Taxation Policy and Personal Wealth Management Diverge

TL;DR

- Taxing AI or companies that use it could offset job displacement, but risks weaponizing the tax code and creating definitional confusion, suggesting a broader progressive tax structure is more effective.

- Eliminating the capital gains tax deduction and raising its rates to match income tax levels would restore a progressive structure and address wealth transfer from younger to older generations.

- Implementing a $25 minimum wage would stimulate the economy by increasing consumer spending and creating a living wage, despite initial business costs.

- Overturning Citizens United would curb corporate influence in politics, addressing a root cause of many economic and social problems stemming from corporate interests.

- Maintaining a father's memory for children involves actively preserving photos, letters, and stories, and encouraging relationships with paternal relatives and friends.

- For boys, the involvement of male role models is crucial for emotional and neurological development, especially after the loss of a father figure.

- Spending money on experiences and giving generously, rather than hoarding wealth, contributes to personal fulfillment and societal well-being, preventing wealth accumulation from becoming a "virus."

Deep Dive

Kara Swisher and Scott Galloway's end-of-year listener mail episode delves into critical policy questions and personal philosophies, revealing how taxation policies and personal wealth management diverge significantly between the hosts. Their discussion highlights a fundamental tension in modern economics: how to adapt tax structures to technological advancements like AI and how to reconcile wealth accumulation with societal benefit.

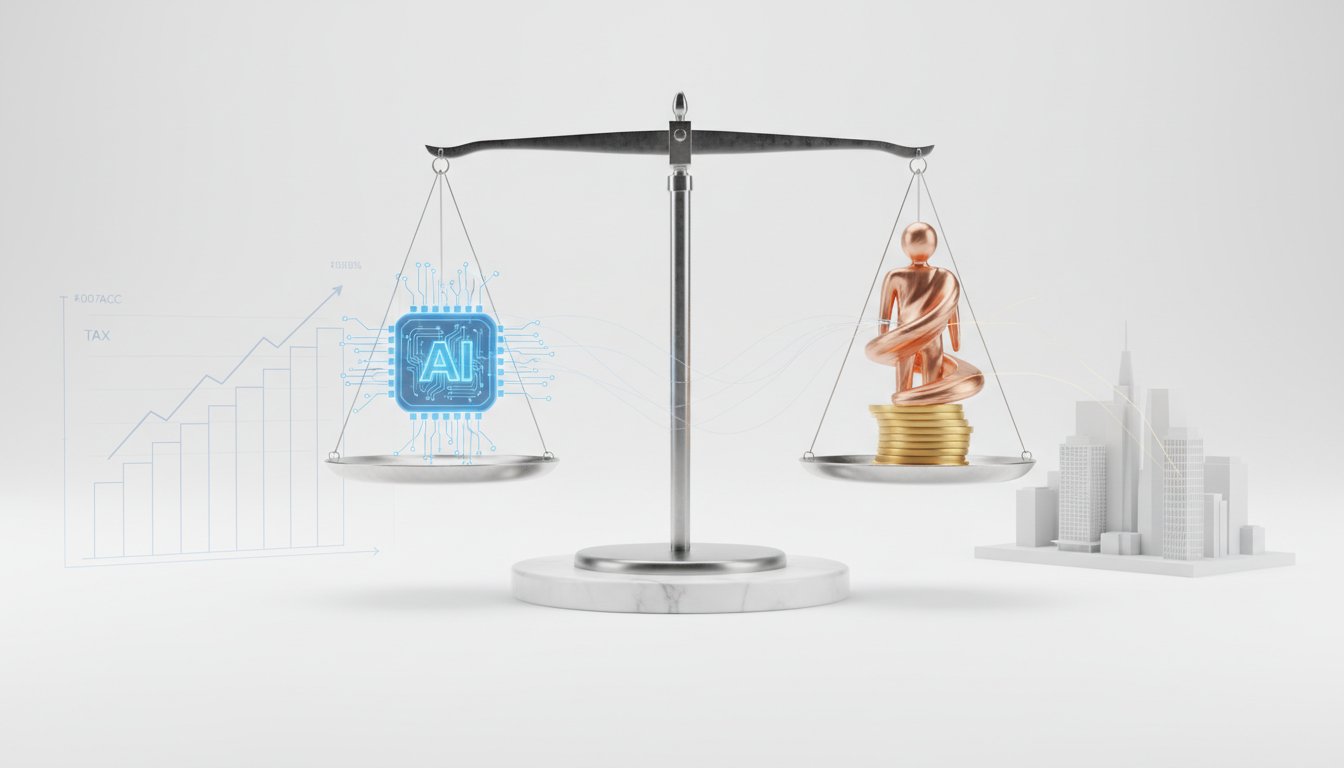

The core debate around taxing AI centers on its potential to displace workers, with Galloway advocating for a broad, progressive tax system that applies equally to all income and firms, rather than singling out specific industries like AI. He argues for eliminating the capital gains tax deduction, which he views as a transfer of wealth from younger generations to older ones, and increasing long-term capital gains tax rates to 37%. Swisher echoes the sentiment that taxes need to increase, suggesting a robust Alternative Minimum Tax (AMT) for high earners, and expresses skepticism about taxing specific technologies, preferring to focus on broader tax reform.

On personal investment and spending, the hosts present contrasting philosophies. Swisher, who grew up with a spendthrift mother and later inherited money, prioritizes savings, diversification, and a generally frugal lifestyle, spending primarily on necessities like her children's education and occasional upgrades like first-class travel or hotel stays. She emphasizes having significant cash reserves and a diversified portfolio including stocks and real estate, but expresses a lack of tolerance for volatile investments like Bitcoin. Galloway, driven by a childhood scarcity and a belief that "we don't own money, we rent it," spends lavishly on homes, experiences, and philanthropy, matching his annual spending for charitable donations. He intentionally aims to not increase his net worth, believing hoarding wealth is a "virus" and that spending on loved ones and societal contributions is more fulfilling. He invests in real estate in desirable global locations, positioning them as potential future assets for billionaires, while also supporting causes that enabled his own success.

The episode also touches on parenting and loss, with both hosts sharing deeply personal experiences. Swisher, who lost her father young, wishes her mother had done more to preserve her father's memory and connections. Galloway, raised by a single mother, emphasizes the critical importance of male role models for boys, particularly in single-parent households, and credits his mother with instilling confidence. Both agree on the profound impact of parental loss and advocate for open discussion and remembrance of lost loved ones.

Ultimately, the episode underscores how differing backgrounds and philosophies shape perspectives on economic policy and personal wealth. Galloway's approach champions active spending and redistribution, viewing wealth as a tool for impact and personal fulfillment, while Swisher's emphasizes prudence, security through savings, and a more restrained approach to discretionary spending. Both, however, acknowledge the value of experiences and family, and express a desire to give back, albeit through vastly different mechanisms.

Action Items

- Audit AI taxation: Analyze potential tax structures for AI and AI-utilizing companies to offset job displacement impacts.

- Implement progressive tax reform: Advocate for eliminating the capital gains tax deduction and raising long-term capital gains tax rates to 37%.

- Establish $25 minimum wage: Propose a $25 minimum wage policy to stimulate economic activity and provide a living wage.

- Overturn Citizens United: Support efforts to overturn Citizens United to reduce corporate influence in politics.

- Create universal daycare: Advocate for nationally funded universal daycare programs to support working parents.

Key Quotes

"my view around taxation is that the moment you start taxing specific industries you weaponize special interest groups to come to their defense and you also create some confusion around like is oracle ai you know if if i mean at what point what qualifies as an ai company and not an ai company is microsoft an ai company what i'm a big fan of and i think that the caller is alluding to i want to go back to reagan era taxation and that is there's no difference between i think the capital gains tax deduction is nothing but a transfer of wealth from young to old because somehow we've decided that sweat is less noble than money and that is the money i make on money gets taxed at a lower rate than the money that young people make on sweat so i would like to see an elimination of the capital gains tax deduction and raise those rates to current income and restore a progressive tax structure in my view you do it across all income and all firms because i think the moment you start getting into this notion of let's put a super tax on this type of firm i think that's i think you regulate them i think you have an epa you have an ai act you have privacy you have laws but in terms of taxation i just think you say look above a certain level of profitability when you sell a stock you pay this much in tax i think taxes need to go up i think we need to do away we need to raise long term capital gains from 21 to 37 it makes no sense and i'm paying lower taxes than people actually working for a living but i think you apply it to every company because a lot of a lot of for example the ai boom is going to make a lot of people in the construction industry very very rich it is that's one people that group of people that are benefiting yeah would you tax them right would you tax oh my attitude there's so many loopholes right now the only way we get there is with an amt there should be an amt anything above 10 million anything above 3 million you pay a federal amt of 40 because what happens is guys like me weaponized the tax code and do 1202 and buy assets and we end up paying high teens in tax rates so the stated the stated we focus too much on tax rates not on the tax code and enough already there is no reason why someone working for money should be taxed at a higher rate than someone who is making money from investments although i don't see any wrong taxing robots if they're workers i don't know it's an interesting one yeah yeah i just when he said it and i thought oh bill gates and then i thought oh actually he's really smart and i forgot anyway it's an interesting question we have to deal with all these things and what happens with displaced workers and how we're going to pay for that or get them different jobs so there's going to be a lot of rethinking of all the way the workplace is taxed how it's conducted what people get paid um and obviously the damage that some of this ai is going to do there's going to have to be some mitigation"

Scott Galloway argues against taxing specific industries like AI, suggesting it leads to weaponization by special interests and confusion. Instead, Galloway advocates for a broader tax reform, specifically eliminating the capital gains tax deduction and restoring a progressive tax structure across all income and firms. He believes focusing on loopholes and the overall tax code, rather than just rates, is crucial for a fairer system.

"if i could overturn citizens united i would i think a lot of our problems stem from the weaponization of washington by corporate interests and corporate money oh wow um and then wow bernie sanders i like that answer well i mean it's just true there's more there's more full time lobbyists living in dc working for amazon than there are sitting us senators huh"

Kara Swisher identifies the Citizens United Supreme Court decision as a root cause of many problems, arguing that corporate money and interests have weaponized Washington. Swisher supports this by noting the disproportionate number of lobbyists in D.C. compared to senators, implying that corporate influence overshadows legislative action.

"my approach to spending money is that we don't own money we rent it and also you collide that with my atheism you know i believe that this is all coming to an end pretty quickly for me so i spend a great deal of money i spend between three and 400 000 a month i own homes all over the world i uh have a plane and i spend most of my money on homes and experiences not gifts for kara just please but along those lines the way i try and keep in check is i think hoarding money is a virus when i hit my number eight years ago i decided anything above that number i would give away and what i do each year is i look at my total spending and i match it and i give that amount of money away and it keeps my my net worth has not increased in eight years and because i think hoarding wealth is a virus there's no reason anybody needs to be a billionaire but there's no i can't stand it when wealthy people can't aren't good at spending money i have an amazing time yeah i do things for my friends and family to get us all together in the same place i never let money get in the way of a good time i'm spending money like a 50s gangster just diagnosed with ass cancer"

Scott Galloway explains his philosophy of "renting" money, driven by his atheism and belief in enjoying life now. Galloway spends significantly each month on homes and experiences, and he has committed to giving away any money earned above a certain threshold, effectively capping his net worth increase. He views hoarding wealth as a "virus" and emphasizes spending money on people and experiences rather than accumulating it.

"i grew up with a lot of money and so i guess i don't care i've always had money um you think about money less than almost anybody i know i know you get mad at me because i don't i don't i have enough i like i don't also let me point out my mom was a spendthrift and it upset me and made me my brothers and i are very hard workers and we don't spend a lot of money all of us are very we like my brother built a beautiful house in pennsylvania where he lives and it's beautiful and he didn't it's it's gorgeous and he loves it and so that's what he spends money on and i love that because i feel like it was money well spent because he enjoys it and it's quite beautiful it's beautiful settings so we always spend money on homes but not extremely like not like ridiculously"

Kara Swisher contrasts her approach to money with Galloway's, stating that growing up with money has made her less concerned with it. Swisher notes that her mother's spendthrift habits influenced her and her brothers to be hard workers who do not spend excessively. She finds value in spending money on homes that provide enjoyment and beauty, but avoids excessive or ridiculous spending.

"unfortunately if you were to reverse engineer a young man's problems to a single point

Resources

External Resources

Books

- "The Loss That Is Forever" by [Author Not Specified] - Recommended for understanding and acknowledging grief.

Articles & Papers

- "The AI Gold Rush" (The Vergecast) - Discussed as a two-week series exploring AI integration in technology.

- "2025 Tech Recap" (The Vergecast) - Discussed as a series reviewing the year's tech industry events and predictions.

People

- Bill Gates - Mentioned for his past comments on taxing robots.

- Reagan - Referenced in the context of taxation era.

- Bernie Sanders - Mentioned in relation to policy ideas.

- Jeff Bezos - Referenced as an example of wealth.

- Taylor Swift - Mentioned as an example of someone Kara might want to see perform.

- Groucho Marx - Mentioned as a potential tattoo idea.

- Don Lemon - Mentioned as a guest backstage at a tour stop.

- Chelsea Handler - Mentioned as a guest backstage at a tour stop.

- Jill - Mentioned in relation to a backstage interaction.

Organizations & Institutions

- Pivot (New York Magazine and Vox Media Podcast Network) - The podcast network producing the show.

- Pivot YouTube channel - Where episodes can be watched.

- Instagram and Threads (@pivotpodcastofficial) - Social media platforms for the podcast.

- Bluesky (@pivotpod.bsky.social) - Social media platform for the podcast.

- TikTok (@pivotpodcast) - Social media platform for the podcast.

- Vox Media - The podcast network.

- National Football League (NFL) - Mentioned in relation to taxing robots.

- Pro Football Focus (PFF) - Mentioned as a data source.

- New England Patriots - Mentioned as an example team.

- AT&T - Sponsor mentioned for wireless services.

- Ferragamo - Sponsor mentioned for holiday collection.

- MongoDB - Sponsor mentioned for database solutions.

- Vanta - Sponsor mentioned for security and compliance.

- Zbiotics - Sponsor mentioned for pre-alcohol probiotic.

- Vanguard - Sponsor mentioned for financial advisory services.

- Citizens United - Mentioned as a potential policy to overturn.

- EPA (Environmental Protection Agency) - Mentioned as an example of regulation.

- Darpa - Mentioned as a benefactor of government-assisted programs.

- University of California - Mentioned as a benefactor of government-assisted programs.

- Jira by Atlassian - Sponsor mentioned for project management.

- AWS (Amazon Web Services) - Mentioned as a platform used by Epic Games.

- Epic Games - Mentioned in relation to scaling Fortnite on AWS.

- Fortnite - Mentioned as a game scaled on AWS.

- Rubric - Sponsor mentioned for AI agent management.

- Sequoia Capital - Mentioned as the host of Crucible Moments.

- New Mexico - Mentioned for its universal daycare program funded by oil and gas money.

- Charles Schwab - Sponsor mentioned for wealth management.

- The Vergecast - Podcast mentioned for AI and 2025 tech recap series.

- Nymag.com/pod - Website to subscribe to New York Magazine.

Tools & Software

- Chevy Bolt - Mentioned as Kara's car.

- Acura - Mentioned as a car Scott received from his mother.

- Opel Manta - Mentioned as the car Scott learned to drive on.

- Gulfstream G600 - Mentioned as a potential purchase if Kara had unlimited money.

Podcasts & Audio

- Pivot - The podcast being discussed.

- The Vergecast - Podcast mentioned for its AI and 2025 tech recap series.

- Crucible Moments - Podcast mentioned for stories of tech company make-or-break moments.

Other Resources

- Capital gains tax deduction - Discussed as a mechanism that benefits older generations.

- Progressive tax structure - Advocated for as a fairer system.

- Alternative Minimum Tax (AMT) - Discussed as a way to ensure higher tax payments.

- Section 1202 - Mentioned in relation to tax loopholes.

- Minimum wage ($25) - Proposed as a policy to solve multiple economic problems.

- Housing (8 million more houses) - Proposed as a policy to solve multiple economic problems.

- National service - Mentioned as a potential policy.

- Universal childcare - Proposed as a policy.

- Medicare eligibility reduction - Proposed as a policy.

- AI (Artificial Intelligence) - Discussed in relation to job displacement and taxation.

- Robots - Mentioned in the context of taxation.

- Bitcoin - Mentioned as an investment Kara considered but did not pursue.

- Pell Grants - Mentioned as a government-assisted program.

- Private equity firm - What Scott would start if he had unlimited money.

- American values - What Scott would focus on restoring with unlimited money.

- Fairness and equity - Principles associated with American values.

- Traditional American values - What Scott would focus on restoring.

- Progressive values - What Scott would focus on restoring.

- Taxes - Discussed extensively in relation to AI, capital gains, and wealth.

- Tax code - Discussed in relation to loopholes and complexity.

- Income inequality - Discussed as a worsening problem.

- Parenting - Discussed in relation to raising children after loss.

- Male role model - Discussed as important for sons.

- Scarcity of money - Scott's upbringing experience.

- Top ramen and bananas - Food Scott ate during college due to scarcity.

- Student debt - Scott's financial situation in college.

- Mother's healthcare - A financial burden Scott faced.

- Wealth hoarding - Described as a "virus."

- Capitalist society - Mentioned in relation to spending money.

- Tombstone tattoo - Mentioned as a potential tattoo idea.

- Barcode tattoo - Mentioned as a potential tattoo idea.

- Raccoon holding a beer tattoo - Mentioned as a potential tattoo idea.

- Cat and dog fighting/hugging tattoo - Mentioned as a potential tattoo idea.

- Receipt tattoo - Mentioned as a potential tattoo idea.

- Broken halo tattoo - Mentioned as a potential tattoo idea.

- Fortune cookie tattoo - Mentioned as a potential tattoo idea.

- Daisy Duck tattoo - Mentioned as a potential tattoo idea.

- Penis tattoo - Mentioned as a potential tattoo idea.

- Groucho Marx nose tattoo - Mentioned as a potential tattoo idea.

- Roll of toilet paper tattoo - Mentioned as a potential tattoo idea.

- "Scott tried" tattoo - Mentioned as a potential tattoo idea.

- "At least he's not Scott Jennings" tattoo - Mentioned as a potential tattoo idea.

- "Rest in peace Scott's sanity taken by Kara" tattoo - Mentioned as a potential tattoo idea.

- "In case of emergency call Scott" tattoo - Mentioned as a potential tattoo idea.

- "Problem with Scott" barcode tattoo - Mentioned as a potential tattoo idea.

- "Item: Putting up with Cara" tattoo - Mentioned as a potential tattoo idea.

- "Tattoo of a receipt total zero zero zero" - Mentioned as a potential tattoo idea.