Brian Armstrong's Vision for Decentralized Finance and Unbundling the State

TL;DR

- Brian Armstrong's early exposure to hyperinflation in Argentina and broken global payment systems at Airbnb directly informed his conviction that a decentralized financial system was necessary.

- The initial Coinbase prototype, a mobile Bitcoin wallet, revealed the need for a cloud-based service to handle data, security, and backups, demonstrating that even flawed initial steps can illuminate the right path.

- Applying to Y Combinator and receiving $150,000 from Paul Graham was the critical catalyst for Armstrong to quit his job, symbolizing external validation and belief in his vision.

- The realization that users couldn't easily buy Bitcoin within the initial wallet app, coupled with legal advice on money transmission licenses, pivoted Coinbase towards becoming an exchange and a crucial on-ramp.

- Coinbase's commitment to regulatory compliance, even when costly and complex, built trust and attracted institutional capital, differentiating it from less scrupulous competitors and enabling long-term growth.

- Armstrong's decision to make Coinbase an apolitical company focused solely on its mission of economic freedom, despite significant internal and external backlash, established a clear operational focus and attracted aligned talent.

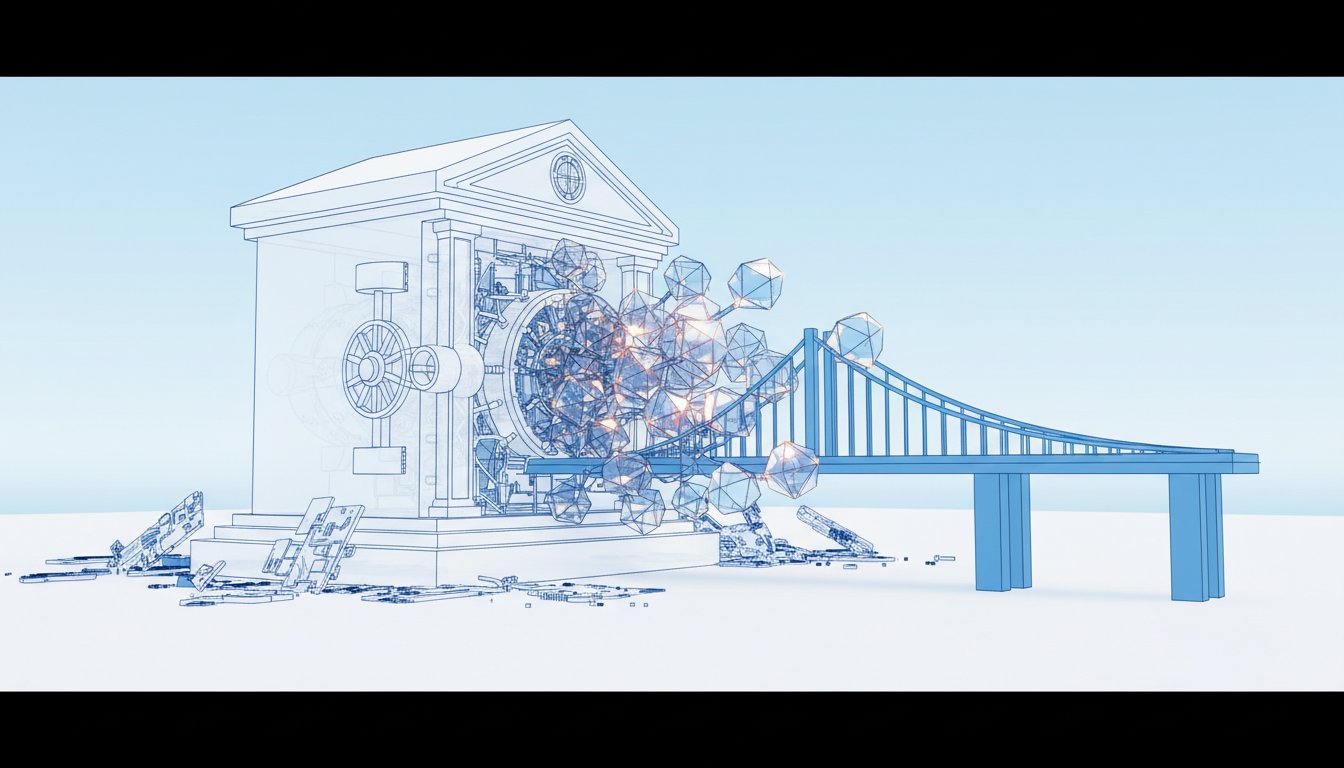

- The ultimate promise of Bitcoin is to "unbundle the state" by offering alternatives to government-issued money and identity, empowering individuals and fostering new forms of digital communities and governance.

Deep Dive

Brian Armstrong's journey from early skepticism of global payment systems to co-founding Coinbase highlights a profound dissatisfaction with the inefficiencies and inequities of traditional finance. His experiences with hyperinflation in Argentina and the broken payment rails at Airbnb revealed systemic flaws that motivated his pursuit of a decentralized financial future. This dissatisfaction, coupled with a deep dive into the Bitcoin white paper, ignited a vision for a global, decentralized system for value exchange, leading to the creation of Coinbase.

The foundational insight driving Armstrong's work is that the current global financial system is fundamentally broken, characterized by monopolies, high fees, and inefficiencies. This contrasts sharply with the internet's global, decentralized model for information transfer. Armstrong argues that a similar paradigm shift is needed for value, and Bitcoin offers the potential for such a transformation. The development of Coinbase itself illustrates this iterative process of innovation: an initial attempt at a mobile Bitcoin wallet, though technically flawed, revealed the necessity of a cloud-based service to manage security and data, leading to the more robust exchange model. The subsequent realization that users wanted a simple way to buy Bitcoin, rather than just a wallet, further refined the product-market fit, underscoring the principle that action and user feedback are critical drivers of product development.

Second-order implications of this vision are far-reaching. The rise of stablecoins, for instance, represents a significant evolution, moving beyond Bitcoin as "digital gold" to create a digital dollar that can be used for global, low-cost, and instant payments. This not only democratizes access to dollars for individuals in high-inflation economies but also strengthens the dollar's global soft power by providing a more efficient rail for its use. This development, while controversial to some, is seen by Armstrong as a positive force, enhancing the dollar's utility and potentially encouraging fiscal responsibility in governments by introducing competition.

Furthermore, Armstrong posits that blockchain technology and cryptocurrencies are fundamentally about "unbundling the state," shifting power from centralized governmental control to individuals. This extends beyond finance to areas like decentralized identity and social networks, potentially fostering new forms of community and governance. His experience at Coinbase navigating employee activism and regulatory scrutiny underscores the tension between corporate mission and external pressures. By advocating for an "apolitical" company focused solely on its mission of economic freedom, Armstrong sought to align the organization and resist capture by activist agendas, a move that, while controversial internally, ultimately reinforced the company's focus and resilience. This stance, coupled with a willingness to confront regulatory overreach, highlights a broader theme: that innovation often requires challenging established norms and, at times, holding government accountable to its own principles. The development of decentralized systems, from finance to identity, represents a fundamental challenge to traditional power structures, offering a glimpse into a future where individual sovereignty and freedom are more deeply embedded in technological and economic systems.

Action Items

- Audit Coinbase's internal processes: Identify 3-5 areas where regulatory clarity is lacking and draft proposals for clear, actionable guidance.

- Create a framework for evaluating new crypto asset listings: Define 5-7 objective criteria for assessing risk and potential, moving beyond speculative hype.

- Implement a system for tracking customer support ticket trends: Analyze 10-15 recurring issues to identify systemic problems in user onboarding or platform usability.

- Design a pilot program for decentralized identity verification: Explore integrating self-custodial identity solutions for 2-3 core user journeys within the next quarter.

- Develop a proactive risk assessment model for AI agent transactions: Establish parameters to monitor and flag unusual or potentially fraudulent activity across 5-10 key transaction types.

Key Quotes

"I spent a year living abroad in Argentina. None of this made sense to me at the time by the way. This only in hindsight this made sense when I was living in Argentina I saw this economy that was going through hyperinflation and it destroyed the lives of the average poor people in the society they could only hold cash."

Brian Armstrong explains that his experience with hyperinflation in Argentina was a pivotal moment in understanding the fragility of traditional financial systems. This firsthand observation of economic devastation due to currency devaluation highlighted the need for more stable and accessible forms of value storage.

"I also had worked at Airbnb as an early employee and they were moving money into and out of about 180 countries around the world and I got to see how difficult and broken that was like we were trying to send money into Cuba or Ecuador or these places where people were renting their homes and we were trying to pay them out and we had no idea how much money was going to show up on the other side it was like a cartel or almost like a black market where these like extraordinarily high fees were being charged and no one could even tell us how much the fees were."

Brian Armstrong details his experience at Airbnb, observing the inefficiencies and exorbitant fees associated with international payments. This practical encounter with the broken global financial system solidified his belief that a more streamlined and transparent method for transferring value was necessary.

"I happened to read the Bitcoin white paper. It was describing how the world could have something kind of like the internet that's global and decentralized but instead of for moving information around it was for moving value around and it immediately caught my attention I was like that's a pretty interesting idea."

Brian Armstrong recounts discovering the Bitcoin white paper, which immediately captured his imagination. He recognized its potential to create a decentralized, global network for value transfer, akin to the internet's impact on information exchange.

"I realized almost like the minute that we launched it that there would need to be some sort of cloud service, you know, that would do all the data and the security and backups. It's kind of like, you know, for email, a lot of people use like, they don't run their own email server on their phone, they use Gmail or something in the cloud. So there was an important lesson in that of like, just getting started with anything, even if it's the wrong thing, will sometimes let you figure out what the right thing is too."

Brian Armstrong reflects on an early product iteration, realizing the necessity of a cloud-based service for a Bitcoin wallet. This experience taught him the value of launching even imperfect solutions to gain crucial insights for future development.

"The thing that actually convinced me to quit my job and do it full time was that I applied to Y Combinator, which is this startup incubator and Paul Graham, I had read a lot of his essays on the internet and I really had like a ton of respect and this is like somebody who's like a hero of mine."

Brian Armstrong explains that acceptance into the Y Combinator incubator program, led by his admired Paul Graham, was the catalyst for him to leave his job and pursue his startup idea full-time. This validation provided the confidence and resources needed to commit to the venture.

"The lesson I take away from that is just get started. You know, you can sit there in an analysis paralysis forever and I think there's a lot of value in just kind of stepping into the unknown and Paul Graham actually has a great saying he says action produces information and that was very true for us."

Brian Armstrong emphasizes the importance of taking action and starting, even without complete certainty, as a means to gather information and progress. He cites Paul Graham's adage that "action produces information" as a guiding principle for overcoming indecision.

"The ultimate potential of Bitcoin is that it's going to unbundle the state. And by that I mean, we rely on the government to issue money. Okay, if we don't need it to do that, what about identity? We also rely on the government to like issue these driver's licenses and passports, and crypto is now coming out with these decentralized identities where you can feel like your sense of ownership around that."

Brian Armstrong posits that Bitcoin's ultimate potential lies in its ability to "unbundle the state," suggesting a future where individuals rely less on government for essential services like money and identity. He highlights the emergence of decentralized identities as a key development in this shift.

"I think the biggest roadblocks to accelerating [technological progress]... it's really culture. Because to have a society that can rapidly advance, you have to have a culture of people that want to do that. They are willing to, every time something bad happens, not say, 'Well, this will never happen again, we need to put some new rule in place.' They actually have to still have freedoms in the society where people can be allowed to experiment and try ideas, live on the frontier, and we have to sort of celebrate it when it happens."

Brian Armstrong identifies culture as the primary barrier to accelerating technological progress, arguing that societies must foster a willingness to experiment and embrace new ideas rather than solely focusing on regulation after negative events. He believes celebrating innovation is crucial for advancement.

Resources

External Resources

Books

- "The Network State" by Balaji Srinivasan - Mentioned as a book whose view the interviewee tends to agree with regarding people having a greater sense of identity with internet communities than their country of origin.

Articles & Papers

- Bitcoin white paper - Mentioned as the document that described how the world could have something like the internet for moving value around, which immediately caught the interviewee's attention.

- "WTF Happened in 1971" (Website) - Mentioned as a website with graphs showing how many things inflected in 1971, the year the US went off the gold standard.

People

- Balaji Srinivasan - Former Coinbase employee, author of "The Network State."

- Fred Ersum - Co-founder of Coinbase.

- Gary Gensler - SEC Chair under the last administration.

- Jonathan Haidt - Author of books on activism and college campuses.

- Milton Friedman - Author whose books the interviewee read growing up.

- Paul Graham - Founder of Y Combinator.

- Peter Thiel - Mentioned for his saying about contrarian but right ideas.

- Rick Rubin - Host of the podcast "Tetragrammaton."

- Sam Bankman-Fried - Founder of FTX.

- Shinya Yamanaka - Japanese scientist who won the Nobel Prize for demonstrating epigenetic reprogramming.

- Steve Jobs - Co-founder of Apple.

- Steve Wozniak - Co-founder of Apple, former employee at HP.

- Toby (Shopify) - Mentioned for publishing something similar to Coinbase's mission-first approach.

- Warren Buffett - Mentioned for a quip about a constitutional amendment for balanced budgets.

Organizations & Institutions

- Airbnb - Mentioned as the company where the interviewee worked as an early employee and experienced payment system frictions.

- Coinbase - The largest cryptocurrency exchange in the United States, co-founded by the interviewee.

- Y Combinator - A startup incubator that the interviewee applied to and was accepted into.

- Hacker News - A website where the interviewee found the Bitcoin white paper.

- Goldman Sachs - Mentioned as the company where co-founder Fred Ersum worked.

- NewLimit - A longevity company co-founded by the interviewee.

- ResearchHub - An initiative co-founded by Brian Armstrong.

- SEC (Securities and Exchange Commission) - Mentioned in relation to interactions with its chair.

- StandWithCrypto.org - A 501(c)(3) organization that helped fund to organize pro-crypto voters.

- The New York Times - Mentioned as a mainstream media organization that the interviewee believes is more of a political advocacy organization.

- US Treasury - Mentioned in relation to stablecoin reserves.

Tools & Software

- Coinbase App - The primary application used by the interviewee for investing and payments.

- Base App - A self-custodial wallet being developed by Coinbase.

- X402 Protocol - A protocol launched by Coinbase that allows any web request to have a small payment attached to it.

Websites & Online Resources

- athleticnicotine.com/tetra - Website for Athletic Nicotine, a sponsor.

- drinklmnt.com/tetra - Website for LMNT Electrolytes, a sponsor.

- squarespace.com/tetra - Website for Squarespace, a sponsor.

- tetragrammaton.com/join-newsletter - Website to sign up for Tetragrammaton Transmissions.

Other Resources

- Bitcoin - Mentioned as digital gold, the original cryptocurrency, and a store of value.

- Bitcoin white paper - Mentioned as the document that described how the world could have something like the internet for moving value around.

- Cryptocurrency - Discussed as a technology for moving value around and a potential alternative financial system.

- Decentralized Autonomous Organization (DAO) - Mentioned as an on-chain equivalent to a Delaware C-corp for company governance.

- Decentralized Finance (DeFi) - Mentioned as a way for anyone with a smartphone to get a loan.

- Digital Gold - A term used to describe Bitcoin.

- Economic Freedom - The core mission of Coinbase.

- Epigenetic Reprogramming - A biological concept related to changing cell states, being developed by NewLimit.

- Ethereum - A blockchain that came after Bitcoin, known for smart contracts.

- Fiat Currency - Discussed in contrast to Bitcoin and stablecoins, with the idea that many may disappear.

- Hashing Power - Mentioned in relation to Bitcoin mining and decentralization.

- Hyperinflation - Experienced by the interviewee in Argentina, influencing their views on financial systems.

- MICA (Markets in Crypto-Assets) - EU legislation that helps regulate crypto and stablecoins.

- Money Transmitter License - A license required for certain financial services, discussed in the context of Coinbase's early development.

- Proof of Work - A consensus algorithm used in Bitcoin mining.

- Proof of Stake - A consensus algorithm used by Ethereum, which uses significantly less energy than Proof of Work.

- Smart Contracts - Code that executes contract terms on a blockchain, pioneered by Ethereum.

- Stablecoins - Tokenized representations of fiat currency, used for payments.

- Universal Basic Income (UBI) - Mentioned in relation to philanthropic experiments.