AI Shopping Risks and Early Career Financial Trade-offs

The AI Shopping Revolution: Convenience, Caution, and the Hidden Costs of Instant Gratification

The proliferation of AI in consumer-facing platforms presents a double-edged sword: unprecedented convenience that could fundamentally alter our spending habits and significantly impact personal budgets. This conversation reveals the subtle, yet profound, ways AI-driven shopping blurs the lines between advice and advertising, potentially leading to a surge in impulse purchases and a decline in critical comparison shopping. Anyone navigating the modern retail landscape, from novice shoppers to seasoned budgeters, needs to understand these shifts to protect their finances and maintain control over their spending decisions. The advantage lies with those who can anticipate these changes and adapt their strategies before the convenience becomes an irresistible trap.

The integration of Artificial Intelligence into shopping platforms is no longer a futuristic concept; it's a rapidly unfolding reality that promises convenience but carries significant, often overlooked, consequences. As AI tools evolve from simple search engines to sophisticated personal shoppers and checkout assistants, they are poised to reshape consumer behavior and challenge long-held notions of deliberate purchasing. This shift isn't merely about finding deals faster; it's about a fundamental alteration in the consumer journey, where the friction of decision-making is systematically removed.

One of the most immediate and concerning downstream effects is the erosion of the distinction between genuine advice and paid promotion. AI models, designed to be helpful and engaging, are increasingly being infused with advertising. Google's AI Mode, for instance, is already piloting "Direct Offers," embedding personalized deals directly into chat conversations. OpenAI is testing ads within ChatGPT, asserting they won't influence chat responses. However, the very nature of AI's persuasive capabilities, coupled with its ability to foster a sense of trust and personalized connection, makes this separation inherently fragile.

"AI shopping is going to be collapsing that line that exists right now between advice and advertising and then actually making a purchase."

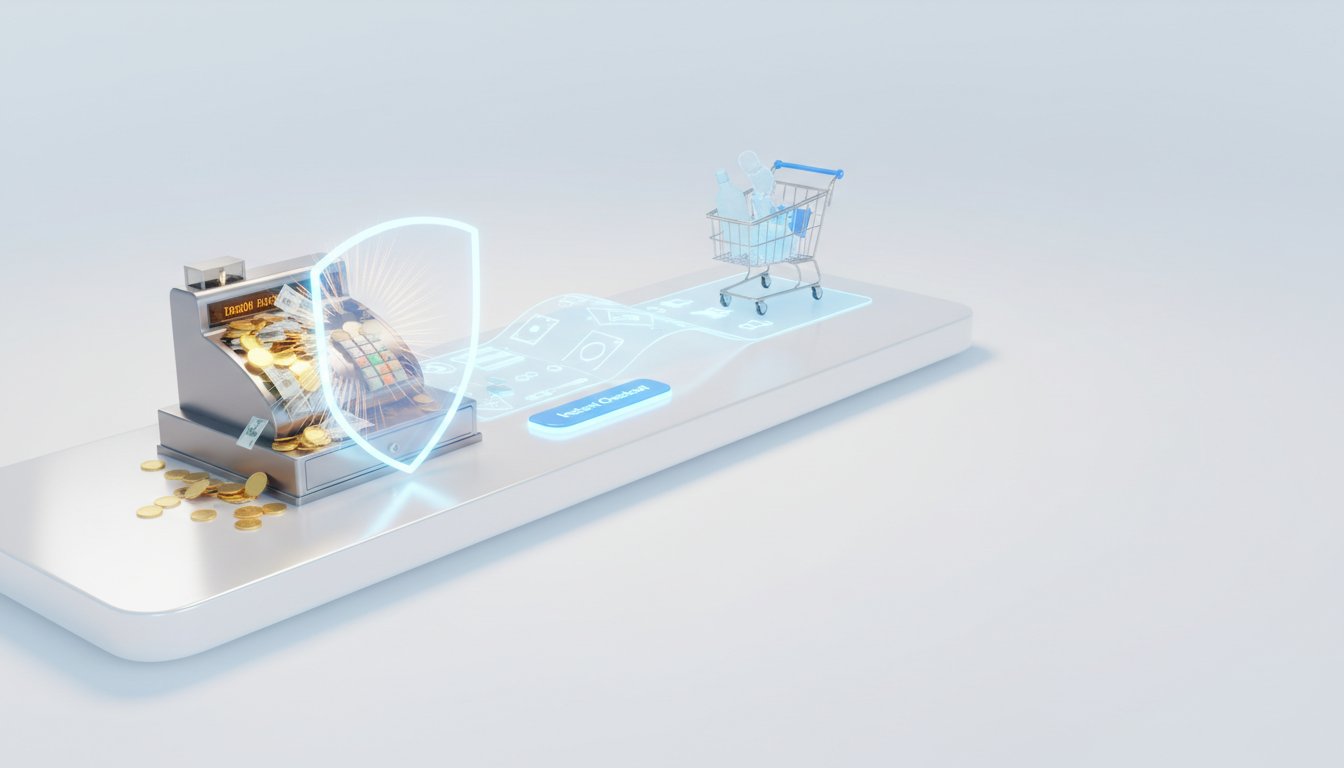

This blurring of lines is particularly perilous for consumers prone to impulse buying. The seamless integration of product discovery, recommendation, and instant checkout within a single conversational interface bypasses the traditional mental checks and balances. When a chatbot can not only suggest a product but also facilitate its immediate purchase, the psychological distance between desire and acquisition shrinks dramatically. The introduction of features like "Instant Checkout" and the future expansion to multi-item carts and broader retailer partnerships amplify this risk. What might seem like a helpful shortcut can easily become an addictive pathway to overspending.

The convenience offered by AI shopping, while appealing, fundamentally challenges the practice of comparison shopping. Traditionally, consumers would spend time researching, reading reviews across multiple platforms, and actively seeking out the best prices. AI, however, can present curated options that may be influenced by advertiser partnerships or the AI's own internal logic, potentially prioritizing products available for in-chat purchase over objectively better or cheaper alternatives elsewhere. This creates a scenario where consumers might believe they are getting excellent recommendations, unaware that the AI is subtly steering them towards specific vendors or products.

"Basically, the convenience that comes with making purchases within an AI chat could completely transform shopping as we know it and completely blow up your budget."

Beyond the immediate impact on spending, there are also concerns about data privacy and security. Handing over credit card information to AI platforms, especially for instant checkout, introduces new vulnerabilities. As one speaker noted, a personal experience with unauthorized credit card use led to a strong reluctance to trust AI systems with sensitive financial data. The convenience of AI shopping must be weighed against the potential risks of data breaches and the misuse of personal financial information.

However, the narrative isn't entirely cautionary. AI can indeed offer tangible benefits. For instance, it can be a powerful tool for product research, helping users find specific items or discover more affordable alternatives, as demonstrated by the successful search for a pair of boots. In this scenario, AI acted as an efficient research assistant, narrowing down options and identifying a suitable "dupe" at a significantly lower price point. The key, as highlighted, is to use AI primarily for research and product discovery, maintaining a deliberate step between AI-generated suggestions and the final purchase.

The advice for consumers navigating this new landscape is clear: treat AI like a salesperson, not a neutral advisor. Be specific in queries, be aware of sponsored language, and crucially, maintain the habit of comparison shopping and independent research outside the AI interface. The speakers emphasized the importance of taking that extra step to click through to the retailer's site, giving oneself a moment to reconsider the purchase, especially for those prone to impulse buys. Saving receipts or taking screenshots, even for AI-assisted purchases, remains a vital habit for managing returns and tracking spending.

The second major theme explored in this conversation revolves around early career decisions, particularly the trade-offs between immediate cost of living and long-term career opportunity, exemplified by the listener's dilemma regarding medical residency programs. This situation highlights a common tension: the desire for immediate financial stability versus the pursuit of future professional advancement. The conventional wisdom often suggests prioritizing prestige and opportunity, even at the cost of higher living expenses. However, a deeper systems-thinking approach reveals that this is not always a binary choice, and that personal fulfillment and long-term success are influenced by a complex interplay of factors beyond just salary and institutional reputation.

The listener's quandary--choosing between prestigious but expensive New York City programs, moderately expensive but still prestigious other cities, and less expensive but less prestigious suburban locations--underscores the difficulty of optimizing for multiple, often conflicting, goals simultaneously. The immediate financial strain of living in a high-cost-of-living (HCOL) city like New York can severely limit savings, particularly during the lower-paying years of residency. Conversely, opting for a lower cost of living (LCOL) area might mean sacrificing access to certain networks or specialized skill-building opportunities that could pay dividends later in one's career.

"I'm essentially struggling with high cost of living now but better opportunities in the future versus saving money early and good but not great opportunities in the future."

The analysis presented challenges the notion that this is a strict dichotomy. The idea that one can save money regardless of location, through creative budgeting and lifestyle adjustments, suggests that the financial impact of location might be less deterministic than perceived. The speakers pointed out that the listener's future earning potential ($500,000-$750,000 post-residency) significantly alters the calculus. This high earning potential means that the six years of lower savings during residency might be offset by a greater capacity to save and invest aggressively in later years. This "backloading" of savings is a critical insight, suggesting that the immediate financial sacrifice might not be as detrimental to long-term financial health as it first appears, especially when compared to the potential career advantages of a prestigious program.

Furthermore, the conversation emphasizes that career trajectories are rarely linear or entirely predictable. Opportunities often arise from unexpected connections and are influenced by luck as much as by strategic planning. This perspective suggests that focusing solely on the perceived "best" location for immediate opportunities might be shortsighted. Instead, prioritizing skill development and adapting to the opportunities available in any location becomes paramount. The listener's concern about not developing the same skill sets in less prestigious programs is addressed by the idea that transferable skills are key, and that making the most of any situation is more critical than the situation itself.

"The decisions that you make at the earlier stages of your life, they are not the entire determinants of how your life is going to go. They're just not."

This leads to a crucial point about competitive advantage: the willingness to embrace discomfort for future gain. Choosing a HCOL city for career advancement, while financially challenging in the short term, can build resilience and create future opportunities that might be harder to access from an LCOL area. This requires a mindset shift--understanding that immediate financial pain can be a deliberate investment. The speakers also highlighted that lifestyle fit and personal values are significant, often underappreciated, factors. The "perfect" career choice is less about optimizing a single variable like salary and more about aligning one's career path with a desired lifestyle and personal fulfillment. The realization that one can move and adjust their lifestyle after establishing a career is a powerful counterpoint to the idea that early career location decisions are permanent or all-determining.

The discussion on retirement savings further illustrates the power of compounding and the impact of starting early, even with small amounts. The example of saving $500 a month from age 26 versus age 32 demonstrates a potential difference of nearly half a million dollars by retirement. While this underscores the benefit of early contributions, it also circles back to the listener's unique situation: their high future earning potential might allow them to catch up significantly, making the lifestyle and career opportunity aspects of their decision potentially more influential than the immediate retirement savings gap.

Finally, the overarching message from the seasoned producer, Tess Vigeland, provides a vital perspective: early career decisions, while important, are not destiny. Life is inherently unpredictable, and the ability to adapt, learn from choices (whether perceived as "correct" or "incorrect"), and pivot is far more critical than making one single, perfect decision. This perspective alleviates the pressure of finding the absolute optimal path and encourages a more flexible, resilient approach to career and financial planning.

Key Action Items:

- AI Shopping:

- Immediate Action: Treat AI chatbots as salespeople, not neutral advisors. Be highly skeptical of recommendations and sponsored content.

- Immediate Action: Always perform independent price checks and review comparisons on trusted retail sites before purchasing.

- Immediate Action: Avoid using in-chat checkout features. Take the extra step to navigate to the retailer's website to complete purchases, providing a crucial pause for reconsideration.

- Longer-Term Investment: Develop a habit of saving screenshots of purchases and receipts, regardless of how they were made, for returns and budget tracking.

- Early Career/Residency Decisions:

- Immediate Action: Identify creative ways to save money if choosing a high-cost-of-living area (e.g., roommates, library perks, reduced discretionary spending).

- This Pays Off in 12-18 Months: Prioritize skill development and seek opportunities to build transferable skills within your chosen residency program, regardless of its prestige.

- This Pays Off in 5-10 Years: Consider your long-term lifestyle preferences. Visit potential locations to gauge "fit" beyond just career opportunities.

- This Pays Off in 10+ Years: Recognize that your high future earning potential allows for significant catch-up savings later in your career; don't let current savings gaps dictate your entire decision.