Affirm's AI-Driven Transparency Reshapes Consumer Finance

In a financial landscape increasingly dominated by opaque credit card practices, Max Levchin, co-founder of PayPal and CEO of Affirm, argues for a radical transparency in lending. This conversation reveals the hidden consequences of traditional credit, where hidden fees and revolving debt trap consumers, often without their full understanding. Levchin demonstrates how "buy now, pay later" (BNPL) can serve as a more honest alternative, especially for those who, like his younger self, find traditional credit systems confusing or punitive. This analysis is crucial for consumers seeking clearer financial terms and for businesses looking to build trust by offering genuinely transparent payment options, providing a significant advantage over entrenched, less scrupulous financial models.

The Illusion of Familiarity: Why Credit Cards Aren't Your Friend

The prevailing wisdom suggests that credit cards, despite their complexities, are a known quantity. Yet, as Max Levchin explains, this familiarity breeds a dangerous complacency. The true cost of credit cards lies not just in stated interest rates, but in the insidious nature of revolving debt and the profit derived from consumer missteps. Levchin highlights how the "familiarity" of credit cards masks their inherent design to accrue interest, often indefinitely, on purchases that could otherwise be managed with transparency.

Levchin recounts his personal experience of being denied a car loan despite significant wealth, a direct consequence of a youthful misunderstanding of credit card mechanics that led to a severely damaged credit history. This foundational experience fuels his mission at Affirm: to build financial products that are understandable and trustworthy, particularly for those new to credit or disillusioned with existing options.

"The sort of a oh gosh any way to borrow money let's stick with the old one because it's better is pretty disingenuous for most people it is not better for most people it's actually i just don't understand it but it's always been here and so maybe i could just stick with that"

This quote encapsulates the core critique: the "old way" of credit cards is often chosen out of ignorance rather than genuine benefit. The downstream effect of this choice is a perpetual cycle of interest payments, a hidden cost that accumulates on even mundane purchases like a burrito. Levchin contrasts this with Affirm's model, where transparency is paramount. Before a transaction is finalized, users see the payment schedule, understand the total cost, and confirm their commitment. This immediate clarity, he argues, fundamentally alters the borrowing experience, shifting it from a potential trap to a managed transaction. The advantage here is clear: consumers who embrace this transparency can avoid the compounding interest and hidden fees that plague traditional credit card users, leading to significant long-term savings and a more stable financial footing.

The Merchant's Gambit: Incentives and Transparency

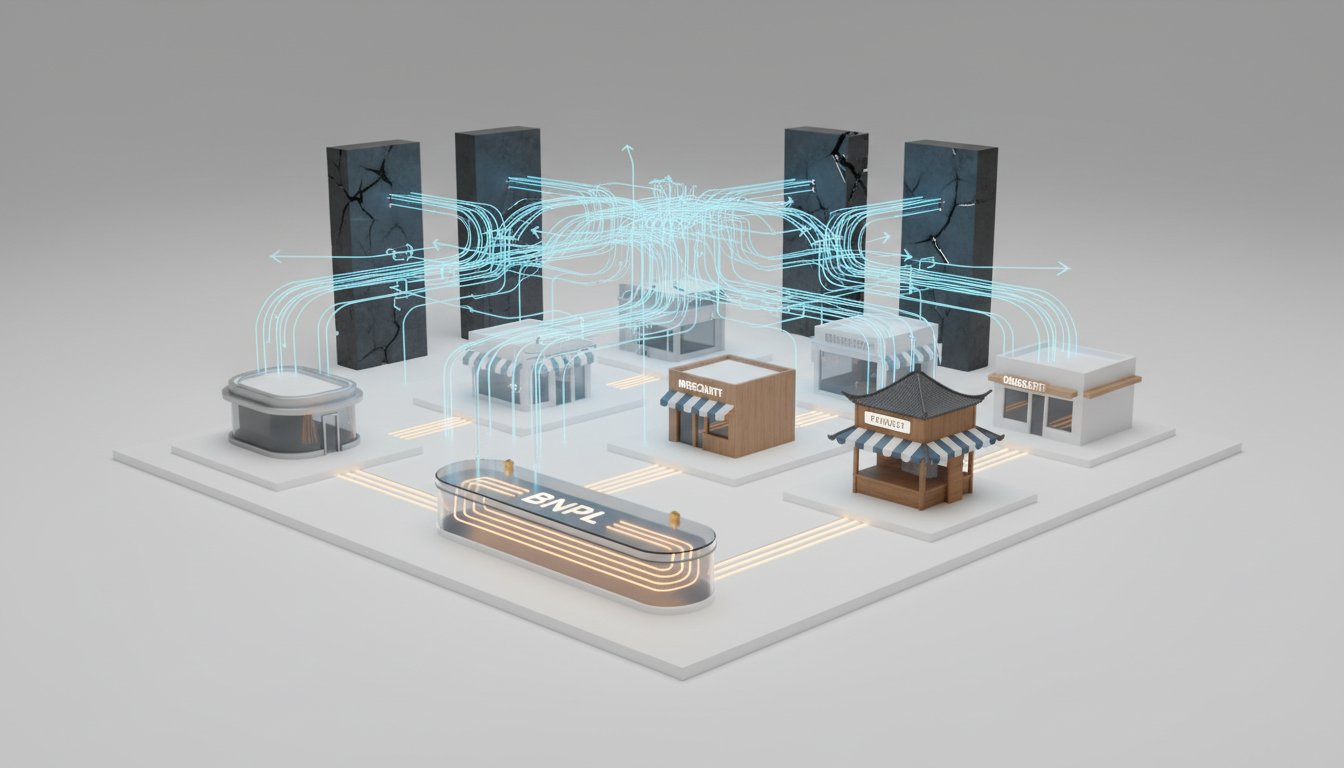

The adoption of BNPL by merchants is often driven by the immediate uplift in sales. Levchin explains that instead of offering discounts, merchants can effectively "turn that dollars into interest," making the transaction appear interest-free to the consumer. This creates a powerful incentive for consumers to complete purchases they might otherwise hesitate on.

The early pitch to merchants, Levchin suggests, was essentially a reproduction of his own personal journey: offering a solution to consumers wary of credit cards, whether due to confusion, cost, or a desire to avoid revolving debt. For merchants, offering a simple, transparent payment plan--one where costs are spelled out and cannot change--becomes a significant differentiator. This leads directly to increased sales, often by 20-30%.

"The experience you had the zero percent one is especially compelling but really obviously no one invented sort of free money in the future what's really going on here is the merchant said if you paid interest it would cost you this many dollars how about i use that as an incentive for you to transact"

This highlights the systemic dynamic: merchants leverage the cost of interest that consumers would otherwise pay to credit card companies as an incentive to use BNPL. The immediate benefit for the merchant is increased sales volume. For the consumer, the perceived benefit is an interest-free loan, a powerful draw. The hidden consequence, however, is that this "free money" is a strategic merchant investment, not a consumer windfall. The long-term advantage for consumers who choose BNPL options like Affirm, which are transparent about any interest charged, is avoiding the perpetual debt cycle of credit cards, allowing them to manage their finances with predictable payments and a clear end date to their borrowing.

Redefining Risk: AI, Cash Flow, and a More Equitable Future

A significant departure from traditional finance is Affirm's approach to underwriting. Levchin posits that conventional credit scores, calcified since the 1980s, often fail to accurately represent an individual's financial reality, particularly for those with non-traditional backgrounds or recent financial missteps. He recounts his own experience as a stark example: a successful entrepreneur with a damaged credit score due to early financial errors.

This frustration drives Affirm's investment in its own credit scoring system, heavily leveraging machine learning and artificial intelligence. The company explores metrics like personal cash flow--analyzing both income and spending--to build a more nuanced view of a borrower's financial health. This approach, Levchin argues, allows Affirm to provide credit to individuals who might be overlooked or unfairly penalized by traditional scoring models.

"The question that's always been in my head how can we do better the short answer is well if we knew we the credit scoring universe that max had done pretty well for himself that he had a solid salary that he had you know some reasonably good stock option participations in in this company perhaps i would have been eligible for all sorts of credit products"

This reveals a critical downstream effect of traditional credit scoring: it can perpetuate financial exclusion, preventing individuals who demonstrate financial responsibility in other ways from accessing credit. By using AI and cash flow analysis, Affirm aims to create a more equitable system. The advantage for consumers is access to credit based on their actual financial behavior, not just an outdated score. For Affirm, this expanded view of creditworthiness allows for broader market penetration and a more robust loan book, as they can identify individuals who are good risks but might not fit the traditional mold. This requires significant investment in AI and data analysis, a longer-term play that builds a more resilient and inclusive business model.

AI and the Evolving Shopping Landscape

Levchin touches upon the transformative potential of AI in the shopping experience, moving beyond simple keyword searches to a more conversational and personalized interaction. He envisions a future where consumers can engage with AI chatbots to research products, considering factors like room fit, compatibility with existing systems, and even sale availability, all within a conversational flow. This shift, he believes, will significantly simplify the purchasing process.

Within this evolving landscape, Levchin sees a strong synergy with Affirm. As AI becomes more adept at understanding consumer needs and preferences, it can also seamlessly integrate financing options. The chatbot, acting as an intelligent shopping assistant, can inform the consumer about available payment plans, including Affirm's zero late fee, zero deferred interest model.

"The cool thing about these tools which is sort of what gets me out of bed every morning i've always thought it should include at least 5 of the time spent on figuring out what is the plan to pay for this ai can take that burden off our hands and will be there for it"

This highlights a key consequence of AI integration: the potential to automate not just product discovery but also the financial planning associated with a purchase. The immediate benefit is a more streamlined and less burdensome shopping experience. The longer-term payoff for Affirm is the integration of its transparent financing into this AI-driven ecosystem. By embedding its offering within these new shopping paradigms, Affirm secures a competitive advantage, positioning itself as the go-to solution for transparent and manageable credit in an increasingly AI-powered retail world. This requires continuous innovation in AI integration and a commitment to maintaining the core values of transparency and consumer benefit.

Key Action Items

- Immediate Action (Next Quarter): For consumers, actively compare the total cost of a purchase using Affirm versus a credit card, factoring in potential interest and fees.

- Immediate Action (Next Quarter): For businesses, evaluate the transparency of your current payment options and consider how they align with customer trust and long-term value.

- Short-Term Investment (6-12 months): Consumers should explore and understand BNPL options beyond just the initial zero-interest offers, looking at the total repayment structure and any associated fees.

- Short-Term Investment (6-12 months): Businesses should investigate how AI can enhance customer discovery and seamlessly integrate transparent financing solutions like BNPL.

- Medium-Term Investment (12-18 months): Consumers who frequently use credit should assess if a BNPL model offers a more predictable and cost-effective way to manage installment purchases, potentially reducing overall interest paid.

- Medium-Term Investment (12-18 months): For companies, invest in understanding and potentially developing proprietary AI models for customer underwriting that look beyond traditional credit scores, focusing on cash flow and behavioral data.

- Long-Term Strategy (18+ months): Consumers should prioritize financial products that offer clear, upfront terms and avoid those that rely on revolving debt or hidden fees, building a foundation of financial literacy and trust.