Government Intervention Undermines Free Markets and Innovation

The Trump administration's aggressive intervention in private enterprise, marked by direct government investment in companies and public pressure on CEOs, represents a fundamental departure from traditional American capitalism. This approach, while framed by some as necessary for national security, blurs the lines between political power and economic decision-making, raising significant concerns about a slide into crony capitalism. The hidden consequences of this shift are not immediately apparent, as the stock market may currently appear robust. However, this conversation reveals that prioritizing political favor over innovation and market competition could undermine the long-term dynamism of the U.S. economy. Business leaders, policymakers, and investors who understand these systemic shifts gain an advantage by anticipating the potential for instability and a decline in genuine market-driven growth.

The Unseen Hand: When Presidential Power Becomes a Market Force

The traditional understanding of American capitalism is rooted in a belief in free markets, where companies compete on innovation, efficiency, and product quality. This bedrock principle, however, is being fundamentally challenged by President Trump's administration, which has demonstrated a willingness to exert direct influence over private companies. This isn't just about lobbying or policy shifts; it's about the government taking direct financial stakes in corporations and publicly pressuring their leaders. The immediate narrative often focuses on national security or economic stimulus, but a deeper analysis, drawing from the insights of NPR's Maria Aspan, reveals a more complex and potentially destabilizing dynamic.

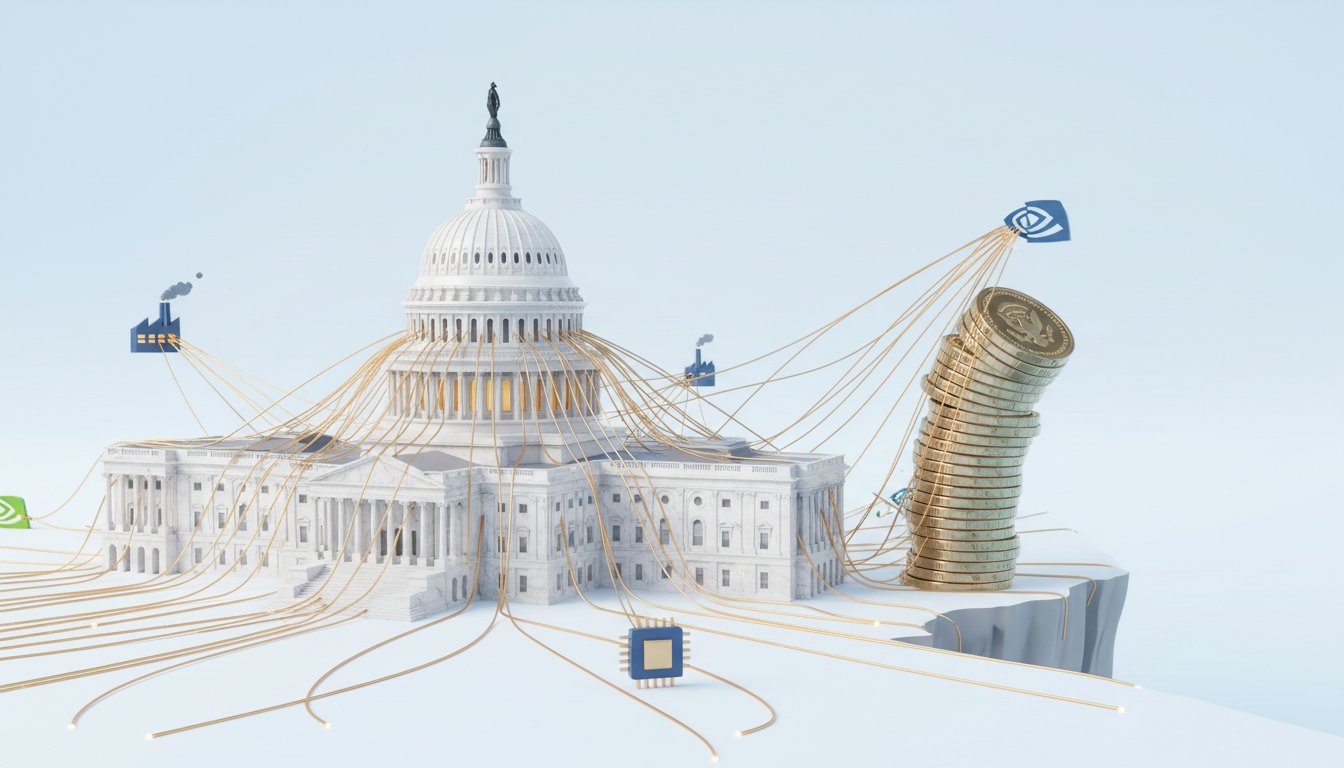

The administration's actions, such as the government taking a stake in Intel or demanding a percentage of sales from Nvidia, represent a stark break from historical norms. For decades, the U.S. government has largely abstained from direct ownership in domestic companies, a stance that underpinned the idea of a level playing field. When the government becomes a shareholder or a direct negotiator of business deals, the incentive structure for companies shifts dramatically. Instead of competing on merit, they may find themselves competing for political favor.

"If companies aren't competing on their ability to innovate and develop better products, if they're competing on their ability to schmooze, then that's bad for everybody."

This quote, highlighting the shift from innovation to "schmoozing," encapsulates a core concern. When political access becomes a primary driver of corporate success, the engine of innovation sputters. Companies that might otherwise invest heavily in research and development could instead divert resources towards cultivating relationships with those in power. This isn't an immediate crisis; the stock market may continue to boom in the short term, buoyed by other factors. However, over time, this dynamic erodes the competitive edge that has historically defined American enterprise. The "conventional wisdom" in Washington and Wall Street, as noted by experts, has long warned against such interference precisely because it disrupts the natural forces of market competition that foster growth and create jobs.

The Erosion of Rules-Based Capitalism

The shift away from a "rules-based capitalism" toward a system driven by "personalized decision-making" carries significant downstream consequences. Daniela Ballouairs, a former Obama administration official and founder of the Leadership Now project, voices a critical concern: the risk of tipping into crony capitalism. This isn't merely about perceived corruption; it's about a fundamental alteration of how economic value is created and distributed. In a crony system, success is less about a company's ability to deliver value to consumers and more about its proximity to political power.

This personalized approach, described as "chaotic decision-making" and "instability," creates an environment where long-term planning becomes exceedingly difficult. For business leaders, the uncertainty of political winds can paralyze strategic investment. As Ballouairs points out, standing up to a president who publicly pressures CEOs is fraught with risk. The consequences for those who fall out of favor can be severe, even if not as extreme as the "falling out of windows" metaphor used in relation to Russia. The implication is clear: the system encourages compliance and deference, not the robust challenge and independent decision-making that innovation requires.

"What we have right now is a lot of personalized decision-making, chaotic decision-making, instability, that we're seeing the cost of."

The advantage here for those who recognize this pattern lies in anticipating the long-term effects of this instability. While the immediate market might seem strong, the underlying foundations are being weakened. Companies that continue to prioritize innovation and customer value, even in the face of political pressure, may build a more resilient and sustainable competitive advantage. This requires a willingness to endure short-term discomfort or political awkwardness for the sake of long-term market leadership. The conventional wisdom, which champions free markets, might seem out of step in the moment, but its underlying principles often prove durable over extended periods.

The Hidden Cost of Political Patronage

The administration's defenders argue that actions like taking stakes in Intel or Nvidia are vital for national and economic security. However, this framing often overlooks the systemic costs associated with government intervention in private markets. When political leaders can influence corporate decisions, dictate terms of market access, or even demand equity stakes, the very definition of competition is altered. This is where the concept of "crony capitalism" becomes more than just a pejorative; it describes an economic system where personal connections and political influence, rather than merit, determine success.

The long-term implication of this is a potential decline in overall economic dynamism. If companies are incentivized to "court the White House" or "fund Trump's controversial White House Ballroom," as seen with Nvidia's CEO Jensen Huang, then the resources that could have gone into product development, research, or expansion are being siphoned off into political maneuvering. This creates a hidden drag on the economy, one that may not be immediately visible in quarterly earnings reports but that compounds over time.

"The U.S. government also holds positions in other companies, many involved in minerals and energy. President Trump has publicly pressured CEOs and forced the restructuring of social media giants like TikTok."

This persistent pattern of intervention suggests that the administration views private enterprise not as an independent engine of growth but as an instrument of state policy. While the U.S. stock market may indeed be booming, this success could be masking a deeper vulnerability. Companies that are not competing on their ability to innovate but on their ability to navigate political currents are ultimately less resilient. The advantage for those who understand this dynamic is the ability to identify and invest in businesses that are insulated from, or actively resisting, these pressures, thereby positioning themselves for sustained growth in a potentially less predictable economic landscape.

- Immediate Action: Re-evaluate investment portfolios to identify companies that appear to benefit primarily from political connections rather than intrinsic market strength. Prioritize businesses with a clear focus on innovation and customer value.

- Immediate Action: For business leaders, carefully assess the risks and rewards of engaging directly with government officials on matters outside core business operations. Focus on clear, demonstrable business interests.

- Short-Term Investment (Next 3-6 months): Develop contingency plans for supply chain disruptions or market access challenges that could arise from unpredictable government policy shifts.

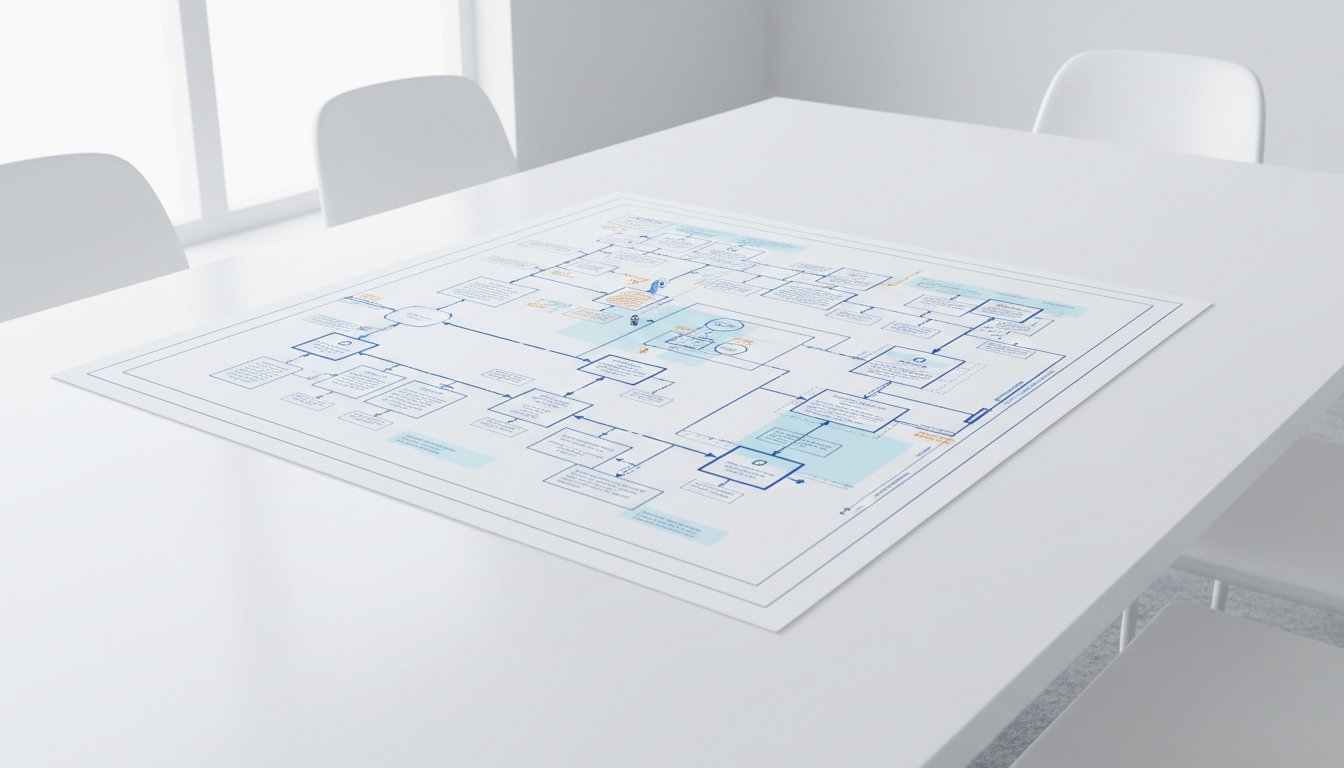

- Short-Term Investment (Next 3-6 months): For policymakers and analysts, begin mapping the second-order effects of direct government equity stakes in private companies, focusing on potential impacts on market competition and innovation.

- Medium-Term Investment (6-12 months): Cultivate a deep understanding of regulatory environments and political landscapes relevant to your industry, recognizing that these may become increasingly intertwined with business strategy.

- Long-Term Investment (12-18 months): Advocate for and support policies that reinforce rules-based capitalism and market competition, even when immediate political expediency might suggest otherwise. This builds a more durable economic future.

- Long-Term Investment (18-24 months): Build organizational resilience by fostering a culture that prioritizes long-term innovation and adaptability over short-term political alignment. This creates a competitive moat that is difficult for others to replicate.