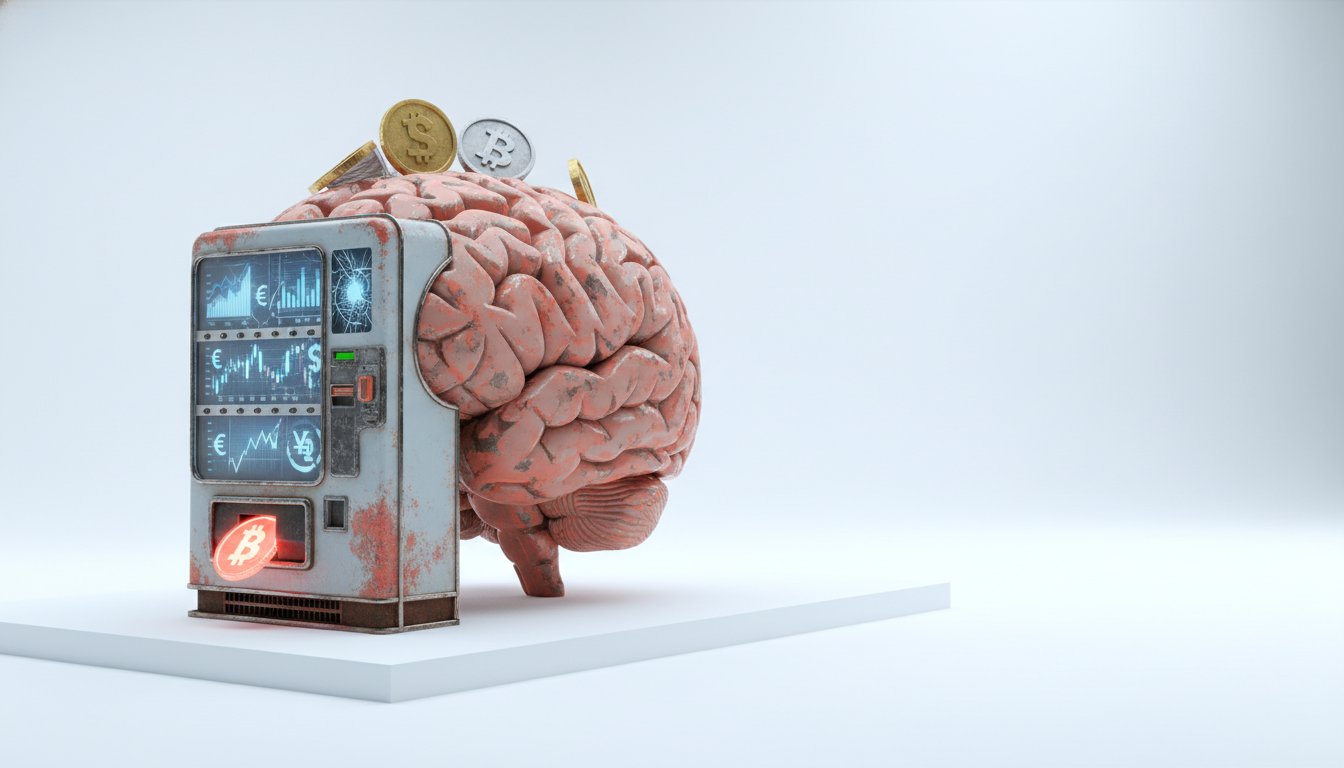

Human Brain's Evolutionary Biases Undermine Investment Decisions

The human brain, a marvel of evolution, is fundamentally ill-equipped for the cold, rational calculus of investing. This conversation with Scott Nations, author of "The Anxious Investor," reveals how deeply ingrained psychological biases, honed for survival on the savanna, actively sabotage our financial returns. The hidden consequence? A consistent drag on wealth accumulation, often costing investors 1.5% annually. This analysis is crucial for anyone looking to move beyond instinct and toward a more robust, process-driven approach to investing, offering a distinct advantage by leveraging a deeper understanding of market psychology and systemic dynamics. Understanding these pitfalls is the first step to building a portfolio that can weather the inherent irrationality of the market.

The Siren Song of Stories: Why Narrative Trumps Numbers (Until It Doesn't)

The market, Scott Nations argues, is often driven by narratives, not just fundamentals. This "fantastic objects" bias, where investors become enamored with charismatic founders like Steve Jobs or Elon Musk, leads them to buy stocks not based on financial health, but on an emotional connection or the allure of a compelling story. While these narratives can be rewarding in the short term, as seen with Tesla's meteoric rise, they create a dangerous susceptibility. The system rewards these story-driven investments until it inevitably doesn't. When the narrative falters, investors often cling to their positions, exhibiting a form of grief that keeps them invested until the absolute bottom.

"The problem is that it works until it doesn't. Yes. And then when it doesn't, we still hold on too long because we have confidence in the company or or the founder and we hold on we hold on we hold on and we go through a series of stages a little bit like the kubler ross stages stages of grief and it's only when we've gotten discussed it with ourselves that investors pull the plug sell and that's often at the bottom."

-- Scott Nations

This tendency to chase popular stocks, fueled by availability bias and herding, means investors often limit their universe to well-known names, ignoring potentially better opportunities in less-hyped companies. The long-term consequence is underperformance. Nations emphasizes that while short-term market movements are a "voting machine," swayed by popular sentiment and stories, the long term is a "weighing machine," where fundamentals ultimately prevail. The challenge for investors is to disentangle the compelling narrative from the objective financial reality, a task made difficult by our innate psychological wiring.

The Illusion of Control: Why "Buy the Dip" Becomes a Trap

A striking observation from the conversation is the diminishing role of volatility in signaling risk. Events that historically would have sent markets into a tailspin now elicit muted reactions. Nations attributes this to a learned behavior: "buy the effing dip." This strategy, while effective in recent years, has fostered a dangerous sense of fearlessness. Investors have become so accustomed to market sell-offs being swiftly reversed that they no longer price in significant downside risk. This creates a system where implied volatility, the cost of options reflecting perceived risk, spikes and then rapidly normalizes due to a legion of traders eager to sell options when they are expensive.

"This is one of those things that it will stay quiet until all of a sudden it doesn't and there's a really geeky word about volatility volatility is heteroskedastic meaning it'll stay low for a while and then some shock will come along and it will jump and it will stay high for a while the shock and the jump is going to happen tomorrow don't know next month is it next year we don't know but people have to be have to have a portfolio that can weather that sort of thing that's not overly not overly aggressive."

-- Scott Nations

The proliferation of zero-day-to-expiration (0DTE) options further exacerbates this issue. What were once tools for hedging risk have devolved into speculative bets, gamified by zero commissions and the allure of quick, leveraged gains. This explosion in options trading, particularly short-dated ones, signifies a market increasingly driven by speculation rather than long-term investment. The downstream effect is a market that is more prone to sudden, sharp corrections when the prevailing narrative or the "buy the dip" mentality finally breaks. The system has adapted to absorb shocks, but this adaptation itself creates a new, more insidious form of systemic risk.

The Opaque Frontier: Private Credit as the Next "Novel Financial Contraption"

Nations identifies private credit as a significant concern for the future, likening it to the "novel financial contraptions" that have historically preceded market crashes. Unlike more transparent markets, private credit is opaque, vast, and often deals with second and third-tier credit risks. This lack of transparency makes it difficult to assess the true leverage within the system, potentially hiding systemic vulnerabilities. The danger lies in its potential to cause problems for major financial institutions, much like portfolio insurance in 1987 or mortgage-backed securities in 2008.

"But one thing that could cause real problems is private credit for a couple of reasons it's opaque it's huge and it has the potential to do a little bit like what long term capital did in the late 1990s and that is if the problems in private credit get big enough and again it's opaque we don't know how big the market really is then it could it could come along and and be sneaky dangerous for one of the big pillar financial organizations whether it's a investment bank or one of the big commercial banks."

-- Scott Nations

While AI is seen as a fundamental technological shift with long-term potential, and current valuations might be a "bubble we can grow into," the opacity of private credit presents a more immediate and unpredictable systemic risk. The downstream effect of problems in this sector could be a contagion that impacts broader financial stability, a risk that is currently underestimated due to its hidden nature. This highlights a critical failure in conventional wisdom: assuming that what is not immediately visible poses no threat.

Key Action Items

- Develop and Adhere to a Process: Create a well-defined investment process and stick to it, resisting emotional impulses. This is a long-term investment in self-discipline.

- Challenge Your Own Convictions: Regularly engage in a "fearless conversation" with yourself about why you are considering a particular investment. Distinguish between genuine analysis and narrative-driven interest. (Immediate action, ongoing practice)

- Diversify Beyond the Headlines: Actively look for investment opportunities outside of the most popular, frequently discussed stocks. This broadens your investment universe and reduces susceptibility to herding. (Immediate action, ongoing practice)

- Re-evaluate "Buy the Dip": Recognize that the strategy of consistently buying dips may become a trap. Prepare for scenarios where dips do not immediately recover and adjust portfolio risk accordingly. (Immediate action, requires a shift in mindset)

- Understand Options as Tools, Not Bets: If using options, focus on their hedging capabilities rather than treating them as speculative gambles, especially 0DTE options. This requires education and a commitment to risk management. (Requires education, pays off in 6-12 months)

- Monitor Opaque Markets: Pay closer attention to less transparent financial sectors like private credit. Understand the potential systemic risks, even if precise quantification is difficult. (Ongoing vigilance, pays off in 12-18 months)

- Prioritize Long-Term Retirement Savings: For young investors, consistently max out 401(k) and IRA contributions and invest in a diversified, low-cost basket of assets, resisting the urge to trade frequently. (Immediate action, pays off in 10+ years)