealth, gaining a significant advantage over those who remain anchored to outdated financial models. This analysis is crucial for anyone aiming for genuine financial security, not just a nominal sum.

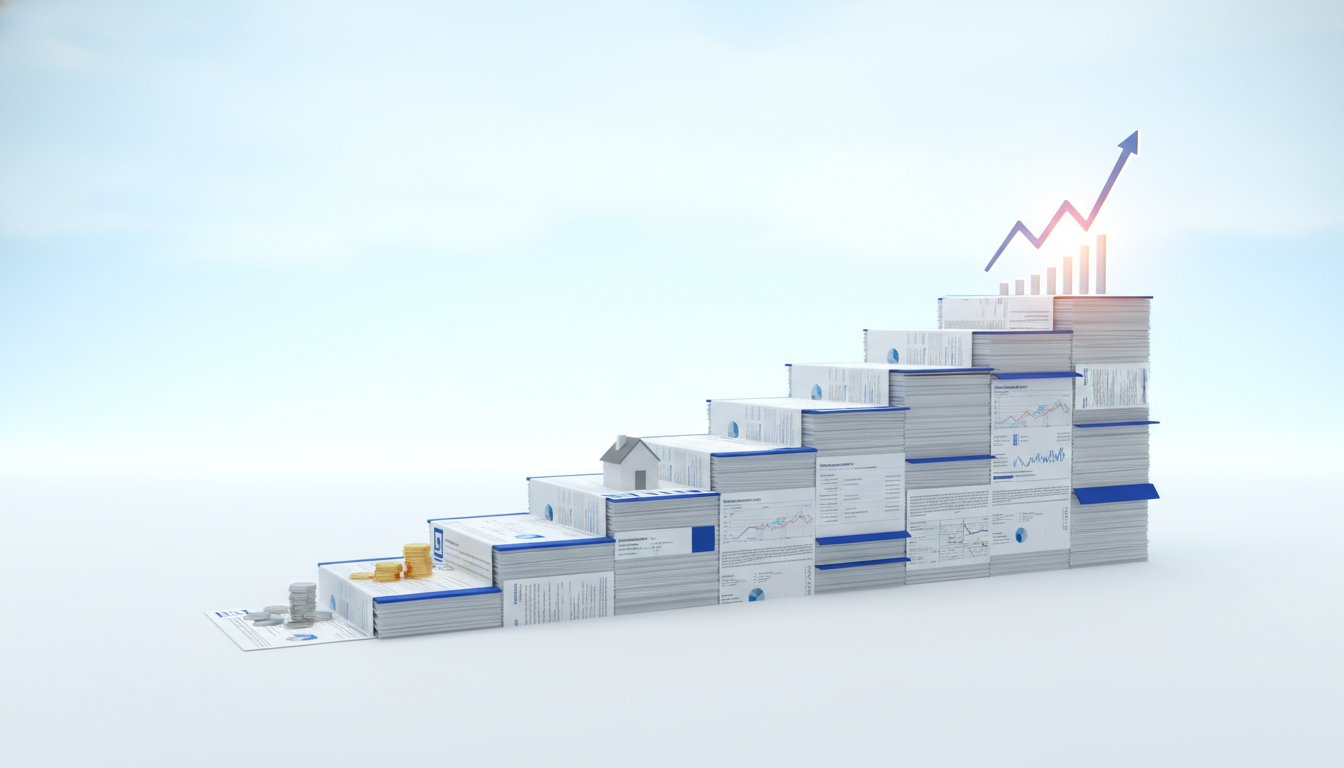

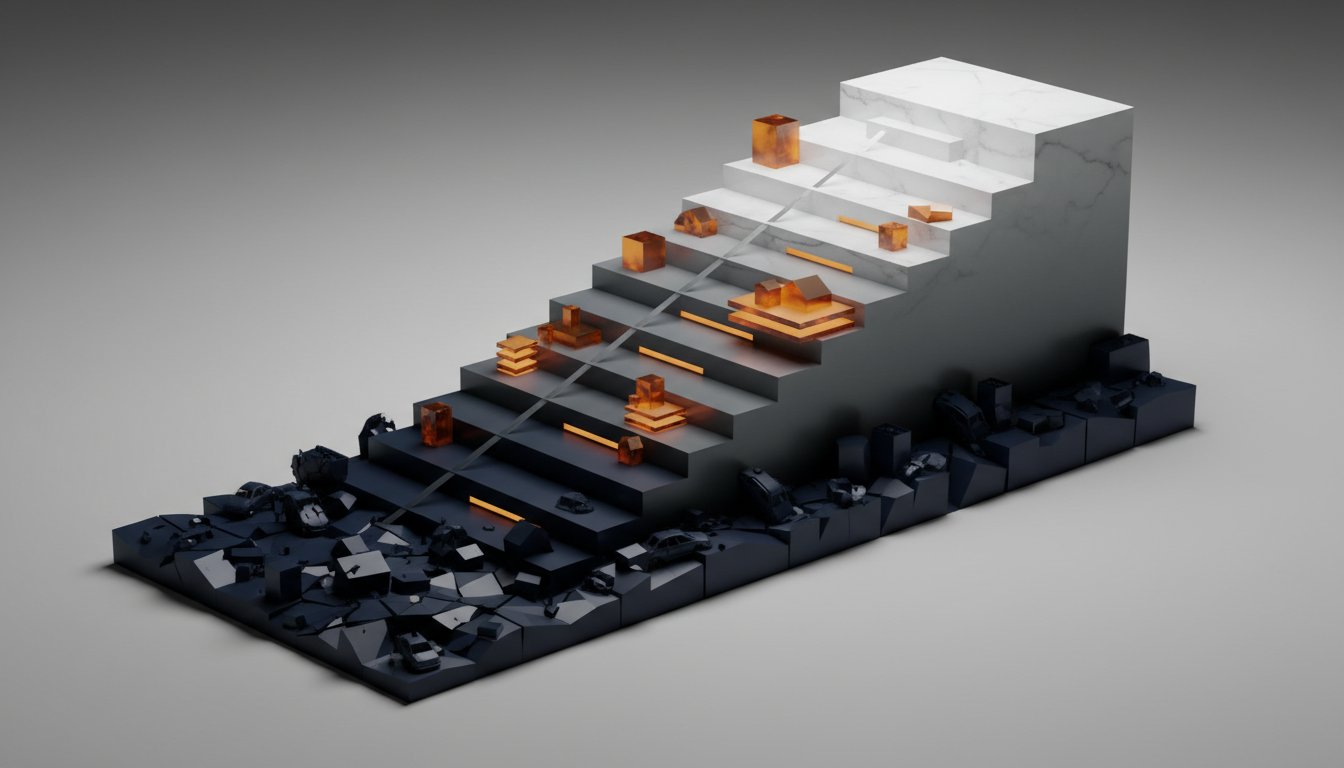

The Inflationary Erosion of Future Wealth

The common financial advice to save a modest amount monthly, while seemingly responsible, sets individuals up for a future where their accumulated wealth buys significantly less than anticipated. The erosion caused by inflation, particularly in late-stage capitalism where currency supply can expand, means that a million dollars saved over a lifetime might only afford the lifestyle that $170,000 buys today. This isn't a minor inconvenience; it fundamentally redefines what "financial freedom" means.

"Just $1 in 1975, 50 years ago, has today's equivalent purchasing power of $6.02. That's a 6x difference in 50 years. The main reason is inflation."

This stark reality forces a re-evaluation of long-term financial goals. A retirement income target of $50,000 per year, based on a $1 million nest egg, translates to a mere $8,000 in today's purchasing power. The ambition to live comfortably on passive income becomes a pipe dream if future dollars are not accounted for. This is precisely why Hormozi advocates for a radical shift in perspective, urging individuals to think in terms of future dollars and the real purchasing power they will command. The implication is that traditional savings plans are not just insufficient; they are actively detrimental to achieving long-term financial well-being.

The Power of Income Acceleration Over Saving

Hormozi’s core argument is that focusing solely on saving a percentage of a low income is a flawed strategy. The real leverage lies in dramatically increasing income, as the potential upside is virtually limitless, whereas spending can only be reduced to zero. This isn't about accumulating more possessions; it's about generating more capital that can then be invested to outpace inflation and compounding.

Consider the impact of an extra $1,000 per month. While seemingly modest, if invested consistently, it can lead to $10 million by retirement. This highlights a critical distinction: the time value of money is amplified when combined with increased earning capacity. The money earned and saved today, due to its potential to compound over decades, is worth significantly more than money earned and saved later in life.

"The money that you make and spend now counts 80x. Why? Because 9% compounding, it's bigger than inflation. Compounding over 50 years, 9% over 50 years is 80x. But we can't be one-sided. We also need to realize that $80,000 in 50 years is only worth $13,000 today. So in reality, every $1 you save today is worth $13 when you retire."

This calculation underscores the immense value of even small, consistent efforts to increase income early on. A $200 gig that might seem insignificant could translate to a $2,600 investment in the future, making the hustle far more rewarding. Conversely, the analysis of spending reveals how seemingly small luxuries can have devastating long-term consequences. A $500 belt, for instance, represents a $6,500 loss in future purchasing power, while an $18,000 car lease can amount to a $1.4 million erosion of wealth over 50 years. The insight here is that reducing spending, especially on depreciating assets or status symbols, acts as a powerful, albeit less glamorous, multiplier for wealth accumulation.

The Unrivaled ROI of Skill Acquisition

Where Hormozi’s strategy truly diverges from conventional advice is in its emphasis on investing in income-earning skills. He posits that this is the most potent way to counteract inflation and accelerate wealth creation, offering returns that traditional investments often cannot match. The reasoning is straightforward: skills are always valued in present terms, regardless of the economic climate or currency. They are the ultimate hedge against inflation because they directly increase one's ability to earn more money.

Hormozi illustrates this with a personal example: spending $750 per hour for 8 hours of ad-running training. While an enormous sum at the time, this investment, which cost $6,000, generated hundreds of millions in returns. The key is that this skill directly translated into increased income, which could then be reinvested. The math is compelling: a $2,000 investment in a sales skill that boosts income by $75,000 post-tax annually, living leanly, provides an additional $35,000 per year in investable income. Over 50 years, this single skill acquisition could lead to $31 million, assuming no further increases in earning or investment.

"The first is that skills will always trade in today's denominations. Whether we're trading dollars or Bitcoins or seashells, it doesn't matter, because if you have something valuable to exchange, you will be able to exchange it at the present value in whatever denomination exists. That's why skills are always the ultimate hedge against inflation."

This perspective reframes education not as an expense, but as a high-return investment. While acknowledging the risks and the existence of ineffective programs, Hormozi champions alternative education and coaching as significantly more effective and faster than traditional higher education for acquiring real-world, income-generating skills. The willingness to "pay for speed" and accept short-term losses in pursuit of long-term gains is what separates those who achieve exponential growth from those who tread water. The strategy is to view every dollar earned beyond essential living expenses as a currency to acquire skills that will generate even more dollars.

Actionable Strategies for Future-Proofing Wealth

The insights from this conversation translate into a clear, albeit challenging, path forward for anyone serious about building substantial wealth. The emphasis is on proactive, often uncomfortable, decisions that yield significant long-term advantages.

- Reframe Financial Goals: Adjust all future financial targets (e.g., retirement income, nest egg size) to reflect current purchasing power, not nominal future values. This requires understanding inflation's impact over your planned investment horizon.

- Prioritize Income Generation: Focus intensely on increasing your earning capacity. Explore side hustles, negotiate raises, or develop high-demand skills. Understand that a small increase in income today, when invested, compounds significantly over time.

- Embrace Extreme Frugality (Early On): Live significantly below your means, especially in your younger years. Every dollar saved and invested early has a disproportionately larger impact due to compounding. This means making sacrifices on non-essential purchases.

- Invest in Income-Earning Skills: Treat skill acquisition as a primary investment. Identify skills that are in demand and directly contribute to higher income. Be willing to spend money on high-quality training, coaching, or mentorship, viewing it as a high-ROI investment.

- Automate Investment of Excess Capital: Implement a system where a fixed amount or a percentage of income above a defined "watermark" is automatically invested. The richest individuals tend to prioritize investing first, then living on the remainder.

- Adopt a Learning Budget: Allocate a specific portion of income or profits towards testing new strategies, learning new skills, or experimenting with growth opportunities, even if there's a high probability of short-term loss. This fuels continuous improvement and competitive advantage.

- Pay for Speed and Feedback: Actively seek out mentors, communities, or accelerated learning programs that provide direct feedback and shorten the learning curve. Recognize that "figuring it out on your own" takes significantly longer and is often less effective than guided learning.