Athletic Brewing Captures Sober Majority With Craft Non-Alcoholic Beer

In a world saturated with alcoholic beverages and traditional notions of socializing, Bill Shufelt, CEO and co-founder of Athletic Brewing, has masterfully carved out a new category by addressing a fundamental, yet often overlooked, consumer need: the desire for enjoyable social experiences without the negative consequences of alcohol. This conversation reveals the hidden consequences of an industry built on a false premise -- that people primarily consume alcohol. Shufelt's success hinges on recognizing that the vast majority of waking hours are spent sober, and that a significant, underserved market exists for high-quality, non-alcoholic alternatives. Anyone seeking to understand market disruption, generational shifts in consumer behavior, and the power of authentic brand building will find immense strategic advantage in Shufelt's approach, which prioritizes long-term vision over short-term industry norms.

The Unseen Market: Beer for the 99%

The traditional beverage alcohol industry operates under a fundamental assumption: that consumers are drinking alcohol most of the time they are awake. Bill Shufelt, however, identified this as a flawed premise, recognizing an enormous "total addressable market" (TAM) of "normal, modern, healthy adults" who are not drinking alcohol 99% of their waking hours. This insight, born from his own life stage transition and a desire for social connection without compromise, became the bedrock of Athletic Brewing. The immediate consequence of this realization was a pivot from mimicking existing alcoholic beverages to creating something entirely new, catering to a desire for flavor and social participation without the detrimental effects of alcohol. This strategic reframing allowed Athletic Brewing to tap into a market that larger, established players either ignored or failed to understand.

"It hit me as such an intuitive moment that people are not drinking alcohol 99% of the time they're awake, but the alcohol industry treats people as if 99% of the people are drinking alcohol 99% of the time. I saw this enormous TAM of normal, modern, healthy adults."

-- Bill Shufelt

The downstream effect of this perspective is profound. While competitors focused on incremental changes within the alcoholic beer market, Shufelt built a category from the ground up. This meant not just creating a product, but also reimagining marketing and consumer perception. The conventional wisdom of focusing on existing beer drinkers was bypassed in favor of cultivating a new generation of consumers who might not have a traditional "taste for beer" but value the social occasion and the beverage itself. This approach creates a distinct advantage: Athletic Brewing isn't just taking market share; it's expanding the overall market by bringing new occasions and new consumers to the table. The immediate benefit is a product that aligns with health and wellness trends, but the lasting advantage is the creation of a new category that traditional players are now scrambling to enter, often with less authentic offerings.

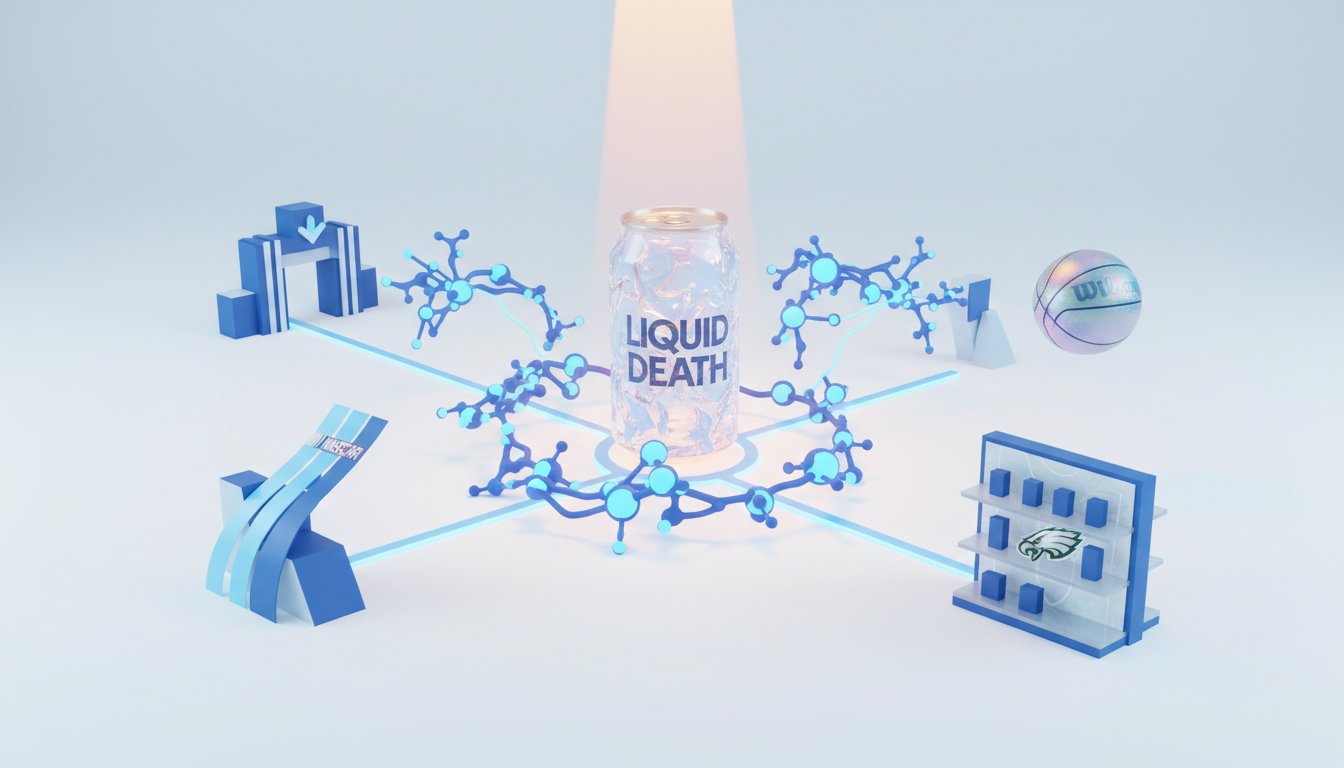

The Authenticity Advantage: Building a Brand Without Alcohol's Shadow

A critical element of Shufelt's strategy, and a key differentiator from legacy brands, is Athletic Brewing's inherent authenticity. Unlike established alcoholic brands that have to adapt to the non-alcoholic space, Athletic was "unburdened" from the start. This freedom allowed them to focus purely on crafting the best possible non-alcoholic beer, rather than trying to mimic the taste of alcohol or navigate the complexities of a dual-brand identity.

"What's different about Athletic is we didn't start with that burden. We started with passion, with authenticity. We started from the ground up trying to create something that is literally going to be a change-making beverage."

-- Bill Shufelt

This lack of a "reference brand" has allowed Athletic to appeal to consumers who may not even like the taste of traditional beer. Shufelt points out that alcohol itself is often a primary flavor component that some consumers dislike. By removing it, Athletic can offer a product that is not only healthier (lower in calories) but also more palatable to a broader audience. This creates a powerful competitive moat. While major brewers like Heineken and Guinness can launch non-alcoholic versions, they carry the baggage of their alcoholic heritage. Athletic, on the other hand, embodies the non-alcoholic experience. This authenticity resonates deeply with consumers, particularly younger generations like Gen Z, who are increasingly scrutinizing brand values and seeking genuine connections. The immediate payoff is a product that satisfies a specific need; the long-term advantage is a brand built on a foundation of trust and genuine innovation, making it harder for fast-following giants to replicate its core appeal.

Building for Resilience: Manufacturing as a Strategic Moat

In an industry often characterized by rapid growth and outsourced manufacturing, Athletic Brewing made a deliberate, and initially unpopular, decision: to build and control its own production facilities. This choice, made early in the company's history, ran counter to conventional CPG wisdom, which favors the scalability and speed of contract manufacturing. However, this punitive economic approach, as Shufelt describes it, has yielded significant long-term advantages, particularly in navigating supply chain disruptions and economic volatility.

"We took a punitive economic approach to that, but that was in 2018. But that's turned out to be very lucky, not only from a quality standpoint, we own every piece of our quality and can just keep reinvesting in our own quality. But when COVID hit, we were operating all our own breweries and we controlled so much more of our supply chain and operations than most companies."

-- Bill Shufelt

The immediate consequence of owning their manufacturing was greater control over quality and supply chain. When the COVID-19 pandemic hit, Athletic's in-house operations provided a level of resilience that many outsourced competitors lacked. Similarly, in the face of economic policies like tariffs, their more "onshore, domestic, Athletic-run supply chain" offers a buffer against external shocks. While this strategy might have seemed inefficient during periods of hyper-growth, it has proven to be a strategic imperative, creating a durable competitive advantage. This foresight allows Athletic to maintain consistent quality and supply, even when broader economic forces create instability. The discomfort of building infrastructure early has translated into a significant advantage, enabling the company to weather storms that have sunk less prepared competitors.

The Future of Social Connection: Beyond Alcohol

Shufelt articulates a vision for the future that extends beyond simply replacing alcoholic beverages. He sees Athletic Brewing as a catalyst for a broader cultural shift towards moderation and new forms of social connection. While acknowledging the enduring appeal of alcohol, he emphasizes that the beverage industry is ripe for innovation that meets evolving consumer preferences. The rise of light beer, he notes, was a response to nutritional preferences of a new generation, but it eventually failed to meet their evolving flavor expectations. Non-alcoholic beer, in Shufelt's view, represents the confluence of those two trends: the nutritional benefits of light beer combined with the flavor profiles sought in more recent beverage innovations.

This positions Athletic Brewing not merely as a beer company, but as a facilitator of modern social experiences. Their marketing efforts, from sponsoring elite endurance athletes and events like Ironman to partnering with Live Nation for concerts, are designed to integrate the brand into active, health-conscious lifestyles. This strategy moves beyond traditional beer marketing and positions Athletic as an "athletic drink" or a lifestyle beverage. The immediate impact is brand visibility in relevant contexts, but the long-term payoff is establishing Athletic as a go-to beverage for a generation that prioritizes wellness and authentic connection. By focusing on "new consumers, new occasions, and new rounds," Athletic is not just participating in the beverage market; it's actively shaping its future, creating a lasting advantage by aligning with an emerging megatrend.

Key Action Items:

- Immediate Action (Within 1 Month):

- Reframe "Occasion" Thinking: Analyze current social or professional gatherings. Identify moments where non-alcoholic options are needed but currently absent or inadequate.

- Audit Brand Messaging: For any consumer-facing brand, review language and imagery. Does it implicitly assume alcohol consumption as the default for social connection?

- Short-Term Investment (1-3 Months):

- Explore Category Expansion: If in a related CPG space, investigate the viability of offering high-quality non-alcoholic alternatives that stand on their own merit, not as mere substitutes.

- Invest in Authentic Storytelling: Develop marketing narratives that highlight genuine brand values and the "why" behind product development, focusing on consumer needs rather than industry norms.

- Medium-Term Investment (3-9 Months):

- Evaluate Supply Chain Resilience: Assess the company's supply chain for single points of failure or reliance on external factors that could be disrupted by economic or geopolitical events. Consider options for greater in-house control or diversification.

- Pilot New Consumer Segments: Test non-traditional marketing channels and partnerships that align with health, wellness, or active lifestyle trends to reach new audiences.

- Long-Term Investment (9-18 Months):

- Build for Category Leadership: If entering or expanding in a new category, focus on establishing authentic brand leadership and defining the category's future, rather than simply competing on price or features. This requires a commitment to quality and innovation that outlasts short-term market trends.

- Foster a Culture of Unconventional Thinking: Encourage teams to challenge industry assumptions and explore "unmet needs" that others overlook, recognizing that true innovation often lies in addressing the 99% of the market that traditional players ignore.