Allies Resist US Tariffs; Netflix Prioritizes Retention; Aldi Leverages Frugality

This conversation reveals how conventional business wisdom often misses critical downstream consequences, particularly when short-term gains are prioritized over long-term systemic health. The hosts dissect three seemingly disparate business stories--Trump's Greenland gambit, Netflix's content strategy, and Aldi's retail model--to expose how immediate pressures lead to counterproductive actions and how understanding user behavior, even at its most distracted, can be a powerful lever. This analysis is crucial for business leaders, strategists, and anyone seeking to build durable competitive advantages by anticipating and navigating complex, often counterintuitive, market dynamics. By understanding these hidden forces, readers can gain an edge by avoiding common pitfalls and identifying opportunities others overlook.

The Unseen Costs of Geopolitical Theater and Content Algorithms

The current business landscape is rife with decisions that appear rational in the moment but unravel over time, creating unintended consequences that ripple through markets and consumer behavior. This podcast episode, through its examination of a geopolitical trade dispute, Netflix's content strategy, and the rise of Aldi, offers a potent case study in how focusing on immediate wins can derail long-term stability and how understanding the subtle, often overlooked, aspects of user interaction can unlock significant competitive advantages.

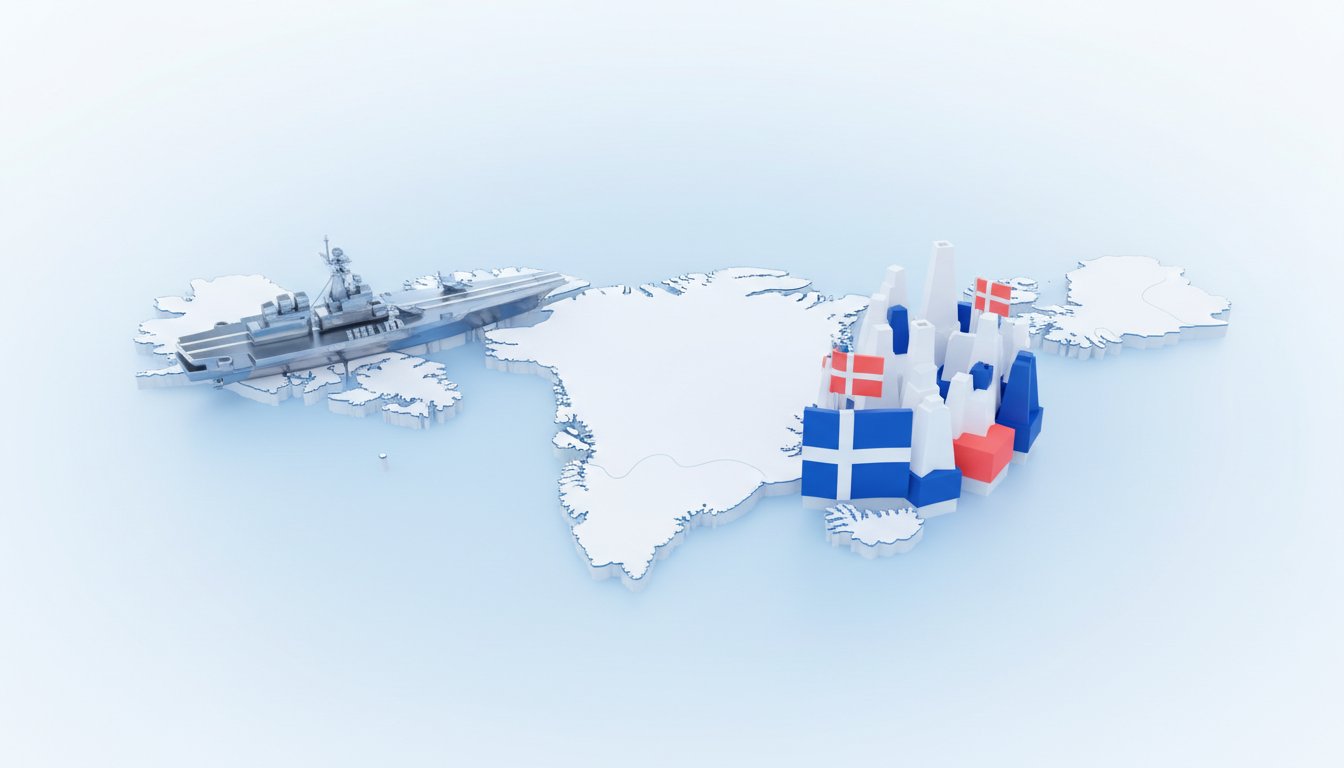

Trump's Greenland Gambit: A Trade Civil War Fueled by Short-Term Thinking

President Trump's audacious attempt to purchase Greenland, framed as a national security and resource acquisition play, quickly devolved into a geopolitical and economic quagmire. The immediate reaction from European allies was not capitulation, but retaliation. By threatening tariffs on Denmark, Germany, the UK, France, and others, Trump initiated a "trade civil war," where the United States found itself at odds with its historic allies. The consequence? Not only did the US face retaliatory tariffs on its own products (like Tennessee whiskey and Harley Davidson motorcycles), but allies like Canada moved closer to adversaries like China, signing a trade deal. This demonstrates a fundamental failure to map the system's response: aggressive, unilateral actions against allies do not yield compliance; they foster resentment and strategic realignment.

The narrative highlights how this approach fundamentally misunderstands the interconnectedness of global trade and diplomacy. Instead of leveraging existing relationships and existing frameworks, the administration opted for a confrontational stance that alienated partners and triggered a "Sell America" trade sentiment, leading to a significant drop in US stocks and the US dollar. The irony, as the hosts point out, is that many of the desired outcomes--like mining rights or military base access--could likely have been achieved through negotiation and partnership, rather than an attempted "imperial conquest."

"This is the 'Sell America' trade. The European Union actually has a list of symbolically American products that they're going to toss 100 billion of retaliatory tariffs on."

This situation underscores a critical lesson: actions that appear to solve an immediate problem (acquiring Greenland) can create far larger, more complex problems (eroding alliances, triggering retaliatory tariffs, and damaging economic confidence) that compound over time. The suggestion of "off-ramps"--peaceful negotiation, investment proposals, and rental agreements--contrasts sharply with the chosen path, illustrating how a lack of long-term consequence mapping can lead to self-inflicted wounds. The episode emphasizes that true "art of the deal" involves understanding the other party's reactions and the broader systemic implications, not just asserting dominance.

Netflix's Formula: The "Second Screen Syndrome" and the Erosion of Art

Netflix's recent earnings report, while strong, was overshadowed by Matt Damon's revelation on Joe Rogan's podcast about the streaming giant's content formula. This isn't about artistic merit; it's about retention in an increasingly distracted world. Netflix, Damon explained, often requests major action sequences within the first five minutes of a film and demands that plot points be reiterated multiple times in dialogue. This strategy, born from the understanding that viewers are often multitasking on their phones--a phenomenon dubbed "second screen syndrome"--prioritizes immediate engagement and plot clarity over narrative subtlety or artistic flow.

The consequence of this approach is a homogenization of content, where films begin to resemble "content cake mix," driven by algorithmic optimization rather than creative vision. While this strategy may be effective for retaining viewers who are simultaneously scrolling through Instagram or checking emails, it fundamentally alters the viewing experience. Traditional cinema, which relies on undivided attention, does not face this challenge. However, platforms like Netflix, competing not just with other shows but with the infinite scroll of social media, must adapt.

"The force making everything we consume feel more TikTok. It's second screen syndrome."

This shift from art to science, from immersive storytelling to attention-grabbing tactics, has broader implications. As the hosts note, this trend is visible across media, from shorter songs with earlier choruses on Spotify to Duolingo competing with TikTok for user attention. The implication is that any content creator, from podcasters to public speakers, must contend with this pervasive distraction. The long-term consequence for Netflix, and for content creation in general, is a potential decline in depth and complexity, favoring easily digestible, high-impact moments that can be absorbed even with a divided focus. This creates a feedback loop: audiences conditioned to constant stimulation may become less tolerant of slower, more nuanced storytelling, further reinforcing the algorithmic demand for immediate payoffs.

Aldi's Parking Lot Test: Frugality as a Durable Advantage

Aldi's rapid ascent to become America's second-largest grocery chain, surpassing even Trader Joe's in revenue, offers a compelling example of how a deep understanding of customer behavior and a commitment to operational efficiency can create a powerful, enduring competitive advantage. The key, according to the podcast, lies in what's observed in their parking lots--a microcosm of their business strategy.

Aldi's model is built on Deutsche Sparsamkeit, or German frugality. This isn't about being cheap; it's about delivering exceptional value by minimizing costs at every touchpoint. The quarter-to-unlock-a-cart system, for instance, eliminates the need for staff to round up stray carts, saving labor costs. Products are often displayed in their original shipping containers, reducing stocking time and labor. The stores themselves are smaller (around 10,000 square feet), private-label brands dominate (90% of products), and even music is absent to cut overhead. These aren't just cost-saving measures; they are signals to the consumer that the brand is ruthlessly focused on delivering the lowest possible price.

The "parking lot test" serves as a brilliant heuristic for understanding Aldi's appeal. The presence of a wide range of vehicles, from luxury sedans to more modest cars, indicates that Aldi's value proposition transcends socioeconomic boundaries. Wealthy shoppers appreciate the no-frills efficiency and savings, while budget-conscious consumers benefit from accessible prices. This demonstrates a profound understanding of universal consumer desires: people want value, and they are willing to forgo certain conveniences to achieve it.

"Frugality is not cheapness. Value, paying what something is worth, that has universal appeal."

The long-term implication here is significant. While competitors might chase trends or offer superficial perks, Aldi's model is built on a foundational principle that is durable across economic cycles. The discomfort of unpacking your own groceries or using a quarter for a cart is a minor inconvenience that yields a substantial, consistent reward: lower prices. This creates a powerful feedback loop: customers tolerate the minor inconveniences because they receive consistent value, which in turn drives higher volume and allows Aldi to negotiate better terms with suppliers, further reinforcing their low-price advantage. This is a classic example of a difficult-to-replicate business model that creates a moat through disciplined execution and a clear understanding of customer priorities.

Key Action Items

-

For Geopolitical and Trade Strategies:

- Immediate Action: Prioritize diplomatic engagement and multilateral cooperation over unilateral threats when dealing with allies. Map potential retaliatory responses before enacting tariffs or sanctions.

- Longer-Term Investment: Build and maintain strong relationships with key trading partners, focusing on mutual benefit rather than perceived exploitation. This pays off in 12-18 months through increased stability and reduced trade friction.

-

For Content Creation and Product Design:

- Immediate Action: Analyze user engagement metrics to understand distraction patterns. Consider incorporating "hook" elements early in content and reinforcing key messages, but avoid excessive repetition that alienates attentive audiences.

- Longer-Term Investment: Invest in understanding the fundamental user need beyond immediate attention-grabbing tactics. Develop content and products that offer genuine depth and value, even if it requires more focused engagement. This builds brand loyalty that transcends fleeting trends, paying dividends over 2-3 years.

-

For Retail and Value-Based Businesses:

- Immediate Action: Implement small, operational efficiencies that directly translate to lower prices for the consumer. Examples include cart-release systems, simplified product displays, and a focus on private-label brands.

- Immediate Action: Conduct "parking lot tests" or similar observational analyses to understand the diverse customer base and their core motivations for choosing your product or service.

- Longer-Term Investment: Cultivate a brand identity centered on demonstrable value and frugality, rather than superficial luxury. This requires consistent discipline and a willingness to embrace operational austerity, creating a durable competitive advantage that pays off over 5+ years.

-

General Strategic Principle:

- Requires Discomfort Now, Advantage Later: Actively map second and third-order consequences of all major decisions. Embrace strategies that involve immediate difficulty or perceived austerity if they promise significant, long-term systemic benefits and competitive separation.