Shift Entertainment--Education Ratio for Exponential Growth and Mastery

TL;DR

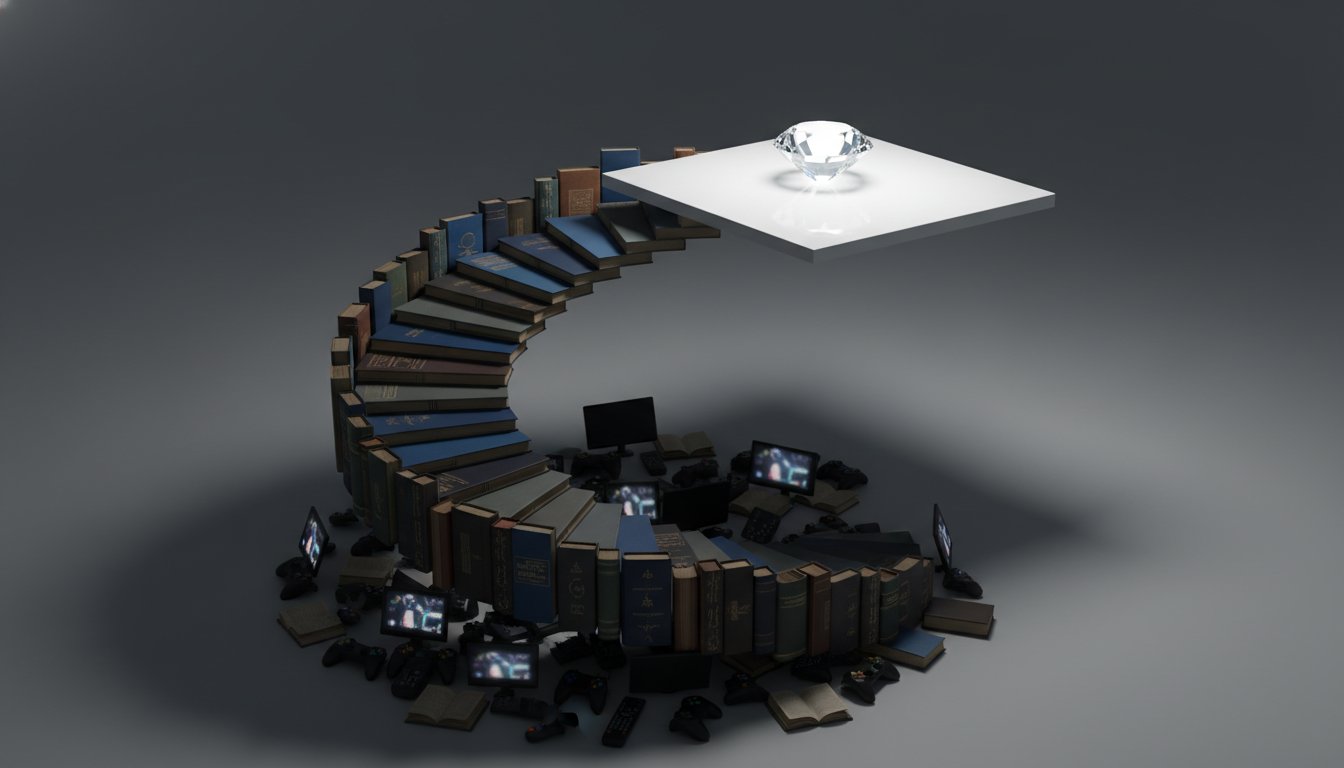

- Shifting the Entertainment vs. Education (E-v-E) ratio by dedicating even a small amount of time to learning can lead to exponential personal growth and mastery of new topics within six months.

- Prioritizing intentional education over passive entertainment cultivates curiosity, which fuels further learning and drives individuals toward becoming experts by consuming foundational knowledge.

- The deliberate act of reading physical books, rather than solely relying on audio or digital formats, enhances comprehension and retention, particularly for technical or detailed subjects.

- Stagnation in personal growth is a form of decline; actively pursuing education is essential for continuous improvement, whereas neglecting it leads to decay and missed opportunities.

- Valuing education and demonstrating this value through consistent actions, such as reading one book per month, transforms one's trajectory and fosters a lifelong pursuit of skill development.

- Curiosity acts as the foundational driver for seeking knowledge, and this skill can be developed over time, leading to a continuous cycle of learning and intellectual exploration.

Deep Dive

Mastering new subjects and achieving significant personal growth hinges on strategically shifting the balance between entertainment and education, a concept known as the E-v-E ratio. While the average person dedicates vastly more time to entertainment than to learning, intentionally prioritizing education, even through modest daily efforts, can lead to profound mastery of any topic within six months. The critical implication is that time spent on passive consumption, rather than active learning, represents a missed opportunity for advancement, leading to stagnation or even decline over time.

The core argument is that the E-v-E ratio, a measure of entertainment versus education time, directly dictates an individual's potential for growth and mastery. The widely observed ratio of 50 minutes of entertainment for every one minute of education is presented not as a rigid statistic, but as an accurate reflection of how many people neglect intentional learning. This imbalance has a cascade of downstream effects: skills remain undeveloped, problems go unsolved, and individuals fail to reach their potential. The podcast emphasizes that books and other educational resources are readily available solutions, but their effectiveness depends on active engagement. For instance, reading the top five books on any subject can place an individual significantly ahead of the majority who do not read at all, illustrating a direct causal link between educational input and expertise. Furthermore, the act of learning itself can cultivate curiosity, which then fuels further learning, creating a positive feedback loop that accelerates mastery.

Ultimately, the pursuit of education is not merely about acquiring knowledge; it is a choice to actively participate in one's own development rather than passively consume content. The E-v-E ratio serves as a practical framework for evaluating time allocation, highlighting that even small shifts--reading one more page of a book instead of watching a few more minutes of TV--can compound over time to produce significant mastery and personal transformation. The challenge lies not in philosophical agreement with the value of education, but in the daily discipline to choose growth-oriented activities, especially during moments of fatigue or stress when entertainment is the default. Embracing this intentionality can lead to mastering complex topics within months and becoming a more capable, evolved version of oneself.

Action Items

- Create a personal E-v-E ratio tracker: Log entertainment vs. education hours weekly for 4 weeks to identify personal imbalances.

- Draft a 6-month learning plan: Select 1-2 new topics and identify the top 5 books and 100 videos for each.

- Implement a "one great idea" rule: For every 100 pages read or 1 hour of audio consumed, extract and document one actionable insight.

- Schedule 3-5 dedicated learning blocks per week: Allocate 30-60 minute sessions for focused reading or audio consumption of educational material.

Key Quotes

"I am in this constant cycle of personal growth and I want to make sure that the books that are around me are books that matter they are books that speak to who I am where I am and most importantly where I am going next and so if you look at my current collection of books I have purged all of the ones that no longer appeal to me in terms of my season of growth I am moving myself into and the ones that are front and center reflect my current focus and the stack of books that I've brought with me today on my desk are all related to one particular topic in this case it's finance and investing and trying to figure out all the nitty gritties of improving the money side of our personal and professional lives for my wife and i and it has been an epic focus for the last six months or so"

Jeff Sanders explains that his personal growth involves a continuous process of acquiring and purging books to align with his current stage of development. He highlights that the books he keeps are those that are relevant to his present situation and future direction, using his current focus on finance and investing as a specific example of this curated approach to learning.

"whenever i take on a new topic the very first thing i do is reach for a book it is always my go to and it's one thing that continues to blow my mind just how simple it is to acknowledge a problem in your life or a goal you want to achieve and you could take the approach of saying well i don't know how to do whatever this thing is i have no idea how you would tackle topic x and you stop there and simply say i don't know that's it and you walk away well the problem is that issue will never be resolved or you're just going to cross your fingers and hope that some magic happens in the future and you figure it out but the reality is is that for most problems in life if you have a problem or you have a goal you are also the solution and so my question to you and to myself frequently is what are you going to do about it"

Jeff Sanders emphasizes that books are his primary resource when encountering a new subject or challenge. He contrasts the passive approach of admitting ignorance with the proactive stance of seeking solutions, asserting that individuals are the key to resolving their own problems or achieving their goals. Sanders encourages listeners to actively address their issues rather than passively waiting for resolution.

"I do not like this book and I have not liked this book for a long time i reviewed it again just to confirm that was true and it is yes there are great concepts in it but this book is not for me there are way better books out there to truly understand wealth and ways to get ahead in life and i think that his advice is just weird i think it's aggressive it's not for most people i know he's popular and i get it i'll probably get hate emails for this alone but i'm not a fan"

Jeff Sanders expresses his strong disapproval of Robert Kiyosaki's "Rich Dad Poor Dad," despite acknowledging its popular concepts. Sanders states that the book is not personally suitable for him, suggesting that superior resources exist for understanding wealth and advancement. He describes Kiyosaki's advice as "weird" and "aggressive," indicating it may not be appropriate for a broad audience.

"now the eve ratio stands for education versus entertainment which is a concept that i first learned from brian tracy the very famous author and speaker who was a guest on this podcast just a few months ago now this idea is very simple you're asking the question how much time do i spend on entertainment for every one minute that they spend on education now that number the 50 to one ratio here could be made up however i think it's actually fairly accurate for a lot of people because for a lot of people they don't spend any time at all in education"

Jeff Sanders introduces the E-v-E Ratio, a concept from Brian Tracy, which measures the balance between time spent on education versus entertainment. Sanders posits that the commonly cited 50:1 ratio of entertainment to education, while potentially an estimation, reflects the reality for many individuals who dedicate minimal or no time to intentional learning. He frames this as a critical question for self-assessment.

"the real drive home message of this episode has nothing to do with books has nothing to do with investing it has to do with how you think about how your time is spent and how you value growth itself and education itself and if you want to get the most value from your time it's going to be very easy conceptually to say well of course i would want to read a great book but the real rub here is not the philosophy of education it's the practical day to day moments when you're tired you're stressed out it's the end of the workday and you don't want to read a book right now you have no interest in that it's been a long day that's the last thing you want to do so you turn on the tv you grab a beer you do whatever it is you would do to wind down but that's the opportunity to change your life"

Jeff Sanders clarifies that the central message of the episode is not about specific books or investment strategies, but rather about one's perception of time allocation and the value placed on personal growth and education. He identifies the critical challenge as overcoming the daily inclination towards convenience and entertainment when fatigued, suggesting that consciously choosing educational activities in these moments is the key to life transformation.

"I can tell you right now that as i am exiting this current season of you know massive amounts of investment knowledge i'm going to transition into a new season now i don't yet know what that season is but i do know that this current season is winding down and so my big question to myself is what will be the next book that i pick up on the next topic that i choose which of course is based on curiosity yes but it's also based on real life what current major problems do i need to solve next what major goals am i striving to achieve next and that will dictate which books that i grab and what curiosity i then am able to explore because i'm on an adventure of personal growth all the time"

Jeff Sanders discusses his approach to transitioning between learning seasons, moving from extensive investment knowledge to an as-yet-undefined new topic. He explains that his selection of the next book and area of focus is driven by a combination of curiosity and practical needs, such as solving current problems or pursuing future goals. Sanders frames this continuous learning as an ongoing adventure in personal growth.

Resources

External Resources

Books

- "The Simple Path to Wealth" by JL Collins - Mentioned as a highly impactful book for personal investing, serving as a great starting point for beginners.

- "Introduction to Trading Psychology" by Mike Bear - Discussed for its insights into the psychology behind day trading and how changing one's thinking can lead to better decisions.

- "The Little Book of Common Sense Investing" by John C. Bogle - Referenced as a good introduction to common sense investing, similar in concepts to JL Collins' book.

- "The Only Investment Guide You'll Ever Need" by Andrew Tobias - Described as an introductory book covering many financial topics rapidly, potentially a game-changer for those new to money.

- "The Millionaire Next Door" by Thomas Stanley and William Danko - Recommended as required reading for understanding true wealth and the actual behaviors of millionaires, despite outdated data.

- "The Millionaire Choice" by Tony Bradshaw - Mentioned as an introductory book emphasizing that becoming a millionaire is a choice with specific behaviors and actions.

- "Rich Dad Poor Dad" by Robert Kiyosaki - Expressed as a disliked book with great concepts but considered aggressive and not suitable for most people.

- "Money Master the Game" by Tony Robbins - Advised against for money advice, despite Tony Robbins' expertise in personal growth, due to confusion and outdated information.

- "Investing for Dummies" - Described as a long, encyclopedia-like reference book for investing, suggesting Google as an alternative.

- "Your Money or Your Life" by Vicki Robin - Stated as a disliked book, focusing more on "life energies" than practical money advice, and not resonating with the speaker.

- "The Psychology of Money" by Morgan Housel - Mentioned as a wonderful book currently being read.

- "The Intelligent Investor" by Benjamin Graham - Mentioned as a book to be started soon, with a new updated version available.

People

- Brian Tracy - Referenced as the originator of the E-v-E Ratio concept and a past guest on the podcast.

- JL Collins - Author of "The Simple Path to Wealth," mentioned for his impactful book on investing.

- Mike Bear - Author of "Introduction to Trading Psychology," discussed for his work on trading psychology.

- John C. Bogle - Founder of Vanguard and author of "The Little Book of Common Sense Investing," recognized for popularizing low-cost index funds.

- Andrew Tobias - Author of "The Only Investment Guide You'll Ever Need," noted for covering a wide range of financial topics.

- Thomas Stanley - Co-author of "The Millionaire Next Door," recognized for his work on wealth and millionaire behaviors.

- William Danko - Co-author of "The Millionaire Next Door," recognized for his work on wealth and millionaire behaviors.

- Tony Bradshaw - Author of "The Millionaire Choice," mentioned for his book on making wealth a choice.

- Robert Kiyosaki - Author of "Rich Dad Poor Dad," discussed for his popular but disliked book.

- Tony Robbins - Author of "Money Master the Game," noted as a personal growth expert but not for money advice.

- Vicki Robin - Author of "Your Money or Your Life," discussed for her book's focus on life energies rather than practical money advice.

- Morgan Housel - Author of "The Psychology of Money," mentioned as currently being read and considered wonderful.

- Benjamin Graham - Author of "The Intelligent Investor," mentioned as a classic book to be read.

Other Resources

- E-v-E Ratio (Entertainment vs. Education) - A concept discussed for its importance in mastering new topics and the balance between learning and leisure time.

- Low-cost index funds - Mentioned in relation to John C. Bogle and their role in investing.

- Audiobooks - Referenced as a valuable tool for learning, especially when time is limited, suitable for story-driven content.

- YouTube videos - Identified as a powerful educational resource, particularly for finance and investing, but requiring careful selection.