Grindr Super-App Strategy Contrasts Saks's DTC Failure

In this conversation, Jack Crivici-Kramer and Nick Martell of The Best One Yet dissect the strategic missteps and hidden dynamics behind major business stories, revealing how seemingly obvious decisions can lead to unforeseen consequences. They highlight how delayed payoffs and embracing difficulty can create durable competitive advantages, while short-sighted strategies, often driven by immediate pressures or conventional wisdom, crumble under systemic pressures. This analysis is crucial for founders, investors, and strategists who need to look beyond immediate wins to understand the long-term viability and competitive positioning of their ventures. By mapping consequence chains and understanding system responses, readers can gain an edge in navigating complex market landscapes.

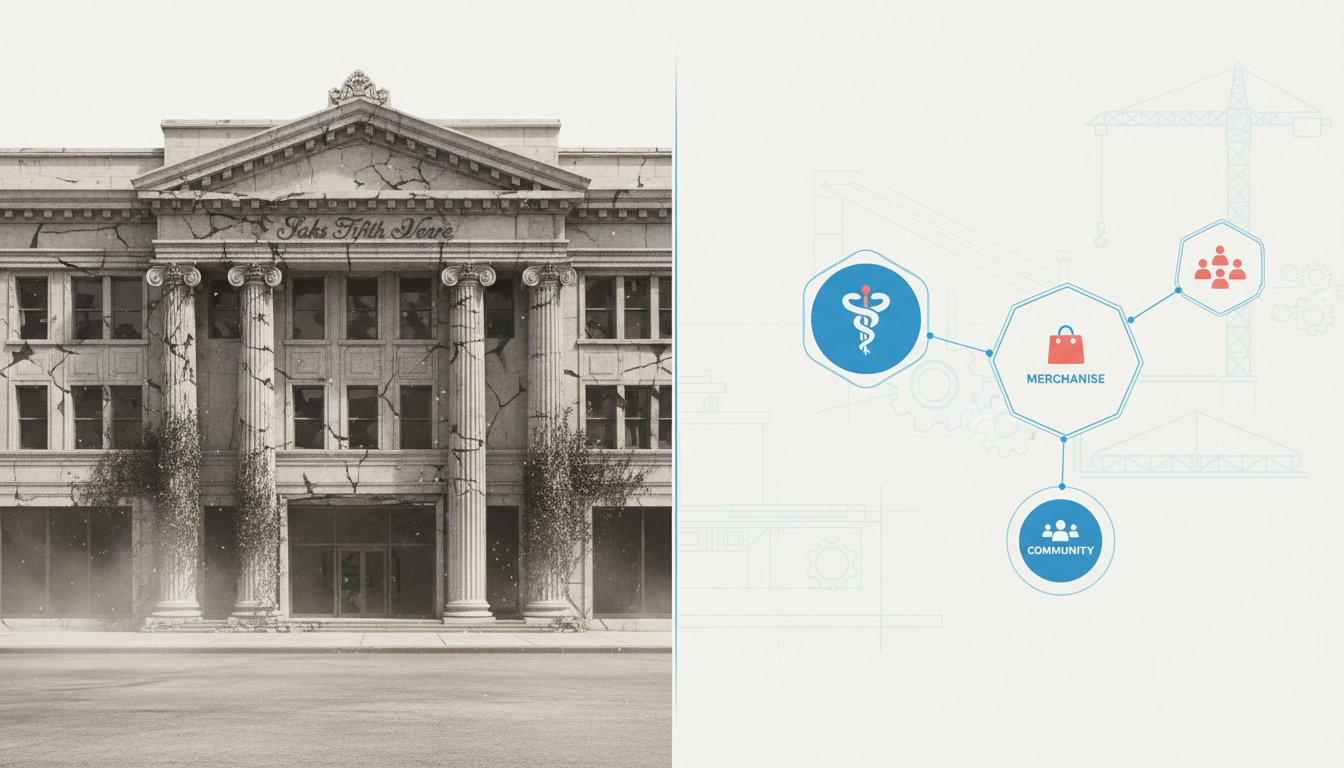

The Hidden Cost of Obvious Moves: How Saks, Grindr, and EquipmentShare Reveal Deeper Business Truths

In the fast-paced world of business news, headlines often capture the immediate drama: a bankruptcy filing, a new app launch, or a company going public. But beneath the surface of these events lie intricate systems of cause and effect, where decisions made with the best intentions can cascade into unforeseen consequences. In a recent conversation on "The Best One Yet," hosts Jack Crivici-Kramer and Nick Martell delved into three distinct stories--Saks Fifth Avenue's bankruptcy, Grindr's strategic pivot, and EquipmentShare's IPO--to illustrate these deeper dynamics. They moved beyond the surface-level narratives to map out the hidden costs of conventional strategies and the often-unpopular paths that lead to lasting advantage. The common thread? That true success is rarely found in the easiest or most obvious solutions, but rather in understanding the full arc of consequences and having the patience to navigate them.

The Alligator and the Hippo: When Acquisitions Devour the Acquirer

The dramatic bankruptcy of Saks Fifth Avenue, a retail institution for over 150 years, serves as a stark reminder that even established brands can fall victim to their own strategic decisions. While the immediate cause might appear to be a missed interest payment, Jack and Nick trace this back to a more fundamental issue: a real estate deal that overextended the company.

"Saks borrowed $2 billion to acquire their rival Neiman Marcus," Nick explained, "basically, they tried to eat their rival, but Neiman was so big, Saks choked on it." This aggressive acquisition, intended to consolidate market share and secure valuable Fifth Avenue real estate, backfired spectacularly. The immense debt incurred, coupled with rising interest rates, created a financial black hole. The interest alone on that loan cost $400 million annually, a burden Saks ultimately could not sustain.

The analogy Jack and Nick employed was vivid: "Saks was stuck in one of those safari situations... like the gator of Saks tried to eat the hippo of Neiman in one bite and basically got crushed." This illustrates a critical failure in consequence mapping: the immediate benefit of acquiring a competitor was overshadowed by the downstream, systemic impact of the crippling debt. The acquisition, which seemed like a bold move to capture market dominance, instead became the direct cause of the company's demise.

Furthermore, the conversation highlighted a shift in the retail landscape that Saks failed to fully adapt to. As Nick pointed out, "the number one reason why department stores existed [was] curation... But over time, luxury brands realized it's way more profitable to just go direct to consumer." Brands like Louis Vuitton, now a creditor to Saks, increasingly bypass department stores, selling directly to customers. This direct-to-consumer (DTC) model offers better margins and greater control over brand experience. Saks's strategy, rooted in the traditional department store model, was essentially trying to sell dresses while operating as a real estate firm, a model that had lost its core value proposition in the face of evolving consumer behavior and brand strategies. The company's most valuable asset was its prime real estate, not its ability to curate and sell merchandise in a world that increasingly preferred direct engagement with brands.

The Gatherhood Strategy: Grindr's Vision Beyond the Swipe

In contrast to Saks's struggles, Grindr, the dating app primarily for gay, bi, trans, and queer people, presents a compelling case study in proactive strategic evolution. While other dating apps like Tinder and Bumble have seen their stocks plummet due to user fatigue, Grindr is not only surviving but thriving, with revenues and profits hitting all-time highs.

"Grindr is selling to you even after you stopped swiping," Jack noted, pointing to the app's success in retaining and engaging its user base. This longevity, however, is not a passive outcome. Grindr is actively preparing for a future where dating apps may become less central to its users' lives. Their internal "Gatherhood Strategy" envisions transforming Grindr into a "gay AI super app."

This strategy is rooted in a deep understanding of their community and its needs. Grindr isn't just a dating platform; it's a digital gathering place, a "digital neighborhood" that fosters connection and community. The leaked internal documents reveal plans to expand beyond dating to offer a range of products and services, including hair care, skin care, and even erectile dysfunction pills (like their product "Woodwork").

"Grindr knows that its customer base will eventually stop using the core product," Nick explained. "So now they're leveraging their real asset--their brand--to sell those customers physical things too." This is a crucial distinction: Grindr is not merely chasing new markets; it's leveraging its existing, deeply engaged community. The proposed expansion focuses on "recurring products," such as skincare and hair care, which ensure repeat purchases and more stable, long-term revenue streams, a stark contrast to one-off impulse buys. This foresight--anticipating the decline of the core service and building a sustainable ecosystem around the community--is a powerful example of systems thinking. It acknowledges that user behavior evolves and that a brand's true value lies in its relationship with its audience, not just its primary function.

The Stagnant Construction Site: EquipmentShare's IPO and the Cyclical Trap

The impending IPO of EquipmentShare, a company that offers an "Airbnb for construction equipment," introduces another layer of complexity: the impact of cyclical industries on long-term stock performance. While EquipmentShare's business model is innovative, addressing a significant productivity gap in the construction sector, Jack and Nick caution investors about its inherent cyclicality.

The statistics are stark: construction productivity has risen at a "pathetically slow" rate since 1947, lagging far behind agriculture and manufacturing. In fact, construction productivity has actually declined since 1973. EquipmentShare aims to tackle this by providing smart, connected machinery, tracking productivity, improving safety, and reducing costs. Their business model involves both renting and selling fleets of construction vehicles, managed through sophisticated software.

"The result? The average revenue growth over EquipmentShare is 140%," Nick stated, highlighting the impressive growth of the company. However, he immediately followed this with a critical caveat: "we can tell you who's not going to buy EquipmentShare stock on their IPO day... CNBC's Jim Cramer." The reason, as Jack elaborated, is the cyclical nature of the construction industry.

"Construction is a cyclical industry," Jack explained. "It does well when the economy is doing well, but it shrinks when the economy is not." This means that while EquipmentShare's growth has been phenomenal during economic upswings, it is highly vulnerable to economic downturns. The hosts pointed out that EquipmentShare's growth rate has been shrinking annually since 2022, dropping to just 27% last year, directly correlating with the spike in inflation and interest rates that began to impact the construction sector.

This situation exemplifies the difference between a successful business and a successful stock. EquipmentShare's operational model is innovative and addresses a real market need. However, its susceptibility to economic cycles limits its potential for consistent, long-term growth that investors like Jim Cramer seek. The immediate appeal of a rapidly growing company is tempered by the downstream consequence of its industry's inherent volatility. The lesson here is that understanding the broader economic system in which a company operates is as crucial as understanding its internal mechanics.

Key Action Items

- For Retailers and Brands: Re-evaluate your core value proposition. If you are a middleman, understand how brands are increasingly going direct-to-consumer. Invest in building direct relationships with your customers, focusing on unique experiences or curated selections that cannot be replicated online. This requires a strategic shift now, with benefits realized over the next 1-3 years.

- For Digital Platforms: Map your user lifecycle. Anticipate when users might disengage from your core service and proactively build adjacent revenue streams that leverage your brand and community. Focus on recurring revenue models that foster long-term customer loyalty. Begin mapping user lifecycle and potential adjacent services immediately; initial product development could take 6-12 months.

- For Companies in Cyclical Industries: While innovation is key, acknowledge the inherent limitations of your industry's economic sensitivity. Develop strategies to mitigate cyclical impacts, such as diversifying revenue streams, building strong cash reserves during upswings, and focusing on operational efficiency that pays off even in leaner times. Implement efficiency measures continuously; long-term diversification strategies should be explored over the next 12-18 months.

- Embrace Delayed Gratification: Recognize that the most durable competitive advantages often come from strategies that require immediate discomfort or patience. The "unpopular but durable" approach, like Grindr's long-term community building or the groundwork for fundamental operational improvements, creates a moat that competitors unwilling to invest that time and effort cannot easily cross. Identify one area where immediate discomfort can yield long-term advantage and commit to it, accepting a payoff horizon of 18+ months.

- Master Consequence Mapping: Before implementing any major strategic decision, map out the first, second, and third-order consequences. Consider how your actions might impact other stakeholders, the broader market, and the system as a whole over time. Incorporate a mandatory consequence mapping step into all significant strategic planning processes, beginning next quarter.

- Invest in Brand as an Asset: For platforms with strong community engagement, view the brand and community itself as the primary asset, not just the product. This allows for diversification into new areas that resonate with the audience, creating a more resilient business model. Assess your brand's community engagement and identify potential diversification opportunities within the next 6 months.

- Question Conventional Wisdom: Be wary of solutions that seem too easy or address only the immediate problem. Often, the most effective strategies involve tackling underlying systemic issues, even if they are more complex or less immediately rewarding. Challenge one "obvious" solution in your next strategic meeting by asking, "What are the hidden downstream effects?"