Focusing Craftsmanship and Adaptability Drives Guitar Industry Success

The Unseen Symphony: How Taylor Guitars Built an Enduring Legacy by Embracing Slow Growth and Strategic Patience

This conversation with Bob Taylor and Kurt Listug of Taylor Guitars reveals a profound, often overlooked, truth about building enduring businesses: the immense competitive advantage found in deliberately eschewing rapid growth for the sake of sustainable, high-quality creation. The hidden consequences of this approach, starkly contrasted with conventional wisdom, demonstrate how embracing "slow" can actually accelerate long-term success. Anyone seeking to build a resilient, respected brand, particularly in a craft-driven industry, will gain a critical edge by understanding how Taylor Guitars navigated market downturns and built a loyal customer base through an unwavering commitment to craftsmanship and strategic patience. This narrative offers a masterclass in how delayed gratification, when strategically applied, becomes a powerful engine for differentiation and lasting competitive moats.

The Paradox of One Done Guitar

The journey of Taylor Guitars from a modest $30,000/year repair shop to a nine-figure global icon is a testament to an operating principle that defies the typical Silicon Valley playbook: "one finished guitar beats 10 half-finished ones." This mantra, born from a moment of profound insight, fundamentally reshaped their production and, by extension, their entire business trajectory. In an era where speed and volume often dictate success, Taylor’s deliberate focus on completing individual instruments, rather than churning out partially completed units, created a cascade of downstream effects that built a durable brand. This wasn’t just about manufacturing efficiency; it was about embedding quality and intentionality into the very fabric of their product, a stark contrast to conventional wisdom that often prioritizes immediate output over downstream product integrity.

Bob Taylor’s early struggles with guitar construction highlight the inherent resistance of the materials and the process itself. The idea of building a guitar, an object designed to resist the very forces that hold it together, underscores the difficulty of the craft. His dedication to working "two days a day" -- one for making guitars, another for inventing tools to make the next one easier -- illustrates a deep commitment to process improvement that wasn't about shortcuts, but about building a more robust foundation. This meticulous approach, while slow, laid the groundwork for consistency.

The pivotal moment arrived not through a grand strategic shift, but a simple, yet profound, question from an older guitar maker: "Bob, what would you rather have, 10 half-done guitars or one done guitar?" This question, as Bob recounts, "changed my life. It changed everything about our company." This wasn't merely a change in workflow; it was a philosophical reorientation. By shifting to a "one guitar at a time" model, they moved away from batch processing, which, while seemingly efficient, often led to compromises. This single-minded focus on completion meant that each guitar left the shop as a finished, quality product, fostering a reputation for reliability and excellence. This commitment to finishing one guitar perfectly before starting another created a feedback loop where quality became the primary driver of demand, rather than sheer volume.

"What would you rather have, 10 half-done guitars or one done guitar?"

-- Bob Taylor

This philosophy directly countered the prevailing market pressures. In the late 1970s and early 1980s, acoustic guitars were considered "boring and old-fashioned," overshadowed by disco and new wave. Yet, Taylor Guitars, by focusing on the quality and playability of each instrument--particularly the slimmer necks and lower string heights that appealed to electric guitarists--carved out a niche. Their survival through this period wasn't about adapting to market trends by sacrificing quality, but by doubling down on what made their guitars unique and desirable to serious musicians. This deliberate pacing and focus on quality, even when sales were slow and founders were paid $15 a week, built a foundation of trust that would pay dividends for decades.

The Hidden Cost of Distribution Deals and the Power of Partnership

The narrative of Taylor Guitars is also punctuated by cautionary tales about the allure of rapid expansion, often facilitated by external partners. The deal with Rothschild’s Musical Instruments, a distributor aiming to scale their sales, serves as a stark illustration of how a seemingly beneficial arrangement can mask significant downstream costs. Paul and Edward Rothschild, with their connections to legendary artists, presented a compelling vision of widespread distribution. However, their model, which involved buying guitars at prices that barely covered Taylor’s costs while selling them at a significant markup, was unsustainable. Kurt Listug’s observation that "the math wasn't making sense" was an understatement. This arrangement, while increasing the number of guitars being produced, devalued the product and strained the company’s resources without offering a path to true profitability or brand equity.

The eventual dissolution of the Rothschild deal, though leading to painful layoffs, was a crucial turning point. It forced Taylor Guitars back to basics, relying on their own sales efforts and direct relationships with music stores. This period, though challenging, reinforced the importance of controlling their own destiny and ensuring that the value generated by their craftsmanship was reflected in their pricing and profitability. It taught them a vital lesson: a distributor’s ability to move volume is not the same as building a sustainable business. The immediate relief of having orders fulfilled by Rothschild was overshadowed by the long-term damage to their pricing power and financial health.

Furthermore, the enduring partnership between Bob Taylor and Kurt Listug itself represents a critical system at play. Bob, the craftsman obsessed with innovation and quality, and Kurt, the disciplined businessman focused on operations and sales, created a symbiotic relationship. Their ability to navigate disagreements, as seen in the buyout of their third partner Steve, was essential. Steve’s perspective, which Bob described as a "different perspective on what he wanted to do," contrasted with Bob and Kurt's shared vision for rapid, focused progress. The decision to buy Steve out, while requiring them to take on debt again, was framed as removing "the brakes" from the business. This allowed them to move with a unified purpose, accelerating their ability to innovate and scale production efficiently. The success that followed, with the business doubling in the first year after the buyout, underscores how a clear, aligned partnership can unlock significant downstream benefits.

"We have a bad habit of not paying ourselves. I want a paycheck every single Friday, and we need to remove the things that keep us from having that paycheck."

-- Bob Taylor

The Long Game: Delayed Payoffs and Enduring Advantage

The story of Taylor Guitars is a compelling case study in how delayed payoffs create significant competitive advantage. For years, the founders barely paid themselves, subsisting on $15 a week. Bob Taylor’s perspective on this period is particularly insightful: "this is my education." He viewed the struggle not as a failure, but as an investment in learning the craft and the business. This mindset, which prioritizes long-term mastery over short-term financial gain, is a hallmark of companies that build lasting value. The conventional wisdom would suggest that such a meager salary would lead to burnout or a search for more lucrative employment. Instead, it fostered a deep understanding of the business’s financial realities and a commitment to building something that could eventually provide sustainable livelihoods.

The decision to focus solely on guitar making, abandoning repair work and parts sales, was another example of embracing short-term pain for long-term gain. While repair work provided consistent, albeit smaller, revenue streams, it distracted from their core mission of building and selling guitars. By "shutting the door" on other activities, they dedicated their limited resources to perfecting their primary product and developing their wholesale strategy. This focus allowed them to refine their manufacturing process, leading to Bob’s development of tools and jigs that improved efficiency and consistency.

The introduction of the MTV Unplugged series in the 1990s, while not directly sponsored by Taylor, represented a massive market shift that played directly into their strengths. The renaissance of acoustic guitars created a surge in demand. While other companies might have scrambled to meet this sudden increase with less rigorous production methods, Taylor’s established commitment to quality and their refined manufacturing processes allowed them to capitalize effectively. Their ability to produce a consistent, high-quality instrument, coupled with Kurt’s efforts in artist relations and brand building (including the memorable tree ad campaign and the Wooden Steel magazine), positioned them to capture this growing market. This wasn't just about being in the right place at the right time; it was about having built the operational and brand infrastructure to effectively leverage the opportunity. The delayed payoff of their years of patient, quality-focused work meant they were perfectly poised to benefit from this market turn.

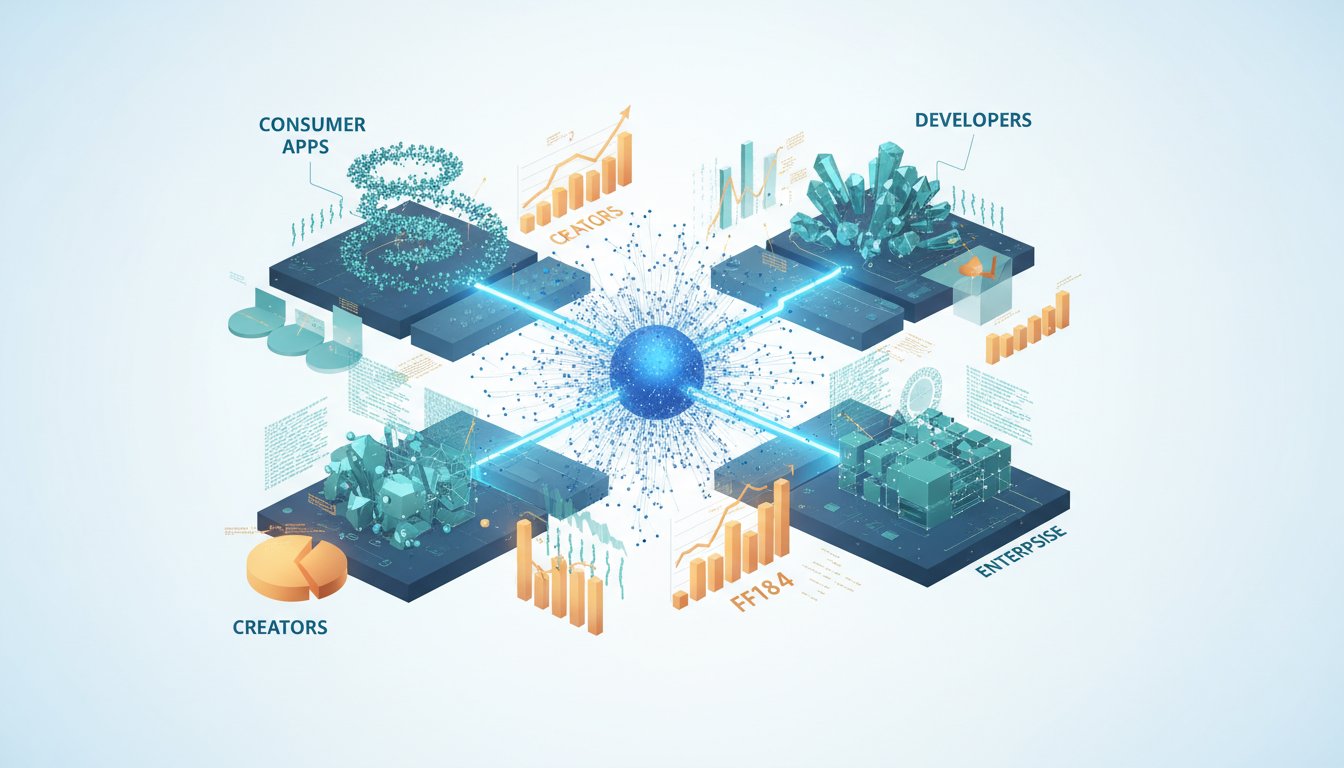

Finally, the decision to convert Taylor Guitars to 100% employee ownership through an ESOP (Employee Stock Ownership Plan) is perhaps the ultimate expression of their long-term vision. This move, while complex, aligns the incentives of every employee with the success of the company. It transforms the workforce from mere laborers into stakeholders, fostering a culture of shared responsibility and long-term commitment. This strategy ensures that the company’s value, built over decades of hard work and strategic patience, benefits those who contribute to its ongoing success, creating a powerful moat against external acquisition and ensuring the company’s legacy.

Key Action Items

- Embrace "One Done Guitar": Prioritize the completion and quality of individual units over batch production. Focus on finishing one product perfectly before moving to the next, fostering a reputation for excellence. (Immediate Action)

- Invest in Process Improvement, Not Just Speed: Dedicate resources to developing tools, jigs, and workflows that enhance quality and consistency, even if it means a slower initial pace. This builds a foundation for scalable, high-quality production. (Ongoing Investment)

- Scrutinize Distribution Deals for True Value: Carefully evaluate any partnership that promises volume. Ensure the financial terms and brand alignment genuinely benefit your core business, rather than creating a short-term illusion of growth with long-term costs. (Immediate Action)

- Cultivate a Unified Partnership Vision: Ensure co-founders and key leaders share a clear, aligned vision for the company's future. Address disagreements proactively to avoid stagnation and enable decisive action. (Immediate Action)

- View Early Struggles as Education: Reframe periods of slow growth and low personal compensation as essential investments in learning and building foundational expertise. This mindset fosters resilience and long-term commitment. (Mindset Shift, pays off in 1-3 years)

- Develop a Brand Story Beyond the Product: Invest in marketing that communicates the brand's values, craftsmanship, and unique story, rather than solely focusing on product features. This builds deeper customer loyalty and pricing power. (Ongoing Investment, pays off in 12-18 months)

- Explore Employee Ownership Models (ESOP): Investigate employee stock ownership plans as a long-term strategy for aligning incentives, fostering loyalty, and ensuring a sustainable succession plan that preserves company culture and value. (Long-term Investment, pays off in 3-5 years)